Lisa Maree Williams/Getty Images News

The market continues to dump on the cruise lines, but Norwegian Cruise Line Holdings (NYSE:NCLH) reported a solid quarter last week. The cruise line repeated the mantra of strong bookings in 2023 with the covid restrictions stripped away, but an analyst just double downgraded the stock to a Sell rating. My investment thesis remains ultra Bullish on the stock and the sector.

Big Quarter

One only needs to read the initial highlights of the Q3’22 earnings release to understand the cruise sector is ready to fully recover by 2023. Norwegian made these key statements:

- Total revenue per Passenger Cruise Day exceeded expectations, increasing approximately 14% in the third quarter of 2022 compared to the same period in 2019.

- On track to generate positive Adjusted Free Cash Flow in the fourth quarter of 2022.

- 2023 cumulative booked position equal to record 2019 levels at significantly higher pricing.

- Reaffirm expectation for record Adjusted EBITDA and record Net Yield for FY 2023.

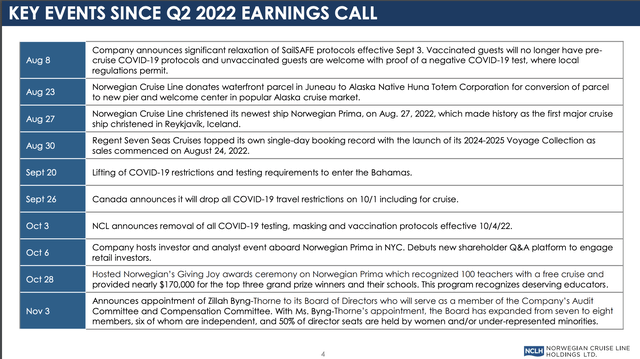

The cruise line reported mixed Q3 numbers with Norwegian beating estimates, but the company still reporting a large loss. Ultimately though, this quarterly report was all about the future. The covid restrictions weren’t stripped away until part way through the quarter with the majority of the restrictions not removed until the start of Q4 in the US and key destinations like Canada and the Bahamas.

Source: Norwegian Q3’22 presentation

The key here is that Norwegian guided to actual positive free cash flow generation in the traditionally tough Q4. Even more important is the reaffirmation of record adjusted EBITDA in 2023 based on far higher pricing on bookings for next year.

The market has an odd mindset that the cruise lines can’t return to record numbers so soon. Higher share counts and debt loads make topping 2019 EPS targets difficult, but even peer Royal Caribbean Cruises (RCL) has already forecast record EPS by 2025 generally missed by the stock market.

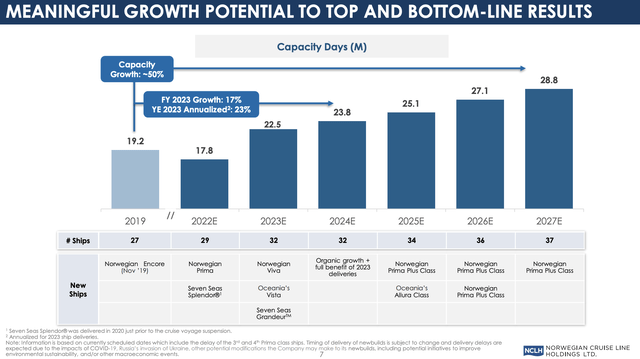

Back in 2019, Norwegian generated $1.94 billion in adjusted EBITDA. Investors need to keep in the mind the plan to grow capacity far in excess of 2019 levels in the next few years. The cruise line plans to add 3 ships this year to add to existing base of 29 ships leading to 17% boost in capacity from the 2019 levels and far above the 2022 level.

Source: Norwegian Q3’22 presentation

The biggest risk to the industry is the company and other cruise lines overbuilding capacity. A lot of the growth the next couple of years is normal for the sector and adjusts for the typical growth rates that would’ve existed without covid impacts. Cruise lines still under penetrate overall travel demand with cruise travel less than 10% of the targeted population in the US and Canada cruising back in 2019.

Double Downgrade

Credit Suisse Benjamin Chaiken double downgraded Norwegian in an odd move. All of the cruise lines are cheap based on the forecasts for the sector returning to record profits over the next few years.

Mr. Chaiken sees Norwegian missing the target of hitting record adjusted EBITDA next year topping $1.94 billion and suggesting a number reaching $2.0 billion. His forecast is for the cruise line to “only” generate $1.8 billion in adjusted EBITDA in 2023

A lot of market participants generally view Norwegian as even reaching positive EBITDA as a miracle with so many thinking the cruise line sector is headed towards bankruptcy. The mere prospects of reaching either $1.8 or $2.0 billion in EBITDA next year makes the stock far more valuable.

Oddly though, Credit Suisse cut the price target on the stock to $14 from $20 in the process of suggesting other cruise lines offer better value. The price target is odd with Norwegian only having an enterprise value of ~$21 billion here with net debt of $12.7 billion. The stock trades at just 10x EV/EBITDA targets and closer to 11x the estimates of Credit Suisse.

Over time Norwegian will repay a lot of the debt built up during the years of covid losses and the EV will naturally dip. For this reason, investors looking at the EV multiple only have to be careful.

Once one looks at the EPS targets for Norwegian out a few years, the EPS targets soar. The current 2024 target of 10 analysts is nearly $2 per share. As our research as shown, these analyst estimates are conservative and earnings will get a huge boost in future years as interest expenses are cut.

Source: Seeking Alpha

With Norwegian targeting the premium market focused on consumers not impacted by a recession, the confidence in the numbers is higher. Based on this and the Royal Caribbean guidance for a record 2025 EPS topping $10+ with analyst estimates below $9, the market should have more confidence in Norwegian blowing past these estimates similar to the peer targets.

After all, Norwegian reported a $5 EPS back in 2019 and other financial targets are set to top the 2019 records. Interest expenses are only up $300+ million now causing a minimal $1 hit to EPS until those numbers are whittled down.

Takeaway

The key investor takeaway is that Norwegian is extremely cheap when investors starts factoring in a cruise line with a $2+ EPS target for 2024 with the stock only trading at $16 now. Over time, the cruise line should join Royal Caribbean forecasting a top to the 2019 EPS of $5 where the stock trades at just 3x those normalized profits.

Be the first to comment