syahrir maulana/iStock via Getty Images

Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” ― Sam Ewing

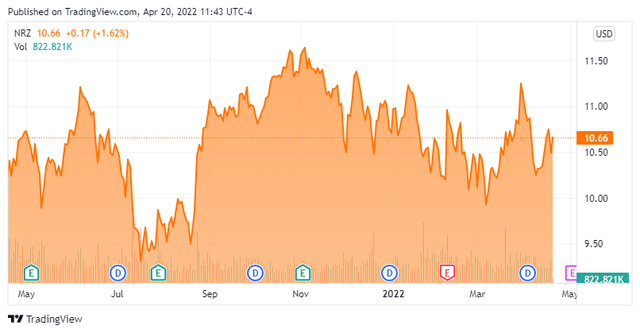

Today, we take an in-depth look at one of few concerns connected to the housing market that should benefit from the recent sharp rise in average mortgage rates. The average 30-year mortgage rate now stands just over five percent. This has risen just over three percent a year ago as the Federal Reserve has embarked on a monetary tightening effort as inflation has reached the highest levels in four decades. The company appears to be a rock-solid inflation play given its business model. With the shares selling under book value and a 9.5% dividend payout, the stock looks poised to deliver a 15% to 20% return over the next year. Hardly a “home run,” but in the current market, more than an acceptable performance. A full analysis follows below.

Seeking Alpha

Company Overview:

