y-studio/iStock via Getty Images

Investment thesis

Nomura Holdings (NYSE:NMR) is making progress in scaling its Investment Management business to generate a sustainable income stream. However, earnings remain primarily driven by market conditions and investor activity, keeping shareholder returns on a volatile footing. With the shares trading on consensus dividend yield of 4.7% for FY3/2023, we rate the shares as a hold.

Quick primer

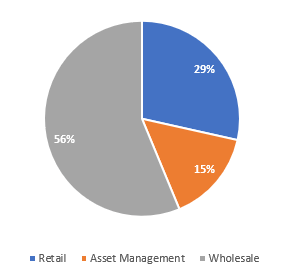

Nomura Holdings is the largest Japanese securities brokerage and asset management business headquartered in Tokyo. The Wholesale business which includes investment banking, equities, and fixed income made up 56% of Q3 FY3/2022 YTD sales, followed by Retail brokerage at 29% and Investment Management at 15%. The business is aiming to shift its business model towards generating sustainable earnings by growing its asset management and capital-light origination activities.

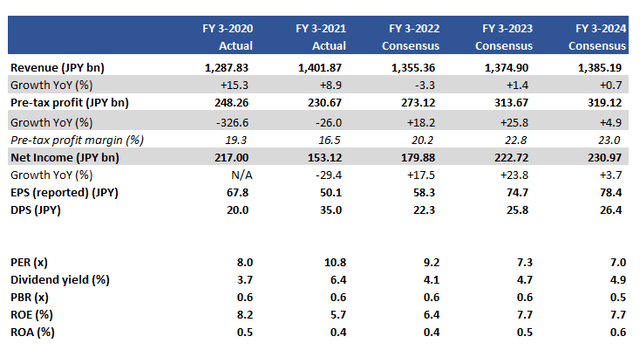

Key financials with consensus forecasts

Key financials (Company, Refinitiv)

Q3 FY3/2022 YTD sales split by segment

Q3 FY3/2022 YTD sales split by segment (Company)

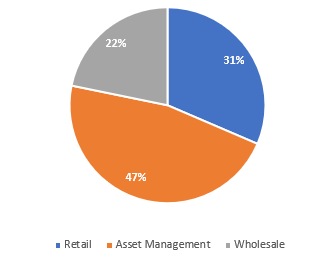

Q3 FY3/2022 YTD income before taxes split by segment

Q3 FY3/2022 YTD income before taxes split by segment (Company)

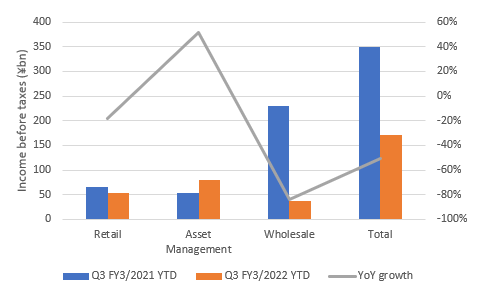

Q3 FY3/2022 YTD income before taxes by segment vs prior period

Q3 YTD FY3/2022 income before taxes by segment vs prior period (Company)

Our objectives

Q3 FY3/2022 YTD results highlighted a significant weakening in trading YoY. Wholesale income YTD declined by 84% YoY as macro conditions deteriorated resulting in falling activity in rates and FX businesses. In this piece we want to assess the following:

- progress made to develop sustainable income streams for the business.

- implication and outlook for shareholder returns.

We will take each one in turn.

Some success in investment management

We note that despite Q3 FY3/2022 YTD total income before taxes fell by 55% YoY, the Investment Management business saw growth of 44% YoY (see chart above). This was driven by continued inflows raising assets under management to record levels, with a strong customer appetite for global balanced funds and ESG products. Although there have been minor one-off investment gains to boost revenues, earnings growth overall has been achieved via steady progress in booking repeatable management fees.

Nomura has a strong domestic retail network and is leveraging external regional financial institutions (such as regional banks, page 11 of presentation) for selling funds and asset management products – these are clearly beginning to yield results. For the longer term, the company is aiming to develop new business from high-net-worth services in Asia ex-Japan markets, as well as progress in building private market businesses and alternative investments such as cryptocurrency.

Although the Investment Management business is attracting attention due to its large contribution to current earnings, if risk-on market conditions return then the Wholesale business will take center stage. More time is required for a sustainable earnings stream to fully develop at Nomura in order for investors to view the business as a higher quality cyclical offering greater scope for steady shareholder returns.

Dividend volatility is here to stay

In our previous note, we expected shareholder returns to decline YoY in FY3/2022. Although the company is yet to issue formal dividend guidance, the current consensus estimate of JPY22.3 dividend per share denotes a 36% drop YoY and an implied dividend payout ratio of 12% which is low and unattractive.

The company has bought back JPY39.4 billion/USD328 million of shares (equivalent to around 2% share buyback) in November 2021 but this event appears to be a one-off. Nomura remains relatively well-capitalized with a CET1 capital ratio of 18.0% (page 14 of presentation) providing scope for more buybacks but as trading conditions have become more volatile in Q4 FY3/2022, we do not expect more repurchase activity as financial institutions are likely to conserve liquidity.

Consensus forecasts estimate a steady rise in dividends into FY/2023 and beyond, but we believe it is too early to categorically state such stable dividend growth will materialize. However, we believe the market has priced in Nomura’s dividend outlook as volatile and expectations are not high.

Valuation

Consensus (please see Key Financials table at top of article) currently forecasts a dividend yield of 4.7% for FY3/2023 which looks like fair value to us. Return on equity is forecast to rise to 7.7% from 6.7% in FY3/2023 which is a limited improvement, showing that despite continued efforts at cost-cutting and risk management the business remains inefficient at generating profits versus quality global peers, particularly in Wholesale operations.

Risks

Upside risk comes from Nomura announcing a policy on higher shareholder returns as management begins to see its earnings mix materially shift to investment management activities, bringing it greater earnings visibility and less volatility.

A return to ‘risk-on’ market activities may not be a sustainable trend but this will help Nomura’s Wholesale business generate business in macro-related products which had seen a recent slowdown.

Downside risk comes from deteriorating macro conditions resulting in decreasing market activities as the underlying economy stutters with high inflation, rising financing costs, and continued pressure from COVID-19.

Risk management and governance have been a focal area for management after the Archegos Capital Management event in April 2021. However, Nomura’s recent track record here is not strong.

Conclusion

We view Nomura as a medium-quality cyclical business. Although efforts to grow its Investment Management business are having a positive impact, the earnings profile still remains weighted towards discretionary market activities in Retail and Wholesale operations which are difficult to sustain. The reality is that the outlook for shareholder returns remains volatile. We believe that the shares are currently fairly valued on a dividend yield of 4.7% for FY3/2023, and rate the shares as a hold.

Be the first to comment