Justin Sullivan

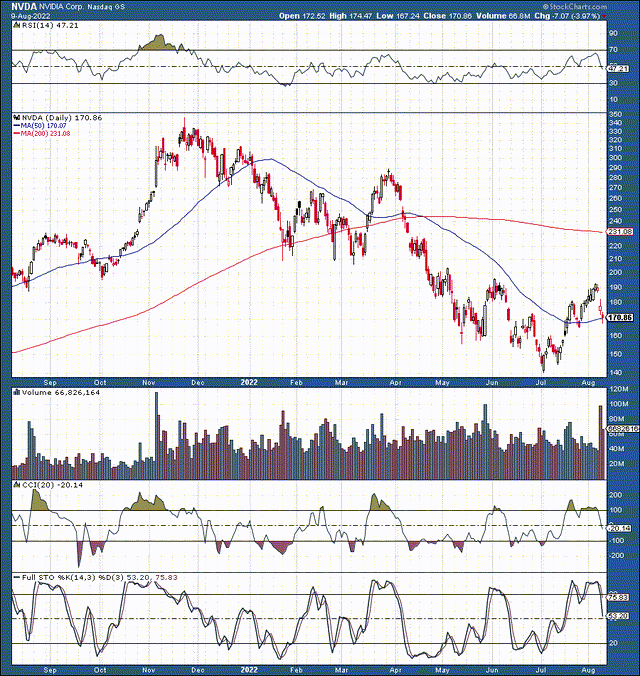

Over the years, Nvidia (NASDAQ:NVDA) has been one of my top investments. The company’s stock appreciated by a staggering 10,000% in the ten years leading up to the peak in November 2021. However, Nvidia’s stock became drastically overbought, overhyped, and overvalued, then the epic drop came.

Since topping at around $350 a share in November, it’s been mostly downhill for Nvidia. The stock recently hit a low of approximately $140, roughly a 60% drop from the top. We saw a robust rebound of about 35% in July, but then Nvidia preannounced weaker-than-expected second quarter revenues. Now, I mean much weaker, roughly 17% below most estimates. This deteriorating sales dynamic changes everything in the near term. There is increased uncertainty regarding what sales and earnings will look like as the company advances. The company will probably face numerous price target downgrades and earning estimate reductions from the analyst community.

Additionally, it’s not entirely clear what occurred to produce such a drastic decline in sales. The company is blaming significant declines in gaming revenues, but the losses could also be cryptocurrency-related. Furthermore, it’s not apparent if the lost revenue will be regained soon. Also, Nvidia’s stock is not cheap, and it’s about to look much more expensive with the plunge in sales and subsequent profits. Therefore, Nvidia’s drop from the top could continue, and I will look to rebuy this stock at a better, lower price point.

Nvidia’s Preannouncement

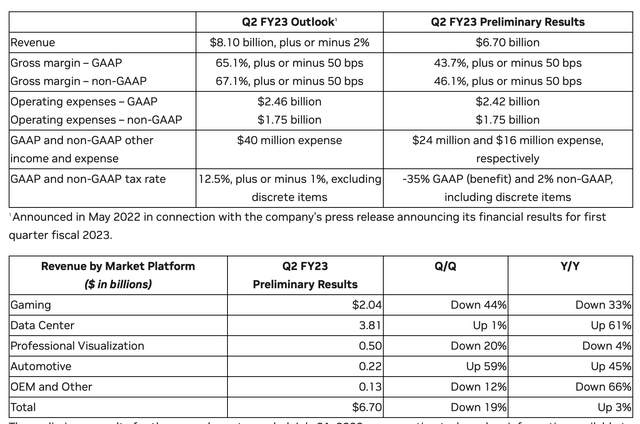

On Monday, August 8th, 2022, Nvidia announced preliminary second quarter revenue of $6.7 billion vs. the outlook of $8.1 billion. This shocking result represents a revenue miss of more than 17%. The shortfall was blamed on weaker gaming revenues, and management will discuss financial results and outlook on August 24th.

The $6.7 billion revenue announcement is down by 19% sequentially and represents growth of only 3% YoY. Gaming revenue came in at $2.04 billion, down by a whopping 44% sequentially and down by 33% from last year. Nvidia pointed to macroeconomic headwinds and challenging market conditions for the massive shortfall.

Preliminary Results

Preliminary Results (Nvidianews.nvidia.com)

We see that Nvidia’s situation deteriorated quickly in Q2. After the Q1 results, the company gave a revenue outlook of around $8.1 billion, but the results illustrate a much different reality. Moreover, the company’s gross margins were much lower than anticipated, just under 44% for the GAAP gross margin vs. the expected 65%. Therefore, we see the company’s results suffering from much lower than anticipated revenues and worsening profitability.

