Seiya Tabuchi/iStock via Getty Images

Introduction

What do most American electric utility companies have in common? They have accelerated investments in renewable energy to become carbon neutral by 2050. Unfortunately, this has caused their balance sheet to experience a sharp increase in debt. In most cases, it’s manageable, given that a lot of valuable assets are being created as well. However, what if I told you there’s a utility company that already generates most of its energy from carbon-free sources? A company that is now accelerating free cash flow instead of borrowing money to distribute dividends?

Constellation Energy (NASDAQ:CEG) pays a dividend of less than 1%, yet it is in a fantastic spot to deliver outperforming capital gains and high, long-term dividend growth for its investors. It has a spectacular balance sheet and a future-proof business model.

In this article, I will make an investment case for CEG, including my view on nuclear energy.

Why Nuclear Energy Makes Sense

In a recent article, I discussed the geopolitical risks that come with accelerating demand for nuclear energy – and two actionable ideas in the mining space.

The first part of that article was dedicated to the reasons that explain why nuclear energy is making a comeback. In a world where governments and non-government organizations are pushing hard for a fast transition to net-zero, there are not a lot of suitable options that make sure that energy doesn’t become scarce – as we’re currently finding out the hard way thanks to poor fossil fuel supply growth.

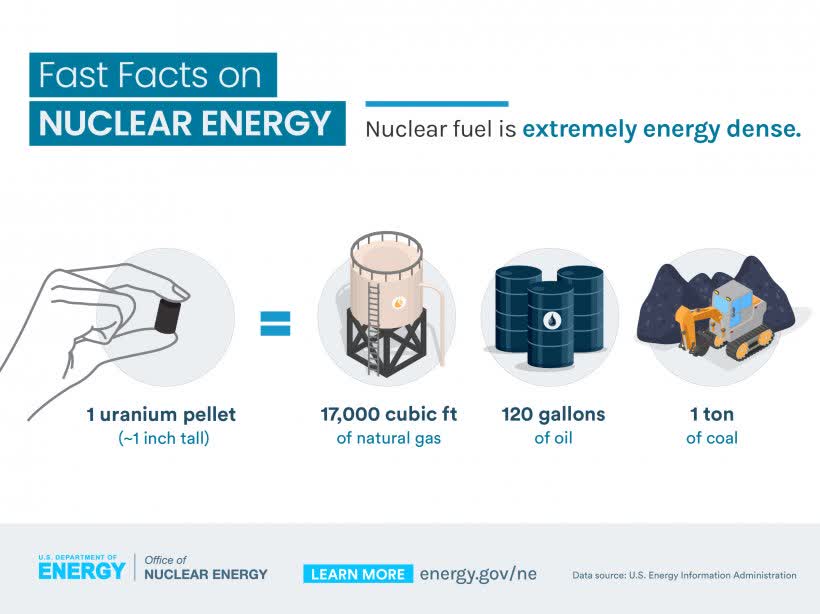

Nuclear energy beats every existing energy source when it comes to energy density. A single 1-inch tall uranium pellet has as much energy as 17 thousand cubic feet of natural gas, 120 gallons of oil, or 1 ton of coal.

US Department of Energy

It’s no surprise that the Biden administration launched a $6 billion nuclear power credit program to keep older reactors online. As reported by Reuters:

The U.S. nuclear power industry’s 93 reactors generate more than half of the country’s carbon-free electricity, according to the Department of Energy (“DOE”). But 12 reactors have closed since 2013 in the face of competition from renewable energy and plants that burn plentiful natural gas.

In addition, safety costs have soared after the 2011 tsunami at Japan’s Fukushima plant and after the Sept. 11, 2001, attacks. The industry produces toxic waste, currently stored on-site at plants across 28 states.

The DOE said it will take applications from owners of nuclear plants for the first round of funding in its Civil Nuclear Credit Program until May 19. It will prioritize reactors that have already announced their intention to close.

It makes sense for the Biden administration to push for nuclear energy as it’s an easy way to reduce carbon emissions. In 2020, the US avoided more than 471 million metric tons of carbon dioxide thanks to nuclear energy. That’s the equivalent of 100 million cars.

