serg3d

After Nvidia’s (NASDAQ:NVDA) truly shocking pre-release of FQ2’23 earnings earlier this month, the chipmaker is getting ready to submit its full earnings scorecard next week. Nvidia’s earnings release is timed for August 24, 2022 and the company is going to provide much anticipated details about the state of its Gaming business.

Given how quickly business fundamentals have eroded in the second fiscal quarter, I believe that Nvidia’s guidance for FQ3 will be very disappointing and likely include a second consecutive decline in gross margins. Since investors have not taken a “wait-and-see” approach after the release of preliminary results but piled back into the stock, investors might be in for a surprise of the not so positive kind next week!

Investors May Be In Denial

Nvidia’s preliminary results indicated a massive and rapid deterioration of business fundamentals, especially in the graphics card business, which has been affected by negative pricing headwinds and declining PC shipments. Based off of Nvidia’s preliminary results, the Gaming segment has seen a dramatic 33% year-over-year drop in revenues in FQ2, which caused the Data Center business to pull ahead to the number one spot regarding revenues.

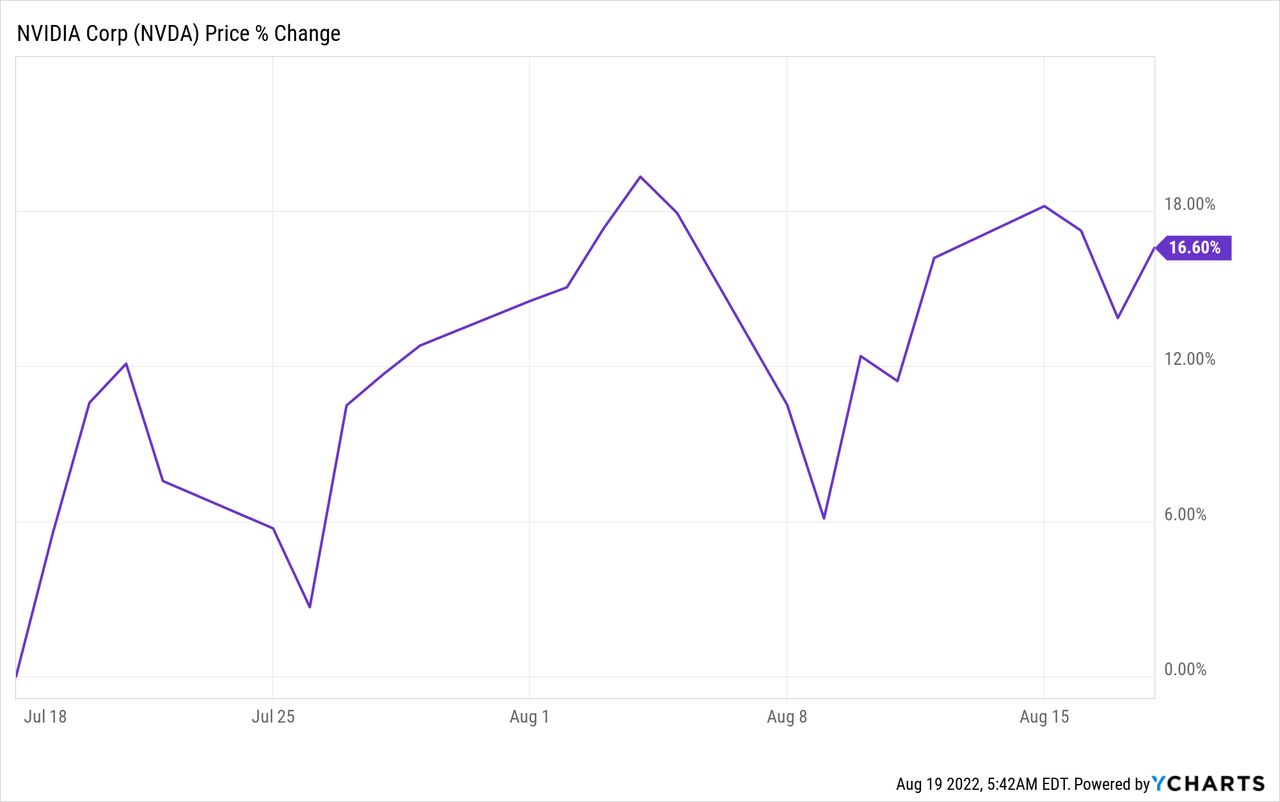

Despite the unprecedented drop in revenues and gross margins, investors have bid Nvidia’s price up again in the last two weeks. Shares of Nvidia are now trading at about the same level they were trading at before the FQ2 pre-release… and investors act as if nothing ever happened.

