Scharfsinn86/iStock via Getty Images

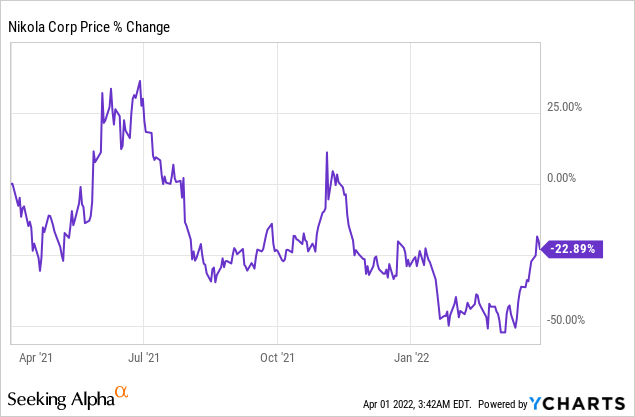

Electric vehicle startup Nikola (NASDAQ:NKLA) reported slightly more than a week ago that it was moving into the production stage for its Nikola Tre battery powered electric truck. The beginning of production marks an important milestone for the electric vehicle company which faced a considerable amount of production setbacks in its recent past. Shares of Nikola surged on the announcement, but have recently dropped back again. I believe the risk/reward is still very attractive here and the stock has more upside!

Why truck production start is a milestone event for Nikola

Nikola has worked through multiple issues over the last year that unfortunately resulted in a significant delay in the production of its first-ever production truck, the Nikola Tre BEV. Nikola also found itself in the cross-hairs of regulators after its founder, Trevor Milton, got indicted on securities fraud charges related to the over-promising of Nikola’s technological capabilities.

But with Nikola’s latest announcement, it looks as if the company can now approach its future more confidently. The company said last week that it commenced commercial production of the Nikola Tre battery powered heavy duty truck and expects to make its first deliveries in the second quarter of FY 2022. The start of production is a big deal for the EV startup because originally Nikola expected to begin truck manufacturing in Q1’21, meaning the firm is about a year behind its original production plan and investors really need some good news after the stock got battered.

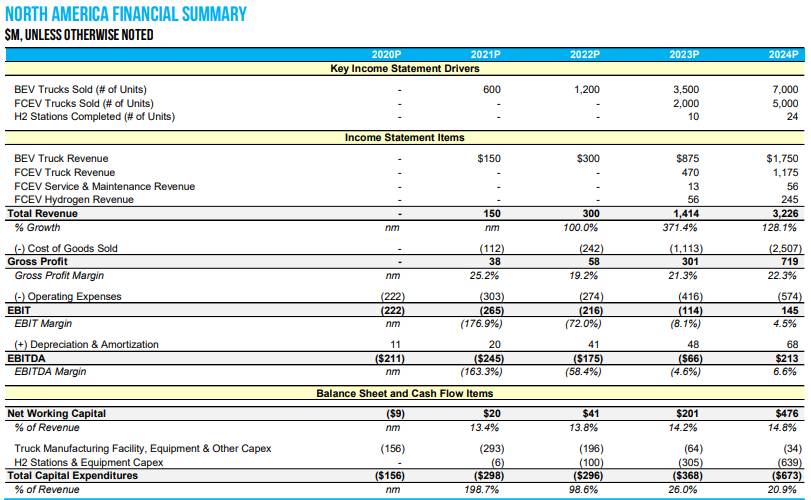

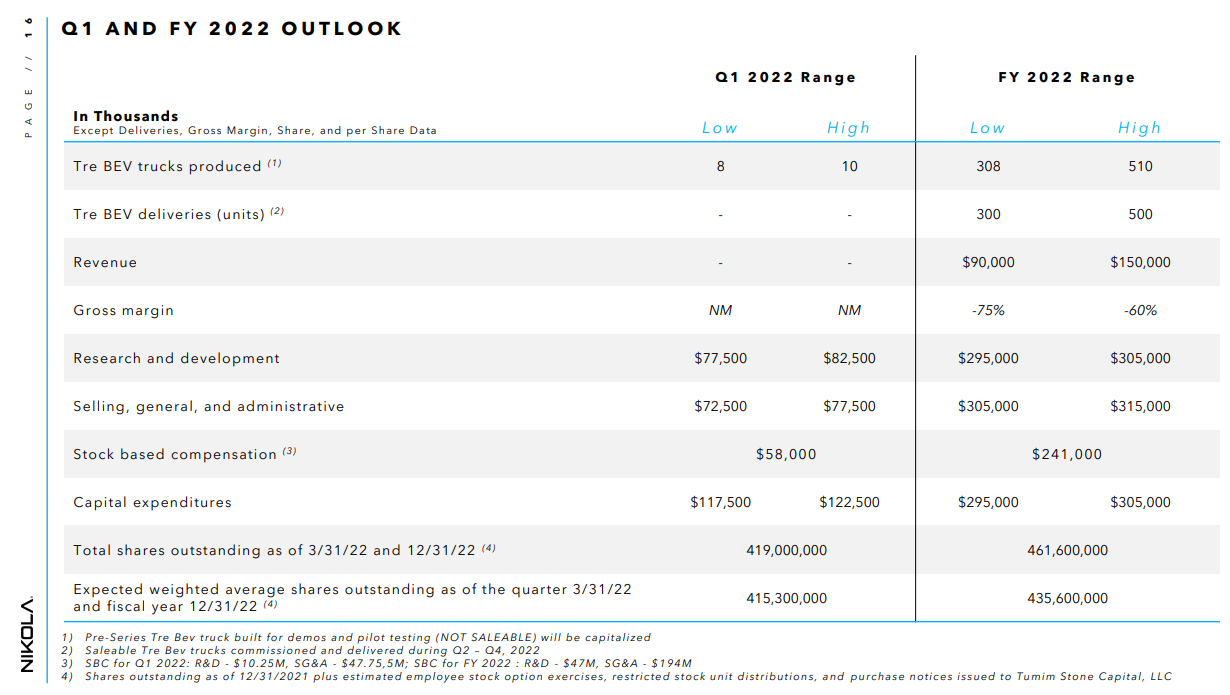

Starting production is usually regarded as a big milestone event for electric vehicle startups, whether they produce passenger electric vehicles or electric trucks. Based off of Nikola’s original production plan, the company planned to produce and sell 600 BEVs in FY 2021, which unfortunately did not materialize. The firm expected to ramp BEV and FCEV production up to about 12 thousand units by FY 2024… a timeline that is now no longer realistic. I believe Nikola is about 12-18 months behind its original production plan, but the start of production definitely clears a big hurdle for the EV company going forward.

Nikola

Nikola has said that it is going to start truck deliveries in the second quarter and the company expects to deliver between 300 to 500 Tre BEV heavy duty trucks to customers in total this year. This expected FY 2022 delivery volume translates to $90M to $150M in revenues which would mark massive growth compared to FY 2021, a year in which Nikola didn’t have any revenues at all. In FY 2023, Nikola is expected to fully ramp up manufacturing, in part because the firm’s facilities in Germany are expected to commence truck production in Q2’23.

Nikola

Crucial tests for Nikola in the coming months

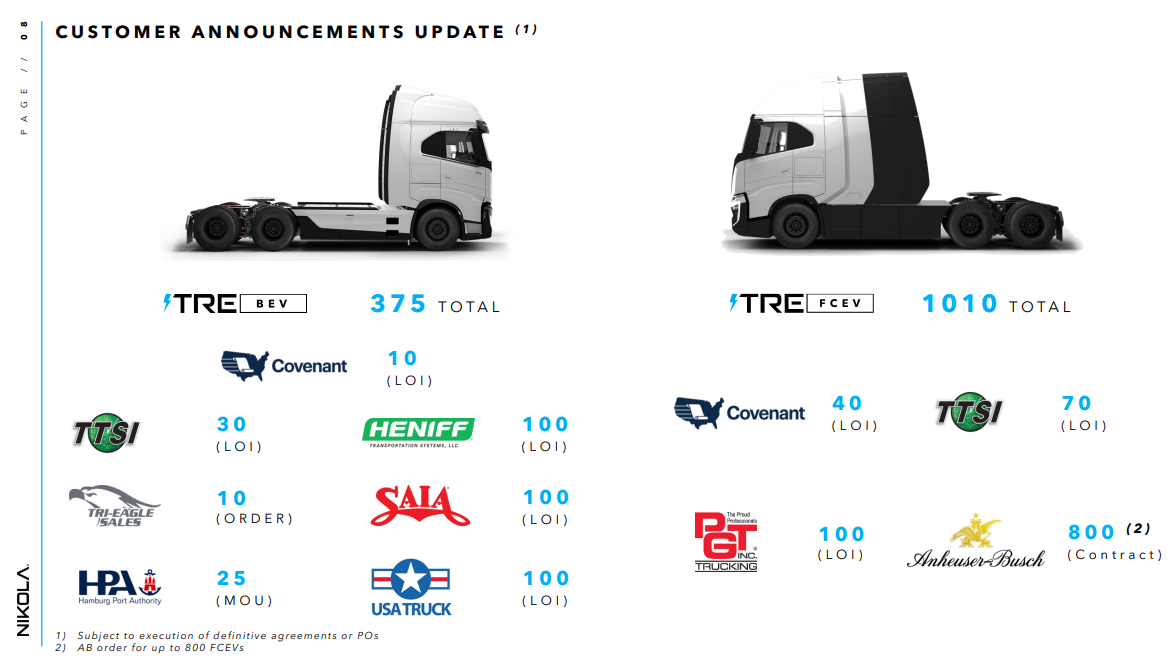

Nikola is in multiple pilots with transportation companies that are currently testing out Nikola’s truck solutions. Multiple companies have signed letters of intent/LOIs with Nikola and the company built 30 pre-series Tre BEVs in its Coolidge, Arizona manufacturing facility in Q4’21 to kick off pilot projects.

Nikola has also guided to complete its phase 1 build-out of its Arizona plant by the end of Q1’22. Once phase 1 is completed, Nikola will have an annual production capacity of 2,500 electric trucks annually. The phase 2 build-out, which is expected to be completed in Q1’23, is set to boost Nikola’s factory output levels to 20 thousand units annually, resulting in an eight-fold increase in production capacity. Nikola’s Coolidge facility is expected to produce both the BEV and the FCEV trucks on the same production line.

What is going to matter most to Nikola and the stock in the coming months is if companies that are currently in pilots opt to expand their relationship with Nikola. The EV startup has seen some nice momentum at the start of FY 2022 and signed new letters of intent with transportation companies that look to deploy zero-emission truck solutions to lower their operating costs. I expect Nikola to sign new LOIs with transportation companies throughout the year and also expect that most current pilots will be completed successfully.

Nikola

Risks with Nikola

Nikola has signed multiple LOIs with transportation companies in FY 2021 and FY 2022 that want to integrate Nikola’s Tre heavy duty trucks into their commercial truck fleets. The LOIs define terms for additional truck purchases if customers are satisfied with pilot testing. Nikola is also not an established truck manufacturer, so timeline and production risks continue to be a risk for the company and the stock.

Should Nikola pass the pilot tests and customers place new orders with the truck company, shares of Nikola could revalue a lot higher. What would change my mind about Nikola is if customers ended the pilot programs without placing new BEV and FCEV orders with the company or new production delays were to occur.

Final thoughts

Shares of Nikola have reacted strongly to the announcement of the firm’s official truck production start which indicates that investors highly value the progress the electric vehicle startup has made lately.

Going forward, Nikola is going to face a couple of tests. The biggest test for Nikola in FY 2022 will be if interest in the firm’s battery and fuel cell truck solutions translates to new letters of intent or purchase orders. If customers place additional orders and production ramps up without further delays, shares of Nikola could revalue a lot higher in FY 2022!

Be the first to comment