I have already made up my mind, don’t confuse me with facts. – Phillip Fisher (Warren Buffett’s mentor)

Author’s note: This is a sample of the FULL research published in advance to members of Integrated BioSci Investing on October 28. To improve access, I will publish one article like this to all readers on the weekend.

Biotech investing can churn your stomach due to stock volatility. Nevertheless, you have the best chances of enjoying alpha returns if you employ a fundamental approach and have a long-term investment horizon. That is to say, you should either hold your shares “as is” or average down some more during a market decline. Now, you just don’t do that for any bio-equities. Specifically, you have to conduct thorough research on the company’s fundamentals to see if it would survive the market downturn to grow into a giant of tomorrow.

In this research, I’ll revisit a growth/stalwart biotech known as NovoCure (NASDAQ:NVCR). After seeing market success with its lead technology (Optune), sales have been stagnating. Nevertheless, there are powerful catalysts on the horizon that would catapult sales to a new high in the coming years. Here, I’ll feature a fundamental analysis while focusing on upcoming growth catalysts. Moreover, I’ll share with you our IBI strategy to capture the upsides in this stock.

Figure 1: NovoCure chart

About The Company

As usual, I’ll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior article,

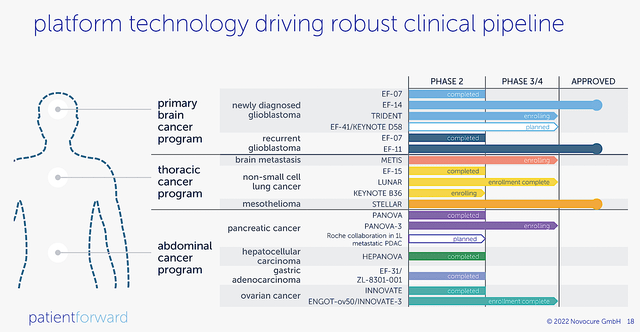

Headquartered in St. Helier, Jersey, NovoCure is a global oncology leader that dedicates its efforts to the innovation and commercialization of a novel cancer treatment dubbed Tumor Treating Fields (i.e., TTF). Notably, TTF is delivered by a device known as Optune which is portable and convenient for patients. As an uncanny method of attacking cancerous cells, TTF is highly efficacious and safe against many deadly cancers. Accordingly, the technology has been approved and launched for three indications. They include both newly diagnosed and recurrent glioblastoma multiforme (i.e., GBM) as well as mesothelioma. To boost further growth, NovoCure is investigating TTF for other cancers such as non-small cell lung cancer (i.e., NSCLC), brain metastases, and pancreatic, ovarian, liver as well as gastric cancers.

Figure 2: Therapeutic pipeline

Tracking NovoCure Investment Thesis

First things first, you should put NovoCure into the appropriate investment category. That way, you can better track its progress to know whether the thesis (i.e., story) is playing out as it should. In doing so, you’d know when to buy, sell, or hold your shares.

As follows, NovoCure is a “growth biotech” that recently transitioned into a “stalwart.” More precisely, NovoCure is still more or less a growth biotech. However, it’s getting near the end of the growth spectrum to become a stalwart. According to Peter Lynch, Stalwart are companies that already exhausted the most aggressive growth phase. Nevertheless, there is still growth left that you can expect anywhere from 20% to 40% a year.

For a stalwart, you want to closely monitor the lead franchise to see if it can deliver additional growth. Specific to NovoCure, you want to see if Optune continues to generate growing revenues for the currently approved indications (newly diagnosed and recurrent GBM and mesothelioma). On this note, growth for biotech is not linear like other firms. So there will be several years of stagnancy until the drug/device would gain additional approval and/or new label expansions.

Significant Partnership

Shifting gears, let us walk through various fundamental developments of NovoCure. The first one that I’d like to assess is a partnership. As you can appreciate, a partnership provides several functions for a small/young biotech company. Though NovoCure is no longer a young biotech (as it’s been founded since 2000), a partnership is still important to the company. I noted in the prior research,

First and foremost, the partner would help absorb the costs associated with the capital-intensive therapeutic development process. Second, they can either take over the future launch or co-launch the drug with the smaller operator. Third, they provide their development expertise as well as their relationship with the FDA. Fourth, they can instill confidence in investors. After all, there is no point in doing a partnership unless the partner sees great value in the development pipeline.

On this front, there is a clinical partnership with Roche for the development of the TTF combo with Roche’s immune checkpoint inhibitor drug (atezolizumab) for metastatic pancreatic ductal adenocarcinoma (mPDAC). It made sense that the partners want to use TTF for mPDAC because it’s one of the deadliest cancers. And, TTF is certainly a big gun. In China, NovoCure has a commercialization partnership with Zai Lab.

You might be thinking that with such stellar technology, why is it that there is currently no significant partnership beyond what I mentioned? As TTF represents such a disruptive and novel approach, it’s possible that most larger players don’t want to take a risk on the uncertainty. Moreover, it’s likely that larger players would be afraid that the TTF advancement can reduce the utility of currently approved cancer drugs.

If NovoCure is a young company, it’ll likely die just like how Starbucks (SBUX) acquired Teavana to stop consumers from drinking tea. As you know, NovoCure is already a $7.3B company. Hence, I believe that it can survive on its own without a partner. But of course, a strong partner would catapult sales growth to a new height.

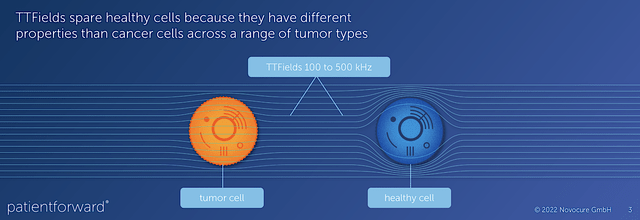

Mechanism of Action (i.e., MOA) of Tumor Treating Fields

Further discussion/analysis/forecasting of NovoCure’s clinical developments would be most fruitful if you first go over TTF’s MOA. Like many things in this world, even the Earth itself has an electromagnetic field. The same is true inside your cells. That is to say, cellular processes are highly dependent on electromagnetism.

When the cell starts to divide, chromosomes (containing your DNA) would line up in the middle of the cell. That way, they can be equally divided equally into two daughter cells. Consequently, the lining-up process creates a very strong polarity in the cell’s own electric fields. Hence, you can apply TTF (which is essentially an external electromagnetic field) to disrupt/displace that chromosomal/DNA lining-up process.

Figure 3: Tumor Treating Field Mechanisms of Action

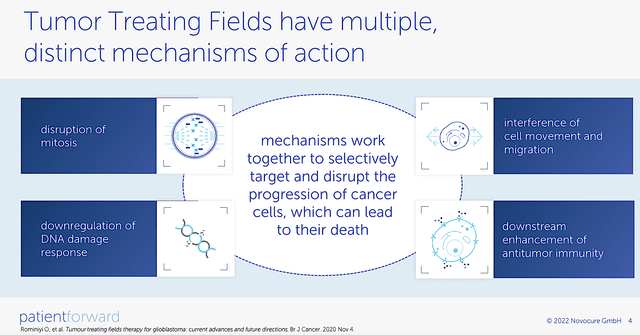

Interestingly, cancer cells divide rapidly. As such, their chromosomes lined up more often than normal cells. Therefore, they can easily be disrupted by TTF. As a ramification of chromosomal disruption, cancer cells die off. Like other drugs/technology, TTF also has its associated side effects. And, that’s typically limited to cells that divide rapidly as conventional chemotherapy would.

Asides from disrupting cellular division (i.e., the mitosis process), TTF also interferes with other cellular processes like migration. As you can see, advanced cancer cells that are difficult to treat are notorious for spreading from one area of the body to another in a process called metastasis. By halting metastasis, TTF delivers crucial therapeutic benefits against deadly cancers.

Figure 4: Other MOA beyond mitosis disruption

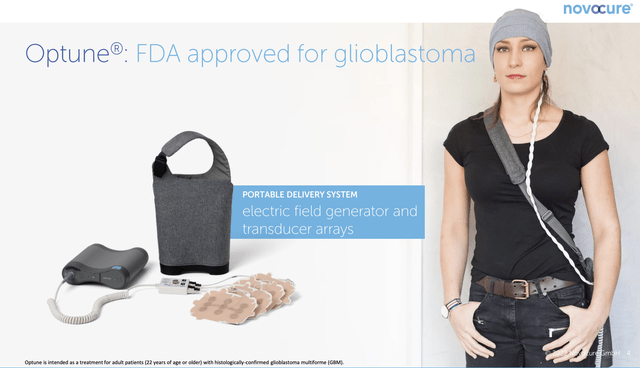

In putting science to practical application, NovoCure implemented the delivery of TTF via a small/portable device coined Optune. As you see from the figure below, Optune can be easily assembled and put onto the patient. There is also an adjustment for various TTF strengths. As you can appreciate, Optune is a convenient little device that is far ahead of its time. You’d likely never thought about having a cancer treatment that looks like a device from the Star Trek movie. After all, conventional cancer treatment is usually a pill, an injection, or radiation therapy.