FQ3 Guidance Likely Going To Be Gloomy

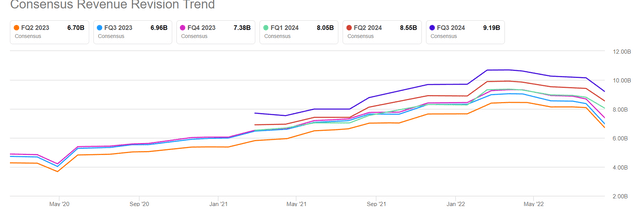

After Nvidia’s devastating FQ2 earnings sheet, investors have likely not much to expect from Nvidia’s guidance for FQ3 either. The expectation is for $7.0B in revenues for Nvidia’s third fiscal quarter, implying a (2)% growth rate year-over-year. In the last 90 days, there were 20 revenue downward revisions. Considering that Nvidia grew its top line at 46% year-over-year in FQ1, a sequential drop-off in growth rates in FQ3 would strongly indicate that the current expansion cycle has ended.

Seeking Alpha: Nvidia Revenue Estimates

My expectation is for Nvidia’s FQ3 revenues to fall in a range of $6.2B to $6.4B — which would mark a sequential decline of up to 7% — and gross margins dropping below 40%. Nvidia’s preliminary earnings release for FQ2 showed gross margins of 46.1%, showing a decline of 21 PP quarter-over-quarter. Two sequential quarters of gross margin declines would likely indicate that the cyclical upswing in the chip making industry is ending, and that valuation multiplier factors are set to compress further.

Declines In PC Shipments May Accelerate In FY 2022, Rising Inventories Posing A Risk

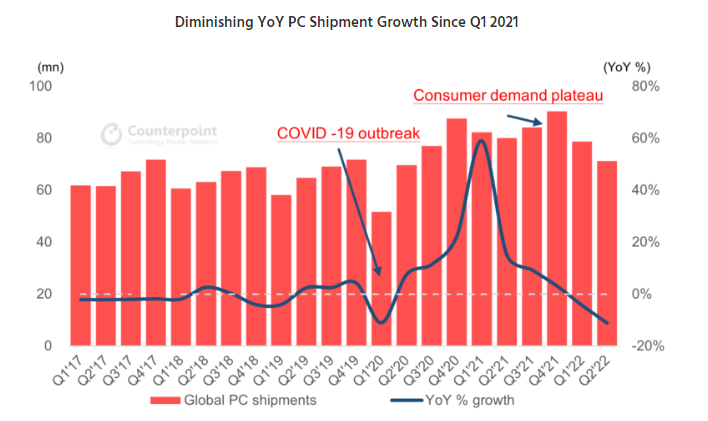

Gartner’s estimate of a 9.5% decline in PC shipments in FY 2022 may be optimistic, and I see a sharper downturn ahead that is set to affect shipment volumes of Nvidia’s GPUs. After reaching a shipment peak in Q4’21, the PC market has seen two consecutive quarters of shipment declines, driven by weak demand.

