georgeclerk

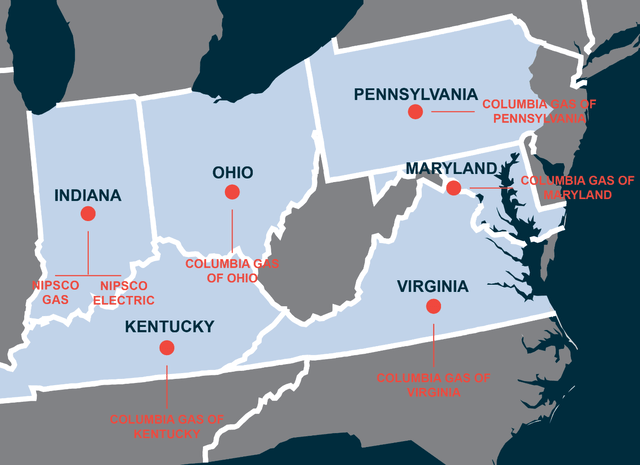

NiSource (NYSE:NI) comprises five Columbia Midwestern and mid-Atlantic gas local distribution utility companies (LDCs) and one gas and electric utility, NIPSCO. The company offers investors a 3.4% dividend and a relatively low beta of 0.46.

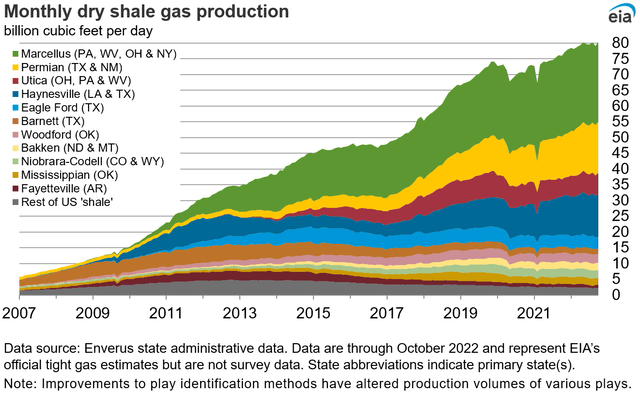

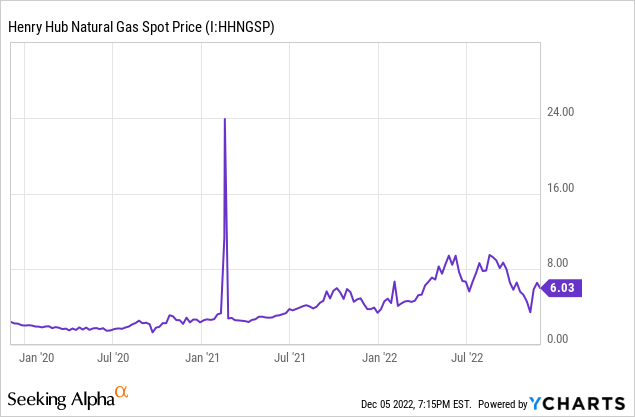

While US natural gas prices have been quite high, gas production volumes have responded with new highs of over 100 BCF/D. NiSource passes through gas costs to direct gas customers, but cheaper (and available nearby) natural gas benefits NiSource’s electrical generation.

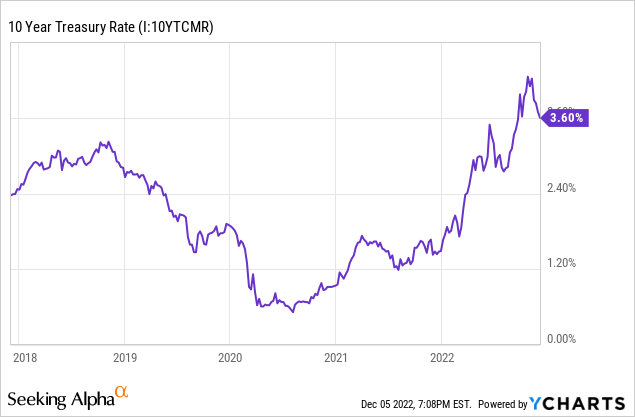

NiSource’s price/earnings ratio is high at 18 and the utility sector is under pressure from Federal Reserve rate increases. Already, a classic competitor—10-year Treasuries—are yielding more.

Once the utility sector recovers, NiSource is worth an early look. For now, I am downranking it from “buy” to “hold.

Third Quarter 2022 Results and Guidance

In the third quarter of 2022 NiSource earned net income of $52.0 million or $0.12/share, virtually identical to 3Q21 results.