Moreover, it’s so much more efficient. Thanks to the aforementioned energy density, it requires only one square mile for a typical 1,000-megawatt nuclear reactor to function. Wind farms require 360 times more space.

Cameco Corporation

Because of these benefits, global demand is soaring. This is accelerated by a steep surge in oil, natural gas, and even coal prices. Not only that but between 2020 and 2050, global electricity demand is expected to rise by 75%. That’s caused by a higher population, more wealth in emerging markets, and the energy transition.

Currently, 56 reactors are under construction. China alone is home to 18 of these reactors. And, as I pointed out in my previous article, other areas of the world are increasing their nuclear energy production:

In Europe, the UK and France are leading the way. The UK, which generated roughly 16% of its electricity from nuclear in 2020, wants to boost that number to 25% by 2050. It is building eight large reactors.

France, which already generates 70% of its energy from nuclear energy, is building six new reactors and extending the lifetime of all existing reactors – after assessing the safety situation.

A Great Way To Benefit From Nuclear Energy

With a market cap of $29.4 billion, Constellation Energy is one of America’s largest utility companies. There are roughly nine electric utility companies with a larger market cap.

What makes Constellation Energy special is its focus on nuclear energy. Headquartered in Baltimore, Maryland, the company is the result of a spin-off from the diversified utility company Exelon Corporation (EXC).

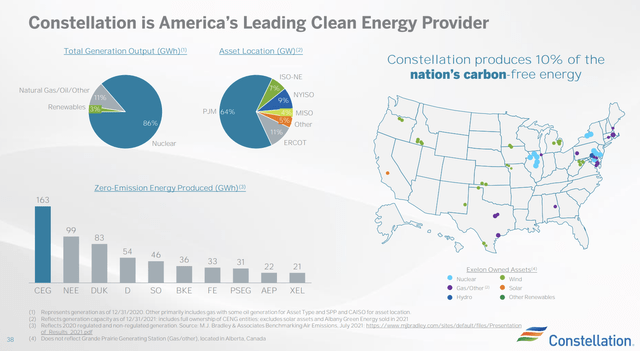

CEG produces 10% of America’s carbon-free energy. Its energy mix consists of 86% nuclear, 11% fossil fuels (natural gas, oil, others), as well as 3% renewables. Looking at produced zero-emission energy, the company is a clear leader, ahead of NextEra Energy (NEE) and Duke Energy (DUK), which is part of my dividend portfolio.

Constellation Energy

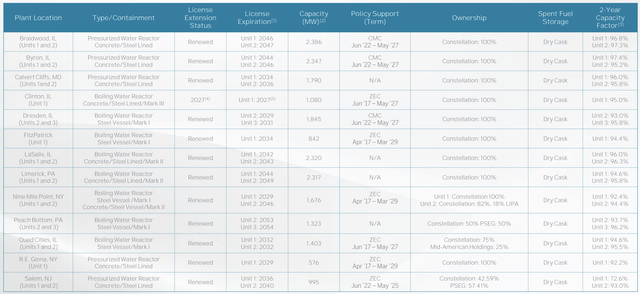

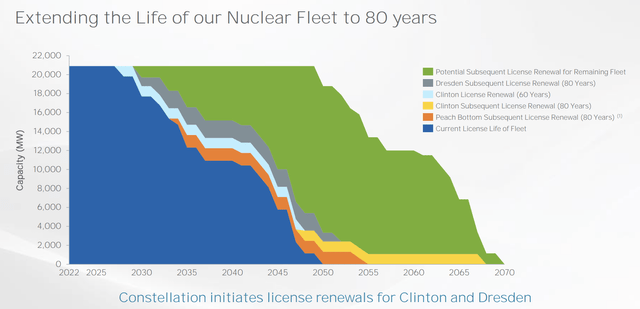

As the somewhat hard-to-read (my apologies for that) overview below shows, Constellation owns more than a dozen reactors with most license expirations after 2040.