Source: Counterpoint Research

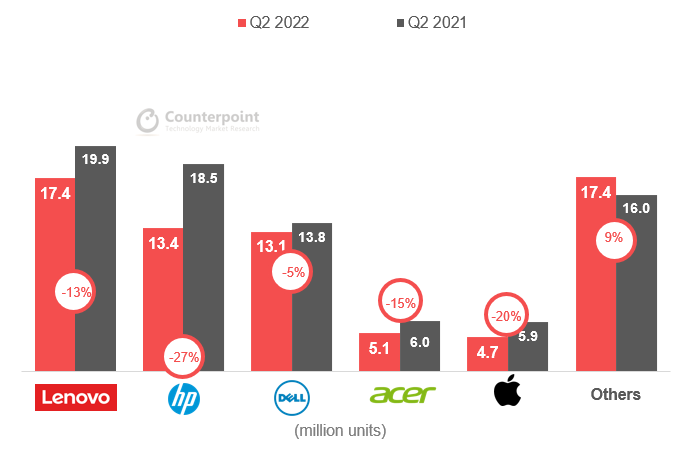

Major vendors have seen highly concerning, double-digit declines in PC shipments, with HP seeing the steepest drop-off in shipments of 27% in Q2’22. The decline in shipment rates has affected all well-known PC brands, including Apple, Dell and Lenovo. The broad-based decline in shipments leads me to believe that the overall market decline in PC shipments could be significantly larger than the 9.5% decline projected by Gartner.

Source: Counterpoint Research

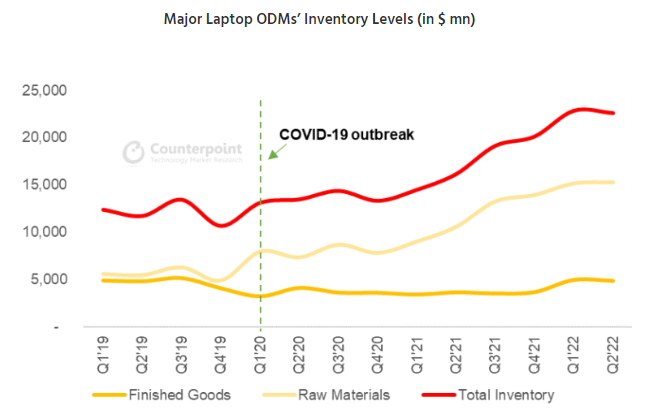

Equally concerning, inventory levels in the laptop industry have risen rapidly in FY 2021 and FY 2022, indicating that demand weakness has led to an inventory build-up that will have negative effects on the pricing power of original design manufacturers/ODMs for the foreseeable future.

Source: Counterpoint Research

A Weak Outlook Is Coming, Estimate Risks Are Rising

For those reasons, I expect pressure on Nvidia’s top line and bottom line estimates to increase in the next two weeks, which is when analysts are incorporating Nvidia’s FQ3 guidance into their expectations for full-year revenues. Most analysts, I believe, are standing ready to lower Nvidia’s FY 2023 revenue estimates further if the company submits another sequential down-grade in its revenue guidance.

Estimates for FY 2023 are currently calling for revenues of $29.3B, but I believe these estimates, given the shockingly fast speed of business deterioration in the second quarter, will have to be downgraded. I estimate that Nvidia could achieve $28B in revenues on a full-year basis in FY 2023, assuming that we are seeing a stabilization in the Gaming business in the third fiscal quarter. Nvidia had revenues of $26.91B in FY 2022, so my estimate for FY 2023 implies a revenue year-over-year growth rate of only 4%, which, by Nvidia’s standards, is a weak growth rate.

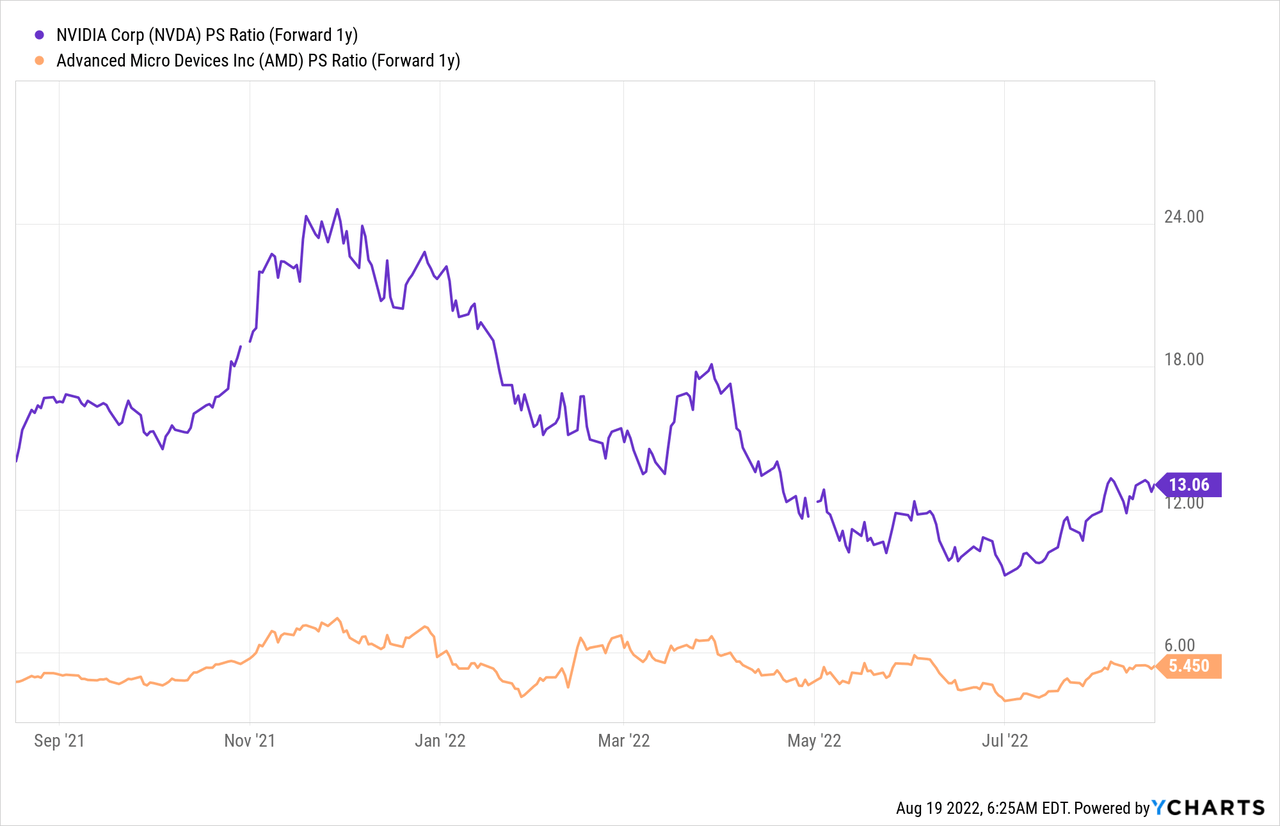

Sales Multiplier Factor

The preliminary release did not have a lasting effect on investors: Nvidia has about the same P-S ratio it had earlier this month.

Based on consensus revenues of $35.9B in FY 2024 (next year), Nvidia has a P-S ratio of 13.1 X. AMD’s price-to-revenue ratio is 5.5 X and I believe AMD not only has a much more attractive valuation ratio but also better execution in the Data Center business.

Risks With Nvidia

A continual slowdown in the Gaming business, weak expected revenue growth for FQ3 and another sequential decline in gross margins are major short-term risk factors for Nvidia. But it could get worse from here: if weakening revenue momentum spreads to Nvidia’s Data Center business, which so far is not showing a deceleration just yet, then Nvidia may be set for a major revaluation to the down-side.

Final Thoughts

Things about to get worse for Nvidia next week and investors need to brace for impact. New details about the seriousness of the decline in the firm’s fundamentals and the guidance for FQ3 will determine what happens to Nvidia’s shares in the short term. Investors must be prepared for a very weak FQ3 outlook due to PC market weakness and inventory build-ups, which could lead to broad-based revisions of Nvidia’s top and bottom line estimates!

Be the first to comment