For the first nine months of 2022, GAAP net income was $518.2 million, or $1.18/share compared to $377.6 million or $0.91/share for the first nine months of 2021.

For the first nine months of 2022 non-GAAP net operating earnings were $427.2 million or $0.97/share. Full-year 2022 non-GAAP net operating earnings are expected to be about $1.44-$1.46/share. For full-year 2023, non-GAAP net operating earnings are expected to be $1.50-$1.57/share. Projected annual NOEPS growth rate for 2021-2027 is 6-8%.

Capital expenditures for 2022 are expected to be $2.4-$2.7 billion and for 2023 are expected to be $2.8-$3.1 billion.

investors.nisource.com

Segments

Gas component utilities are:

- Columbia Gas of Ohio;

- Columbia Gas of Pennsylvania;

- Columbia Gas of Virginia;

- Columbia Gas of Kentucky;

- Columbia Gas of Maryland.

- NIPSCO Gas.

The electric utility is NIPSCO Electric.

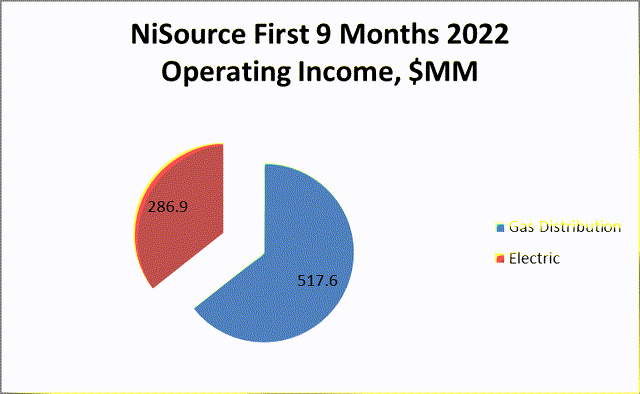

Gas segment operating earnings for the first nine months of 2022 are $517.6 million compared to $457.9 million for the first nine months of 2021.

Electric segment operating earnings (NIPSCO Electric only) are $286.9 million compared to $305.3 million for the first nine months of 2021.

nisource.com and Starks Energy Economics, LLC

Electric Generation

Per the company’s 2021 annual report, the coal Schahfer units (2/3 of its remaining coal capacity) are expected to be retired in 2023, the natural gas Schahfer units are expected to be retired 2025-2028, and the Michigan City coal units are slated for shutdown in 2026-2028.

However, the company’s solar projects are on hold until appropriately sourced solar panels can be delivered per the Uyghur Forced Labor Prevention Act.

In 2021, the company’s electrical generation capacity was 1856 megawatts comprising:

- Wind 804 MW

- Coal 1346 MW

- Natural gas 690 MW

- Hydro 16.4 MW.

It is vital to realize capacity does not equal operation: coal units can theoretically be operated at high rates of 80-90% while wind units depend on-well-the wind and may be operated at a 10-30% capacity factor.

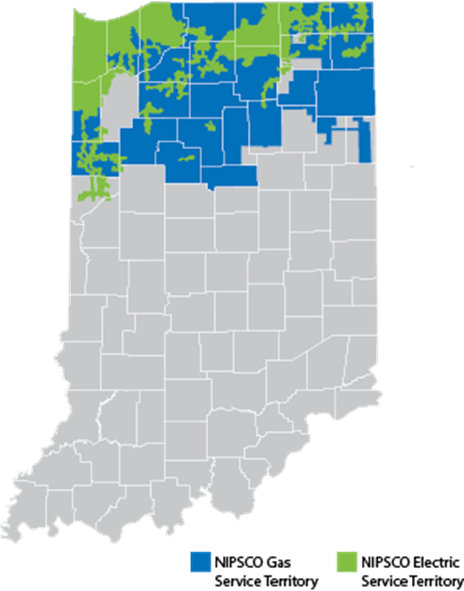

Service territories for NIPSCO Gas and Electric are illustrated below.

NiSource.com

Macro

In contrast to last year, high energy costs cascading from Russia’s invasion of Ukraine and the subsequent cutoff of Russian energy exports to Europe have reordered the traditional Western policy goals to: (1) energy security, then (2) affordability, then (3) minimizing emissions. (One can argue than in developing countries the first priority has always been affordability since it allows much-needed industrialization.)

In the US, this has increased the importance and cost of coal and nuclear as baseloads and natural gas (in generation) as a good load-following choice.

The primacy of natural gas for heating has been reinforced. It is still not clear policymakers understand electricity is a secondary, or derivative source—it has to be generated from primary fuels with an appropriate mix of operational characteristics, costs, and availability.

Natural Gas Supply and Prices

While gas costs are treated as pass-throughs for the gas distribution utilities, availability of supply remains an important factor. Meanwhile, gas competes with coal on the generation side. This is a temporary direct boon for NIPSCO Electric because it plans to retire all its coal-fired generation between 2026 and 2028.

On December 6, 2022, the January 2023 Henry Hub natural gas futures price closed down -10.5% from the prior trading day at $5.62/MMBTU. With plenty of production, Freeport LNG export plant still offline, and more Gulf Coast LNG plants many months away, natural gas forward prices are lower.

The Dutch TTF (Title Transfer Facility), a European futures reference is still extremely high at $41.77/MMBTU for January 2023 delivery. Shortages from the shutoff of Russian gas exports to Europe will continue, the TTF strip is above $40/MMBTU until February 2024.

Within the US, the Marcellus (Pennsylvania) price is typically lower than the Henry Hub price due to lack of outbound pipeline capacity. The situation is not expected to change with a new anti-pipeline governor.

EIA

For both retail gas distribution and electrical generation, NiSource is advantaged by its proximity to the giant Marcellus and large Utica natural gas fields in Pennsylvania, Ohio, and West Virginia. US natural gas production hit a new high of 102.1 billion cubic feet/day for the week ended November 30, 2022.

Competitors

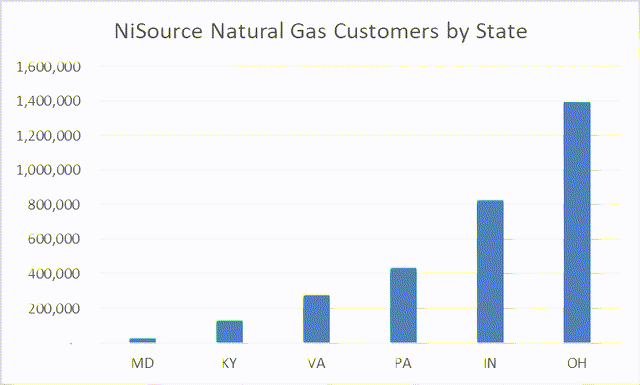

NiSource is headquartered in Merrillville, Indiana. Its largest component utility is Northern Indiana Public Service (NIPSCO). NiSource operates in two regulated segments: retail natural gas distribution across several states under the Columbia Gas and NIPSCO brands to 3.1 million natural gas customers and- in northern Indiana – retail electricity supply to 470,000 electric customers, also under the NIPSCO brand.

Although regulated utilities have their own geographic territories and business lines (electricity, gas, water, steam, or a combination) and so don’t compete directly, they do compete for investment.

Other fuels such as propane and heating oil compete with natural gas in the residential and commercial heating market. In some areas, regulators encourage the use of electric heat pumps.

nisource.com and Starks Energy Economics, LLC

Governance and Regulation

At November 28, 2022, Institutional Shareholder Services ranked NiSource overall governance a 2, with sub-scores of audit (6), board (2), shareholder rights (4), and compensation (3). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

As of August 2022, NiSource’s ESG total risk score of 30 (62nd percentile) was categorized as “medium.” Component parts are environmental risk 14.1, social 10.3, and governance 5.2. Controversy level is 3 on a scale of 0-5, with 5 as the worst.

On November 15, 2022, shorted shares were 4.6% of floated shares. Insiders own only 0.38% of the outstanding stock.

The company’s beta is low side at 0.44: its stock moves with the overall market but less sharply, as is typical for utilities.

NiSource has oversight from and reporting responsibilities to public utility commissions in each state in which it operates. In rate cases NiSource answers to a wide variety of input from customer-stakeholders.

At September 29, 2022, the largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (12.9%), BlackRock (10.1%), State Street (5.6%), Deutsche Bank (3.9%), and T. Rowe Price (3.8%).

Vanguard, BlackRock, and State Street just re-upped as signatories to the Net Zero Asset Managers Initiative, a group that, as of November 9, 2022, manages $66 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve netzero alignment by 2050 or sooner.

However, states such as Florida, Louisiana, Texas, and West Virginia expect to or have begun pulling billions in state funds from BlackRock because its ESG advocacy, particularly their disinvestment from hydrocarbon energy, impede getting the best possible returns for participants and/or damage primary businesses in these states.

A Split Decision

Pennsylvania has just elected as its governor a former attorney general who has pursued an environmental case against gas company Coterra (CTRA) and who is likely to discourage hydrocarbon production in his state.

Investors should also be aware that Virginia and Maryland have explicit, statutory greenhouse gas emissions reduction targets and have implemented carbon pricing. Pennsylvania has greenhouse gas emission reductions targets at the executive rather than statutory level.

