Editor’s note: Seeking Alpha is proud to welcome Robert Ribciuc as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Joe Raedle

Does the share price falling (a lot) tell us anything about “pricing power”?

Last week, Nike (NYSE:NKE) – the world’s largest footwear and apparel company – lost about 15% of its market cap, taking a lot of the sector down. It had already been by and large a very rough year for footwear company valuations. Some urged investors to “run for the hills.” Its earnings call alarmed investors and analysts: gross margins declining, inventories rising dramatically, and management warning of decisive markdowns ahead to unload inventories. All of these sound like the very opposite of what most would expect from a company with serious “pricing power.” The swoosh is made to look like it’s pointing down, hard.

The trajectory of Nike’s stock price appeared consistent with declining pricing power, as evidenced by need for significant markdowns to clear ballooning inventory. (Author)

Pundits (including CNBC’s ever-entertaining Jim Cramer) and journalists alike have for many months now conditioned us that in this market, “pricing power” sets apart the winners and losers. Yet, until recent months, Nike would have been rated by nearly anyone as a “very high” pricing power company. And its super-premium valuation would have made no sense unless the market and analysts believed it could grow earnings at a healthy clip.

What gives?

Author / Seeking Alpha

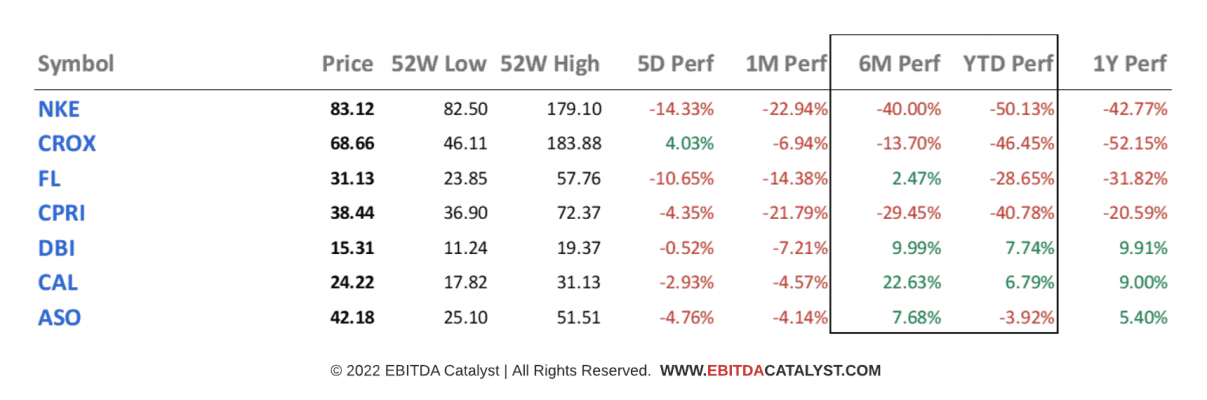

After a brutal week post-earnings, Nike is now underperforming a fair number of footwear companies YTD.

Is pricing power predictive of stock price appreciation?

Not really, though caveats apply.

First, it turns out to be remarkably difficult to pin down what different people mean by “pricing power” to begin with. This is a very important gateway issue, and something I plan to address in a separate article, complete with a proposed preferred definition, and explaining the limitations I perceive in some leading definitions out there.

Second, regardless of what definition one picks, pricing power is just like every other asset (or liability) of a company: it can be “already priced in” the current stock price, and thereby either correctly or over-/undervalued by the market. Also, to even enter into the conversation as a driver of valuation, pricing power has to translate into large enough earnings upside/downside to materially impact the cumulative trajectory of future cash flows. This is a tall hurdle for any company, but particularly for global giants like Nike whose size, geographic and currency footprint, and product portfolio breadth are formidable.

Third, pricing power is not some sort of universal constant describing some unchanging law of a company’s fortunes. It can change dramatically with time and actions both by the company, other actors, geopolitics, or even, in some cases, the weather. Big moving pieces (say, wars or pandemics or supply chain blowups or currency headwinds) can intervene to dwarf, offset, or mitigate impact of pricing power.

Fourth, talent or management prowess might or might not be there to harvest even such pricing power as there is into pricing execution and ultimately material earnings growth.

Is pricing power related to stock prices (or valuations) at all?

The answer is, yes, absolutely.

Pricing power is one of the most important assets of a company. Building brands like Nike is directly related to (and motivated by) building customer loyalty and pricing power in the process. Companies that actively manage, nurture, build up, and harvest pricing power become more valuable in the process. Interbrand’s ranking of the world’s most valuable brands spells out a core part of its methodology as follows: “Brand strength measures the ability of the brand to create loyalty and, therefore, sustainable demand and profit into the future.” Pricing power is the key link between “sustainable demand” and “sustainable profit into the future.”

