Jim Ekstrand/iStock via Getty Images

California’s new tax regime is causing a lot of angst for California-based lithium producers. Thankfully, Lithium Americas (NYSE:LAC) is in Nevada, where the regulatory environment is much more stable. The need for a domestic supply chain remains high and the more difficulties that appear elsewhere, the more necessary Thacker Pass appears.

California Introduces a Flat Tax on Mined Lithium; the Industry Looks Elsewhere

California approved a new tax on lithium mining as part of the must-pass state budget last Thursday. The tax will be allocated at a flat rate contingent upon the number of tonnes mined:

$400 per tonne for the first 20,000 tonnes of lithium produced annually, $600 per tonne for the next 10,000 tonnes, and $800 per tonne with output of 30,000 tonnes or more.

Multiple executives of corporations seeking to extract lithium from the Salton Sea’s geothermal resources have warned this tax may kill the industry. Despite the tax being an infinitesimally small percentage of current spot rates, executives fear that future prices could decline, making the initial investment calculus less attractive with the added tax. Additionally, the contracted price per tonne is often lower than spot rates in the first place. While Controlled Thermal Resources has said that the tax may cause it to miss its production deadline of 2024, others have been less sour on the new taxation. Berkshire Hathaway’s (BRK.A, BRK.B) BHE Renewables division, also working on geothermal lithium extraction, does not oppose the tax saying:

a lithium tax provides for the local community, and that a balanced outcome will ensure California-sourced lithium can compete in the world market.

Nonetheless, the majority view of companies in the area seems to be pretty solidly negative about the news.

So why might this be good news for Nevada?

Well, Nevada is known as a historically pro-mining jurisdiction with a cap on mining taxation at 5% of net proceeds in its state constitution (Article 10, Section 5). There have been several proposals (here, here, and here) to amend the constitution and raise the taxation rate, but none of these measures have reached the ballot. All three were proposed in 2020 and were approved for the ballot by the legislature, but Nevada requires this process to succeed two years in a row for a measure to be put to the people and none of these measures received a vote in 2021.

Such a cap on proceeds must be great for mining companies then, right? Sleeping well at night, knowing taxes can’t be raised on them? Well, not exactly: in 2014 a measure to remove the 5% limit did reach the ballot and was only narrowly defeated by a 0.6% margin. However, the political will to raise taxes in this environment does not seem to be strong in Nevada, especially as the lithium industry is already expected to bring a lot of income and new jobs to the state.

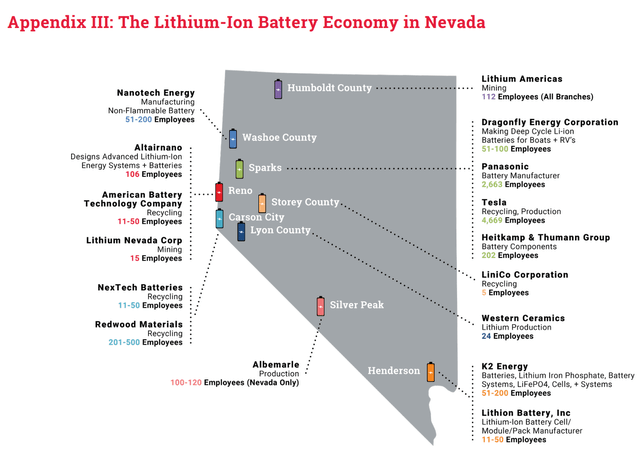

A recent paper from UNLV suggested Nevada is the perfect state for the industry, as it encompasses every facet of the battery’s lifecycle (something no other state can yet boast).

Nevada is also well-positioned near the west coast to export LCE to China and East Asia should the US demand falter or the overseas prices become more attractive.

With the development of the Salton Sea as America’s largest lithium resource being put into question (though not out of the picture; I doubt that companies will cease their projects in entirety despite being upset about the flat tax), The Salton Sea, per a California Energy Commission study, is capable of producing 600,000 tonnes of lithium carbonate (LCE) at its theoretical maximum. With that number likely lowered and pushed further back, the need for a domestic American lithium supply is no less needed. And here, America’s largest lithium project comes into focus.

Lithium Americas’ Thacker Pass project. I have discussed this project in detail previously, but it is projected to produce 40,000 tonnes of LCE per year in stage 1 and 80,000 per year in stage 2. No small sum to be sure. And if prices achieved for this production are even half of the current levels, the site is earning in excess of $1 billion per year for stage 1 or $2 billion for stage 2.

Persistent Risks but Nothing New

Thacker Pass remains held up by a pending lawsuit, but the time for a decision draws near in the coming fall. Lithium Americas is backed by the Federal government in the suit and looks likely to prevail amidst the current political will in favor of developing a national lithium supply chain. The risks of future price fluctuations in lithium or the unforeseen dominance of another battery form using less lithium is certainly something to pay attention to, but neither is a pressing concern for the company.

As mentioned above, the regulatory environment in Nevada is more certain and pro-mining than in California, which the Lithium Americas [and other industry companies in Nevada like Tesla (TSLA), Redwood Materials, Albemarle (ALB), and American Battery Technology Company (OTCQB:ABML)] stands to stands to benefit from. There is also the possibility that other producers mining in other states, like Piedmont Lithium (PLL), will also create lithium hotspots in the US, but that does not preclude Lithium Americas’ growth.

The main concern in this market remains irrational sell-offs and price pressure related to macro concerns. Though I cannot predict or ward against these pressures, I believe buying into a solid company, such as Lithium Americas, with clear catalysts and growth potential that taps into much larger macro trends (energy transition, electrification, EVs) than just quarterly swings is still worthwhile.

Valuation Now More Attractive

My valuation of Lithium Americas’ combined segments (the company may spin off Thacker Pass as a US-only lithium company) still stands at around $76 billion. This is based on an average industry price-to-earnings ratio of 23.5 for production-level companies and a conservative LCE price of $30,000 per tonne. This works out to around $565 per share, a more than 2800% upside from today’s share price of $19.10. This may seem like a meteoric price target, especially in this market, but we are looking at a company superbly positioned to capitalize on a historic commodity supercycle.

Takeaway

The new California lithium flat tax policy has caused rumblings (and grumblings) in the industry there. Non-California producers developing a domestic lithium supply chain are now even more attractive. Specifically, Lithium Americas, with its massive Thacker Pass project. The company’s shares have gotten increasingly cheap after the recent market sell-off while its projects are more attractive than ever. The company’s biggest risk is set to disappear in quarter three; if the court rules for Lithium Americas, shares could explode upwards. If the opposite is true, which seems unlikely, shares will likely face a sharp drop, but the company’s South America segment is still worth more than its current market cap. In any case, the company looks better than ever and shares are cheap.

Be the first to comment