Joe Raedle

Article Thesis

Nike (NYSE:NKE) will release its first-quarter earnings results on September 29. The company has seen its share price drop quite a lot in recent months due to a range of factors. We’ll look into the likelihood of another earnings beat and what investors should keep an eye on when Nike reports its upcoming results.

A Very Weak Performance By Nike Year-To-Date

Like many other consumer goods companies, Nike experienced significant tailwinds during the pandemic from a couple of macro trends. First, lockdowns meant that consumers could not spend as much money on experiences as they did before the pandemic, e.g. eating at restaurants, traveling, concerts, etc. They thus had more cash to spend on goods, which was beneficial for the producers and sellers of these consumer goods — especially discretionary ones that are purchased when consumers have cash to spend but that are not necessary (unlike drinks, food, hygiene products, etc.). On top of that, massive fiscal and monetary stimulus spending increased consumers’ spending power even further, allowing even more people to buy all kinds of goods that are not really necessary. Nike, as one of the leading consumer discretionary companies in the world, benefitted from that trend.

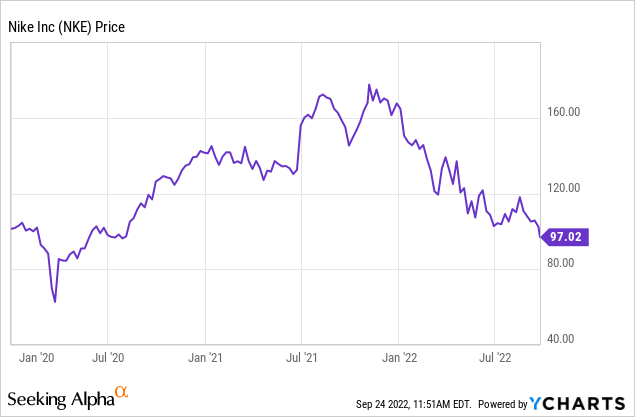

Its share price reflected that, quickly rising above pre-pandemic levels once the initial COVID-induced bear market had ended:

From a price of around $100 per share at the beginning of 2020, Nike rose to as much as $180 in late 2021. Since then, however, shares have dropped sharply. This year alone, Nike has declined by more than 40%, destroying dozens of billions of dollars in shareholder wealth.

There are several reasons for that. First, shares were trading at a too-high valuation when enthusiasm was very high. At the end of 2021, Nike was trading at an earnings multiple of 45. At the same time, the 10-year median earnings multiple is in the high-20s. Buying an established blue chip company at an earnings multiple of well above 40 hardly works out well in the long run, and Nike once again proved that in the following months — valuation matters, after all, no matter what kind of company we are talking about.

But Nike also faces several macro headwinds, thus the price decline was not only driven by multiple normalization. First, as a discretionary consumer products company, Nike is impacted by declining spending power amongst consumers. Whilst food companies or toothpaste manufacturers will be able to sell their products no matter what, discretionary consumer products companies are impacted when consumers spend less. Consumers are reducing their spending on “wants” in the current environment due to two reasons. First, high inflation reduces their spending power and results in a higher allocation for items such as food and energy, which reduces the available spending power for products such as new shoes or apparel. Second, it is looking like the US and the world as a whole are entering an economic downturn, which will likely reduce consumer spending further — some people will lose their jobs, and others will be more inclined to keep their money in uncertain times.

The sales outlook for Nike has thus worsened, and at the same time, margins are coming under pressure due to rising costs for materials, energy, and so on. It is thus not surprising to see that analysts aren’t forecasting compelling growth for Nike’s upcoming quarterly results. In fact, Nike is forecasted to grow its revenue by just 0.3%, according to Wall Street. When we account for inflation running at a high-single-digit rate, that means that sales will actually be down meaningfully in real terms.

Even worse, analysts are forecasting that Nike will earn just $0.92 per share. That’s 21% less than the profit Nike generated during the previous year’s period in real terms, and pencils out to a profit decline of almost 30% in real terms. As noted above, the combination of stagnant revenue due to weak consumer sentiment and rising costs will pressure Nike’s profits considerably.

