Taiyou Nomachi

Finding an attractively priced company that can deliver strong returns is one thing. But it is another thing entirely to get those returns in the timeframe in which you anticipate. A great example of this can be seen by looking at Boise Cascade Company (NYSE:BCC). This company, which produces and sells laminated veneer lumber, laminated beams, I-joints, also distributes products like strand board, plywood and lumber, and other related products. It has proven to me to be a quality operator in its space. However, recent financial performance has served to push shares down, even though the share price decline has paled in comparison to what the broader market has experienced. In the near term, I wouldn’t be surprised if the pains the company is experiencing continue. But given how cheap the stock is at this moment, I have a hard time imagining a scenario in which the company could become overvalued. Because of this severe pricing disparity, I’ve decided to keep my ‘buy’ rating on the enterprise, faithful that the picture will eventually turn around.

Recent weakness is discouraging

Back in January of this year, I wrote an article that took a rather rosy view of Boise Cascade. At that time, I lauded the company’s fundamental performance and said that its overall financial health looked sturdy. On top of that, I was impressed with just how cheap shares were, ultimately concluding that the company still had some upside potential for long-term investors to benefit from. At the end of the day, I ended up rating the business a ‘buy’, indicating my belief that it would outperform the broader market for the foreseeable future. Since then, things have not gone exactly as planned. Shares have incurred a loss for investors since the publication of that article of 8.6%. Although this is painful, the company did technically outperform the S&P 500 as I thought it would, with that index dropping by a slightly more severe 9.5%. Although any decline is disappointing, it is worth noting that shares of the business are still up by 22.3% from the September 2021 article in which I initially rated the company a ‘buy’. This compares favorably to the 10% decline seen by the S&P 500 over that same window.

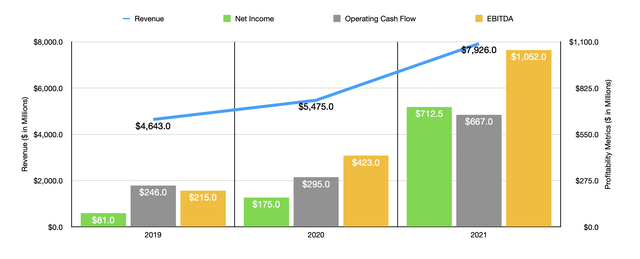

When I last wrote about Boise Cascade, we only had data covering through the third quarter of the company’s 2021 fiscal year. Today, we now have data covering not only through that year but also through the first half of the 2022 fiscal year. For 2021 as a whole, the business generated revenue of $7.93 billion. That represents a significant improvement over the $5.48 billion generated in 2020. From 2020 through 2021, the company benefited from both higher volume and higher pricing. Consider the LVL (or laminated veneer lumber) products for the company. The average net selling price per cubic foot for its products with $21.73 in 2021. That’s 19% higher than the $18.26 per cubic foot seen just one year earlier. Pricing for other wood products also increased, with I-joists rising in price from $1,244 per 1,000 equivalent lineal feet to $1,514. Plywood pricing increased by 74.6%, while lumber pricing rose by 70.4%. Even along the way, sales volumes also rose, with LVL volumes climbing by 5.2%, while I-joists volumes jumped 20.3%. Plywood increased a more modest 0.5%, while lumber volumes dropped by 10.5%. We also saw Sales prices climb by 42% under the Building Materials Distribution segment, while sales volume grew by 3%. On the bottom line, the company saw net income climb from $175 million in 2020 to $712.5 million last year. Operating cash flow grew from $295 million to $667 million, while EBITDA increased from $423 million to $1.05 billion.

