kasinv/iStock Editorial via Getty Images

Thesis

Netflix (NASDAQ:NFLX) experienced a substantial sell-off yesterday, recording its worse one-day move in nearly two decades. The company announced it had lost 200,000 customers in the first quarter, marking the first time it has experienced a decrease in subscribers since 2011. Furthermore, the projections for customer acquisitions are not rosy, the company projecting it will experience even further shrinkage in the second quarter. The turn in fortunes for the company resulted in a massive one-day stock loss that exceeded -35%. The NFLX stock price is now down more than -55% in the past year, bringing the shares to price levels not seen since 2018. Many investors might see today’s stock price as an attractive entry point based on their fundamental analysis.

In this article, we show a savvy investor how to utilize a cash covered put strategy to purchase the NFLX shares at a discount or to realize a substantial annualized yield in excess of 70%, depending on where the stock price ends up upon the option expiry date. The substantial moves in the NFLX stock price heavily impact the volatility matrix for the company’s option chain, volatility which has skyrocketed. A high level of volatility results in a rich option premium which can be monetized via the cash covered put strategy. An investor looking to purchase the stock but still nervous around further weakness in the stock can utilize this strategy to purchase NFLX at a discount to spot levels.

Cash Covered Put Strategy

Many stocks have option chains associated with their equity. An option gives a holder the right, but not the obligation, to exercise it upon maturity. Conversely when selling an option, an option seller has the obligation to perform as the buyer indicates. A cash covered put strategy consists of selling put options on a stock in exchange for a premium, and holding enough cash in the brokerage account to be able to purchase the stock if the put buyer exercises that option.

A cash covered put strategy is in essence either:

a) A cheaper way to purchase a stock (if the stock keeps going down in price or stabilizes lower)

b) A yield enhancing tool if the stock appreciates in value or stays constant

Cash covered put strategies work best for stocks with high volatility. A high level of volatility translates into a higher option premium, which means an investor selling puts can realize a larger discount to spot levels or a higher overall yield.

An investor who likes a company’s stock but might still be nervous around future downside can utilize this strategy as a cheaper way to purchase shares.

What is the Trade

Rather than buying the stock outright, an investor who fundamentally likes the company but might fear further weakness can write a 1-month cash covered put on the shares:

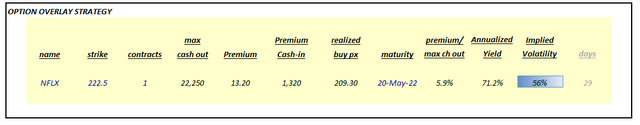

The proposed trade represents the selling of a put option (1 contract) with a May 20th, 2022 maturity date and a strike of 222.5 which is close to the spot levels. By entering this trade, the put seller receives a premium of $1,320. As an option seller an investor has the obligation to perform as the option buyer chooses on expiration date, namely on May 20th 2022.

The potential outcomes for the trade are as follows:

1) On May 20th the NFLX stock price is lower than 222.5

- the option will be exercised and the investor will purchase the stock at a net price of 209.3 per share which represents an approximate discount of 6% to current spot levels

- the investor will need to have $20,930 in cash in their brokerage account in order to purchase the shares

2) On May 20th the NFLX stock price is higher than 222.5

- the option will not be exercised and the investor will end up pocketing the premium of $1,320

- considering the maximum amount of cash, the investor needs to hold in their brokerage account this premium represents a 71.2% annualized yield on the respective cash

- basically, an investor can continue to place the same trade each month this year and if it does not get exercised the net pocketed amount will be $1,320 x 12 (all else constant – i.e., spot, vol, etc.)

Conclusion

Netflix has been an investor darling during the pandemic, greatly benefiting from the “stay at home” trade. As normality resumes in a post pandemic world the company is starting to experience subscriber losses and lower valuations. The stock is down more than -55% in the past year and has experienced the worst one-day sell-off in more than two decades yesterday. These substantial moves in the stock price have resulted in higher volatility and richer option premiums. Our strategy details a cash covered put trade that can result in an entry point that is 6% lower than current spot levels or in an annualized yield exceeding 70% if the option is not exercised. A retail investor who is thinking about purchasing the stock but is not convinced regarding the current spot level as a good entry point can utilize this strategy to obtain a discount on the stock or a substantial annualized yield on their cash.

Be the first to comment