adventtr/iStock via Getty Images

When it Rains it Pours

NVIDIA (NASDAQ:NVDA) is as relevant and dominant today, even as it struggles to recover from the aftereffects of a crypto winter and the Ethereum Merge. It has been a very painful past twelve months for both the company and its shareholders. NVIDIA first started showing cracks in its armor when it walked away from the ARM deal, losing about $1.25Bn in fees. The second and bigger blow crystallized in August 2022 when NVIDIA guided early for a disastrous Q2-FY23, taking a charge of $1.3Bn for excess inventory and guiding for a steep 19% drop in sequential revenue to $6.7Bn against consensus estimates of $8.10Bn. On earnings day on August 24th, it guided to a further fall to $5.7Bn in revenues for Q3-FY23 – another sequential drop of 14%. To add insult to injury, this week, the US government decided to ban all semiconductor sales of strategic importance to Chinese companies.

The 66% drop from $340 in Nov 2021, to $116 today has been gut-wrenching, to say the least.

The Ethereum Merge

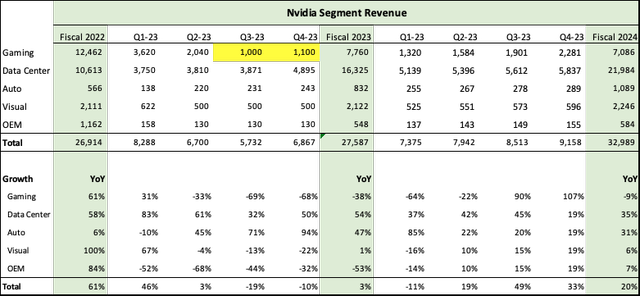

As one of my favorite investors, Peter Lynch said “Fool me once, shame on you; fool me twice, shame on me!”. This is the second time, Gaming has suffered from excess inventories built up from a fall in Crypto prices; this time, the fall was even steeper with Q2-FY23 revenues dropping 33% YoY and 44% sequentially. I estimate Gaming to drop to $1Bn in Q3-FY23, a 69% drop YoY!, as NVIDIA works through excessive inventory. For the past two years, NVIDIA rode the crypto boom as miners used its high-quality GPU cards for Ethereum mining, charging as much as 40% above list price. Now, with Ethereum moving to proof of stake instead of proof of work, used cards have flooded the market.

One of the biggest problems I see going forward is investors not giving the same multiples to NVIDIA; no more pie in the sky market cap of $800 Bn or 30X sales! That should never happen again as some of NVIDIA’s strongest supporters will carefully keep a cautious eye on valuation and multiples a few years down the road. Secular growth meets cyclical volatility.

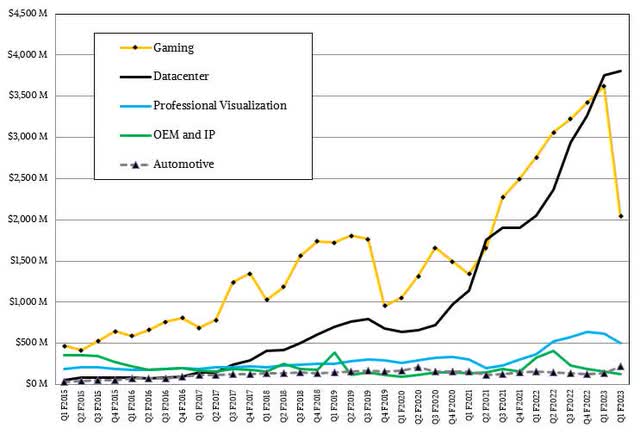

NVIDIA’s Revenue Segments (The Next Platform)

At this juncture, I believe that NVIDIA will come back stronger and product launches should be a key catalyst in resuming growth.

Gaming – The RTX40 Series

NVIDIA has won several plaudits for its new gaming series chips named after Ada Lovelace. Going after what NVIDIA believes will be the future of all high-end games, Ray Tracing, it has packed the RTX40 with features that bring out the rich visualization in games that pretty much no other chip can do. The RTX40 Series has been built in collaboration with TSMC (TSM) on the 4NM node and is easily one of the fastest and most powerful chips in gaming. A great Seeking Alpha article from Beth Kindig describing it in detail.

NVIDIA has always been the best in its class; it doesn’t do windows and it doesn’t do consoles; instead, it positions itself in a halo of super competence and charges a hefty price knowing that the discerning gamer will pay for quality. The innovative turn with the Lovelace, RTX40 is no exception and will be priced about 25-30% higher from its last RTX30 Ampere series and range from $899 to $1,599. More importantly, it is backed with the strategic intent of not letting the used inventory of Ethereum cards take away from the sales of the newer cards. Quite simply, the used Ethereum card cannot perform even close to the Lovelace.

Datacenter – The Hopper and the Grace

The H100 GPU, nicknamed the Hopper, built for the data center segment is also rated one of the best in its class for power and efficiency, with 50% more memory and bandwidth than its predecessor, the A100. It’s also expected to have a 300% better performance and is supposed to be 6 times faster, besides delivering 9X better throughput in AI inference training. The Next Platform has done an excellent deep dive into the Hopper.

Importantly, the Hopper will be priced pretty high, compared to the rest of the market, and even below a strategic price point below $20,000 per unit will be 20-33% higher than its predecessor, the A100.

I expect Datacenter to grow 54% in FY 23 and 35% in FY 24, contributing more than 60% of NVIDIA’s revenues.

