Justin Sullivan/Getty Images News

Investment Thesis

Netflix (NASDAQ:NFLX) has exceeded market expectations for the second time in a row in terms of subscribers. We think the company’s updated strategy is starting to generate solid dividends. With its persistent leadership in the video content market, Netflix continues to be an attractive investment even after the stock’s surge. We maintain our bullish view on the company and look forward to further improvement in financial results.

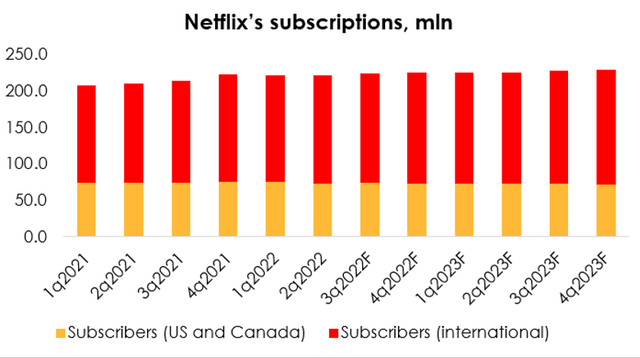

Recovery in the number of subscribers

As of the end of Q3, Netflix showed its first increase in the number of users in 2022. Net user growth for the period total 2.42 mln – 0.11 mln in the U.S. and Canada and 2.31 mln internationally. This is the second time the company exceeded its own expectations for net subscription additions. While management states that churn rates remain elevated relative to historical levels, the absorption of new subscribers allows it to compensate.

We attribute this recovery to the success of Netflix’s new strategic initiatives, and successful fresh releases.

Q3 2022 was not rich in high-profile releases, but there were several debated movies. Monster: The Jeffrey Dahmer Story, a sequel to Dynasty S5, brought success to the company. The previous releases (e.g., Stranger Things S4) are still popular too.

We believe that Netflix will be able to boost its user numbers next quarter as well, despite the general weakness of the economy. Firstly, the Jeffrey Dahmer series only premiered at the end of Q3, so is likely to maintain its audience appeal in Q4 as well. Secondly, several major releases are planned for the end of the year (sequel to the film Get the Knives and The Crown season 5).

Moreover, Netflix’s new low-cost subscription format with ads has been positively received by audiences in testing regions. The user is shown about 5 minutes of advertising per hour, which in our opinion is not that annoying, but the price difference is significant – in some regions the ad-based tariff is 30% cheaper than the standard subscription.

As early as November, the feature will be available in 12 major markets, including the U.S. We are optimistic about this strategy and believe the new subscription format will help Netflix attract and retain new audience which is more sensitive to rising subscription prices and inflationary pressure.

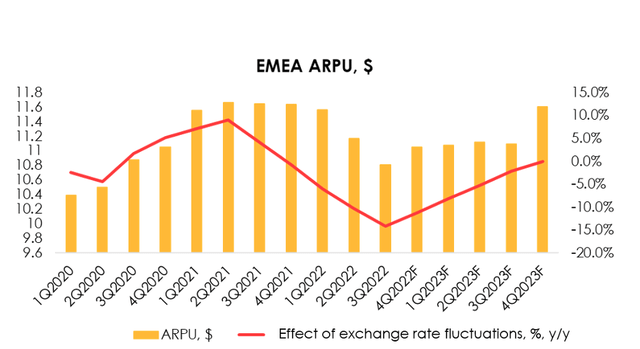

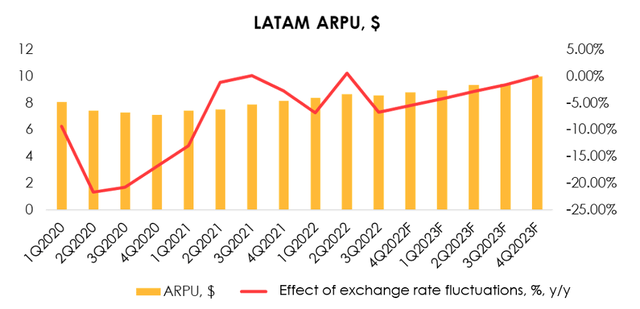

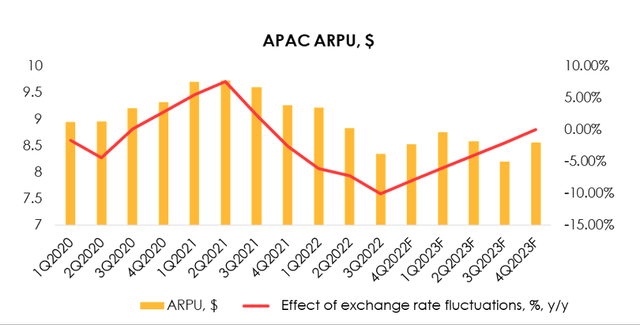

FX negative effect on ARPU

Since more than half of Netflix’s revenue comes from international activity, the company’s ARPU and profitability are quite sensitive to currency exchange rates. The strong appreciation of the dollar against global currencies in 2022 negatively affects almost all international companies, and Netflix is no exception.