Attorneys general for thirteen states have filed a motion with the Federal Energy Regulatory Commission to prohibit Vanguard from investing in utilities in their states due to Vanguard’s discouragement of hydrocarbons. The thirteen states include AGs from states in which NiSource provides service: Ohio (natural gas), Kentucky (natural gas), and Indiana (natural gas and electricity).

Perhaps not coincidentally, EOG Resources (EOG) has just notched what it says is a significant find in Ohio’s Utica Combo play.

Indiana’s state electricity portfolio standard comprises clean energy goals, less constraining than the plans in many other states.

But Few Natural Gas Bans in NiSource States

Of the six states in which NiSource gas utilities operate, four state legislatures have passed laws that prohibit municipalities from banning new gas hook-ups, e.g. new gas hook-ups ARE allowed. These states are Kentucky, Ohio, Indiana, and effective in 2022, Pennsylvania, with a veto-proof majority. Virginia does not have such a law. Maryland’s largest county, Montgomery County, has passed a prohibition on new gas hook-ups.

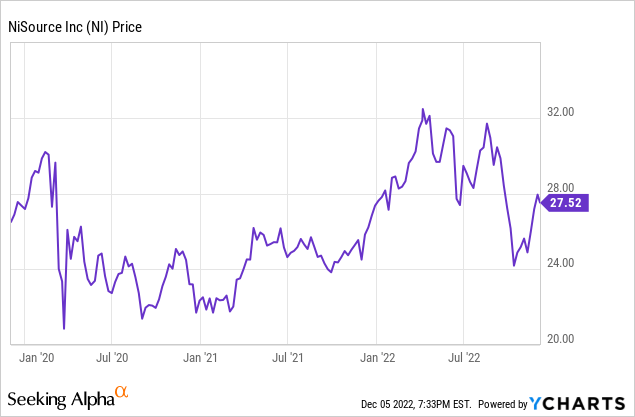

Financial Highlights for NiSource

The company’s closing price on December 2, 2022, was $27.51/share, 84% of its 52-week high of $32.59. The closing price is 95% of a one-year target price of $29.09/share. NiSource’s market capitalization is thus $11.2 billion; its enterprise value is $23.5 billion.

Using the company’s estimates for 2022 and 2023 EPS of $1.45/share and $1.54/share respectively, yields a current price-earnings ratio of 19.0 and a forward price-to-earnings ratio of 17.9.

Trailing twelve-month (TTM) return on assets is 2.9% and return on equity is 10.3%.

TTM operating cash flow was $1.31 billion while levered free cash flow was -$704 million.

The dividend of $0.94/share yields 3.4%, below the 10-year Treasury rate of 3.6%.

As of September 30, 2022, the company had liabilities of $18.1 billion including $9.5 billion of long-term debt and assets of $25.6 billion giving it a liability-to-asset ratio of 71%.

The weighted average maturity of the debt is about 14 years and the weighted average interest rate is 3.72%.

NiSource has an average analyst rating from fourteen analysts of 2.3, or “buy” leaning somewhat to “hold.”

Notes On Valuation And Risk

The company’s market value per share is twice its book value of $13.91/share, indicating positive market sentiment.

The ratio of enterprise value to EBITDA is 12.7, suggesting the stock is not bargain-priced.

As the Fed continues to raise rates to counter inflation, NiSource’s costs, particularly its financing costs, will rise. Recovery of higher costs may be limited.

Slower growth in Ohio and especially Indiana would negatively affect NiSource, as would slower growth in Pennsylvania and Virginia.

Recommendations

NiSource experiences relatively favorable state regulatory regimes, especially in Ohio and Indiana, where two-thirds of its natural gas and all of its electricity customers live.

Due to the prospects of continued inflation and interest rate raises to offset the inflation, NiSource—like most of its utility-sector brethren (except perhaps just-reviewed Black Hills (BKH)) fact significant downward pressure.

By price/earnings and EV/EBITDA measures, the company is not bargain-priced. Moreover, its dividend yield is less than that of a 10-year Treasury.

NiSource has a high liability-to-asset ratio of 71%, typical for utilities but a risk in this environment of rising interest rates.

The company also has favorable state backing in Indiana, Ohio, and Kentucky from attorneys general in those states that opposed utility investment from anti-hydrocarbon institutional investor Vanguard.

Still, NiSource would be an early return-to candidate for its pro-affordable state regulators, especially in its largest states of Indiana and Ohio, its proximity to plentiful natural gas in Pennsylvania and Ohio, and its still-available, reliable, less-costly coal generation units.

nisource.com

Be the first to comment