For publicly traded companies, the current stock price of a company, especially a brand-heavy consumer brand like Nike, reflects and very much depends on what the market already believes (and has priced in) about pricing power. It is the future direction and movements of the stock (and thereby, also, whether one will do well buying the stock today) that might be completely uncorrelated to pricing power, except to the extent there are “surprises” about pricing power that require adjustment from the market’s current view/current stock price.

It’s important to note that even for publicly traded companies, there are (rather rare) instances in which having a view about pricing power and pricing strategy can allow a more educated guess about stock prices. These are typically situations where one pricing decision/strategy/product disproportionately drives the performance of a company. The market cannot agree which way the decision will play out, therefore the expertise to handicap the outcome can help take the right position against the market’s coin toss.

For example, we’ve written elsewhere about such decisions at Peloton (PTON) – only a couple of major products whose pricing success or failure drives the fortunes of the company – and Dollar Tree (DLTR) – in the context of raising its iconic psychological price point of $1 to $1.25. We took a negative view of Peloton’s strategy and a positive view of Dollar Tree’s, both so far vindicated by drastic moves down for Peloton and up for Dollar Tree.

For privately held companies, a completely different analysis applies. For all but the largest and most sophisticated private companies, there is usually unused pricing power, or opportunities to actively manage and increase their pricing power. Furthermore, there are no daily updates to a “stock price” and reporting requirements that help investors and analysts to mostly “price in” updated and accurate estimates of the “value” of pricing power assets. These opportunities are rarely reflected in current valuations, and often can present exceptional upside opportunities for “value creation” with pricing expertise as a driver.

McKinsey’s view is aligned here, as evidenced by the following quotes: “Pricing: The next frontier in private equity value creation” and “Pricing is by far the biggest tool for earnings improvement.”

A more humble (and nuanced) view of pricing power is warranted

Once we accept these points, or even a subset of them, for publicly trade companies like Nike pricing power is better seen as a catalyst of other assets and value the company already produces. I think of it as an EBITDA catalyst or (for SaaS and subscription companies) an ARR catalyst.

Likewise, we should delineate “current pricing power” now from “sustained pricing power” over time. The former is about products and pricing-related actions available to operate on and generate additional earnings today and in the near future. The latter is about a set of assets and capabilities that can be expected to generate repeatable opportunities to harvest both recurring and “new” pricing power-driven earnings increments. For example, using pricing research and refined willingness to pay understanding to create growing customer value with new high-profit-pool products, thus harvesting or indeed creating new customer tastes and demand or gaining share. In this, “sustained pricing power” sounds a lot like Nike.

With these proposed distinctions, the point remains that the market tries its best to price in, efficiently, both current pricing power and sustained pricing power. Because it is, in relatively stable markets, easier to assess the near future, current pricing power is more likely to be accurately priced in already. Therefore it only holds small ability to surprise/drive stock price appreciation or decline, unless the markets are dramatically disrupted or the company is poorly researched and understood (e.g., mispriced).

Crocs vs. Nike: a case of relative “pricing in” of pricing power

Here’s our recent experience with a (rare) opinion we offered about footwear companies stock prices, based (among other factors) on our estimate of current pricing power and whether we felt it was correctly priced in.

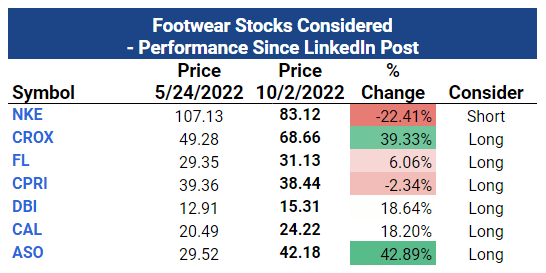

Back on May 24, 2022, I wrote a brief note on footwear brands’ stock prices. I suggested that Nike at $107 was overpriced and Crocs (CROX) at $49 underpriced, certainly on a relative basis, and that the discretionary nature of the sector might explain footwear’s poor performance expectations (with Nike’s still rich valuation seemingly at odds with the rest). Another company that looked undervalued was retailer Academy Sports and Outdoors (ASO), though I did not include it as it was not concentrated enough in footwear. (Full disclosure: I did take some action per my own advice.) The table below shows performance between then and now. Even while the sector was battered, on a relative basis, NKE underperformed both CROX and ASO, and everything else I felt could be a long back in May.