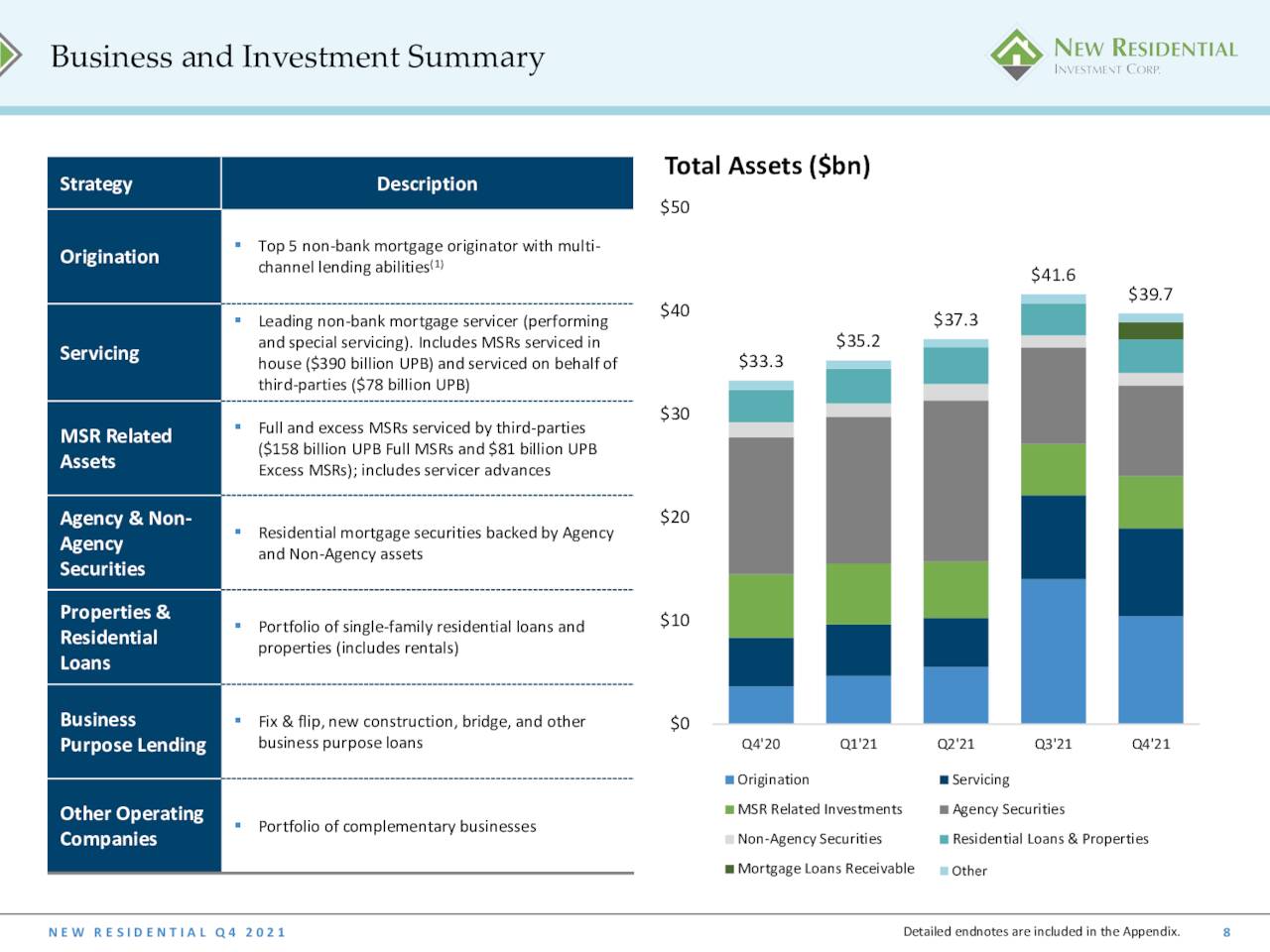

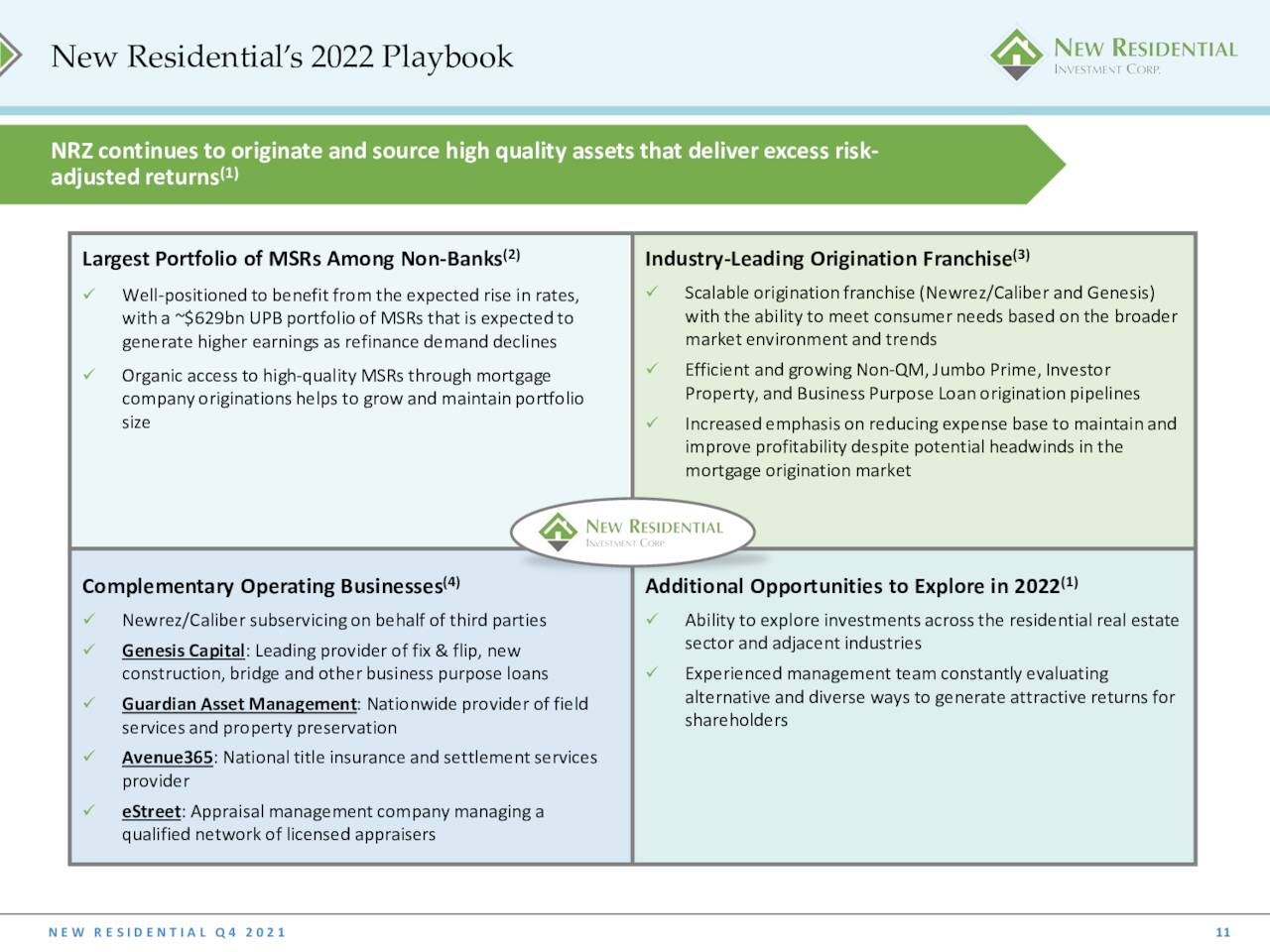

New Residential Investment Corp. (NYSE:NRZ) is a New York City-based portfolio manager structured as a real estate investment trust with a focus on the residential mortgage market. Its ~$40 billion portfolio includes mortgage servicing rights (MSRs), mortgage origination and servicing entities, residential mortgage-backed securities, properties, and mortgage loans, amongst others. New Residential was formed in 2011 as a subsidiary of Newcastle Investment Corp. (now Drive Shack (DS)) and was spun out in 2013, with shareholders of the latter receiving a share of the former on a 1:1 basis. Its first trade was transacted at $14 a share when giving effect to a reverse 1-for-2 split in 2014. Shares of NRZ trade just over $10.50 a share, equating to a market cap slightly below $4.9 billion.

Company Overview (February Company Presentation)

Operating Segments

The company segregates its business into six segments: Origination, Servicing, MSR Related Investments, Residential Securities, Properties and Loans, Consumer Loans, and Mortgage Loans.

