dima_zel

Thesis Summary

NIO, Inc. (NYSE:NIO) has rallied strongly following its Q3 earnings release, but I don’t think the two are linked. The earnings were in-line with expectations, and the company actually missed EPS.

In this article, I look at the latest results and gather insights from the earnings call. The company has faced numerous challenges, but management has addressed these well.

Ultimately, I still believe NIO is a good buy at these prices, but its success will hinge on becoming an internationally recognized brand.

Q3 Results

NIO recently released its third-quarter results, and though the results have been mixed, the stock has rallied over 10% on the day. Arguably, this has had more to do with general market sentiment, with big indexes also rallying strongly (Nasdaq up +6%). But let’s get back to NIO’s results:

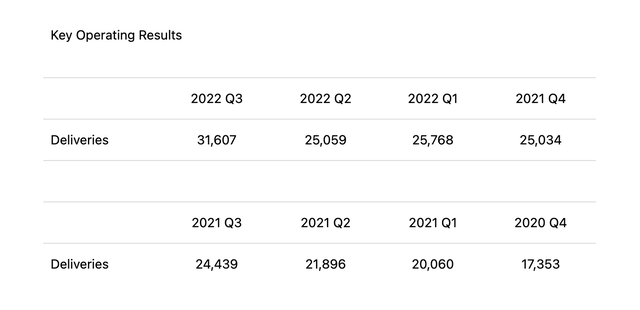

NIO deliveries (Q3 Press Release)

Some of the better news this quarter was the increased growth in deliveries. NIO delivered 31,607 cars in Q3, which is up 26.1% sequentially. This is good news, given that NIO’s deliveries have been almost flat over the previous three quarters.

With that said, there is one issue where NIO is not performing terribly well; profitability. Vehicle margins came in at 16.4%, which is significantly lower than Q3 of last year, 18%, and represents a continuation of a downward trend in profitability.

Gross margins have also come down substantially from last year. NIO had a gross margin of 13.3% this quarter, compared to 13% the previous quarter and 18% this time last year.

Yes, NIO has had to deal with supply issues and is aggressively expanding over Europe. Growth is all well and good, but can NIO ever be a profitable company? We got some insights into the answer to this question in the earning call.

Earnings Call Insights

During the earnings call, a lot of focus was put on profitability, supply chain concerns and future productivity.

Here’s Stanley Qu’s response after being questioned about higher R&D and SG&A in Q3.

Hi, Paul, this is Stanny. The increase of SG&A in Q3 compared with Q2 is because our sales and service network in China and also in Europe since we entered more country market in Europe this third quarter and also some marketing and promotion activities – more marketing and promotion activities in Q3 compared with Q2.

CEO William Li had this to say:

Regarding the R&D operations, I believe right now, we have entered a relative stable phase regarding the R&D development work, as well as the operations. So for us, we believe when it comes to the R&D expenses, including the human resources cost, it will stay at a relatively stable level. For example, probably every quarter, it should be around RMB 3 billion.

So, on the one hand, SG&A can be attributed to a larger sales team due to the Europe expansion. This is understandable. Unfortunately, it is still early to determine how much this investment will pay off. Qu also added that SG&A as a percentage of sales will be further optimized in the future.

Moving on to R&D, this has increased substantially due to numerous new product launches, but this should stabilize at around RMB 3 billion moving forward. Now, it’s just a matter of Li keeping his promise.

As far as margins, the company also provided some guidance on this:

Previously we have also achieved a 20% vehicle gross margin in the past. Like in the past, we didn’t have the battery cost increase. So this is a relatively reasonable vehicle gross margin for – our products. In the future, if the battery cost can come down to a reasonable level, I think it’s possible for us to regain the 20% to 25% vehicle gross margin with our products.

The vehicle margin has been severely hurt, mostly due to the increased cost of Lithium batteries. Li predicted that Lithium prices would come down in the future and even provided some back-of-the-envelope calculations. Supposedly, if Lithium carbonate costs dropped from 600,000 to 400,000, this alone would improve vehicle margins by 4%.

On top of that, it’s worth mentioning that NIO has already made strides to secure its own Lithium by purchasing a 12% stake in an Australian firm

Lastly, there is a very real threat that NIO could face a chip shortage, with American firms recently being banned from selling to China.

Thank you for your question. Regarding the Chip Act. I believe this may have affected the chip used for cloud training. Right now, I believe that we have a sufficient chips like the A100 to satisfy the need for the AD training in the long run.

But at the same time, we are also exploring different opportunities. For example, we’re considering working together with some cloud service providers, and we are also evaluating some long-term solutions to support the integration of our AD solutions. As of now, I don’t actually see any impact on overall operations.

I believe NIO is downplaying this issue when they say this shouldn’t be a problem in the short term. Replacing these high-end chips will not be an easy task. Ultimately, we might see NIO getting into the chip game too.

Closing Remarks

Overall, I’d say the earnings report was in line with expectations. If anything, I’d say NIO’s fall in profitability was higher than what investors thought. Despite this, NIO has rallied over 10% since the release, but, in my opinion, this is not because of the earnings release. NIO has been caught up in a “risk-on” rally, which has seen many other high-beta names rally double digits with no recent catalyst.

Having said this, I still hold my conviction that, at these prices, NIO is a great buy. NIO is showing better growth than its competitors, and although profitability is an issue now, it’s to be expected. I’m not investing in NIO because I expect it to give back to investors any time soon, and neither should you. NIO Is focusing its efforts on expanding its business, which is driving costs up.

What, in my opinion, will determine NIO’s long-term success is its international reach. Tesla Inc (TSLA) has established itself as a household name, even in Europe, where I’m from. But can NIO do the same? If it fails, it won’t be for a lack of trying, and that’s all I want to see right now.

Be the first to comment