mbbirdy

The New York Times (NYSE:NYT) remains one of the most prominent brands in news around the globe, but as has been proven time and again in the markets, recognizable brands don’t necessarily always make for strong investments.

The Times has been under attack from a number of fronts over the past several years: declines in print journalism, increased competition from free or freemium news outlets, declining interest in general in hard news (social media provides a news outlet now for younger generations), and rising newsroom costs. Smaller papers around the country have already had to consolidate in order to survive, but in the end maybe even the New York Times’ scale will be unable to protect its business model.

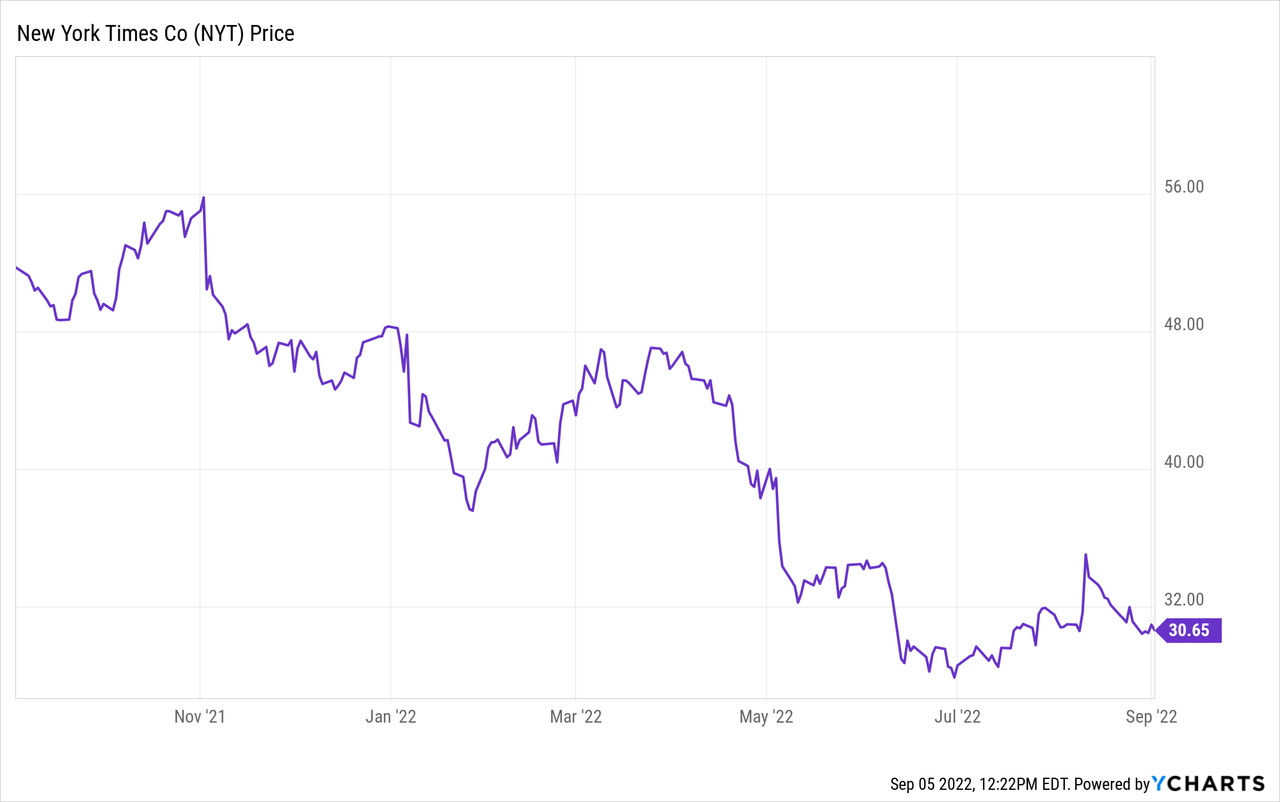

Year to date, the Times has shed nearly 40% of its value. But with so many red flags evident in its near-term results, I continue to foresee further losses for this stock.

I remain bearish on the New York Times. Not only do I think the going will get tougher for the company, but I also fail to see any meaningful catalysts that can put this company in rebound mode.