February Company Presentation

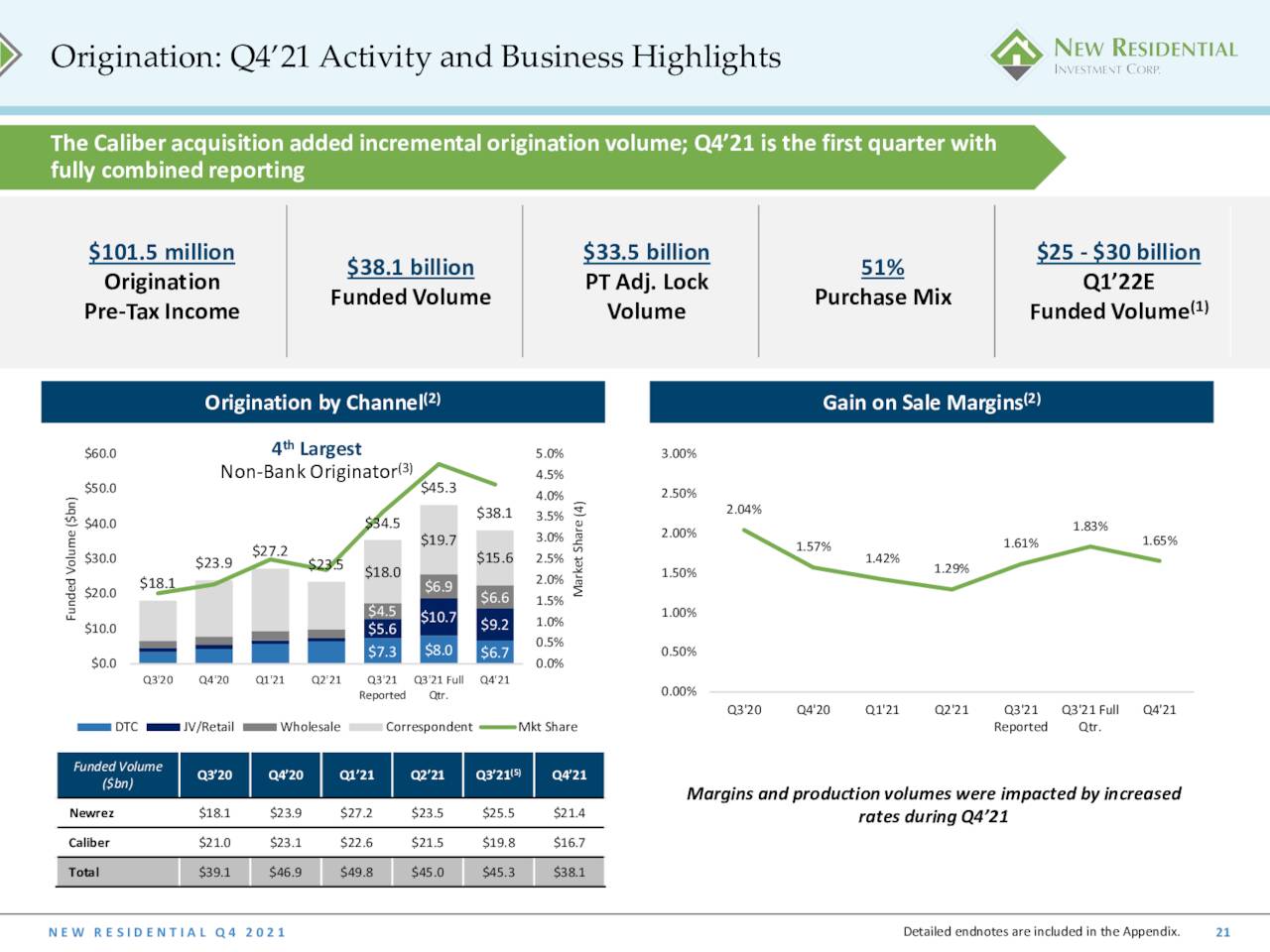

New Residential, through its subsidiaries Newrez and Caliber Home Loans, is one of the largest non-bank mortgage originators in the country, funding $123.3 billion of mortgages in FY21, the preponderance of which are either agency (72%) or government (26%) loans. It generates most of its revenue from gains on sales of its mortgages to government sponsored entities or Ginnie Mae. Its loan sources are multi-channel in nature with low gain-on-sale margin correspondent business (i.e., through community banks, credit unions, and independent mortgage banks) comprising slightly more than half of its originations in FY21, while higher margin direct-to-consumer and retail, as well as lower-margin wholesale channels cover the balance.