Looking at estimate revisions, it’s pretty clear that the worsening macro picture (inflation and recession) has left a mark. Earnings per share estimates for Q1 have dropped by almost 30% over the last six months, while EPS estimates for Q2-Q4 are down by double-digits as well. Wall Street has soured on Nike, at least to some degree, and the share price reflects that the investor community as a whole has become more bearish as well.

Will The Beats Continue In Nike’s Q1 Earnings?

That being said, Nike has a history of outperforming expectations. Over the last ten quarters, Nike has managed to beat earnings per share estimates nine times, and revenue estimates were also beaten more often than they were missed. It is thus not unlikely that Nike will outperform current expectations and report a higher-than-expected net profit for its fiscal first quarter. I still doubt that Nike will be able to keep its profit from declining, but it would not be too surprising if Nike reports a smaller-than-expected profit pullback. If history is a guide, actual earnings per share results might come in closer to $1 than the current consensus of $0.92 — but that would still mean a mid-teens decline versus the previous year’s quarter.

It is likely that a recent trend of Nike Direct outperforming Nike Wholesale will remain in place. Heavy spending to boost its direct sales channels and the overall trend of growing e-commerce sales will continue to benefit Nike Direct’s sales. At the same time, the Wholesale business might feel the majority of the macro headwinds such as weak consumer sentiment causing people to buy fewer discretionary items. That would be in line with reports of brick-and-mortar retailers that talk about high inventory levels and slower-than-expected sales — see, for example, Target’s (TGT) and Walmart’s (WMT) recent comments.

With Nike’s shares down so much this year, it will be interesting to see what management has done on the capital allocation front. The company does not offer an overly high dividend yield, at 1.3%, but it has indicated that it is eager to buy back shares at current valuation levels. During the most recent quarterly report, Nike announced a new $18 billion share repurchase program. That’s equal to around 12% of the company’s market capitalization today. Since shares have dropped further since the last earnings announcement (down another 10% or so), management should, in theory, be even more eager to capitalize on the current share price weakness. Utilizing a significant portion of the current buyback authorization would reduce Nike’s share count meaningfully, thereby boosting the company’s future earnings per share growth outlook. At the same time, a solid pace of buybacks might offer some support for Nike’s falling share price. Right now, Nike is in a blackout period prior to the earnings report, which is why there will likely be no buybacks. But a couple of days past the earnings announcement, buybacks could commence again. Investors should look for potential hints of that in management’s remarks. Since Nike has pretty low debt levels — its net debt even is negative when we account for cash held on the balance sheet — the company is in a position to ramp up shareholder returns significantly if it wants to. Due to it having a clean balance sheet, rising interest rates aren’t a threat for Nike, after all.

Is NKE Stock Attractive Today?

It’s pretty clear that Nike wasn’t attractive at the beginning of the year. Paying a way-above-average valuation is highly risky, after all. Today, things are different, however. Based on current forecasts for this year’s earnings, Nike is trading for 26x this year’s earnings. That’s marginally below the 10-year median earnings multiple, so Nike is not historically expensive today. Instead, it trades close to fair value, arguably slightly below that.

At the same time, we don’t know yet how deep the current economic downturn will be. I thus am reluctant to buy a consumer discretionary goods company today. Overall, I’m thus neutral on Nike right now. From a valuation perspective, the stock does not look bad. The relative strength index reading of 32 also implies that shares could be oversold right now. Last but not least, Nike could ramp up its shareholder returns considerably and buy back shares at a hefty pace if it decides to utilize the current authorization.

But buying a consumer goods company might make more sense once the bottom of the recession/economic downturn has been reached. I thus find Nike neither particularly attractive nor unattractive at current prices, although a better/worse-than-expected earnings report might change that when NKE reports a couple of days from now.

Be the first to comment