IURII KRASILNIKOV/iStock via Getty Images

Investment thesis

Despite valuations looking less expensive than a year ago, Nidec (OTCPK:NJDCY) is unattractive given the negative macro outlook and key man risk related to CEO Nagamori. With mounting cost pressures and limited opportunity for organic growth, we believe there is downside risk to current market expectations.

Quick primer

Nidec is the global leader in small precision motors producing over 3 billion units a year. Key products are HDD spindle motors, car emergency braking systems, haptic motors, and compressors for white goods like fridges and air conditioners.

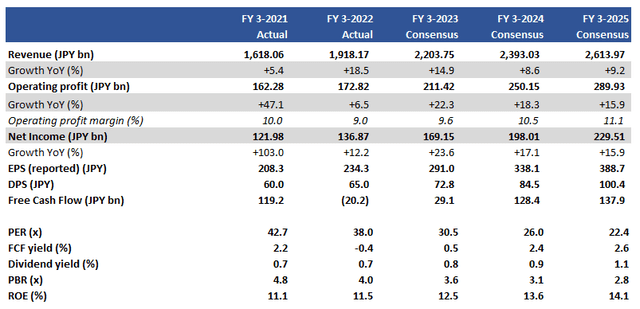

Key financials including consensus forecasts

Key financials including consensus forecasts (Company, Refinitiv)

Our objectives

Nidec’s shares have fallen 34% YTD, and we want to assess whether this is a buying opportunity for the shares. We previously had a neutral rating in May 2021, based on valuations that did not look cheap.

We also look at the implications of COO Jun Seki’s departure after just two years and the fact that the firm continually fails to find a successor for founder CEO Shigenobu Nagamori.

Recent trading and outlook for FY3/2023

The overriding trend witnessed in Q1 FY3/2023 was the depreciation of the Japanese yen driving topline growth by 20.8% YoY. Although Q1 quarterly revenue was a record high, the lack of any meaningful underlying growth meant that the market remained unconvinced, reflected in flat operating profit growth YoY as increasing input costs led to an effective decline in profitability.

With major activity in the foreign currency markets, it is a given that Nidec will once again show relatively robust revenue growth in Q2 FY3/2023; the company’s assumptions (slide 3) for USD is at JPY110 (currently JPY144), and the Euro at JPY125 (currently at JPY139). However, we expect to see limited operating leverage due to increases in direct input costs as well as indirect running expenses such as power and staff.

What is more pertinent is the outlook for H2 FY3/2023 given the massive change in consumer sentiment with inflationary pressures. High uncertainty is already resulting in falling discretionary spending (as well as basic staples particularly in Europe), and this bodes negatively for Nidec’s core earnings drivers – Appliance, Commercial and Industrial Products which include components for white goods and air conditioners (the outlook for both Electrolux (OTCPK:ELUXF) and Whirlpool (WHR) are not exactly stellar), and Automotive with expectations of new car sales to drop again due to a combination of component shortages and consumer sentiment despite growing market share for EVs.

The EV thematic is often used as a case to invest in Nidec. Unfortunately, this subject has been marketed aggressively by the company since 2018, and many institutional investors remember the time that CEO Nagamori promised shipping 2.5 million units of its E-axle traction motor by the end of FY3/2025, currently revised up to 4.0 million! For the next 11 quarters, the company must ship over 325,000 units to meet this target, around four times the current run rate (slide 11) which looks optimistic. In essence, this story has been flagged often enough not to warrant a major re-thinking over Nidec as an electrification-themed investment. In fact, we sense the falling levels of interest by investors in the last earnings call with much fewer participants asking questions compared to recent years.

No heir to the throne

We conclude that with founder CEO Nagamori reaching his 78th birthday this year, the company has a fundamental problem over succession planning and hence poses a high key man risk.

In 2018 ex-Calsonic Kansei (auto parts company supplying Nissan) executive Hiroyuki Yoshimoto was appointed president, viewed as the heir apparent as Nagamori stepped aside for the first time as the head of the business. He was demoted and left in 2021. Chief Operating Officer Jun Seki was appointed 2020 from Nissan (OTCPK:NSANY) but demoted from CEO earlier this year and resigned in September 2022 after just two years at the firm. Currently, there is no visible succession plan in place.

The problem appears to be Nagamori’s positive track record placing a very high bar on any successor who will take his place as CEO, as well as Nagamori’s insistence on being hands-on and involved in everything that stifles any new attempt at running the business. The problem now is that after two very public falling-outs with succession candidates, the post has become much less appealing than ever before. Nagamori has a son but he is said to have no interest in running the family business – Nagamori remains the top shareholder with an 8.3% stake.

High reliance on Nagamori poses the following risks. Growth at the firm has been driven significantly by M&A – if this strategy was to change under new management, investors will review their position over the shares. Nagamori has a strong fanbase with institutional investors, and his absence will take a premium off the share price. With his hands-on approach, Nagamori’s eventual absence may mean his staff is ill-equipped to run a global business with multiple segments due to a lack of experience, particularly in decision-making (as opposed to following his orders).

Valuations

Consensus estimates (see Key financials table above) appear too bullish in our view, with operating profit growth expected in the high teens range into FY3/2024 and FY3/2025. With mounting cost pressures and limited opportunity for organic growth, we believe there is downside risk to current market expectations.

The shares are trading on consensus PER FY3/2024 26.0x, with a free cash flow yield of 2.4%. Although valuation metrics are looking far more palatable than they were a year ago, given the deteriorating macro backdrop and a low dividend yield of 0.9%, we believe the shares are unattractive.

Risks

Upside risk comes from a significant M&A transaction that is earnings accretive and makes a major long-term growth story for the company. This is likely to be in machinery or automotive, although in these sectors the opportunity for high profitability may be limited. Another positive development would be finding a successor to Nagamori as the CEO.

Downside risk stems from dropping underlying growth as demand for auto and white goods decline in the face of a global recession, resulting in flat to falling earnings growth. CEO Nagamori resigning with no formal successor would be a negative event.

Conclusion

Nidec has previously been viewed as a high-quality industrial with positive secular drivers. Unfortunately, there is a limit to the company’s capabilities in managing inflation, negative consumer confidence, and a general global economic slowdown. Key man risk remains unresolved with no outlook for a solution, and consequently, despite improving valuations there are no major new positives for investors to grasp. With this backdrop, we rate the shares as a sell.

Be the first to comment