The economic slowdown impacts results, but it doesn’t explain why Q2 results are so much worse than the company’s outlook. Inflation is a factor, but it doesn’t excuse the massive margin shortfall. The company’s gaming segment experienced a drop-off in demand, but there may be more to the story here.

The Cryptocurrency Factor

An element that often gets overlooked when discussing Nvidia is the cryptocurrency aspect. Nvidia’s GPUs experienced an explosion in demand in 2017 and the following years. While Nvidia launched its CMP line designed for crypto mining, reports surfaced that Nvidia was selling its gaming GPUs to crypto miners as well. The company recently settled a charge with the SEC for $5.5 million. Nvidia misled investors by posting huge boosts to its gaming revenues while hiding how much of its success relied on the more volatile crypto industry.

Well, it appears that its past is coming back to haunt Nvidia. A sequential 44% and a 33% YoY drop in gaming GPU revenue is difficult to fathom. Due to the challenging economic environment, we can attribute some of the lost revenues to a reduction in GPU prices. Furthermore, some declines can be attributed to the Ukraine/Russian situation. Nevertheless, it isn’t likely to produce anything close to a 33% YoY decline.

We need to consider that fewer crypto miners rely on GPUs to mine crypto assets. Bitcoin miners and miners (and other digital asset miners) rely primarily on ASICs for mining solutions. Moreover, possibly the most significant driver of mining GPU sales (Ethereum mining) is moving away from GPU mining as it changes from proof of work to proof of stake protocol. This phenomenon likely impacted Nvidia’s sales negatively in Q2 and should continue plaguing the company as Ethereum completes its transition in September. Moreover, the crypto industry should continue decreasing its reliance on GPUs, likely creating a permanent drop in demand from this segment for Nvidia.

Get Ready For Nvidia To Get Even More Expensive

Nvidia hasn’t been cheap for a long time, the stock is relatively expensive, and it’s likely to get even more costly as we move on. Nvidia is one of the biggest technology companies in the world now, sporting a market cap of about $450 billion. The company’s TTM revenues are around $29.5 billion, illustrating the company’s trailing P/S ratio is approximately 15.25. A 15.25 price-to-sales ratio is remarkably high, especially for a company seeing a drop-off in sales recently.

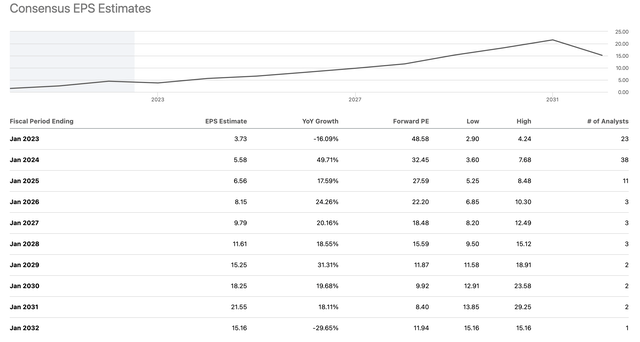

EPS Estimates

EPS Estimates (seekingalpha.com)

The consensus estimates for fiscal 2023 (this year) are for just $3.73. This represents a 16% YoY decline and puts Nvidia’s forward P/E ratio at nearly 50. Moreover, downward earnings revisions may have more room to run. Given the magnitude of the revenue drop and margin decline, it’s unclear whether the company can achieve the consensus figure. Furthermore, given that it’s unclear how much of the gaming revenues are cryptocurrency-related, we may see future years’ EPS estimates come in lower than estimated. Also, even if we take the current $5.58 EPS estimate for fiscal 2024, it still implies that Nvidia is trading around 32 times fiscal 2024 EPS estimates, relatively expensive given the uncertain variables.

The Bottom Line: Patience Is A Virtue

Don’t get me wrong, Nvidia is a great company, but it is going through a difficult phase now. The stock price remains relatively expensive, and it can probably use an adjustment soon. Increased uncertainty could lead to continued volatility for Nvidia shares. The company will likely report disappointing earnings numbers on August 24th and could provide lackluster guidance. Additionally, it’s unclear what impact losses from Ethereum mining will bring. At 15 times, sales shares are expensive, and earnings could decline more than anticipated.

Additionally, the stock is far from cheap, trading at nearly 50 times this year’s EPS estimates. I believe future estimates are flimsy and can’t be relied on right now. Nvidia is an excellent company, but considering the recent developments, it’s likely overpriced. This dynamic should provide an opportunity to enter this stock at a lower level. My new target entry range for Nvidia is $120-140, roughly 22-33% lower from here.

Be the first to comment