Drew Angerer

Thesis

NIO Inc. (NYSE:NIO) heads into its Q3 earnings release on November 10 after delivering a disappointing delivery update for October.

NIO investors likely suffered a “mental breakdown” over the past two months, as it fell an incredible 63.1% from its September highs to its October lows. We postulate that the broad de-rating in Chinese stocks also impacted EV stocks, including Chinese NEV leader BYD Company (OTCPK:BYDDF).

Therefore, NIO was unfortunately caught in the de-risking moves by the market as Chinese President Xi Jinping embarked on his unprecedented third term with no signs of ending its zero COVID strategy.

NIO also reported a hit to production at its Hefei plants, resulting in disruptions to its Q4 cadence.

On its previous earnings call, NIO had telegraphed its confidence that Q4 would be a record quarter. But, the recent production disruption and October’s disappointing deliveries have likely ended investors’ hopes of seeing a record Q4.

So the question to investors is whether the steep selloff over the past two months has reflected these significant challenges, allowing NIO to base constructively at the current levels.

We discuss why the market has likely reflected the worst of NIO’s near-term challenges in its valuation, in line with its all-time valuation lows last seen in 2019. Hence, investors waiting to pull the trigger should find these levels appropriate for a speculative setup in one of China’s leading pure-play EV makers.

However, we assess that the buying momentum has yet to return to NIO decisively, even though the selling downside has likely subsided markedly. Hence, NIO is expected to trade within a tight zone as it consolidates toward its Q3 earnings.

We maintain our Speculative Buy, but cut our medium-term price target to $18 (implying a potential upside of 86%).

More Bad News – So What!

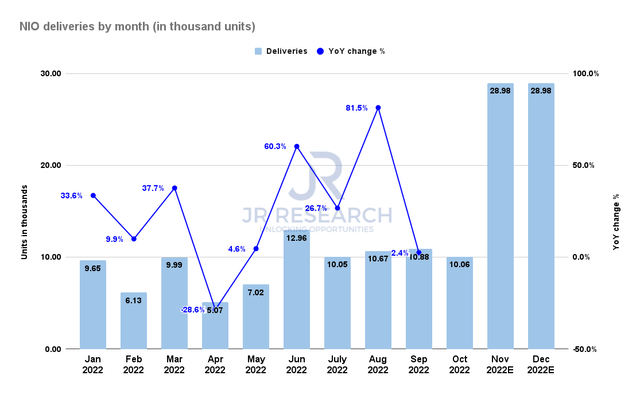

NIO deliveries by month (Company filings)

NIO posted October deliveries of 10.06K, including 1.03K ET5s. Hence, the momentum in October has weakened considerably from September as deliveries fell 7.5% MoM.

As a result, the pressure to deliver in November and December to meet a record quarter has intensified. As such, we don’t expect NIO to meet its previous optimism (as seen above), given the COVID lockdowns disrupting its production and deliveries yet again.

Therefore, as long as the zero COVID situation is not resolved, Chinese stocks will likely continue to suffer tremendous volatility linked to these lockdowns.

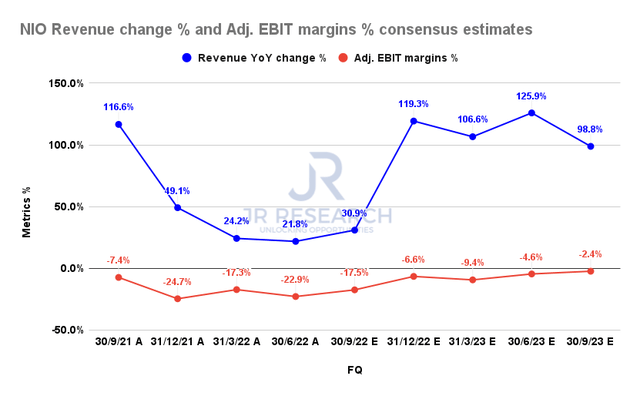

NIO Revenue change % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

As a result, we believe the consensus estimates (bullish) for Q4 are at risk, depending on the extent of the disruption. Hence, we encourage investors to parse management’s guidance carefully on its upcoming earnings call to assess the significance of the damage.