February Company Presentation

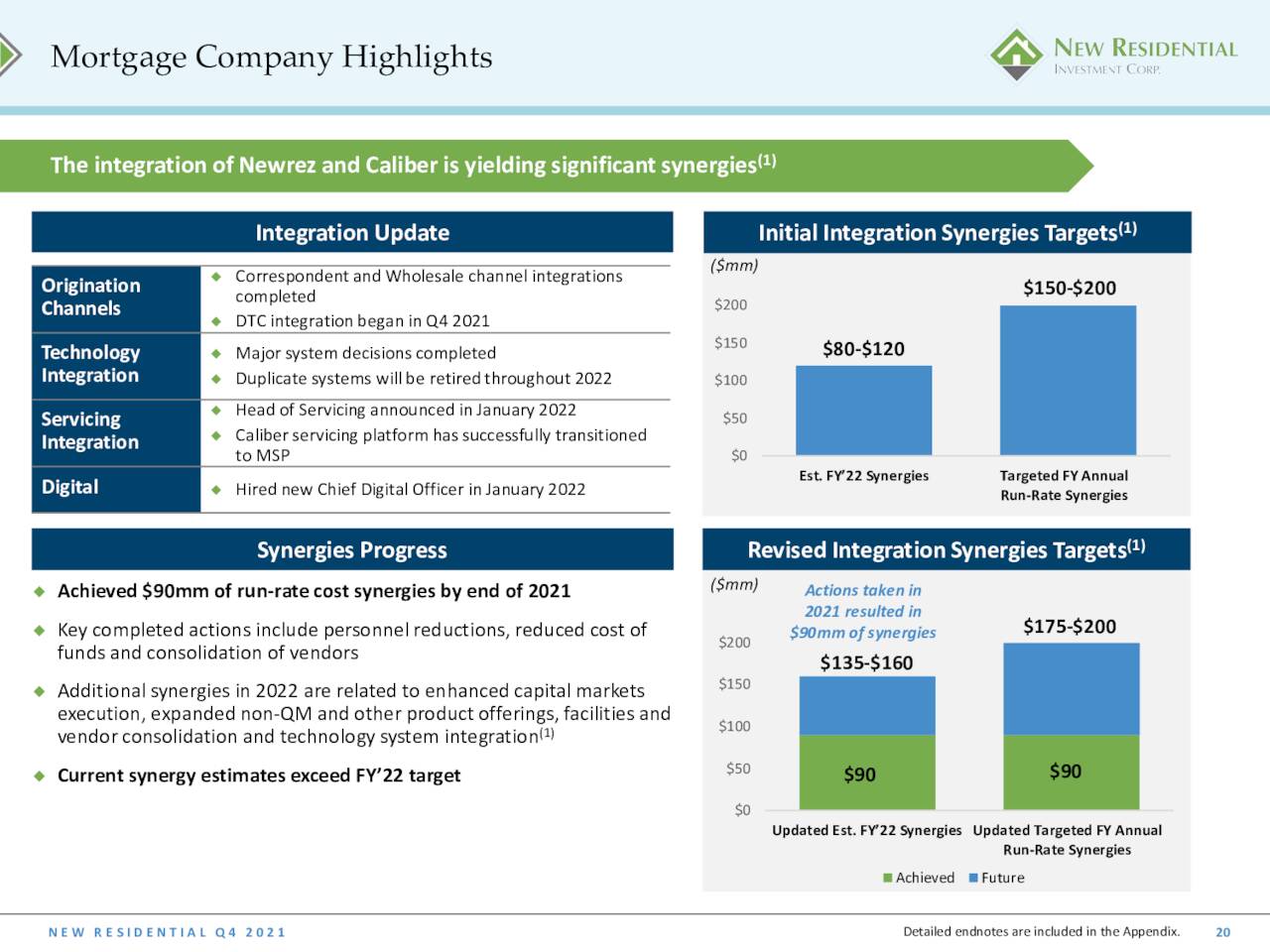

Caliber Home Loans was added in August 2021 for a cash consideration of $1.32 billion, which moved New Residential to fourth in the 4Q21 non-bank league tables. The acquisition was financed with cash on hand, an April 2021 secondary offering that raised net proceeds of $512 million at $10.10 a share, and a September 2021 Series D preferred offering that generated net proceeds of $449.5 million at $25 a share. It’s expected that when fully integrated with Newrez, the Caliber deal will generate $175-$200 million of synergies, ~$150 million of which should be realized by FY22. Origination accounted for FY21 net income of $419.0 million on revenue of $1.89 billion.

With mortgage rates plunging from extremely low to historically low during a pandemic that broadly uprooted Americans from urban centers in the north to suburban areas in the south, origination volumes swelled from $2.3 trillion in 2019 to $3.6 trillion in 2020, followed by $3.9 trillion in 2021. Approximately 60% of the volume during both record years was from refinancings. With inflationary undercurrents turbocharged by the conflict in Ukraine impelling action from the Fed, mortgage rates have surged above 5% – their highest level since 2013 – which will result in refinancings falling off a cliff in 2022.

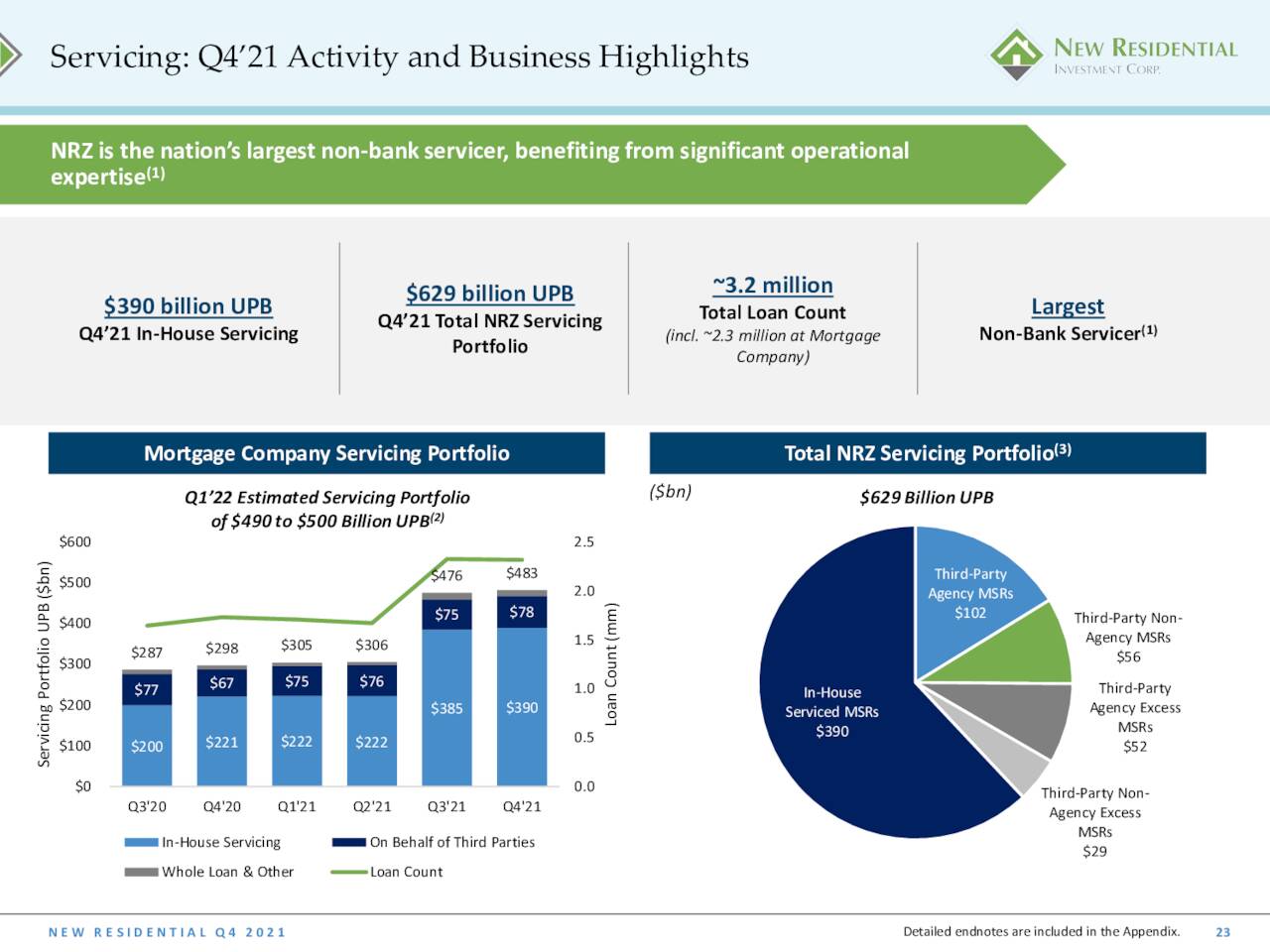

However, New Residential actually benefits from higher mortgage rates thanks to its Servicing business, which is the largest non-bank mortgage servicer in the country – more on this dynamic below. This segment, which collects mortgage payments, credits the proper entities (owner, government, insurers, etc.), and in certain instances initiates foreclosure proceedings, generated FY21 net income of $320.1 million on revenue of $834.6 million.

February Company Presentation

MSR Related Investments are five MSR assets that account for ~30% of the company’s servicing unpaid principal balance (UPB), which totaled $629 billion at YE21. This unit lost $143.4 million on $186.7 million revenue in FY21.

Origination, Servicing, and MSR Investments represent the operational side of New Residential’s business, whereas its other three segments represent its investment arm. Properties and Loans, Consumer Loans, and Mortgage Loans comprise a portfolio of mortgage-backed securities, residential mortgage loans, ~2,700 single-family rental properties, consumer loans, and other investments. In total, they generated FY21 net income of $198.7 million on revenue of $577.4 million.

Against all these segments, there is a corporate offset that subtracted $204.3 million from its net income line in FY21.

Management anticipates entering the commercial mortgage market during 2022.

How the Current Interest Rate Environment Affects New Residential

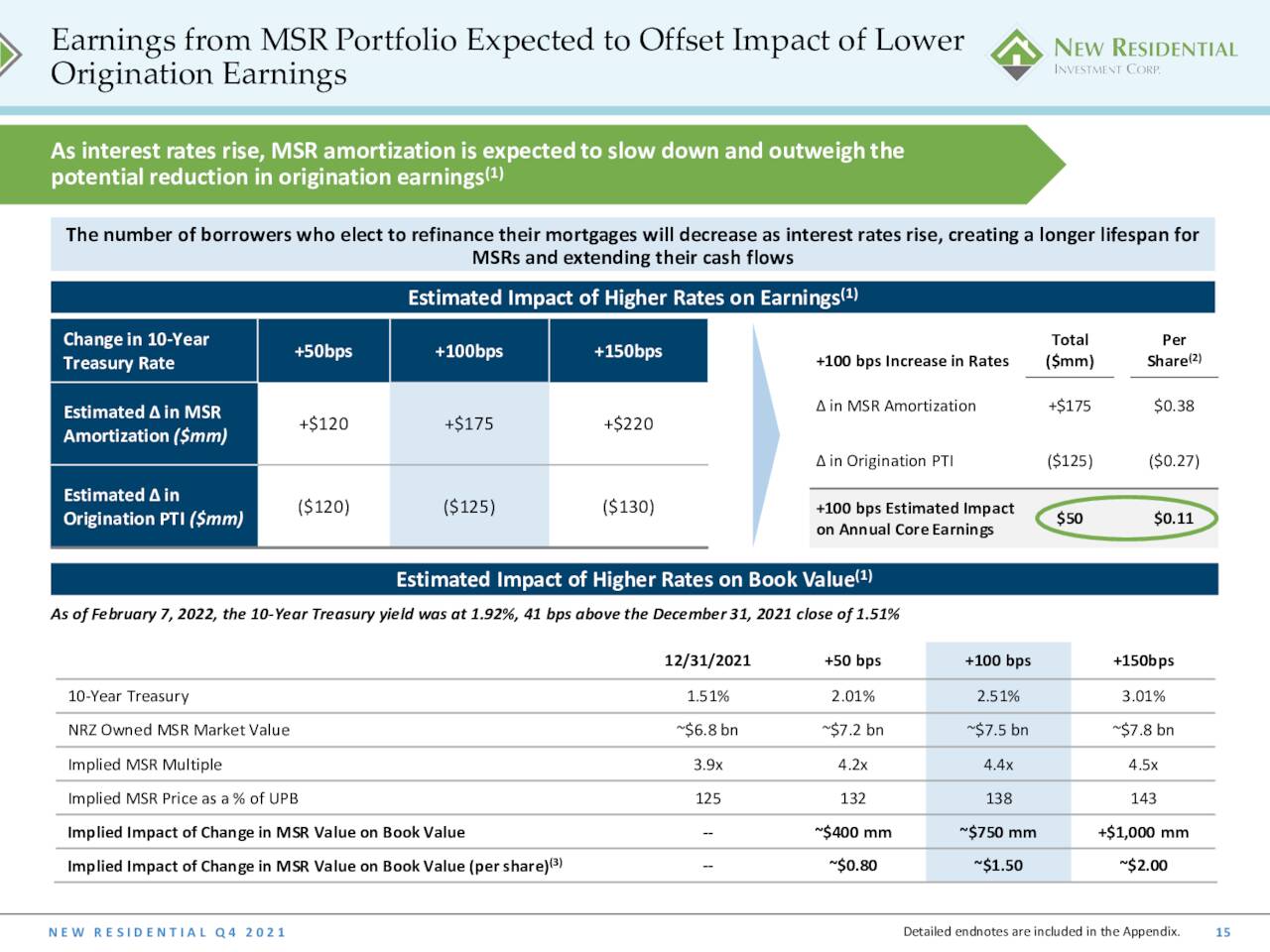

When current mortgage rates are higher than the rates on loans the company is servicing, prepayment through refinancing becomes less likely, increasing the duration (and thus the value) of its mortgage servicing rights and mortgage-backed securities. Before the recent spike above 5%, the Mortgage Brokers Association had expected origination volumes to decrease to $2.6 trillion in 2022, with refinancings composing one-third of the activity. With mortgage rates now at a nine-year high, the question becomes, “does anyone have a mortgage that needs refinancing?” That nuance is sure to hurt New Residential’s origination business, but it receives 25 to 50 basis points every time a homeowner makes a payment on one of the loans it’s servicing, creating a longer-term annuity.

February Company Presentation

Management, through the proxy of the 10-year treasury – 1.91% at YE21 – suggests that a 50-basis point rise in that security would have no impact on its revenue but would increase the implied value of its MSR portfolio by $400 million, translating to a book value bump of $0.80 a share. However, the real jump comes with a 100-basis point increase in the 10-year, which would drive a slowdown in the amortization of its MSR portfolios greater than losses experienced from a slowdown in its origination business to the tune of $50 million, which would translate to another $0.11 a share in earnings. Furthermore, management estimates that the adjusted implied value of its MSR portfolio would increase book value by $1.50 a share. With the 10-year at 2.85% as of April 19th, 2022, New Residential should see a meaningful increase in both earnings and book value going forward.

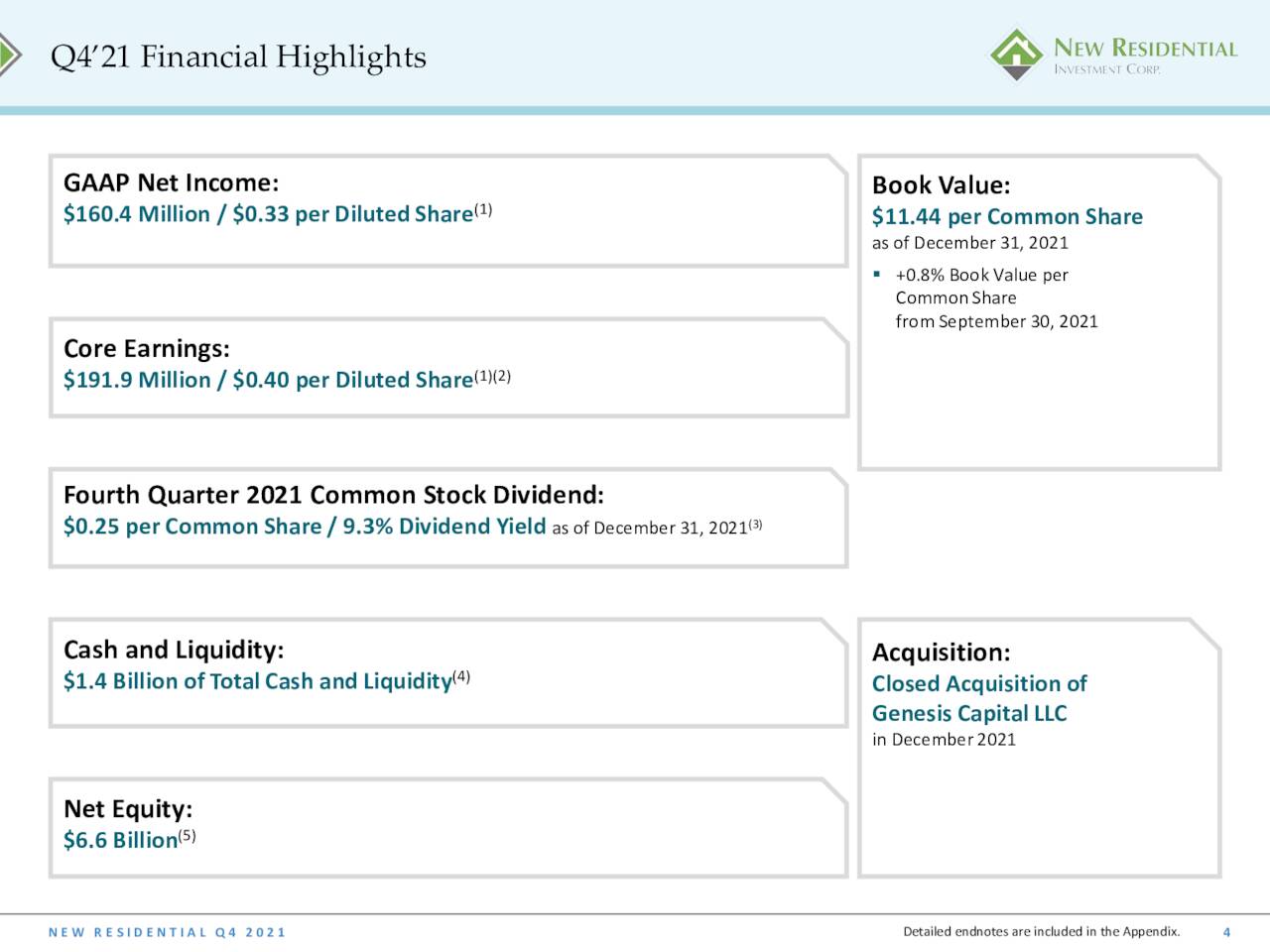

4Q21 Earnings and 1Q22 Outlook

Before the dramatic move in the 10-year treasury, New Residential reported 4Q21 earnings on February 8, 2022, back when the benchmark rate was at 1.92% and 16% of its customers still had an incentive to refinance. It generated non-GAAP (core) net income of $0.40 a share on revenue of $1.1 billion versus $0.44 a share (non-GAAP) on revenue of $952.7 million in 3Q21, The 15% sequential increase at the top line was also $115.1 million better than Street expectations.

February Company Presentation

Those outcomes brought FY21 core earnings to $0.90 a share on revenue of $3.62 billion as compared to $0.50 a share on revenue of $1.67 billion in FY20.

February Company Presentation

Management expects 1Q22 funded origination volume of $25-$30 billion with UPB of $490-$500 billion on its servicing portfolio (exclusive of its MSR Related Investments).

This news sparked a one-day 7% rally in the REIT to $10.71 a share.

Balance Sheet And Analyst Commentary:

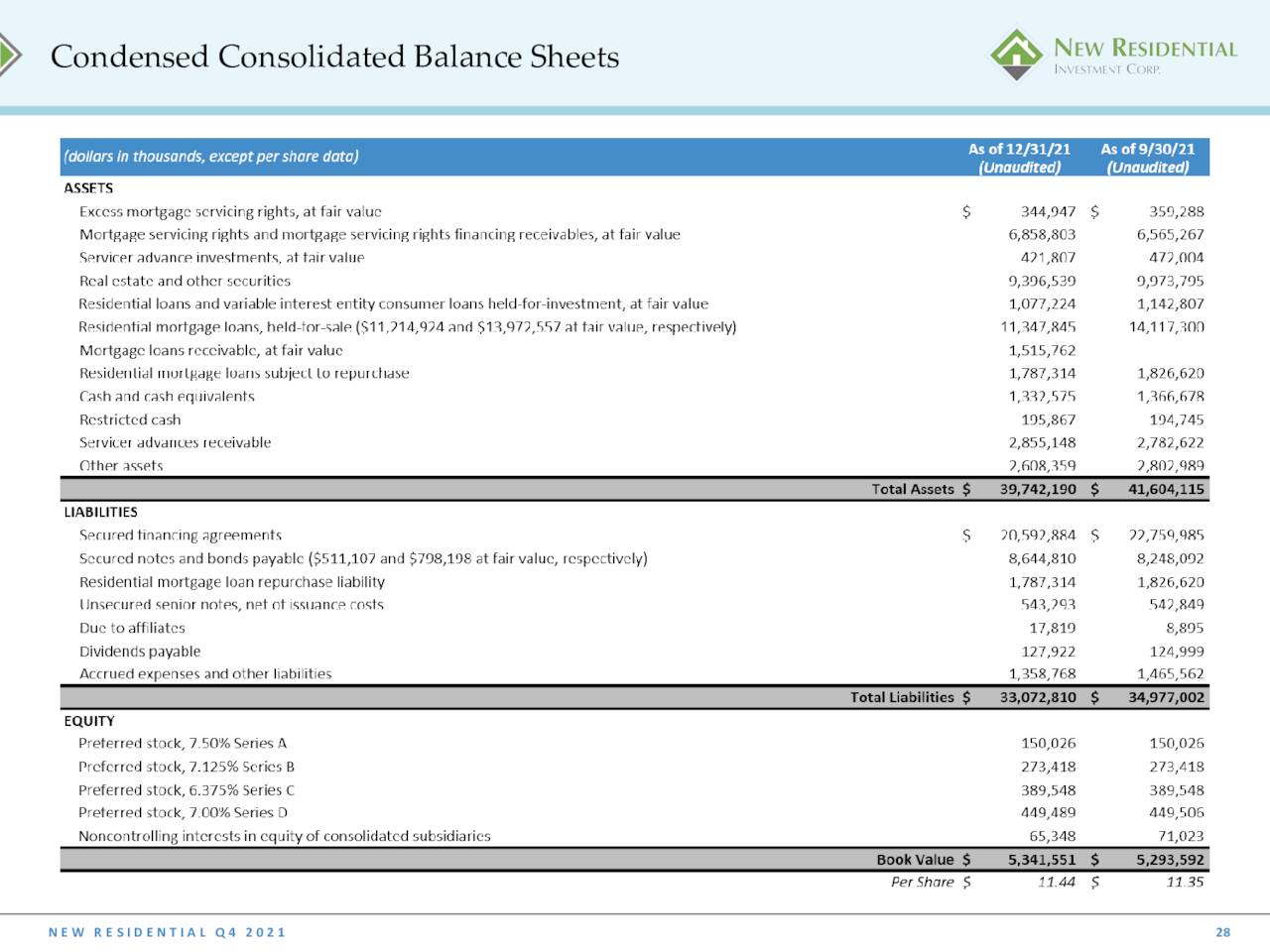

New Residential also announced a $0.25 dividend for its common shareholders, for a current yield of 9.5%. It should be noted that the company has four series of preferred stock on which it paid dividends of $66.7 million in FY21. Book value per share was $11.44 on Dec. 31, 2021, up from $10.87 at YE20. Total liquidity at YE 21 stood at $1.4 billion.

February Company Presentation

Street analysts are bullish on the company’s prospects, featuring one buy and seven outperform ratings vs. one hold and a twelve-month price objective of $12.50. They expect the REIT to generate net income of $1.55 a share (non-GAAP) in FY22, followed by $1.75 a share (non-GAAP) in FY23, representing increases of 72% and 13%, respectively.

Although insider activity has been relatively slow with board member Robert McGinnis’ 4,000-share purchase of the Series D preferred in November 2021 the only activity in one year, New Residential stands out for its lack of insider selling, recording only one disposition since 2015.

Verdict:

At around $10.50, shares of NRZ currently trade at a steepening discount to a book value that could approach $12.50 when it reports 1Q22 earnings in early May. The likely cause of this circumstance is rooted in the slashing of its quarterly dividend from $0.50 to $0.05 during the initial outbreak of COVID-19, generating significant credibility issues with investors. But with a philosophy of growing its overall portfolio while each business line within is (to some degree) hedging another and current net positive exposure to rising rates, its dividend looks very secure unless a severe downturn in the economy creates a sharp uptick in delinquencies or if management’s forecast on originations – where gain on sale margins could compress more than expectations – proves incorrect.

February Company Presentation

However, with plenty of channels to access and not obsessed with market share, the company should be able to adapt to this lower margin dynamic as rates rise by emphasizing higher-margin, lower-volume channels. The 9.5% yield can be enhanced with a simple covered call strategy, especially for those seeking extra yield and some downside protection. The current price is a good entry point into shares of NRZ.

We have gold because we cannot trust governments.”― Herbert Hoover

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment