RiverNorthPhotography

Despite Nordstrom (NYSE:JWN) reporting third quarter results that beat what were very low expectations, we were still disappointed. We expected a positive surprise given that other retailers had been delivering better than expected results, and given that expectations were so low for the company. Nordstrom reported quarterly net sales of $3.4 billion, a loss per share of $0.13, and adjusted earnings per share of $0.20. It seems we were not the only ones disappointed with the results, as shares dropped ~9% in Nov. 22 post-market trading.

When Nordstrom reported its second quarter results it said that customer demand had begun to soften in late June, mostly in Nordstrom Rack. That was why it gave very soft guidance, which we now know materialized, as sales declined ~3% y/y. A big surprise this quarter was that total digital sales declined 16%, although this includes a negative impact of approximately 300 basis points from the anniversary sales shift. Part of the decline in digital sales was also due to customers increasingly choosing to shop in-store.

There were, however, some positive news too. Despite inflationary pressures the company managed to decrease its variable supply chain cost as a percent of sales by approximately 100 basis points compared to last year. Other piece of good news was that New York continues to perform very well, and it’s one of the best stores in terms of sales growth.

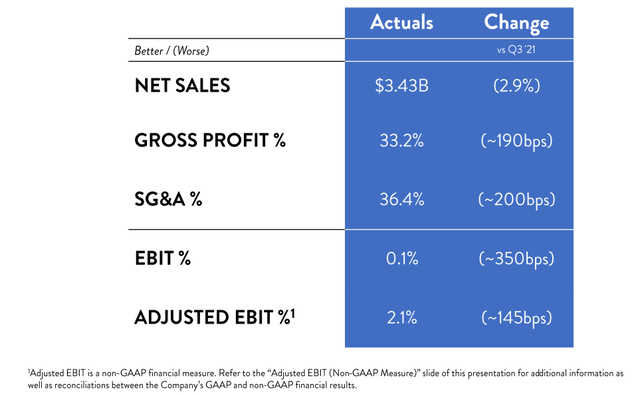

Q3 2022 Results

For Q3 Nordstrom reported a loss per share of $0.13 and adjusted earnings per share of $0.20. Net sales decreased 3%, which included a negative impact of approximately 200 basis points due to one week of the anniversary sales shifting into the second quarter. Digital sales represented 34% of total sales during the quarter.

Gross profit as a percentage of net sales decreased 190 basis points, due in part to higher markdown rates on clearance product. EBIT margin was 0.1% of sales and the adjusted EBIT margin was 2.1%, 145 basis points lower compared to the previous year.

Nordstrom Investor Presentation

Relative Underperformance

With many retailers delivering positive news recently, investors were likely expecting better results from Nordstrom, and not just meeting what were already low expectations. Nordstrom is also significantly underperforming some competitors such as Dillard’s (DDS), which saw total retail sales increase by 8%. Even Macy’s (M) outperformed expectations in the most recent quarter, even if its revenue went down 3.9% y/y.

Inventory

Nordstrom has been working on cleaning up its inventory, which could mean a lower markdown rate in 2023, and could result in a tailwind for gross margin next year. During the earnings call management was asked about excess inventory, and in particular how much is left to clear through in Q4. This is what Michael Maher, Chief Accounting Officer and soon to be interim CFO, had to say in that respect:

[…] with respect to the inventories, we said at the end of last quarter that we expected to take approximately $200 million of incremental markdowns in the back half of the year, roughly evenly split between the third and fourth quarters, and we’re on track for that. So we still expect to exit the year in a healthy and current inventory position.

Balance Sheet

Nordstrom has been improving its balance sheet. It ended the third quarter with $993 million in available liquidity, including $293 million in cash. It also reported that it paid off $100 million that it had borrowed on its revolving line of credit, and has once again the entire balance available. It also reaffirmed its commitment to an investment-grade credit rating, and expects to decrease the leverage ratio below 2.9x by the end of 2022. Nordstrom continues to target a leverage ratio below 2.5x.

Guidance

There were no big surprises with the guidance, and the company just reaffirmed its previous 2022 financial outlook. For fiscal year 2022, it expects revenue growth of 5% to 7% versus 2021, with an adjusted EBIT margin of approximately 4.3% to 4.7% for the full year. This should result in adjusted EPS of $2.30 to $2.60.

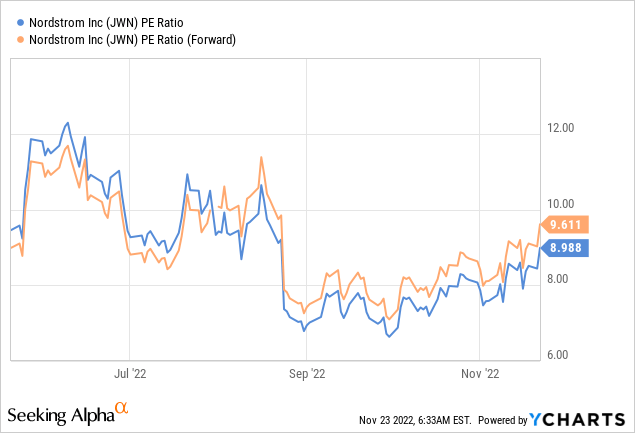

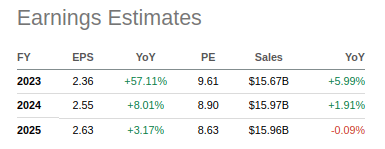

Valuation

It is difficult to value Nordstrom given the volatility of its earnings. Still, we believe even using conservative assumptions that shares are undervalued. The company has an extremely low price/sales ratio of ~0.24x, a price/earnings ratio of ~8.9x, and is trading at roughly 6.9x cash flow. Based on the most recent quarterly dividend declared of $0.19, shares yield a little under 4%, which we view as attractive. With net sales decreasing it is difficult to justify high valuation multiples, but if the company starts growing revenue again at a healthy rate, we believe it could easily justify a price/sales ratio of 0.5x, which would equate to ~$40 per share.

Analysts don’t see much growth in earnings for the next few years. We are a little more optimistic thinking that the company has a decent chance of outperforming these low expectations.

Seeking Alpha

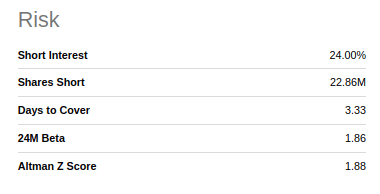

Risks

We continue to view Nordstrom as an above average risk investment, given the volatility in its earnings and low Altman Z-score, which despite some improvement remains below the critical 3.0 threshold. The company also has a very significant percentage of its shares outstanding sold short.

Seeking Alpha

Conclusion

While we were disappointed with the Q3 results that Nordstrom delivered, they were basically in line with what the company had guided to previously. Not everything was bad news, however, as the company appears to be on track to clean its inventory and enter fiscal year 2023 in much better shape. It has also made significant improvements to its supply chain which should help improve margins. We believe shares remain significantly undervalued, even though we consider Nordstrom to be an above average risk investment. Despite our disappointment, we maintain our ‘Buy’ rating for the shares, mostly as a result of the low valuation at which shares are currently trading.

Be the first to comment