Nikolay Evsyukov/iStock via Getty Images

Since my last article on NewLake Capital Partners, Inc. (OTCQX:NLCP), there haven’t been many changes for the company. They added one property to the portfolio in Q4, for a total of 28 properties in 11 states. While I’m not too focused on short-term price actions, shares have fallen by more than 10% in the last couple of months. I recently added to my position and I’m very bullish on the company over the next 3 to 5 years.

Investment Thesis

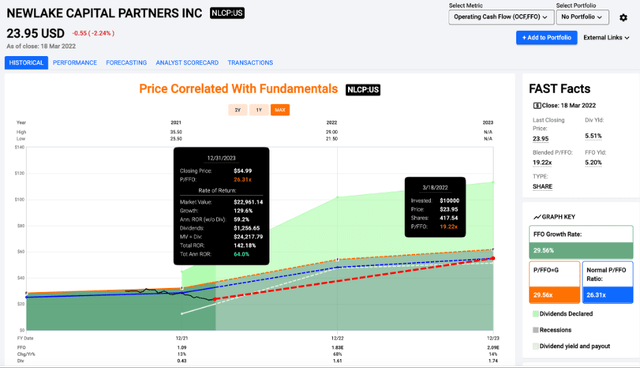

NLCP is a newer cannabis REIT that went public in the last half of 2021. Shares don’t currently trade on a major exchange, which is something that management seems to be working on. The valuation is very cheap, especially compared to big brother Innovative Industrial Properties (IIPR). Shares trade at a price/FFO of 19.2x and I think shares could easily command a 25-30x price/FFO in the next couple of years. The forward yield is 5.5% and I think the dividend growth will likely make it far higher. Investors willing to buy small caps trading on OTC markets should consider buying shares of NLCP.

The Business and the OTC Listing

I covered different pieces of NLCP’s business in my previous article. If you want to read about the lease terms, escalators, and the portfolio, I covered it there. This article will be more focused on the OTC listing piece as well as the current valuation and dividend. NLCP is poised to continue to grow, but the most interesting piece I read from the recent 10-K and earnings call was a piece related to their market listing. CEO David Weinstein said this on the recent earnings call:

Finally, I’d like to address certain dynamics relating to trading in cannabis-related stocks. It has become more challenging for investors to trade in these stocks, as certain banks have restricted secondary trading of cannabis-related stocks that do not trade on either the New York Stock Exchange or NASDAQ. We believe that this has created a less than optimal trading volume and liquidity in all OTC traded cannabis-related stocks, including ours. We have been evaluating alternatives to up list to a major exchange such as NASDAQ. We are currently engaged with NASDAQ regarding a potential approach for an up list, but there is no certainty that we will ultimately receive approval. It is premature for us to say much more, other than we understand that this is an important issue for our company and our shareholders, and we are very focused on working through this issue.

I think that the potential for uplisting to a major exchange could be a game-changer for NLCP. Because they are not technically a plant-touching company like Trulieve (OTCQX:TCNNF) or Curaleaf (OTCPK:CURLF), I think that they will be listed a major exchange much quicker than any of the cannabis companies. I won’t speculate on when the uplisting could happen, but I’m fine either way. If it uplists, the multiple expands, which is great for the growth of the company. If it stays on the OTC, I will be able to accumulate more at current prices. Uplisting could lead to a material valuation rerating as institutions and other entities that can’t invest in OTC markets are able to buy shares of NLCP.

Valuation

I will keep pounding the table on NLCP for as long as the valuation remains attractive. With the portfolio yields, escalators, and growth potential, NLCP could easily trade at or above a 30x price/FFO multiple. Shares currently trade at a price/FFO multiple of 19.2x, which is a steal in my opinion. IIPR, which is larger, and therefore likely to grow slower, currently trades at a price/FFO 30.6x. I own IIPR and still think it is attractively valued today, but I mention the company because it shows that NLCP and investors could benefit from significant multiple expansion.

If the estimates are accurate investors buying now could see massive returns from an attractive combination of FFO/share, current yield, and dividend growth. Long-term investors can get excited about the growth potential of the business over the next 3 to 5 years, but investors looking for current income should consider NLCP as well.

The Dividend

This is where investors focused on current income can celebrate if they own shares. NLCP currently yields 5.5% if you assume the dividend will not be increased for the rest of the year. I am expecting the dividend raises to continue. The most recent raise was 6.5%, from $0.31 to $0.33. I am optimistic about the potential for dividend growth, especially when you look at the underlying asset class and the fact that NLCP has almost no leverage on the balance sheet. I think that investors buying and holding shares could see a double-digit yield on cost at some point in the future.

Conclusion

NLCP is one of the few options I find attractive in today’s public markets. It is underfollowed, and I think investors could be in for explosive returns in the next 3 to 5 years. The valuation is reasonable at 19.2x price/FFO, which is far cheaper than IIPR and NLCP is likely to grow faster. I won’t speculate on when the company will be listed on a major exchange, but I think it will lead to a significant multiple expansion. The dividend yield sits at 5.5% and is likely to be far higher for long-term investors. If you aren’t worried about buying on the OTC, NLCP could provide massive returns for patient investors.

Be the first to comment