Constellation Energy

This fleet has a nuclear capacity factor of at least 400 basis points above the industry average, making Constellation the most efficient operator in the industry. Moreover, the company has just 20-22 refueling outage days per year, the industry average is roughly 50% higher.

Because of its strategic location, its high exposure to carbon-neutral energy, and its reliable business, the company has the largest market share for commercial and industrial companies. It serves three out of four Fortune 100 companies.

Its power customer renewal rate is consistently in the high 70% range.

Moreover, CEG is a major beneficiary of the IRA – Inflation Reduction Act. Last summer, the company was looking to retire its Dresden and Byron plants. Both are located in Illinois. The reactors were losing money or are close to losing money in the future.

The company got $700 million in subsidies from the State of Illinois, which keeps these plants from shutting down. Moreover, the company is now in a good spot to accelerate hydrogen production, which will occur at its Nine Mile Point nuclear plant in New York.

Moreover, the IRA gives the company the opportunity to grow by operating its plants and earning enhanced PTC (production tax credits) for incremental megawatts, to grow by investing in hydrogen, and to grow by extending the lives of its assets to 80 years. The company is positive that a big part of its existing assets will produce energy well into the 2060s.

Constellation Energy

Hence, the company’s balance sheet was upgraded to BBB by S&P Global.

According to the company, it’s now in a much better spot:

A clean energy investment with unlimited upside to higher commodity prices, downside commodity risk protection provided by the U.S. government, unique growth opportunities in hydrogen, life extensions, and upgrades and structural inflationary risk protection.

Moreover, and related to my prior hydrogen comments, the company is in a fantastic spot to become a major supplier of hydrogen. A fuel that could help airlines reduce emissions, fuel steel plants, produce fertilizers, and much more.

On top of that, the company can fuel the hydrogen boom by producing hydrogen itself and by providing clean energy to other producers. After all, if other producers can prove they are using clean energy, they will get the credits as well.

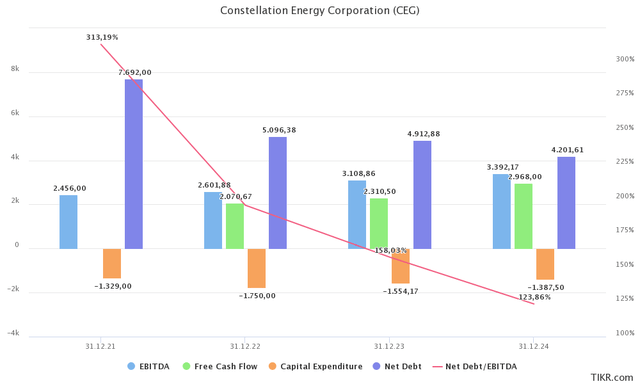

With that said, the company’s financials are terrific. Unlike some of its competitors, the company does not have capital expenditures that exceed operating cash flow. In the years ahead, CapEx is actually expected to drop to $1.4 billion, boosting free cash flow to $3.0 billion.

TIKR.com

This implies a free cash flow yield of 10.2%. Next year, free cash flow is expected to be 2.3%, that’s 7.8% of its market cap, a truly remarkable number.

EBITDA is expected to rise from $2.6 billion in 2022 to $3.4 billion in 2024. EBITDA margins are expected to rise from the low 13% range to more than 21%.

This year, the company has narrowed its EBITDA guidance range from $2.4 to $2.8 billion to $2.5 to $2.7 billion as a result of higher investments in hydrogen (post-IRA), higher employment expenses, and pressure on margins due to existing customer contracts.

Moreover, with regard to the aforementioned S&P credit rating upgrade, the company’s net debt is just 2.0x EBITDA. It’s just 1.5x when excluding non-recourse debt. It doesn’t matter a lot to the bigger picture, but these numbers are less than half of what I’m used to seeing in the industry.

Additionally, of $4.7 billion in long-term debt, the company has zero maturities until 2025, when $900 million in debt matures. After that, the next maturity is in 2039.

