mgstudyo/E+ via Getty Images

Thesis

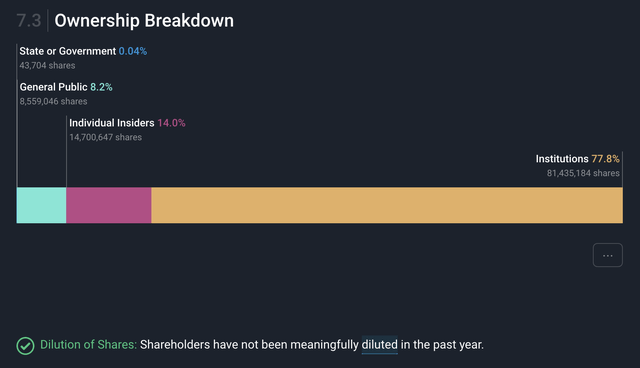

NovoCure Inc. (NASDAQ:NVCR) is a biotech stock with risk but has both institutions and insiders buying shares for the potential outsized reward. I believe there is enough evidence from NovoCure’s business to give retail investors to also buy the stock. NovoCure has maintained a large amount of institutional and insider investors since IPO in 2015. Currently NovoCure has nearly 78% of its shares held by institutions and 14% by insiders at the company.

Future Growth and Patent Protection

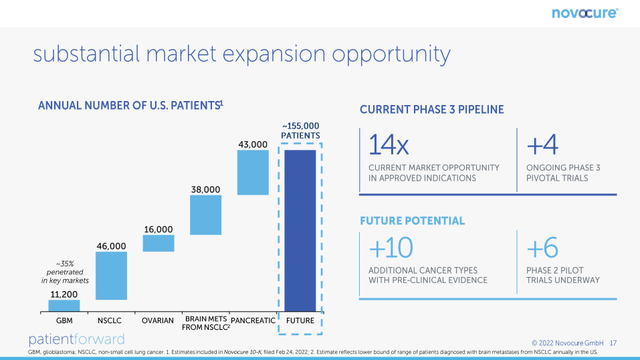

NovoCure is poised for substantial patient growth and strengthening its moat in being able to provide FDA approved treatment for some of the most aggressive cancers. There are several catalysts that could help grow its potential patient audience by 1,400%. If these phase three trials deliver positive readouts and ultimately get FDA approval, the share price could increase significantly.

In addition to expanding its total addressable market, NovoCure has over 140+ patents regarding Tumor Treating Fields (TTF) for cancer. Some of these patents do not expire until 2035, continuing to expand the competitive advantage NovoCure has in the industry. NovoCure’s presence in the market is in a position of strength as it does not directly compete with chemotherapy and other cancer treatments, but augments the treatment for even better results. Consequently, it currently has no true formidable competitor in the industry that can steal market share.

Expanding Market Opportunity for NovoCure Inc. (July 2022 Investor Presentation)

Yoram Palti, M.D., Ph.D. invented the Tumor Treating Fields technology, holds 40 patents personally, and 70+ published scientific papers, and founded NovoCure in 2000. He still plays a role in the company today as the Chief Technology Officer and consultant. Their CEO Asaf Danziger is also like a founder in my opinion as he has been the CEO for the last 20 years.

NovoCure is expanding their competitive advantages in this market with their patent protection for this technology for future years to come, the creator of the technology and of NovoCure is still at the company contributing, and new applications of TTF for other types of cancer could soon could be FDA approved.

These detailed comments from NovoCure’s most recent earnings 10-Q showcase how robust the future pipeline is for the company.

We believe the physical mechanism of action behind TTFields therapy may be broadly applicable to solid tumor cancers. Currently, we are conducting phase 3 pivotal studies evaluating the use of TTFields in non-small cell lung cancer (“NSCLC”), ovarian cancer, brain metastases from NSCLC, and pancreatic cancer. In 2021, we completed patient enrollment in our phase 3 pivotal NSCLC and ovarian cancer studies. Additionally, we have multiple ongoing or recently completed phase 2 pilot studies evaluating the use of TTFields. These studies are in gastric cancer and stage 3 NSCLC, as well as testing the potential incremental survival benefit of TTFields delivered using high-intensity arrays versus standard arrays. We are also currently conducting a global phase 4 post-marketing study testing the potential survival benefit of initiating Optune concurrent with radiation therapy versus following radiation therapy in patients with newly diagnosed GBM. We anticipate expanding our clinical pipeline over time to study the safety and efficacy of TTFields for additional solid tumor indications and combinations with other cancer treatment modalities.

What is Tumor Treating Fields? And Does it Work?

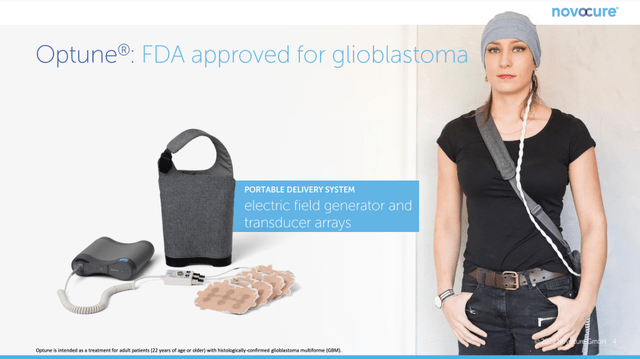

Tumor Treating Fields are alternating electric fields tuned to specific frequencies to disrupt cancer cell division, which results in either slowing or reversing the tumor growth. The patient has to wear these adhesive patches on the place of where the cancer tumors reside and those patches are connected to NovoCure’s Optune medical device. The device transmits electrical fields that disrupt the cancer cell division where the tumor is located.

Currently a patient would wear a cap with these adhesive patches if they had Glioblastoma (GBM) which is an aggressive type of brain cancer. The other place a patient would wear the patches is on their chest if they had Mesothelioma cancer. Both of these cancers are some of the most aggressive around and NovoCure’s technology gives extended quality of life to those who have one of these cancers. As my readers know I like to invest in companies that I believe are making the world a better place to live in, and NovoCure easily checks this box.

Optune: Lua FDA Approved Device (July 2022 NovoCure Investor Presentation)

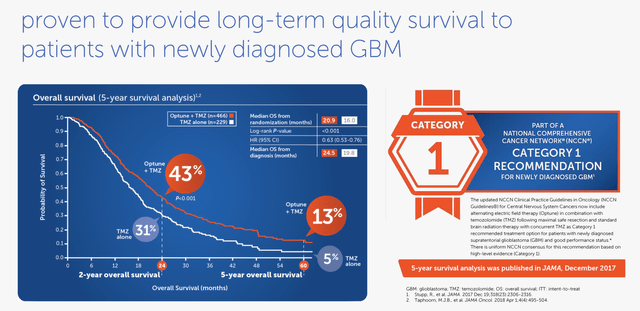

The TTF technology from NovoCure has proven results for extending the quality of life for patients with Glioblastoma and Mesothelioma. It is important to point out that this technology is not meant to replace traditional cancer treatments, but in tandem of the treatments. See below Newly Diagnosed GBM patients who had TMZ treatments increased their overall two-year and five-year survival rates when doing the treatments while also using NovoCure’s Optune device.

2021 NovoCure Corporate Presentation

The innovation of this company continues to widen, as NovoCure has several new clinical trials growing their pipeline and more trials nearing Phase 3/4. This will create new patients to help who have pancreatic, ovarian, non-small cell lung cancer, and grow revenues significantly. NovoCure has a three pillar strategy for generating long-term growth, 1. Drive Commercial Adoption in Approved Indications, 2. Advance Clinical Trials in New Indications and combinations, and 3. Deliver Product Innovation to optimize TTFields therapy.

NovoCure has a global footprint and continues to drive more commercial adoption with different countries and insurer programs to cover their treatments. With building more relationships with insurers and healthcare systems globally, NovoCure will be able to increase patient demand. The current penetration for the company with newly diagnosed GBM is 35%, so there are still so many more people NovoCure can help globally.

The strategy with expanding TT Fields clinical footprint is built on the following: explore synergies with evolving standards of care, expand label in approved indications, and investigate use in new indications. NovoCure is working with other pharmaceutical companies like Merck & Co (MRK) to start joint efforts for clinical trials with their technology and immunotherapy agents.

Lastly NovoCure has already optimized their medical device Optune to a smaller edition called Optune Lua which is more portable, practical, and lightweight for patients. NovoCure is expanding on their device innovations to drive better efficacy in results and ease of use of the devices. They are working to create a next gen device that will generate electric fields like Optune, flex arrays (patches with higher-intensity capabilities for greater efficacy), and a new software platform for their technology.

Risks to Be Aware Of

NovoCure has four different clinical trials that will have readouts in the next 12-24 months and if those readouts are negative, it could cause the stock to heavily drop. Biotech stocks tend to be very lumpy in nature and volatile because the revenues depend much on what new FDA approvals can be acquired for new treatments. For NovoCure to reach more exponential revenues, it will need to be able to serve more common cancers that have larger patient counts. This will require getting those FDA approvals for the Optune technology.

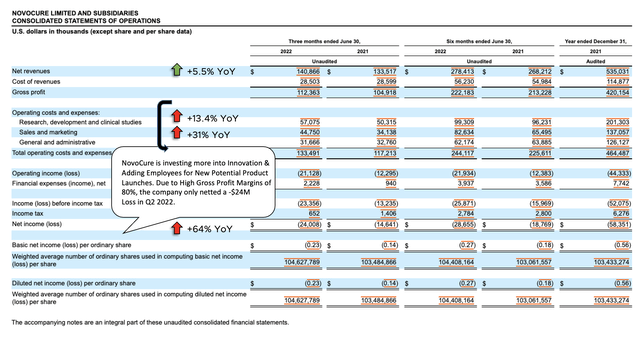

This company is also not profitable and in today’s market environment that is typically not favorable for investors. The reason NovoCure is not profitable is because it is investing in its future growth opportunities and capture new patient audiences geographically. NovoCure is a global company that serves the United States, Germany, other EMEA countries, Japan, and China. The sales and marketing spend this past quarter grew 31% y/y and R&D spend also grew 13% y/y, but NovoCure is not going to apologize for this. In the past 10-Q document the company stated the following reasons for increasing expenses in these areas.

Q2 2022 10-Q Financial Results

“The change was primarily due to an increase in market research and strategic planning activities intended to enhance our commercial capabilities in anticipation of potential future approvals in new indications, including NSCLC and ovarian cancer. Additionally, we are investing in market access capabilities in order to evaluate opportunities, identify optimal access pathways, and successfully gain reimbursement in new geographies.”

In the short term the share price increasing will depend on the data readouts and macroeconomics of the market. Investors should remember that their first three indication studies got FDA approval and FDA approval is easier to get on medical devices than drugs that a patient would have to intake.

There is still risk here but I believe it could be worth taking on that risk as it is my belief the stock will rise much higher with even just one of these phase three trials getting approved. Patience is an important quality and mindset to have with holding this stock, and this could be why only 8% of retail investors have a position. The stock has been trading in a range of $60 to $80 the last nine months and the institutions have been patiently holding strong, as mentioned below!

Simply Wall St. (Financial data provided by Standard & Poor’s Capital IQ.)

The other risk some may say is the valuation of the company currently. It’s an $8.2B market cap stock that trades at a 15x price-to-sales ratio and is not profitable. However, NovoCure has $948M in Cash and Cash Equivalents and a burn rate of only $54M in the last six months. The 8 analysts that cover this stock only have the price going up 19.7% in the next year, but I believe that is being conservative considering all the readouts to come in 2023.

My Conclusion on the Potential Growth

I feel there are too many catalysts that NovoCure has that outweigh any potential risks when it comes to owning shares of NovoCure. This is why I am a shareholder of the stock and believe they will grow their market audience greatly by getting new FDA approvals for treating ovarian, non-small cell lung cancer, and pancreatic cancer. NovoCure is also focused on expanding their global footprint and continue to hire more sales people in new regions to gain new patients for their three approved FDA cancer treatments.

Right now an investor may get hung up on NovoCure’s lack of profitability, but I believe there is a clear path to profitability in the long run. My perspective is that they are very fiscally responsible with minimal cash burn and plenty of cash on hand to support their business operations for easily the next three years or longer. It is my belief that NovoCure will grow its future revenue streams several ways and eventually get to profitability. NovoCure will expand their potential customer base by:

- Increasing sales and their go-to-market footprint in other regions globally

- Gain new patients through more FDA approvals on new types of cancer to treat in 2023 and 2024

- Adding new revenue streams with new devices for TTF, more effective patches to sell, and gaining new relationships with third party insurers to cover the treatment

I have been invested in NovoCure since 2020, and this company is innovating at a rapid pace and I believe institutions feel confident in their future FDA approvals, or why would nearly 78% of shares be held by the smart money. It is not often that a mid-cap stock in biotech has such a large amount of shares held by institutions through volatile times. It appears to me they are playing the long game on this one too, and with all of the competitive advantages with patents, small burn rate, industry experience, and potential new products it seems like it will pay off nicely for those invested in NovoCure.

Be the first to comment