Figure 5: Optune TTF for glioblastoma

Disease Context (i.e., DC) of Cancers

As you know, the DC of cancers is that these cells divide rapidly (for growth) and metastasize. With TTF adept at stopping both their division and movement (i.e., mitosis and metastasis), it would fit perfectly into the cancers’ DC similar to matching puzzle pieces.

As a ramification of the “MOA/DC matching,” you can see that clinical trials of TTF for most cancers would generate strong clinical outcomes. On the contrary, if MOA/DC do not match — i.e., the potential use of TTF for obesity — the DC of fat cells does not fit into the MOA of TTF. Therefore, it won’t generate efficacy.

As a general rule of thumb, when the DC and MOA don’t align, it is nearly impossible to see positive data reporting. Hence, my countless “negative forecasts” have a 100% accuracy rate to this day. Now, when the DC fits with the MOA of the drug/technology, there is still no guarantee that their clinical outcome would be positive. You simply have to look at it case by case.

Supporting Data

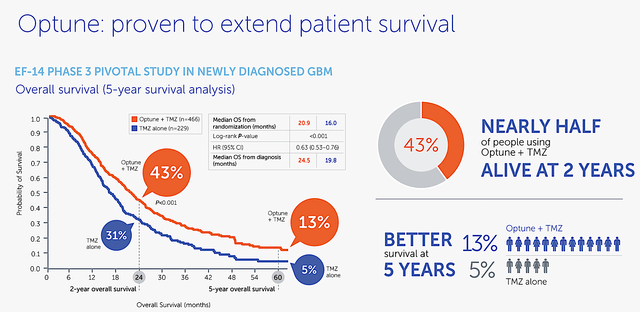

Riding excellent DC/MOA, TTF demonstrated stellar efficacy (i.e., improved overall survival) and acceptable safety in the high-quality Phase 3 (EF14) trial of over 700 patients with newly diagnosed GBM. I elucidated in the previous research,

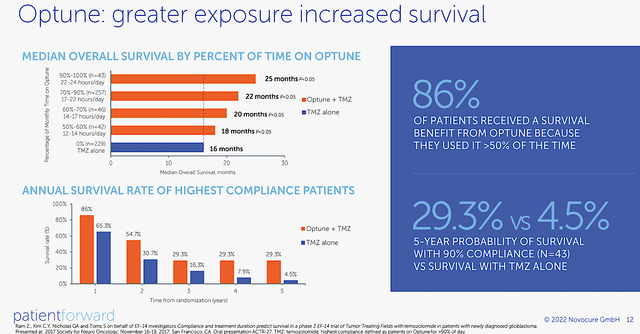

Compared to temozolomide (i.e., TMZ) alone, the Optune/TMZ combo demonstrated the remarkable 43% vs. 31% (at 2-year) and 13% vs. 5% (at 5-year), respectively. As the p-values indicate strong statistical significance, you can bet that the efficacy are due to TTF rather than random occurrences.

Figure 6: Strong Phase 3 EF-14 trial data

When you analyze other efficacy metrics like “percent of the time on Optune,” 86% of patients enjoyed survival benefits when they used the device over 50% of the time. At the 5-year survival analysis, 29.3% of patients on Optune are still alive versus only the meager 4.5% of patients on the conventional drug (TMZ).

Figure 7: More improvement in survival

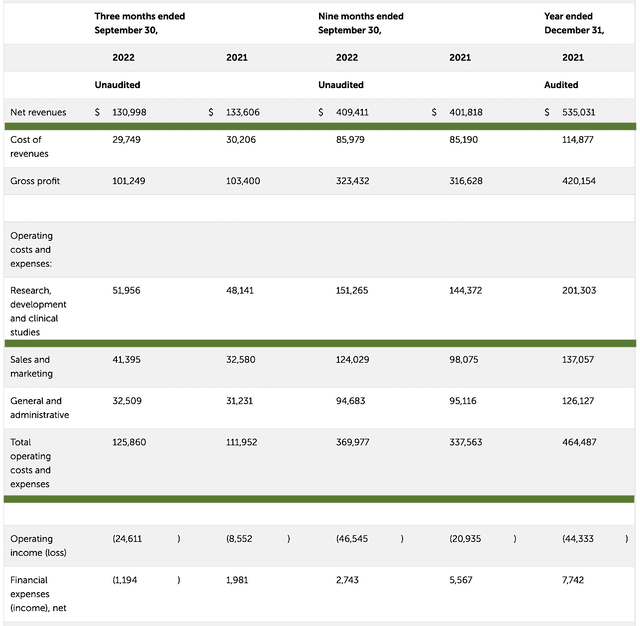

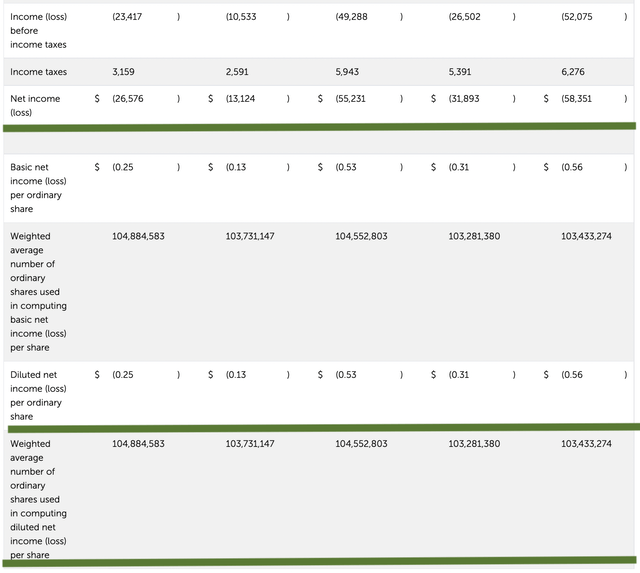

Latest Operating Results

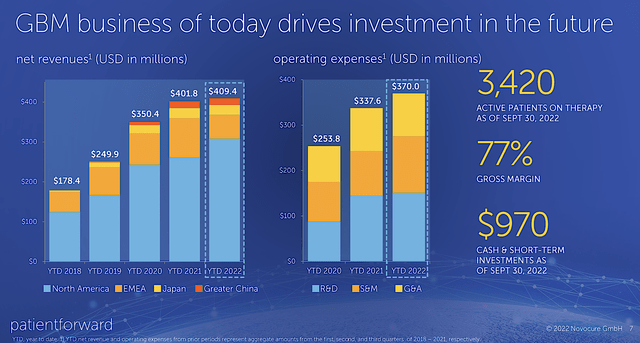

Harnessing the power of superior technology, it’s not surprising that NovoCure procured $131M in revenue for the latest quarter. Though it’s a decrease of 2% compared to the same period a year prior, I believe that the company is still on its way to generating more than $500M for Fiscal 2022. As I focus on long-term growth (and I know that there are normal stagnant growth periods), I’m not concerned about the challenges that the CFO (Ashley Cordova) mentioned in the earnings conference call,

Net revenues in the third quarter were $131M, with $22M in cash flow from operations. We ended the period with 3,420 patients on therapy. There were several notable headwinds this quarter that impacted net revenues, including the volume of cash collections from aged claims in the U.S., the ongoing impact of German coverage update and FX pressure from both the weakening Japanese yen and Europe. With respect to aged claims in the U.S., we continue to pursue previously denied claims. However, the accessible collections will largely be exhausted this year and the remaining outstanding aged claims will take more time and effort to collect. As we look ahead to 2023, we expect our net revenues to more closely reflect the core drivers, active patients on therapy times the net revenue earned per active patients, times 12 months. Gross margin for the third quarter was 77%. Impact to our gross margin from inflationary pressures have been minimal to date and we are working with suppliers to optimize our cost of revenue.

Figure 8: Excellent operational outcomes

Growth Strategy

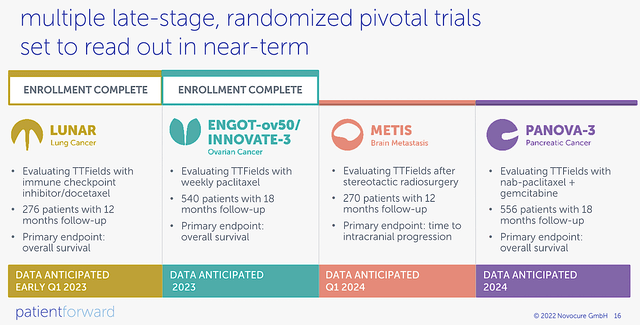

Often time, the research and development (i.e., R&D) efforts this year won’t give you results (i.e., increasing sales) immediately. In periods of growth spurts over the years, the approval/launch for new approval then comes. And, that’s when you can expect sales growth to pick most aggressively. As such, you can bet that various clinical trials advancement as shown below are the strongest of the three comprehensive long-term growth strategies that NovoCure is doing.

Figure 9: Comprehensive long-term growth strategy

Upcoming Catalysts

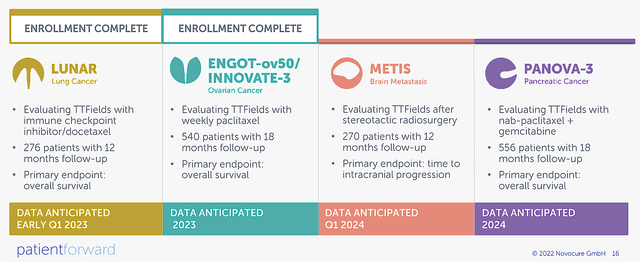

As fundamentally moving growth vehicles, you can see that there are four powerful unfolding catalysts as early as 1Q2023 and then in 2024. You only need one among four positive data releases re the four big franchises (LUNAR, INNOVA-3, METIS, and PANOVA-3) to see big movement in the stock. With robust clinical data, it would correspondingly expand TTF utility for either lung cancer, ovarian cancer, brain metastasis, or pancreatic cancer. Hence, it would galvanize TTF into a multi-billion dollars revenue-generating device.

Figure 10: Powerful unfolding catalysts

Forecasting

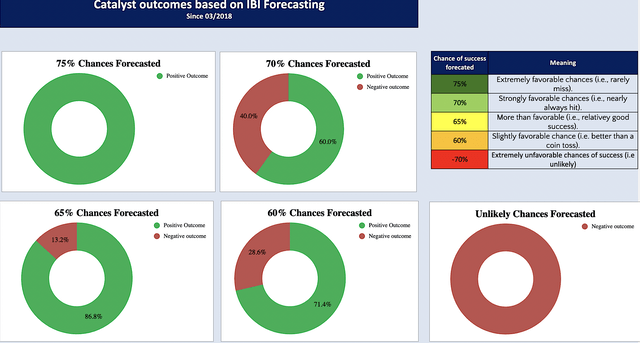

Leveraging my Integrated System of Forecasting, I ascribed a 65% (i.e., more than favorable) chance that LUNAR would clear its primary endpoint of overall survival. The first thing you should notice is that my forecasting is “categorical” rather than numerical data. As such, my 65% category simply means a “more than favorable chance” of a positive outcome.

Given that 86.8% of my 65% category hit, that’s your odds of seeing positive results for LUNAR If you want to translate that into numerical, my 65% would equate to 86.8% … Moreover, all my 75 category hits. As such, a 75% category means a 100% numerical score.

Figure 11: Forecasting data

I based my forecasting on the mechanism of action (i.e., MOA), Disease Context (i.e., DC), available data, my decades of experience, and most importantly my intuition. Asides from LUNAR, I ascribed similar chances of success for the other franchises.

Competitor Landscape

Regarding competition, NovoCure TTF is competing against conventional chemoradiation therapies and immunotherapies. They are the “bread-and-butter” treatments for cancer that will not go away. Notwithstanding, TTF epitomizes a novel and efficacious/safer approach that confers competitive advantages. Additionally, new treatment modalities exert stronger competitive pressure than conventional drugs. I noted in the prior research,

There are novel treatments like CAR-T, CAR-NK, and CAR-macrophage. Notably, CAR-T is already approved for blood cancers. Though these novel CARs have not been proven effective for solid tumors, that’s where future developments are heading. You can bet there will be some CARs that would be highly effective against solid tumors. That aside, there are the tumor-infiltrating lymphocytes (i.e., TILs) of Iovance Biotherapeutics (IOVA) that have demonstrated extremely robust efficacy for cancers. Regardless of the competition, there is always a strong demand for novel therapeutics. The oncology space is vast and thereby affords many blockbusters.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 3Q2022 earnings report for the period that ended on September 30.

As you know, NovoCure enjoyed $131.0M in revenue compared to $133.6M for the same period a year prior. That aside, the R&D for the respective periods registered at $51.9M and $48.1M. I viewed the 9.0% R&D increase positively because the money invested today can turn into blockbuster results. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $26.5M ($0.25 per share) net losses compared to $13.1M ($0.13 per share) net declines for the same comparison. The higher bottom-line depreciation made sense because NovoCure spent more money on its R&D.

Figure 12: Key financial metrics

About the balance sheet, there were $970.3M in cash, equivalents, and investments. On top of the $131M quarterly revenue and against the $125.8M quarterly OpEx, there should be adequate capital to fund operations indefinitely without worrying about a cashflow constraint. Simply put, the revenue and cash position are extremely robust compared to the burn rate.

While on the balance sheet, you should check to see if NovoCure is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 103.7M to 104.8M, my math reveals a <1% annual dilution. At this rate, NovoCure easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise NovoCure to determine how much your shares are truly worth. Before running our figure, I like to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

Figure 13: Valuation Analysis

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 104.1M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

TTF for GBM, mesothelioma, and various cancers (NSCLC, pancreatic, ovarian, brain metastasis, etc.). |

$8B (Estimated from the $582.25B global cancer market). Note: Raised from $6B. |

$2.0B | $192.12 | $134.48 (30% discount TTF is approved for 3 indications with others still in various Phase 3 trials). |

| Others | N/A | N/A | N/A | N/A |

|

The Sum of The Parts |

$134.48 |

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the most important concern is if LUNAR will post positive results in 1Q2023. There is a 35% categorical risk (i.e., 13.2% numerical chance) that data won’t be positive. The other concern is whether NovoCure would gain additional FDA approval for TTF to deliver leaping revenue growth.

Conclusion

In all, I maintained my buy recommendation on NovoCure and raised the stars rating from 4.8 to 5/5 stars. On a two to three years horizon, I expect the new $134.48 price target to be reached. I also ascribed NovoCure with a 65% investment profitability/probability score. And, I lowered this investment risk from medium to low. In a nutshell, you’re going to make money on NovoCure, provided that you hold the stock for the next several years.

From the trading viewpoint, my intuition tells me that NovoCure will likely trade upward toward the release of LUNAR next year.

Figure 14: Dr. Harvey Tran’s M7 Criteria

| Dr. Tran BioSci’s M7 Criteria | Stars Rating (Max 5 stars) | Rationale |

| Medicine | 5/5 | TTFields |

| Market | 5/5 | $582.25B global cancer market. |

| 5/5 |

$970.3M in cash position On top of the $131M quarterly revenue Against the $125.8M quarterly OpEx (No concerns about cash flows constraint) |

|

| Management | 5/5 | Overall good. |

| Maturity | 5/5 | Smooth transition to a stalwart |

| Must-know catalysts | 5/5 |

Novocure |

| Money-making | 5/5 |

Long-term investment |

| Overall rating | 5/5 |

NovoCure is a story of investment success. Since its founding just over two decades ago, NovoCure has now validated its TTF through clinical trials and market launches. This year, I expect the Optune device to generate 1/2 of the $1B mark. Despite the small revenue decline, I’m not concerned because it is related to the larger macroeconomic conditions.

Going forward next year, you can anticipate positive data release from the Phase 3 LUNAR trial for lung cancer. You can also expect positive results for INNOVATE-3 for ovarian cancer. As those indications get approved in the future, you can bet there will be more leaping sales growth. What you’ve seen thus far was aggressive growth for NovoCure but there is more to come.

Portfolio Update/Strategy/Action

As usual, I like to remind investors that the choice to buy, sell, or hold NovoCure is yours to make. In my view, you should increase your shares from 1/4 of a full position to 1 full position in anticipation of good data release and long-term growth.

Questions For Investors

As we are a member-lead community, your insight is very important to me. As such, I’d appreciate it if you can share with me your responses. That way, I can learn more from you. That being said, here are my two questions for this article: 1) Do you think LUNAR will be positive? 2) Do you think TTF will become a common “cancer treatment of the future”?

Be the first to comment