But, we don’t expect structural changes to NIO’s production cadence, even though there could be unforeseen disruptions moving ahead. The critical question is whether NIO expects its path to profitability to be delayed much further.

But, we believe the market has likely reflected these challenges as NIO trades near record-low valuations.

Is NIO Stock A Buy, Sell, Or Hold?

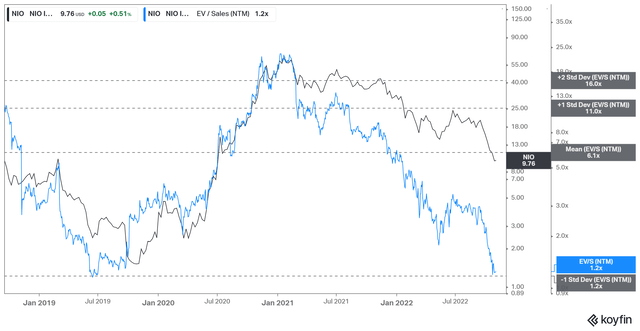

NIO NTM Revenue multiples valuation trend (koyfin)

As seen above, the steep de-rating over the past two months sent NIO spiraling down toward its lowest valuation levels, last seen in 2019. As such, NIO last traded at an NTM Revenue multiple of 1.22x.

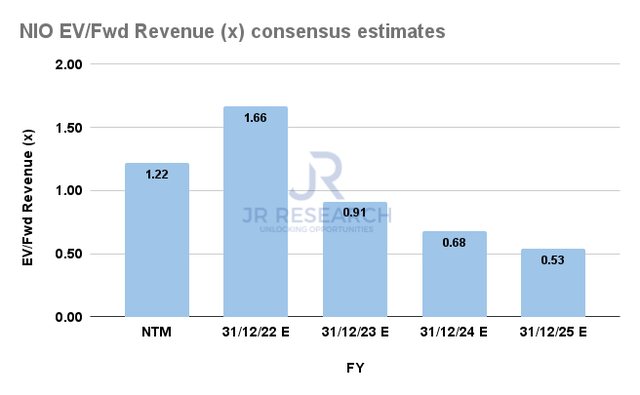

NIO Forward revenue multiples consensus estimates (S&P Cap IQ)

However, that means that the market has priced in NIO at an FY25 revenue multiple of just 0.53x. Even if we considered the near-term impact to its Q4 revenue cadence, it’s simply too cheap to ignore for a high-growth play with a path toward profitability.

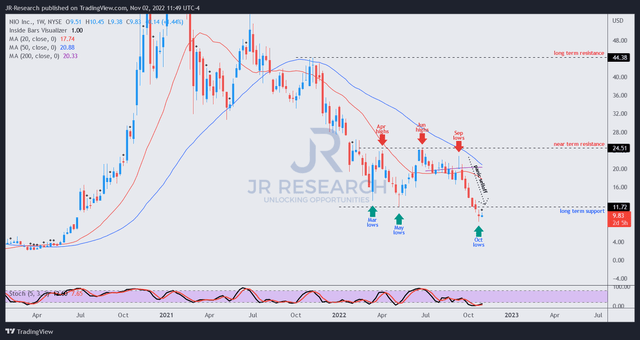

NIO price chart (weekly) (TradingView)

The good thing is NIO’s price action seems to concur with its well-battered valuation, indicating near-term consolidation.

The steep selloff from its September highs is emblematic of a massive capitulation move to instill significant fear and trepidation. Taking out the lows in March and May also forced early bottom-fishers to throw in the towel, as it knocked out their stop-losses.

Hence, we believe this “clearance” event has likely substantially de-risked NIO’s entry levels. However, we must highlight that we have yet to glean sustained buying support that could lift its momentum back up, like in March/May.

Hence, the possibility for further near-term downside volatility cannot be ruled out. But, the reward-to-risk profile looks attractive at these levels.

Maintain Speculative Buy rating.

Be the first to comment