alvarez

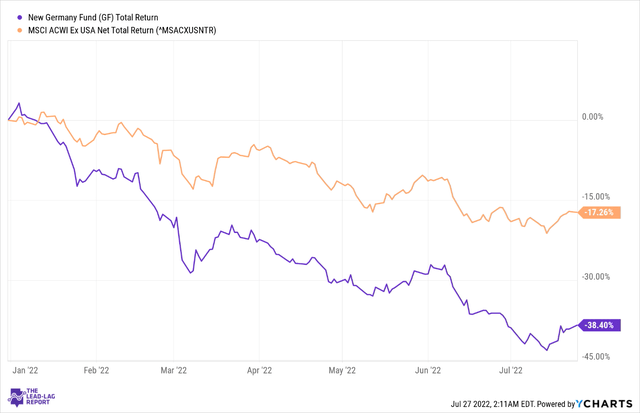

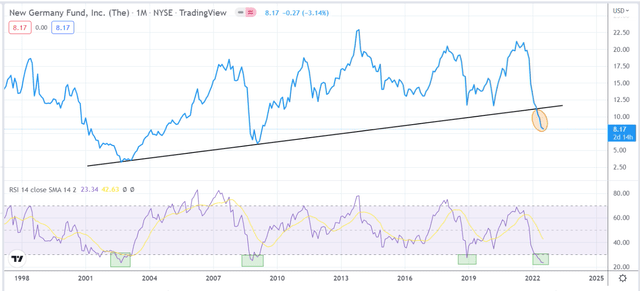

The New Germany Fund (NYSE:GF) is a close-ended fund that primarily focuses on German mid-caps. GF has faced a rough ride this year, delivering negative returns of 38%, which is more than two times worse than what an all-country global (ex-USA) index has delivered.

After such a brutal fall, is it fair to believe that the worst is over, or could there be more weakness in store? Here are some of my big-picture thoughts on German conditions.

German conditions

GF is dominated by industrial and consumer cyclical stocks which jointly account for ~45% of the total portfolio. Sadly, conditions for both segments point to some challenging times ahead.

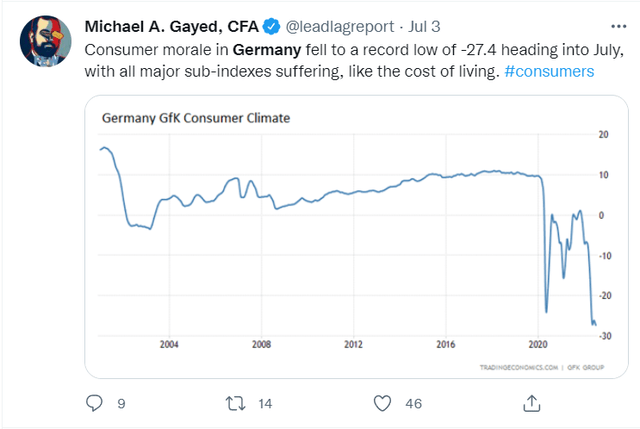

Earlier this month, I had put out a tweet on the timeline of The Lead-Lag Report highlighting how German consumer morale had plunged to record lows; well if you thought a -27 reading was bad enough, you’re in for another surprise as the August figure will likely breach the -30 mark.

The GFK consumer climate index uses certain forward-looking sub-indices that measure a consumer’s economic expectations, propensity to buy, and income expectations, and all of these metrics point to further weakness ahead.

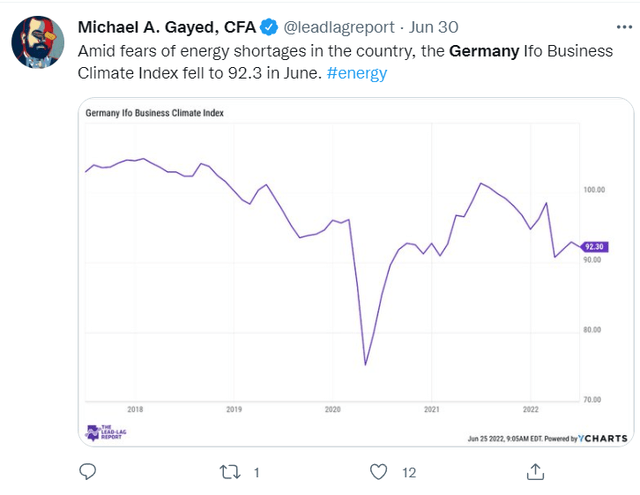

Then there’s the energy crisis which is engulfing not just German households but the industrial class as well. As noted in The Lead-Lag Report, the IFO business climate index continues to plunge and is now at its lowest point since July-2020 (July’s reading was even worse than June’s reading coming in at 88.6).

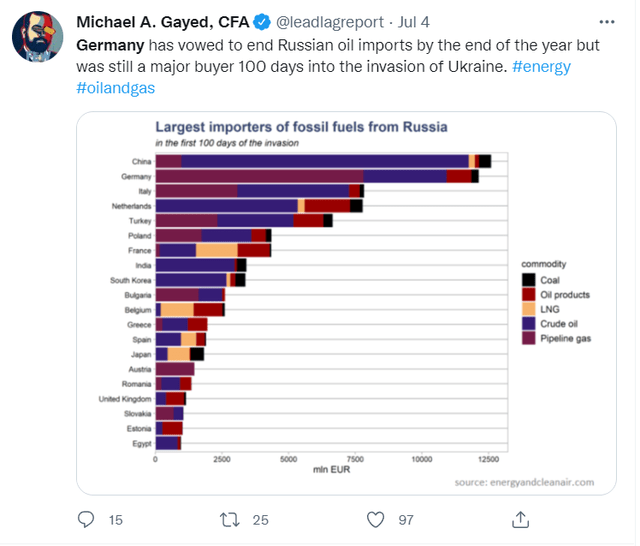

German’s energy import urgency is such that despite making some big-bang announcements to the media a few months back to wean itself from Russian imports, the former has deepened its procurement with the latter over the first 3 months since the Ukraine crisis.

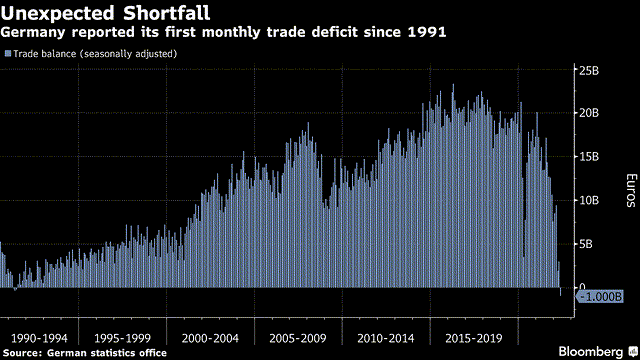

Interestingly, the increased appetite for imports has resulted in Germany ending up with a trade deficit for the first time in over three decades!

Note that in order to fund a higher import bill and other initiatives to tame inflation, German net borrowing plans have gone through the roof and will likely test the constitutional debt ceiling yet again. Just for some context, earlier the German government was budgeting for EUR7.5bn of net borrowings in 2023, but this outlay has since been scaled up by 2.3x and will likely come in closer to the $17.5bn mark.

The ongoing energy crisis also means that around 16% of German industrial firms have been cutting production or suspending operations (source: DIHK). Needless to say, supply-side developments of this sort are the last thing the country needs to counter inflationary challenges.

Having said all that, the ECB’s recent decision to hike rates by 50bps (as opposed to market expectations of 25bps) could provide some respite to the inflationary scenario, but as noted in The Lead-Lag Report, there were some fascinating corollaries to this development in the German Bund market. Despite the surprise hike, what we saw was rates at the short-end of the curve picked up pace, even as those at the long-end dropped; this positioning with long-end bonds show that investors are growing increasingly queasy about what tighter monetary conditions could do for the economic conditions. The German IFO president is on record stating that the German economy is on the brink of recession. It remains to be seen if the ECB plans to take one step at a time with its rate hiking plans, or if it is part of a long-term pivot. Developments on this front will be instrumental in curtailing any further weakness in the EUR/USD which is currently only in the middle of its descending channel.

Conclusion

As far as the technical analysis of GF per se, is concerned, one gets a mixed picture, with something for both the bulls and bears to latch on to. The bulls would be hoping for some respite, as things look quite overextended to the downside; Excluding the current month where things still appear to be weak, GF has gone through 8 straight months where the close has been lower than the open Besides, the RSI looks oversold and has dropped to levels from where one normally witnesses some bounce in the price action.

The bears on the other hand, would argue that the price has now dropped below a multi-year slope, something which would be hard to reclaim.

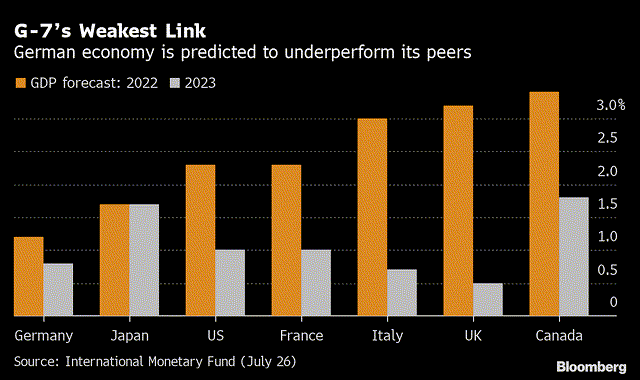

What could perhaps also abet the bears is the pricey valuations of this product. Despite witnessing significant drawdowns over the past year, GF still trades at a premium forward P/E of 17x, whereas a portfolio of global stocks can be picked up at a multiple of only 13.5x. These premium valuations are hard to justify when you consider that Germany will likely deliver the weakest GDP performance amongst its G-7 peers.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment