Pornpak Khunatorn/iStock via Getty Images

Investment summary

There’s plenty to like about Nevro Corp. (NYSE:NVRO) on a forward looking basis, particularly amid a structural rotation of capital back into health care and medtech. We like NVRO for several reasons and are attracted to the economics of its HFX Therapy for painful diabetic neuropathy.

Despite these points, shares are trading in range of our estimate of fair value, and we are seeking to position against cash generating companies in the space. We rate NVRO a hold with a $40 valuation.

PDN contribution strong one year after launch

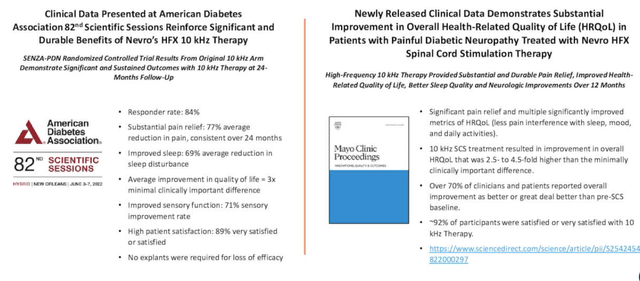

Back in July FY21′ NVRO received FDA approval of its proprietary HFX therapy, indicated in peripheral neuropathic pain stemming from painful diabetic neuropathy (“PDN”). HFX Therapy for PDN [from herein, simply PDN] is the only high-frequency parasthesia-free therapy with FDA approval to treat PDN. Suppositions from Petersen and colleagues (2021) indicate the therapy shows greater efficacy versus substitutes in treating refractory PDN. Readouts at the American Diabetes Association 82nd Scientific Sessions corroborated this data, whereas data presented in the Mayo Clinic Proceedings showed equally as pleasing results, as seen in Exhibit 1.

Exhibit 1. The HFX Therapy for PDN remains a key growth catalyst for NVRO and is well received in a complex disease segment.

Safety and efficacy data has held up well and readouts look promising compared to current standards of care in PDN

Data: NVRO Q2 FY22 Investor Presentation [slide 12]: New clinical data demonstrates significant benefits in PDN patients treated with HFX Therapy.

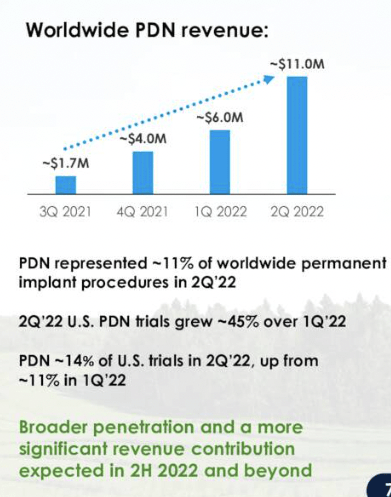

Of its worldwide 200bps YoY revenue growth to $104mm, c.11% of NVRO’s worldwide permanent implant procedures were attributed to PDN, equating to ~$11mm in contribution to the top line. Geographically, US sales were up 500bps YoY to $89mm, and more than 14% higher vs. FY19 [pre-Covid]. Meanwhile, ex-US sales gained 1,200bps YoY to $15.2mm, despite ongoing Covid-related challenges in Australia and The UK.

In terms of reimbursement, NVRO currently has adequate National Coverage Determination (NCD) and reimbursement by Medicare for chronic back and leg pain, by our estimate. Coverage for PDN and non-specific back pain (”NSBP”) is more limited, however.

For instance, Medicare currently provides coverage for NSBP. However, most commercial payors don’t specifically cover it. Despite this, NVRO announced in January that United Healthcare is set to provide coverage for the 10kHz proprietary therapy. Further, Medicare Administrative contractor, Noridian, released its update for Local Coverage Billing and Coding article for spinal cord stimulated for chronic pain. As a result, two new ICD-10 codes were included that cover PDN.

In addition, several coverage updates among BCBS insurers were made to cover PDN explicitly – securing an additional ~23mm commercially-insured covered lives. Very importantly, management says that ~48% of the addressable PDN population in the US is “now covered under a formal policy for PDN”, up 25% YoY.

These are structural tailwinds that must be recognized in the investment debate, especially as the company can realize more updraft from PDN revenues into its core business. Performance last quarter sees management now forecasting FY22 sales guidance for PDN of $42-$45mm, a large step up from previous guidance of $25-$30mm. Additional data points on the PDN segment are seen in Exhibit 2 and in comments, below.

Additional Q2 earnings comments

NVRO printed a solid set of numbers with growth seen in key segments across the portfolio. From total revenue of $104mm as above gross margin decompressed by 140bps YoY for a gross profit of $72.7mm. Meanwhile, OPEX matched to this profit grew 13% YoY as well to $96.5mm and has increased above pre-pandemic levels. The increase in OPEX stemmed from higher R&D investment of $12.5mm and a c.$10mm YoY increase at the SG&A line. Importantly, litigation expenses totalled $4mm for the quarter – down from $6.6mm the year prior [discussed later].

Exhibit 2. PDN global revenue continues to offer long-term value for NVRO with trials momentum up 45% YoY

Image: NVRO Q2 FY22 Investor presentation [slide 7].

US permanent procedures also grew 800bps YoY and are now up 13% from pre-pandemic [FY19] comparables. US third-party claims data also showed US permanent implant procedures grew 150bps from Jan-May, but remain down 400bps from FY19.

In stark contrast, NVRO’s were up 500bps in the same time and are up 1,300bps from pre-pandemic numbers. Meanwhile, trial procedures – the company’s “most important leading indicator” – lifted 14% from the same time last year showing a strong recovery, and again, pre-pandemic, up 400bps.

BSX litigation overhang removed

Another important catalyst is the removal of the Boston Scientific (BSX) litigation overhang. The company reached a settlement just prior to Q2 earnings, and we now have clarity on the matter going forward. Under the settlement, NVRO will receive:

- A license to BSX asserted patents

- A covenant not to sue for any features embodied in current Nevro products

- Dismissal of all current litigations

- A payment of $85 million in cash and a release of the $20 million verdict that Boston Scientific was awarded by a Delaware court in Nov FY21′

Perhaps the greatest upside from this, apart from the obvious outcome, is the clarity on the matter itself. Removal of this headwind positions NVRO well to continue its growth initiatives and allocated a c.$6-$10mm towards capital budgeting per quarter, by estimate.

Keith Grossman, Chairman, President and CEO added additional colour to this effect on the Q2 earnings call:

“Please note that we’ve not licensed or compromised in any way what we consider to be our core high-frequency IP, which ranges from 1.5 to 100 kilohertz. The license to paresthesia-free therapy we granted to Boston Scientific was limited to all frequencies below 1.5 kilohertz, which is where Boston Scientific has been competing.

We remain the exclusive provider of our unique best-in-class HFX 10 K therapy. The terms of the settlement agreement beyond what was stated in Monday’s press release and the 8-K we filed are confidential. So we’ll not be able to answer many of your questions beyond what has already been publicly disclosed. But of course, we’re pleased to have this behind us.”

Valuation and Conclusion

Shares appear to be richly priced at 6.6x book value, well above the GICS sector median’s 2.1x. NVRO also trades at 3.9x TTM sales, and the market consensus has it priced at 3.7x forward sales. Our research team has forecasted top-line growth of ~460bps for FY22, calling for $405mm at the top, stretching up to $453mm by FY23. We see negative earnings across this period.

Assigning the 3.7x forward multiple to our F22 sales estimates sets a price objective of $42, and doing the same to FY23 estimates and discounting this back at 12.5% prices the stock at $39. The arithmetic mean of the pair is $40.50, suggesting the stock is in fact richly priced at its current market capitalization.

Whilst there’s much to like about NVRO, ranging from its expertise in PDN to its strong set of quarterly numbers, shares are trading in range of our estimate of fair value, whilst profitability [or lack thereof] has us trigger shy as well. We rate NVRO a hold with a $40 valuation.

Be the first to comment