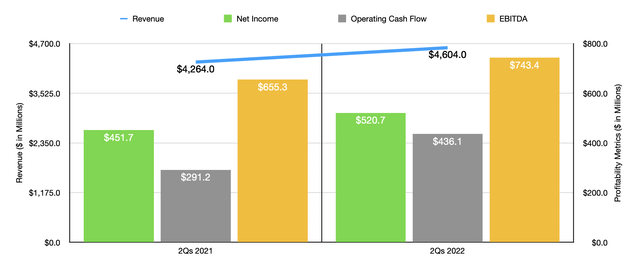

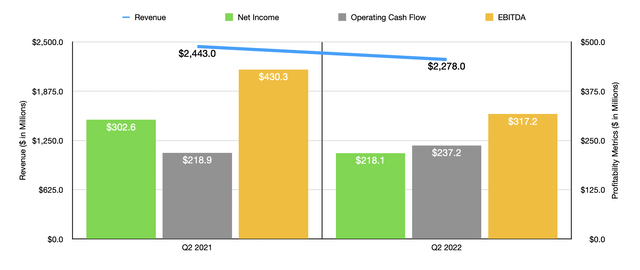

This strength on the bottom line continued into the early stages of the 2022 fiscal year. For the first half of the year as a whole, revenue came in at $4.60 billion. That compares favorably to the $4.26 billion reported just one year earlier. However, looking at data only for the first half of the 2022 fiscal year as a whole would be somewhat deceptive. If, instead, we look at data covering the second quarter alone, we start to get more insight. Sales here came in at $2.28 billion. That’s actually down from the $2.44 billion experienced in the second quarter of 2021. Even as housing starts continued to climb through that quarter, sales volumes for the companies would products dropped. The biggest decline seen involved plywood, with volume dropping by 16.9%. This was offset to some degree by robust pricing. Although plywood pricing came in weak, plunging by 35.2% year over year, LVL pricing jumped by 45%, while I-joists pricing grew an even more remarkable 51.6%.

Looking at it from the perspective of profitability, we can see a similar relationship. For the first half of the year, net income of $520.7 million beat out the $451.7 million experienced one year earlier. But in the second quarter alone, net profits dropped to $218.1 million compared to the $302.6 million seen the second quarter of 2021. As you can see in the charts I already covered in this article, similar relationships can be observed when it comes to operating cash flow and EBITDA. Despite the higher pricing on some of the company’s products, that is being more than offset by last efficiencies associated with lower volumes and by increased costs as a result of inflationary concerns. It should be noted that concerns over market conditions have not prevented management from engaging in some mergers and acquisitions activities. In June of this year, for instance, the company announced that it had agreed to acquire Coastal Plywood Company in a deal valuing it at $512 million. Unfortunately, we don’t know what kind of fundamentals to anticipate from that firm, especially given current market conditions. But this does show that management remains bullish about the broader market in the long run.

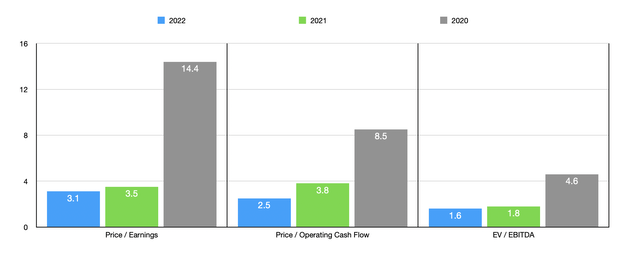

Now when it comes to the 2022 fiscal year, management unfortunately has not really provided any guidance that we can use. If we were to simply analyze results experienced in the first half of the year, we would anticipate net profits of $821 million, operating cash flow of $998.9 million, and EBITDA of $1.19 billion. Using these numbers, we can see that the company is trading at a forward price to earnings multiple of 3.1, at a forward price to operating cash flow multiple of 2.5, and at a forward EV to EBITDA multiple of 1.6. As you can see in the chart above, these numbers are not terribly far off from the results we get using data from 2021. There is a more significant difference relative to the 2020 fiscal year, but shares even then would be likely undervalued or, at worst, fairly valued. As part of my analysis, I also compare the company to the same five firms I compared it to when I last wrote about it. On a price-to-earnings basis, these companies ranged from a low of 2.2 to a high of 7. In this case, only one of the five companies was cheaper than our prospect. Using the price to operating cash flow approach, the range was between 2.9 and 8.9. And when it came to the EV to EBITDA approach, the range was between 2.5 and 9.5. In both scenarios, our prospect was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Boise Cascade Company | 3.1 | 2.5 | 1.6 |

| BlueLinx Holdings (BXC) | 2.2 | 2.9 | 2.5 |

| Hudson Technologies (HDSN) | 4.6 | 8.9 | 3.8 |

| Veritiv Corporation (VRTV) | 5.4 | 5.8 | 4.8 |

| Marubeni Corporation (OTCPK:MARUY) | 4.0 | 4.3 | 9.5 |

| Barloworld Limited (OTCPK:BRRAY) | 7.0 | N/A | 4.0 |

Takeaway

Based on all the data provided, it looks to me as though the fundamental picture for Boise Cascade is changing in the near-term. This should not come as a surprise given its business model and current market conditions. But even if financial performance were to worsen in the near term, I have a hard time believing that the stock could fall much further than where it is right now. Because of that, I’ve decided to keep my ‘buy’ rating on the firm for now.

Be the first to comment