As a refresher for investors who are less familiar with this stock, here are what I believe to be the key bear-case drivers for the Times:

- Organic growth is faltering. Digital revenue growth has fallen to the low-teens, and the pace of subscriber additions is paling in comparison to 2020, which was a super-cycle year for news (COVID plus a presidential election). To boost its growth, the Times has turned to acquiring several different companies, including The Athletic and Wordle.

- Losing focus? The acquisition of The Athletic makes sense. But the addition of Wordle only has a loose connection to the Times’ long-standing history of crossword puzzles. It has become apparent that The New York Times is primarily interested in purchasing companies to keep up digital subscriber growth numbers at any cost, even when large purchases like The Athletic are dilutive to the bottom line. In my view, management is spreading itself too thin in trying to form a conglomerate of different news brands and games.

- Inflation is a real profit killer for The Times. Unfortunately, we are already in an age where lots of news is available for free (or consumed in other ways, such as via social media) – so the thought of raising prices is unthinkable. In fact, The Times’ chief tactic for attracting new subscribers is via lowball introductory offers, such as $1/week for four weeks. At the same time, inflationary wage pressure means that The Times is having to shell out a lot more to keep its newsroom staff afloat. This exploding cost burden, plus the losses at recently acquired companies, is eroding The Times’ profit margins.

The only recent upside risk here is that the company has recently attracted activist attention from ValueAct. Value Act is pushing the Times to more aggressively push its subscription bundles, rethink its board composition and management, and address executive compensation.

Activist interest always provokes a sharp one-time spike to a stock, but in the Times’ case, I really don’t see a near-term exit or buyout in the cards, especially at its current valuation. Even at the company’s fallen share price near $31, the company still trades at an excessive 30x forward P/E relative to Wall Street’s consensus FY23 pro forma EPS estimate of $1.02. Bear in mind as well that The Times’ profit trend is downward, as subscription revenue growth is hardly enough to offset print/ad revenue declines and deceleration and can’t keep up with rising newsroom costs.

The bottom line here: With so many free options available on the internet and with interest in hard news on the wane, consumers aren’t going to be paying more for a subscription to the Times anytime soon – even though the news is becoming substantially more expensive to produce. This is a losing formula for the New York Times, and investors should beware.

Q2 recap

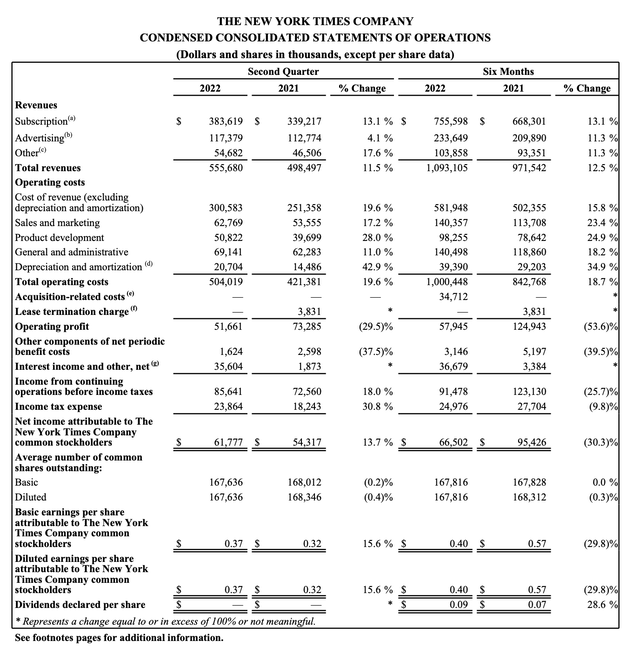

Let’s now cover the New York Times’ latest Q2 results in greater detail. The Q2 earnings summary is shown below:

New York Times Q2 results (New York Times Q2 earnings release)

The company grew revenue at a 12% y/y pace to $555.7 million in the quarter, only barely coming ahead of Wall Street’s expectations of $553.8 million. Revenue growth also decelerated two points relative to 14% y/y growth in Q1.

Note as well that when we consider the linearity of the acquisition of The Athletic, which closed one month into Q1 (two months of results reflected in Q1), organic revenue decelerated even further. The New York Times Group alone, excluding contribution from The Athletic, grew revenue at only 8% y/y, three points slower than 11% y/y organic growth in Q1.

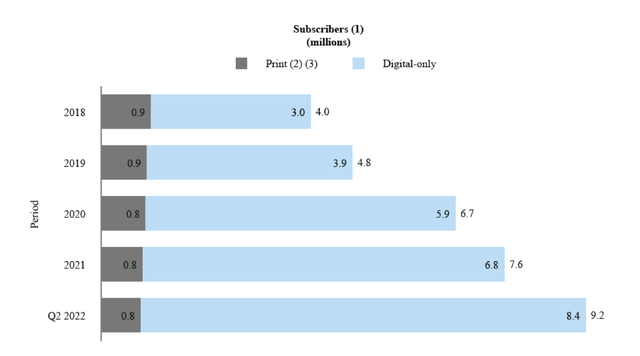

Similarly, subscriber growth also paled in Q2: the company added 180k net digital-only subscriptions in Q1, which is less than half compared to 372k net organic adds in Q1 (excluding a 1.1 million one-time benefit from The Athletic acquisition). The print subscriber base also continued to decline, down -7% y/y to 750k total subscriptions.

New York Times subscriber trends (New York Times Q2 earnings release)

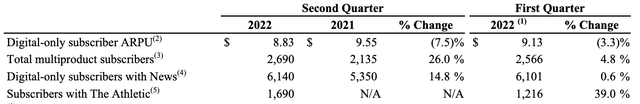

Alongside slowing subscriber growth, The New York Times continues to push ARPU downward – as it mixes into cheaper and discounted subscriptions to keep pushing subscriber counts higher. ARPU fell -7.5% y/y to $8.83, as shown in the chart below, and was $0.30 weaker than in the first quarter:

New York Times ARPU (New York Times Q2 earnings release)

The company’s key strategy to address subscriber deceleration and ARPU declines is to continue promoting subscription bundles. Per CEO Meredith Kopit-Levien’s remarks on the Q2 earnings call:

News remains core to our value proposition. But the bundle helps ensure that The Times is indispensable to an ever-widening group of people even as news engagement ebbs and flows. In the second quarter, we brought in the highest-ever number of new starts to the bundle, thanks to a deliberate effort to prompt more people to buy it versus News-only subscriptions.

As a result, the bundle made up a majority of the quarter’s total net subscriber additions. That means we’re seeing discernible momentum on a key element of our strategy to drive revenue, profit, and shareholder value. Our experience so far is that bundle subscribers including our newest ones pay more, engage more frequently, and retain better.

So our plan is to lean even more heavily into selling the bundle to new subscribers, and getting existing subscribers to upgrade in the back half of the year. We expect much of the revenue benefit from this to begin in 2023, as we follow our proven playbook of moving subscribers from introductory offers to higher prices over time.”

The playbook here is a classic NYT move – it will slash prices for introductory offers, but the jury is still out on whether consumers will retain high-priced bundles when the promotional periods end.

In the meantime, the company has continued to see costs grow alongside wage inflation. Operating costs rose 20% y/y in the quarter, which is far faster than revenue growth (it’s worth noting as well that The Athletic was an unprofitable acquisition).

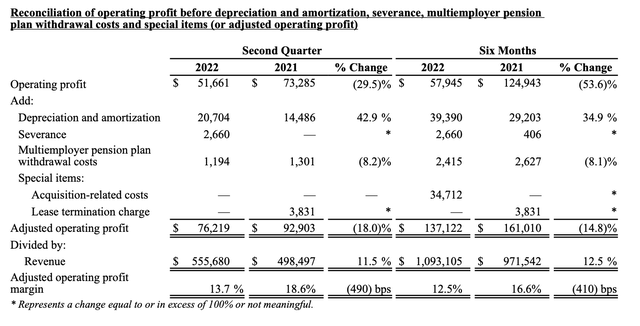

New York Times operating margins (New York Times Q2 earnings release)

As shown in the chart above, adjusted operating profit fell -18% y/y to $76.2 million (a sharper decline than in Q1), while adjusted operating profit margins fell 5 points to 13.7%. Pro forma EPS of $0.24 also declined -33% y/y.

Key takeaways

Now a confusing web of news and digital assets, The New York Times is trying everything it can to keep subscriber growth high. Subscriber add trends, however, are on the wane, as are subscriber ARPUs as promotions continue to be the key method of getting new readers through the door. With costs rising and profits slipping, investors will likely continue to lose patience with The New York Times and send it spiraling further.

Be the first to comment