Uwe Krejci

Niu Technologies (NASDAQ:NIU) reported earnings Nov. 21 and the markets did not take kindly to the results. Volumes of the e-scooters and motorbikes that they manufacture were concerning, and investors are probably waking up to the problem with relying on Chinese wallet share in the days of COVID-zero. But we have further concerns that are more structural. Companies like Niu and the general rush of sharing operators deploying battery-based scooters in cities makes them one of many stakeholders rushing for raw materials for Li-ion batteries. Producers like Niu, but also all their operators, who work on slim margins are at risk as Li-ion becomes more expensive. China risks also persist including de-risking but also black swans like crackdowns on safety standards for scooter use in cities. Not a very compelling prospect for us despite history promising profitability and some value metrics pinging like low P/Bs. Overall, there are volume challenges in the important market of China, and structural issues make it too hard to call longer term. With opportunities abound on the market with more downside protection, clear pass.

Niu Technologies Q3 Breakdown

Let’s go through some of the salient points concerning the Q3 results:

- First is the portfolio optimisation that they did towards premium models, which really was driven by market forces eschewing entry-level models dependent on Li-ion battery prices that helped preserve revenues. The share of premium models grew from just above 30% to just below 40%, and overall the sales declines were pretty limited at 6% despite very severe volume declines in the Chinese market of 32%, only partially tackled by volume growth from first-wave selling in international markets to achieve overall 19% volume declines. ASP effects from better premium mix limited declines substantially and also helped somewhat preserve gross margins from raw material inflation erosion, actually increasing them.

- The declines in China are unsurprising and are coming naturally from the fact that there are intermittent lockdowns that are making it difficult to bring new designs into mass production for markets to patch falling sharing-operator demand. Backlogs are good, and interest is high in the products. The U+ scooter got 50k volumes, which is 20% of what is currently sold in China on a quarterly basis, and launches tend to be met with lots of customer demand despite paused CAPEXing by operators and slowdowns in replacements. Indeed, sharing operators are where demand has really fallen as Li-ion prices rise to uneconomical levels. To some extent, these fleet operator budgets are going to be determined by interest in VC-like investments, and the market hasn’t been worse for those in decades. So this pause in demand is not necessarily becoming pent-up, it may just be evaporating, depending on the secular situation with Li-ion battery prices. Moreover, replacements have apparently already happened of scooter fleets, so there is concretely less pent-up demand with fleets recently renewed. Another problem is that as long as the COVID-zero policies cannot be backed out of because Xi has tied political capital to them, these will continue to majorly harangue industrial efforts and ruin growth prospects from wallet shares in China across industry. 80% of volumes are still in China as of this quarter, so this is a major problem and reflects the political risks of investing in China.

- Net income declines to 3 million RMB from over 90 million RMB, which have brought incomes almost into loss territory, are coming meaningfully from high procurement costs for Li-ion battery raw materials that are pricing out customers and reducing scale, with 90% of the volumes lost being explained by more entry level e-scooters that have become unaffordable for operators. Apparently, interest in acid-based batteries has brought differentials to historic levels, especially among sharing operators who work on razor thin margins and are being pressured by budgets to deploy on buying e-scooter assets. This explains almost all of the volume loss that was seen in China. This is pretty concerning because of the race that’s going on for procuring materials to drive the EV push across geographies. The EU is especially rabid. The greater interest in EV is a procurement issue and a cost issue not only for Niu, which is focusing on bringing up prices and does seem to be able to still grow GM, but also for operators that need to establish fleets that are being built on increasingly expensive cost bases. The economics of the operators is our primary concern and simply doesn’t scale well with the e-scooter phenomenon and EV growth generally.

- They are going to cut down on marketing expenses meaningfully, by about 40 million RMB per quarter most likely, and this should add quite a bit of profit back to the bottom line. But they depend still on volume, probably getting us about 33% back to 2021 levels in net profit.

Bottom Line

While we are already concerned with markets undervaluing how protracted and political the COVID-zero policies might be, and how that can harangue Niu’s product launches which are capable of patching demand, we are more concerned with what rising ASPs will ultimately do to the economics of the sharing operators and the size of the market for Niu. They have preserved their own GM but losses of scale in China are a huge problem for their high operating leverage cost structure, and that scale loss is coming from diseconomy down the value chain. The more EV and e-scooters succeed, the more pressure on raw materials related to Li-ion batteries necessary for the Niu design line-up of e-bikes and e-scooters. Sharing operators don’t make a lot of money as it is, and whether they can function sustainably is a question mark. Prices are unusually high now and are likely to come down to some degree, but the secular pressure on the prices of batteries is going to become a perennial problem for the economics of companies in this value chain.

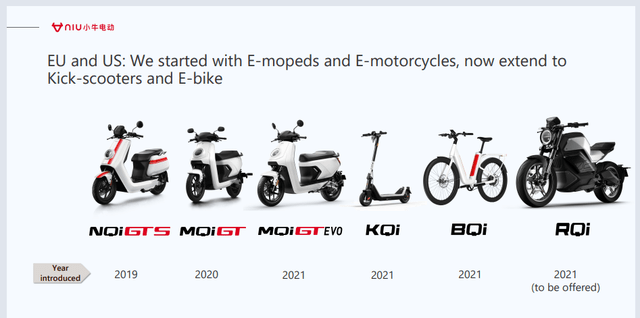

The foreign markets are looking good though. While they only represent 20% of the volumes, they have gone from nothing to something very quickly, and are giving a new wallet to sell into. ASPs are now converged onto prices paid for scooters in China. It will be interesting to see how these evolutions go and how the international sales may better the Niu position.

There are some other extant risks related to China to consider. First of all is safety regulation. God knows how this could develop in the Chinese context to be detriment of interest in using e-scooter fleets. Then there’s the more current risk of delisting. The company is pretty direct in that a delisting of their ADRs which trade on the Nasdaq could be a problem for liquidity and is likely to affect the price pretty meaningfully. There is a vague perception that relations between China and the US are improving, with the Chinese position to take a hit to the capitalisations of major stocks perhaps limited by other economic woes. But still, the matter has not been entirely resolved, and the current line is that in the event of incomplete action by Chinese companies, they’re gone from US exchanges.

P/Bs are getting below 1x, and there has been some historical profitability that could be maintained on the mix side as they premiumise the line-up and cut marketing, but this depends also on keeping their models affordable for operators, which depends on the market forces around Li-ion prices, as well as the financing environment for operators to expand fleets. Overall, scale has been lost, and it could stay low on account of pricing as well as concrete volume issues with Chinese lockdowns. On top of other risks with investing in China, we think there’s too many problems. If the sharing operator market opens up again, potentially helped by loosening credit conditions and better VC conditions for operators with CPIs looking like their peaking, this could be the basis for better business conditions. But for now, the gradient is lower due to structural procurement issues and lockdowns harassing launches of new products that could patch falling operator demand. Even if there is a path to recovering profitability, it could take longer than the stock price implies.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment