Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 11.

The Fed continues to tighten policy aggressively in the face of a deteriorating macro environment even as macro indicators move lower. And this is, in turn, keeping pressure on the broader income market. In this article, we highlight attractive income securities across business development companies (“BDCs”), preferred shares, bonds, and closed-end funds (“CEFs”) that are trading at their lows of the year.

Lower Lows As A Catalyst For New Allocations

Our game plan for income allocation this year can be summarized in the following ways.

First, we continue to avoid chasing rallies. Historically, this is because bottoms are typically reached only after the Fed has finished hiking. Plus, we have not properly entered the much-anticipated recession, much less seen the “green shoots” on the other side.

Second, we have spaced out allocations and added on lower lows to ensure there are some drier-powder assets to use in case the drawdown is extended and brings lower prices, which it has. This is especially appropriate if the recession is long as is likely this time around. This is because the Fed will be less able to provide relief as it will want to ensure that inflation moves back to its target range.

Third, we are not waiting for a bottom. This is for the simple reason that gauging whether or not we are at a bottom at any given time is impossible. It also causes many investors to add on bear market rallies, which look exactly like the rally out of the final bottom. This, in turn, causes investors to buy at local highs and leave less capital available to put to work at new lows.

Finally, we are adding to securities that are trading at unusually cheap valuations rather than targeting historical lows. This is because historic lows have tended to happen during periods of “existential crisis” like the Great Financial Crisis (“GFC”) and the COVID crash, where many investors expected big chunks of the economy to be permanently crushed. The current macro environment has a more benign look to it – likely being much closer to a run-of-the-mill recession caused by the Fed taking away the punchbowl rather than any kind of exogenous economic shock.

Overall, adding on lower lows is, to paraphrase Churchill, the worst allocation method except for all the others. At times, it can feel like throwing good money after bad. However, since other allocation methods have even more problems, this is the one we are sticking with. In our view, it provides some discipline in the allocation process, ensures there is some capital available to add at higher yields and avoids buying bear market rallies.

Some Ideas

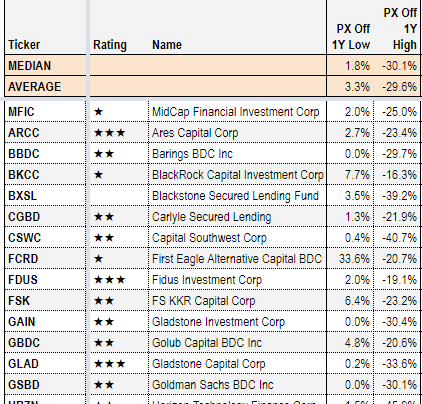

In this section, we highlight some of the securities that have moved to their lows this year. Obviously, not all securities trading at their lows are automatically attractive, so we focus only on those that also have attractive features and a history of outperformance as well. The way we track new lows comes directly from our Investor Tools on the service across BDCs, CEFs, and Preferreds. The snapshot from the BDC Tool is shown below.

Systematic Income BDC Tool

In the BDC space, two companies are trading at or very close to their year-to-date lows that are worth a look: Carlyle Secured Lending (CGBD) and Gladstone Investment Corp. (GAIN).

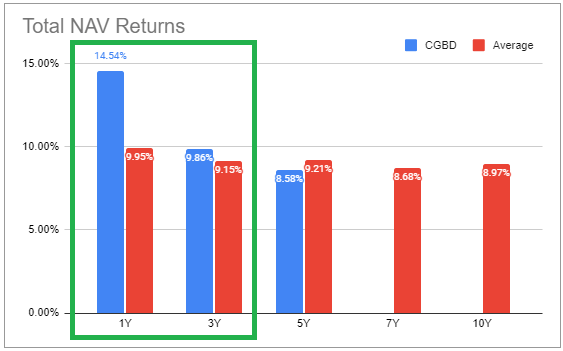

CGBD has been an outperformer in the BDC space over the last 3 years. It has a portfolio focused on secured loans (96% versus 87% BDC average), and though the level of non-accruals is above the sector average, it has been on a steady downtrend and management has guided to a lower level in Q3. Despite its recent outperformance, it trades at a 31% discount to book (versus 17% sector average). It has a 13.8% total dividend yield.

Systematic Income BDC Tool

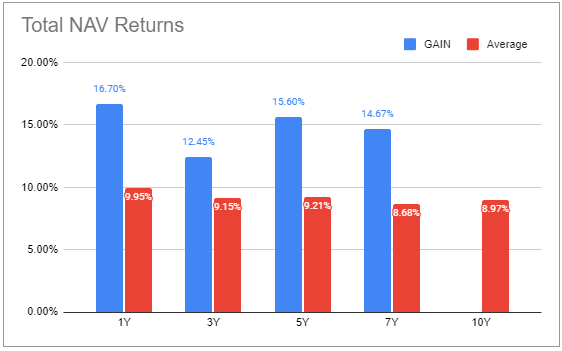

GAIN has been one of the best performers in the sector, which is why it trades at a 12% discount to book versus a 17% sector average. Prior to the recent drawdown, it traded as high as a 30% premium to book. Its total NAV returns have been exceptional across all time periods. It does have a much less diversified portfolio than the average BDC and a much larger allocation to preferred securities, so it is, arguably, for more adventurous investors. GAIN trades at an 11.6% dividend yield.

Systematic Income BDC Tool

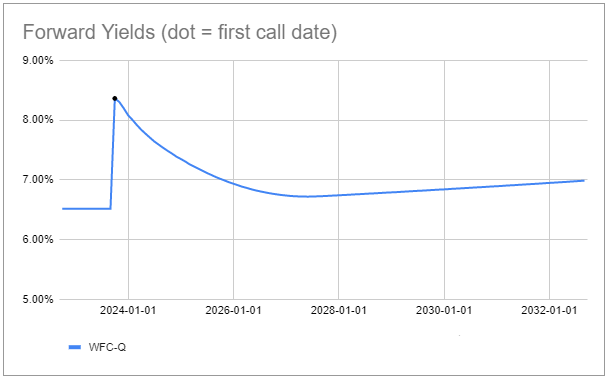

In the preferreds space, we would highlight the Wells Fargo Series Q (WFC.PQ), which trades at a 6.52% stripped yield and will switch to a floating-rate coupon of 3M LIBOR + 3.09% in less than a year. Based on the current path of LIBOR forwards, it is expected to have a stripped yield of 8.4% on the switch, which will move lower over time since short-term rates are expected to also move lower.

Systematic Income Preferreds Tool

In baby bonds, the CLO Equity fund Eagle Point Credit 6.6875% 2028 bonds (ECCX) look very interesting after a sharp drop. This is the only ECC bond that is currently callable. If the NAV of the CEF keeps falling, the fund will want to redeem the bonds – they have previously bought back bonds during previous market shocks – to keep the asset coverage ratio from falling below the level at which they would have to turn off common distributions. The bonds are trading at an 8.65% yield-to-maturity. At its $22.8 stripped price as of this writing, the redemption would result in a significant tailwind in case of redemption.

In the CEF space, we continue to see value in the Western Asset Mortgage Opportunity Fund (DMO) and the Angel Oak Financial Strategies Income Term Trust (FINS), both trading at year-to-date lows. Both funds hold primarily floating-rate securities and will continue to see a rise in net income. DMO focuses on residential mortgage securities which benefit from a tight labor market, low household debt service and a high level of housing equity. DMO trades at a 14.8% discount and an 11% current yield. FINS focuses mostly on investment-grade floating-rate bonds. It trades at a 14.4% discount and an 8.8% current yield.

Be the first to comment