AndreyKrav/iStock via Getty Images

Introduction

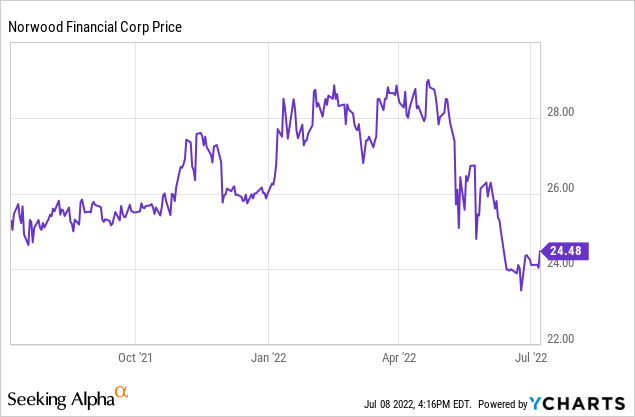

I have written a few articles on Norwood Financial (NASDAQ:NWFL) the holding company for the Wayne Bank, a bank active in New York and Pennsylvania. In my most recent article I started considering Norwood Financial for its dividend yield as the bank was yielding about 4% with a payout ratio of less than 40%. The quarterly dividend now represents a yield in excess of 4.5% as the share price has come down, so I wanted to check if this would be a good moment to add Norwood to my portfolio.

The First Quarter Of The Year Was Very Satisfying

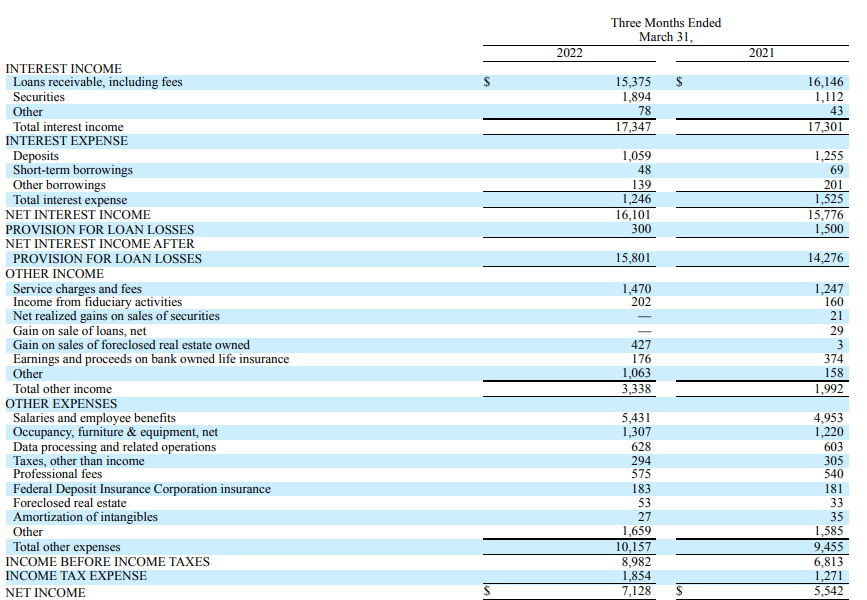

The bank performed well in the first quarter. It was able to keep its interest income stable at around $17.3M and as the interest expenses decreased by a few hundred thousand dollars to $1.25M, the net interest income increased from just under $15.8M to $16.1M. That’s up 2% and probably as good as it gets for the bank. Increasing interest rates should help to boost its net interest income profile down the road.

Norwood FInancial Investor Relations

The bank also reported a total non-interest income of $3.3M and a non-interest expense total of just under $10.2M, for a total net non-interest expense of approximately $6.8M. That’s a better achievement than the $7.5M in Q1 of last year, although this was caused by some non-recurring items, so we shouldn’t read too much into it.

In any case, it did provide a nice boost to the pre-tax income which jumped to almost $9M, also helped by lower loan loss provisions as the amount of provisions fell by about 80% to just $300,000 in the first quarter. The net income was approximately $7.1M or $0.87 per share.

This means the quarterly dividend of $0.28 per share is handsomely covered, and the payout ratio is just over 30%. That being said, keep in mind there were some non-recurring items that contributed to a great quarterly result, so the normalized earnings will likely be a bit lower, going forward. But in any case, a good quarter for Norwood Financial.

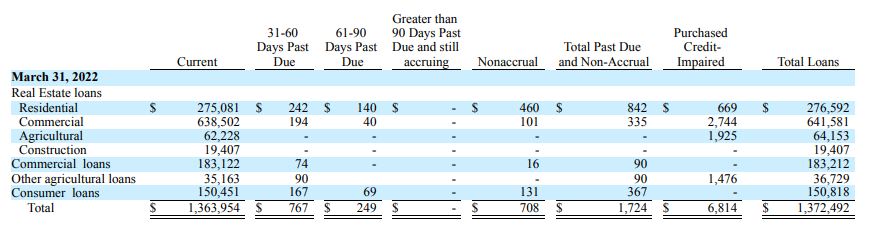

The low allowance for loan losses isn’t something to be too worried about, as the vast majority of the loans are current. Looking at the breakdown below, less than $9M of the $1.37B loan book is classified as past due or impaired. With in excess of $16M in booked loan loss provisions and knowing the bank will always be able to recoup some of the $9M in sour loans, I still think the situation is healthy and Norwood isn’t overly optimistic at this point.

Norwood FInancial Investor Relations

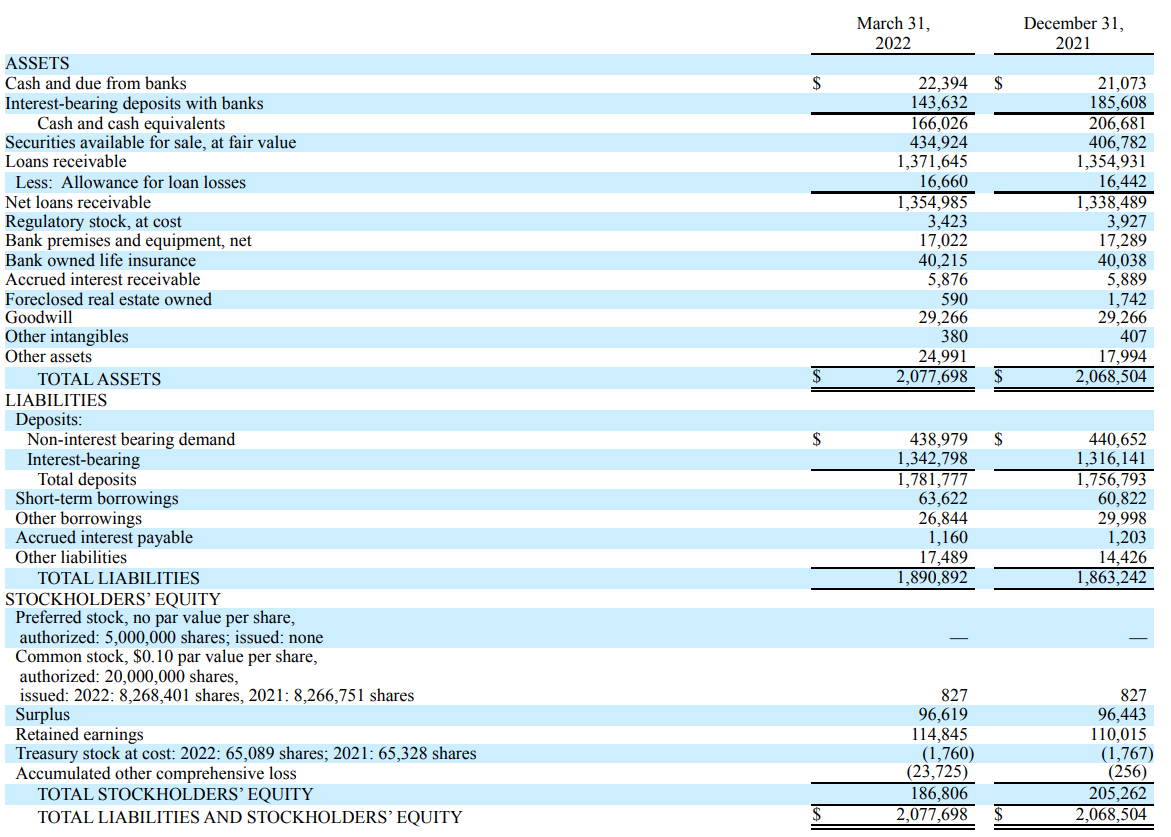

Despite The Strong Earnings Result, The Book Value Per Share Decreased Rather Dramatically

You would think that if a bank reports an EPS of $0.87 and pays out $0.28 per share in dividends, it would see its book value increase by $0.59/share. As Norwood has 8.2M shares outstanding, you would expect to see the book value increase by almost $5M.

But as you can see below, on the liabilities side of the balance sheet, that didn’t happen. Not only did the book value not increase, it actually decreased by almost 10% to just under $187M.

Norwood FInancial Investor Relations

Due to the higher interest rates, the bank’s investment securities have lost some of their value. In the first quarter of 2022, the bank saw its unrealized losses on the securities portfolio increase by in excess of $27M, while there was a $2.6M decrease in unrealized gains. The combination of both weighed on the book value of the bank.

So despite the strong earnings in the first quarter, Norwood saw its book value per share decrease from around $25 to approximately $22.8. And if one would remove the goodwill and other intangibles from the equation, the tangible book value per share has dropped to just over $19.

This would be fine by itself. But as we should expect more pain in the second quarter (interest rates continued to increase and the value of securities continued to go down), I think the situation will get worse before it gets better.

Investment Thesis

And that’s the main reason why I am on the sidelines when it comes to Norwood Financial. I think the bank’s earnings are excellent and if it wasn’t for the fluctuations in the bank’s book value, I would consider this to be an excellent opportunity to go long. But I am waiting to see how the book value evolves in the second quarter and how this potentially impacts capital ratios going forward.

Be the first to comment