Bank of America Analyst, Vivek Arya, updated his cloud spending forecast for 2023, saying he now expects it to rise 7.5%, a slowdown from 2022, but still up year-over-year. The analyst noted that macro turmoil has reduced the pace of growth, but cloud spending is still expected to reach $170B in 2022, up 20% from 2021 and 2023 should be even higher at $183B, which the analyst said would be “in line with last down cycles when capex decelerated”.

AMD (AMD), which also guided Q3 down on slowing PC sales, crucially did not disappoint on datacenter, stating that datacenter revenue grew 8% sequentially and 45% YoY, boding well for NVIDIA.

Grace – The Grace, ARM-based CPU is NVIDIA’s first foray in CPUs, a field dominated by AMD and Intel (INTC). The CPU market in Datacenter was dominated by Intel till AMD started eating its lunch with stronger and more efficient products, packing more transistors in the 5 and 7nm nodes while Intel was struggling to go below 10nm.

Clearly, NVIDIA smelled opportunity, and it’s only surprising why it took them so long to get into this segment. Sticking to its playbook, the Grace will also be a high-performance, pricey chip also on the 4Nm node. Initially, it will be a niche product mainly for AI. Importantly, NVIDIA will bundle the Hopper and the Grace to make inroads into this market.

The Chip War with China

The biggest threat I see for NVIDIA is the China chip blockade from the Biden administration. This is a take-no-prisoners approach, the salvo is broad-based and clearly aimed at restricting China’s prowess in building high-performance chips. The term “chips of strategic importance” is loosely defined and as Dylan Patel, chief analyst at SemiAnalysis says – “These two countries are at war”. Any sales to Chinese firms requiring high-performance chips need specific exemptions or licenses, which could easily be denied. NVIDIA is clearly the leader in high-performance computing and has the most at stake.

Investment Case

Resuming Growth

To value the company going forward, I’ve taken a conservative approach, forecasting only $1Bn in gaming revenues in Q3 with a slight uptick in Q4 as NVIDIA works through excess inventory. I believe that Fiscal 2024 will see sufficient recoveries in gaming volumes aided by strong sticker prices and estimate that NVIDIA will have $7Bn in gaming revenues, still 9% below FY23 but entirely without Crypto sales. For more conservative investors, looking for recurring revenues, this is not a bad thing. Furthermore, having recurring and sustainable revenues recoups some of the ill-will and the loss of the lofty multiple, when NVIDIA failed to identify crypto sales and suffered the ignominy of changing guidance at the 11th hour. Even with conservative estimates, I expect NVIDIA to grow total revenues 20% next year in FY 24.

A silver lining of the entire Ethereum cards boom and bust is that NVIDIA took in close to an estimated $10Bn in “extra” revenues over the past two years. For a company that spent $5.2Bn in R&D last year – that extra cash came in very handy. I also expect the solid growth in Auto to continue.

Attractive Valuation

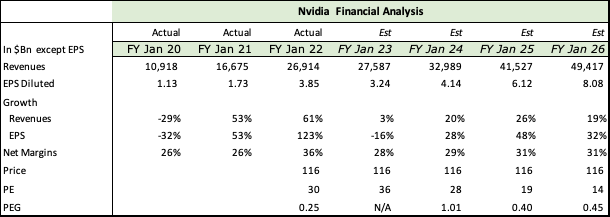

NVIDIA, Fountainhead, Seeking Alpha

Based on my forecast through FY 2026, NVIDIA performs very well in spite of all these headwinds. My estimates are lower than Seeking Alpha consensus estimates and probably conservative given the speed at which NVIDIA has bounced back in the past. At $116, NVIDIA is reasonable at 28X FY 24 earnings and a steal at 19 and 14 times, FY25 and FY26 earnings, respectively.

Besides, the quality of earnings is far superior when they’re free of cyclical crypto earnings.

NVIDIA’s pole position as the best in its class ensures that it will constantly have better multiples than AMD and Intel.

It has the highest margins at over 30%. In FY 2022, NVIDIA had a net profit margin of 36%! – a lot of it crypto-driven. However, given its pricing power for the RTX40, the Grace and the Hopper in Datacenter, I’m confident that it should reasonably earn net margins of around 30% in the next 4 years.

Conclusion

NVIDIA calls it the Omniverse platform, where it has positioned itself as a solution/license/subscription provider. Here, I believe it will have the first-mover advantage when the Metaverse takes off. Again, these will be high-quality earnings with very solid margins. In its pro visualization segment, NVIDIA has taken a solid lead in providing collaborative platforms. Pro-viz revenues doubled to $2Bn in FY 2022 on the back of hybrid and work-from-home trends. While it is now clearly digesting the big gains, it should resume double-digit growth in FY 2025.

One of its key growth drivers in collaborative use cases will be the quality of ray tracing graphics, which will entice more designers to use NVIDIA as a service tool or as a license. This is a competitive advantage and regardless of Meta Platforms’ (META) recent stumbles, Metaverse or Omniverse business uses are already in motion; for example, in car showrooms and surgical walk-throughs. NVIDIA should have a first-mover advantage as a subscription provider, as a complete solution. I believe this is key and will remain a moat. I believe that the Metaverse and Collaborative design markets are still in a very nascent stage and having the best and the most innovative products will give NVIDIA a huge advantage, and allow it to continue skimming the market till competing products emerge.

I’ve owned NVIDIA for more than 5 years and usually bought on dips, sometimes selling when it became too large a part of my portfolio or taking some profits off the table.

Given the Fed’s hawkishness and the US government’s newfound belligerence towards China, there is potential for downside and I would spread my buying over 4-5 installments. I rate it a Buy and expect NVIDIA to double from this price of $116 in the next 3-4 years.

Be the first to comment