Unfortunately, the dividend is a disappointment. After all, investors buy utilities for their yields.

The company currently pays a $0.141 dividend per share per quarter. That’s $0.564 per share per year or 0.63% of its current stock price.

Needless to say, the company pays just a tiny fraction of its free cash flow in dividends. Most utilities actually borrow money to pay a dividend – in light of high CapEx plans.

So, should you ignore CEG? Is CEG a terrible stock?

No, CEG will make sure that its investors benefit greatly.

The annual dividend is expected to grow by 10% per year. That’s consistent, but not a big deal. After all, after 10 years, a 0.6% yield turns into a 1.6% yield on cost. The reason why dividend growth isn’t more aggressive is that the company believes that it can identify investment opportunities that end up benefiting investors more than an annual 10% dividend hike.

And if that isn’t the case, it will buy back shares and issue a special dividend on top of its regular dividend.

Here are the company’s own words:

We believe there are opportunities to grow our business organically and inorganically and we will see growth opportunities that exceed a double-digit unlevered return threshold and will deliver long-term value to our customers. And when we don’t have those opportunities or don’t have those opportunities in a particular time frame, we will return capital to our owners through a special dividend or share buybacks.

So, what about the valuation?

Valuation

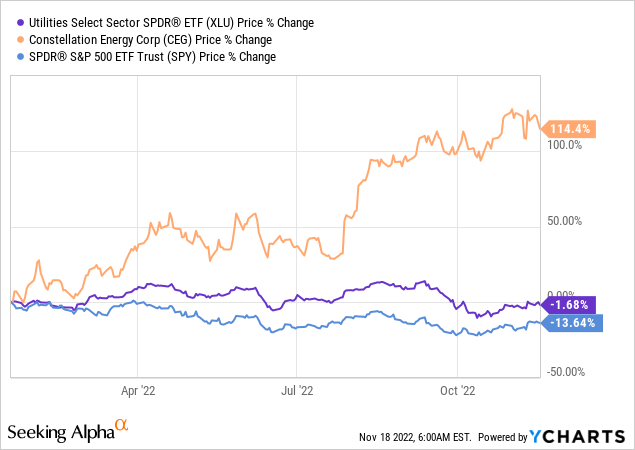

CEG went public in January. Since then, shares have returned 114%. Needless to say, this outperforms its utility peers and the S&P 500. Moreover, the stock has ignored the summer sell-off.

With that said, the company has an implied 2024 free cash flow yield of more than 10%. That makes the stock attractive. Even if that is still two years from now. The same goes for the 7.8% free cash flow yield for 2023E, that’s a good deal.

Using 2023E numbers, the company is trading at 11.7x EBITDA of $3.1 billion. That’s based on its $36.2 billion enterprise value, consisting of its $29.4 billion market cap, $4.9 billion in net debt, $370 million in minority interest, and $1.5 billion in pension liabilities.

I believe that a 13-14x EBITDA multiple would be appropriate, given where peers are trading and the company’s high FCF yield.

Hence, I believe that CEG has another 14% to 25% upside over the next 1-2 years.

Takeaway

I am a big believer in nuclear energy as a tool to allow for pollution reduction without risking energy reliability and affordability.

In this article, we discussed the benefits that come with nuclear energy, which are now finally reaching the minds of the politicians in charge.

This benefits Constellation Energy. This utility company has become my favorite in the industry. The company generates most of its energy carbon-free. It has a huge portfolio of nuclear reactors and a major footprint in the commercial and industrial segments. It now benefits from plant life extensions, increased government subsidies, and its ability to make hydrogen a key part of its business, going forward.

Moreover, it has an incredibly healthy balance sheet, high free cash flow generation due to subdued CapEx, and the ability to deliver significant shareholder value going forward.

Despite its strong performance, I believe there’s up to 25% left to its fair value with consistent outperformance over peers in the long term.

The only reason why I don’t own CEG yet is that I haven’t figured out how I’m going to structure the defensive, higher-yielding part of my portfolio yet going into 2023.

(Dis)agree? Let me know in the comments!

Be the first to comment