Ismed Syahrul

Brief Industry Overview

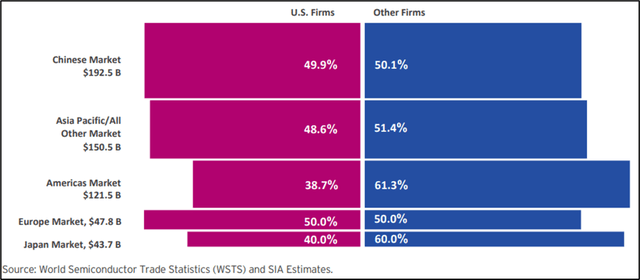

The US semiconductor industry is big. As per data provided by the Semiconductor Industry Association (SIA) fact book, the ~$600B market has witnessed 7% compound annual growth over the past 20 years, spurred by rapid advances in technology.

Characterized by US technological dominance, American semiconductor players own about 50% of this market with most sales emanating from China ($192B – 49.9% market share) and Rest Asia Pacific ($150.5B – 48.6%) Ironically, its foreign chipset firms that dominate the US domestic market, accounting for about ~60% of it.

Market Segmentation – Global Semiconductor Industry (SIA Factbook)

Made in America is a common industry theme too, with roughly 80% of domestic wafer fabrication capacity made up for by US headquartered firms. Foreign domestic investment in US capacity has been modest, possibly given the technological, political, and economic interests protected by sovereign governments the world over. Any investment in the semiconductor field comes heaped in geo-political, technological and trade risk.

It’s common knowledge that a global chipset shortage has been the catalyst for revised numbers from automakers, tv manufacturers & electrical appliance makers alike. Multiple forces came into play with the SARS-Cov2 crisis rapidly shutting down world industry. Only a few years later, the re-opening was just as abrupt & volatile, creating shifts in working, spiraling inflation & a consumer durables boom.

Now, in late 2022 with consumers fully released from home captivity, those trends are progressively fading away. This here paints the underpinning dilemma for the semiconductor industry – despite chipset famine, current signs are the US economy is perhaps moving into a tailspin and taking consumer discretionary, the chipset industry’s biggest market, with it. Bearish.

Company Introduction

Alpha and Omega Semiconductor Ltd. (NASDAQ:AOSL) is a designer, developer, and global supplier of a vast range of power semiconductors, located deep in the heart of the Silicon Valley. Its product line up is destined to a wide range of applications focused on automotive, industrial, communications, consumer & computing segments.

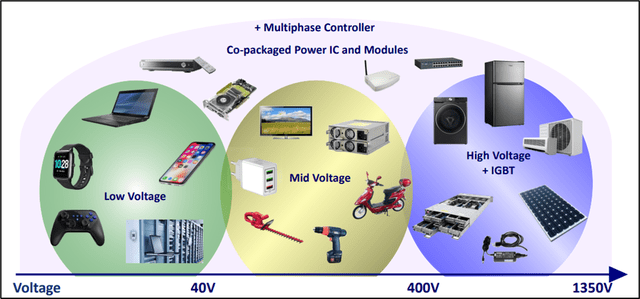

Generating annual revenues North of $700M, its product line-up covers the full power spectrum – from low voltage consumer gadgets to mid-range state-of-the-art TV sets and heavy-duty automotive modules. That’s good news because it does provide some diversification to different consumer markets.

Alpha and Omega Semiconductor Investor Presentation

Product Line-UP

The company touts operations in Hong Kong, China, South Korea & the United States with a balanced mix of in-house fabrication and third-party foundries and subcontractors. Thus far, this has provided the $850M US chipset junior with the flexibility to continue its growth trajectory without having to commit to onerous capital expenditure.

Source: Alpha and Omega Semiconductor Investor Presentation

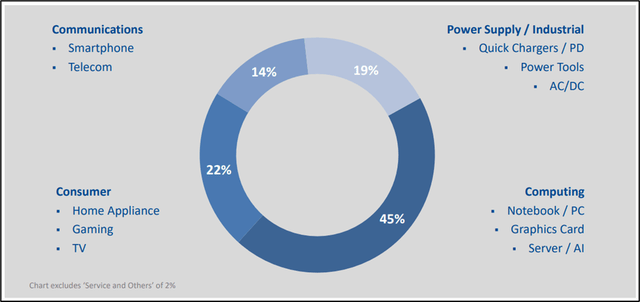

Key AOSL Markets

Computing & consumer segments make up the bulk of the firm’s $777M revenues. Importantly, these are also two of the segments experiencing a pandemic-induced boom as entrapped consumers kitted out their homes.

That was great for positive price action back then but perhaps the same cannot be said today. Both segments are heavily discretionary, implying lower future spend in times of economic hardship like those looming on the horizon.

Beyond the marketing mix hardly prepped for times of economic hardship, a meaningful chunk of the company’s consumer base lies in greater Asia – at a time where geo-political volatility is peaking.

China took an ax to its tech sector forcing an exodus of Chinese US listed firms and subsequent relisting on domestic exchanges. Nancy Pelosí’s recent visit to Taiwan did little to abate One China angst and the relics of Trumps trade wars with China remain all prominent features of the industrial landscape.

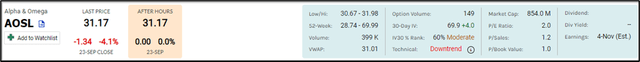

Latest Price Action

Price action for the US chipset junior has hardly been anything to write home about. But nor have US risk assets in general. Year-to-date, Alpha and Omega Semiconductor has relinquished roughly 50% of its market cap.

In September alone, the firm lost 24% as the US Federal Reserve laid siege to risk capital through restrictive monetary policy. For a segment like semiconductors which are somewhat cyclical in nature and heavily focused in the consumer discretionary space, this poses sizable headwinds moving into 2023.

Year-to-date price action Alpha and Omega Semiconductor Ltd. (TradingView)

Despite its lowish P/E multiple, the company’s small-cap technology focused pedigree primes it for more meaningful risk off investor sentiment than larger staples as US capital markets start reeling from hawkish monetary policy.

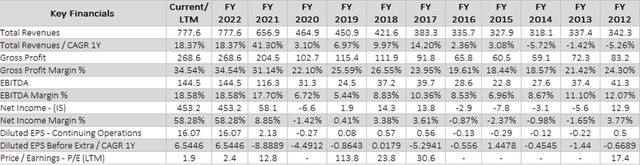

Simplified Income Statement

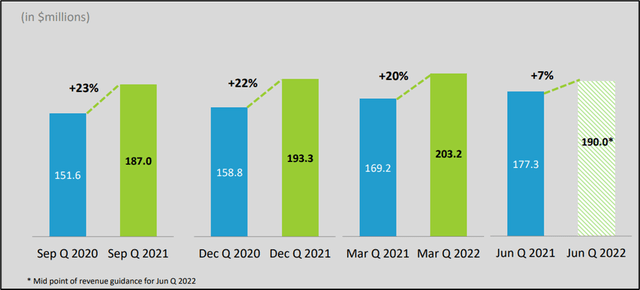

Growth has figured prominently with ~20% year-on-year sales upside not uncommon in the company’s quarterly pressers. Notwithstanding, the rate of change of growth is compressing with the most recent results posting only +7% increase in sales YOY. Those are perhaps signs of a progressive slowdown moving forward.

Source: Alpha and Omega Semiconductor Investor Presentation

Quarterly sales growth profile (AOSL) Alpha and Omega Semiconductor

Gross profit margins have improved over the past few years as prices have benefited from a global chipset shortages and demand heavily outstripping supply. Yet US dollar strength is likely to provide potential future headwinds, particularly for an industry whose main markets are found on the other side of the Pacific.

Alpha and Omega has seen its EBITDA margin go 3x since 2020, from 6.72% FY 2020 to 18.58% in 2022, testament to some of the market forces laying siege to chipset prices.

Net income margins have been erratic, swaying from -1.42% FY 2020 to 58.28% FY 2022. Such volatility in net income margins points toward possible changes in revenue recognition, or even assumptions around inventory. While it’s not a huge red flag, it merits further scrutiny.

Source: Spreadsheet developed by author with input from Koyfin.

Financial Highlights – Alpha and Omega Semiconductor Limited.