Here’s what happened since (as of Oct. 2, 2022):

Performance of selected footwear company stocks compared to Nike (NKE) (Author)

So what does this have to do with pricing power? (My point here is, in general, do not pick stocks because you think they have high/low pricing power.) Three weeks earlier, I had noted the apparent caution and hesitation by Nike to assert its industry leader position when it came to signaling (or, in fact, taking) meaningful price increases. I knew from our work in the space that “some” footwear companies would benefit from some price increases, and what likely delineated the potential for higher or lower “current” pricing power among them.

But most importantly, whatever uncertainty range there was around pricing power, the actual stock valuations offset with additional margin for error. Nike seemed least obviously assertive in its pricing-power-related statements (given its leadership/signaling power), yet its stock was the one priced for perfection. Nike’s 21x EBITDA and 3.6x sales multiples would need not just “great current and sustained pricing power,” but also all the other factors we discussed above to play as tailwinds. One didn’t have to be exactly right that Nike was managing down expectations of current pricing power; any of the other headwinds could come to the “rescue” and negatively impact Nike’s lofty valuation (and they did).

Conversely, CROX fit perfectly the drivers my work had revealed “help” current pricing power, especially in an inflationary environment (among others strong brand/design loyalty with lower average price per pair, broader exposure to low-mid consumer range, no curtailing of retail partner network a-la-Nike to “focus more on Direct” – a risky move if Covid’s trends softened or reversed). Again, valuation to the rescue – it was valued as an impending disaster primarily due to fears about its Hey Dude acquisition not panning out.

So what of Nike’s pricing power (and stock price) going forward?

I have no reason to believe Nike’s sustained pricing power is substantially dented. While we are not in the predictions (or stock picking) business, it’s a safe bet that Nike will keep doing what it does best: innovate and market products people worldwide love to buy, and harvest willingness to pay that it has masterfully built up in its hundreds of millions of consumers. In the short term, Nike’s current pricing power is absorbing some transitory blows from “other moving pieces,” proving our point that predicting stock prices based on pricing power is risky at best, and foolish for most. It bears listening to Nike CFO Matthew Friend on the earnings call:

Earlier ordering by retailers, driven by strong consumer demand and less predictable delivery time lines, had led to elevated inventory levels broadly across consumer goods. Then transit times began to rapidly improve with signals that further improvement may be coming.

At the same time, consumers are facing greater economic uncertainty, and promotional activity across the marketplace is accelerating, especially in apparel. As a result, we faced a new degree of complexity. Demand for NIKE, Jordan and Converse continues to be uniquely strong with positive consumer response and high full price realization on fresh seasonal assortments and key product franchises.

In September, month-to-date retail sales are up double digits versus the prior year, following a strong back-to-school season. However, our North America inventory grew 65% versus the prior year, with in-transit inventory growing approximately 85%.This reflects the combination of late delivery for the past two seasons plus early holiday orders that are now set to arrive earlier than planned and a prior year that was impacted by factory closures in Vietnam and Indonesia. As a result, we are taking decisive action to clear excess inventory, focusing on specific pockets of seasonally late products, predominantly in apparel.While we expect this to have a transitory impact on gross margins this fiscal year, we believe this cost will be far outweighed by the benefit of clearing marketplace capacity to align seasonally relevant product, storytelling and retail experiences for the consumer. Time and again, this is how NIKE responds to adversity. We adapt, we compete and we accelerate forward.

I am with Friend. And the stock, at the very least, is no longer priced for perfection.

Conclusion

Conflating pricing power (again, in whatever permutation of the many definitions out there) with an indicator of future stock price performance is a fallacy. Most of what can be known about a publicly traded company’s pricing power is a) likely already in the current stock price, and b) subject to considerable disruptions from other market forces or company decisions with even larger impacts on the stock price.

The exceptions among publicly traded companies are extremely rare, and require “getting it right” on two fronts that each usually take deep expertise to get right. These are the actual estimate of pricing power’s impact on company’s earnings/cash flows generation, and an accurate read on what the company’s current valuation is pricing in. That is a tall task even for those who claim both kinds of expertise. It is outright gambling when done because someone said on TV that “company X will do well because it has great pricing power.”

Privately held companies, by contrast, hold frequent and sometimes dramatic potential for value creation (appreciation in the valuation) driven by pricing power, thoughtfully and diligently deployed. Nike will be just fine, give or take a couple of quarters. We rate it a hold, but if it dips toward the mid-$70s we’d consider taking a position and selling calls against it.

Be the first to comment