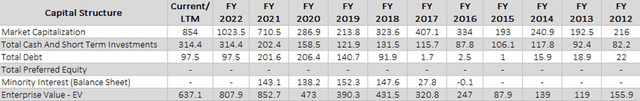

Simplified Balance Sheet

The company’s balance sheet has a few things going for it – cash & equivalents have boosted from ~$200M FY 2020 to ~$314M FY 2022. Receivables have quadrupled since 2020 and inventory too has seen consistent upside movement over the past 4 years.

Plant, property & equipment has decreased suggesting divestments provided positive tailwinds for figures posted in 2022 – any investor would need to look carefully at this too. Why decrease your industrial footprint during a period of supposed industry-wide boom?

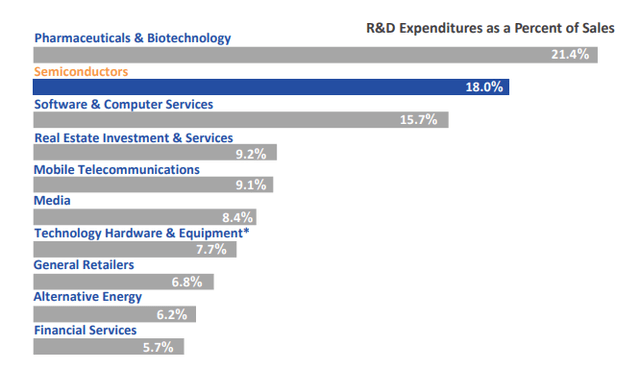

Data from SIA’s factbook shows average R&D spend in the semiconductor industry of 18%

Little in the way of intangibles (~$10M) suggests to me that research & development efforts ($71M in 2022) have not materialized in meaningful patents and intellectual property. The company spends roughly 10% of revenues on research & development in 2022 which is significantly below industry wide averages of ~18%.

Source: Spreadsheet developed by author with input from Koyfin.

Capital Structure – Alpha and Omega Semiconductor Limited

Luckily, debt does not really appear on the top of the risk register as efforts over the past 2 years to reduce debt loading have been realized. In 2021, the company posted roughly $200M in debt. Since then, prudent capital allocation has helped push this below $100M. That’s ideal given the current credit environment.

Simplified Cash Flow Statement

The cash flow statement corroborates observations made in the other financial statements with Asset disposals figuring significantly. Spend on production capacity has doubled over the past 2 years, from $62M FY 2020 to $138M FY 2022.

Recourse to debt has not been a big strategic priority nor requirement for a firm that has squirrelled away $114M in the past year alone. That’s good news for a global economy facing a widespread monetary squeeze.

Long term debt issuances appear to be consistently raised and repaid with no signs of financial strain. Some minor stock issuances and buybacks have also played a role in how the company finances expansion. (~6M to ~8M per year). It is worth noting that the company pays no dividend.

Valuations

Literally every multiple suggests a bargain basement technology play. At only 6.7x forward PE, it’s difficult to chuck this ticker in the wildly overpriced bucket commonplace among high flying technology plays. These tend to be the first to suffer huge risk-off price movements, but Alpha and Omega Semiconductor is hardly overpriced, nor does it have tell-tale fly-by-the-seat-of-your-pants earnings projections that naturally feel the after-effects of increased discount rates.

It’s hard to call the firm expensive, but just as difficult to sound-out an eyes-closed buy.

The Bottom Line

Alpha and Omega Semiconductor provides risk-exposure to a semiconductor industry mutating quickly. The California based chipset junior boasts growing but slowing revenues, acceptable margins, cash on hand and managed debt to stave off any rate-rise gremlins.

But it also remains plagued by multiple issues – geo-political tensions over chipset central AKA Taiwan, a possible lack of investment in R&D, little in the way of patent/ IP firepower and a market heavily cyclical and discretionary.

Semiconductor markets are dominated by Asia which amasses about half of chipset sales. Equally important remains the fact that most chips find their way into consumer discretionary products of all shapes and sizes.

In an era of eye-watering inflation and sovereign banks trying to regain credibility through a barrage of rate rises, only one can wonder how long consumer durables and discretionary spend will hold up as the global economy rolls over. If this occurs, the semiconductor industry will follow shortly thereafter.

Be the first to comment