While the company continues to steadily increase ARPU in fixed currencies in all regions of presence (except APAC), the dollar’s growth relative to global currencies has affected the average ticket (from -14.2 b.p. to -5.5 b.p.). We believe the negative impact will persist till the late 2023, as the Fed’s rate hike cycle is probably not yet close to its end, and the situation with inflation in many countries is much tighter compared to the U.S.

Invest Heroes Invest Heroes Invest Heroes

Overall, we believe that the company’s strategy is opportune in terms of users’ monetization, including the subscription sharing. New chargeable subaccounts format, although not completely, will help make up for the lost profits.

Netflix is turning into something more than just streaming platform

The updated management strategy is not only about solving monetization problems. To retain users and diversify the business, Netflix continues to open new areas of development and thereby shows exceptional business flexibility.

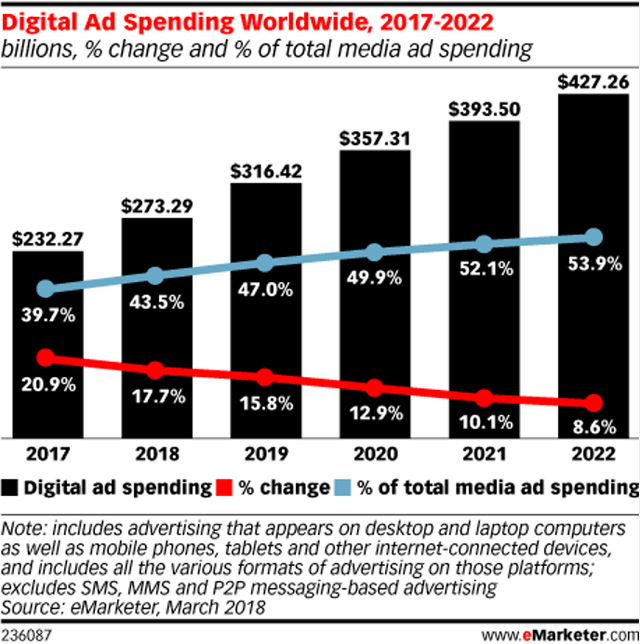

Entering the ad market, although it is more of a way to compensate for lower rates, also provides the company with completely new markets. The trend toward ad digitalization is evident, with lower prices and entry thresholds, and more effective audience targeting, the share of digital ad will gradually increase.

Despite the economic slowdown and natural negative effect on the digital ad market in 2022, there is still significant potential here. The strategic partnership with Microsoft, though not immediately, will bring Netflix good dividends: a loyal audience, advanced personalization, and leadership in the SVoD market are strong competitive factors among other video ad services.

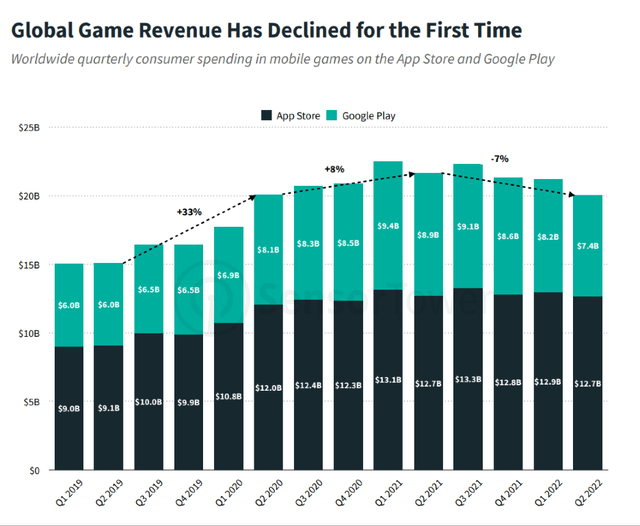

In addition, Netflix is actively developing its gaming division. Like the ad market, activity in the mobile gaming segment has decreased in 2022, according to SensorTower, but given the difficulties in the economy and the effect of recovery from the epidemic, it is too early to declare a stable trend. In addition, for Netflix, this is a very small part of the business, so even considering the market weakness, it will not have a significant impact on the financial results.

We view Netflix’s new direction as more of a way to attract and retain an audience than as a separate profit-making unit. Nevertheless, given Netflix’s M&A activity and investment, the mobile gaming division is growing at an impressive pace. As of the end of Q3, the company released 35 mobile games available for free to Netflix subscribers, 55 more projects are in progress now. By comparison, the company had only 24 games as of the end of Q2.

Valuation

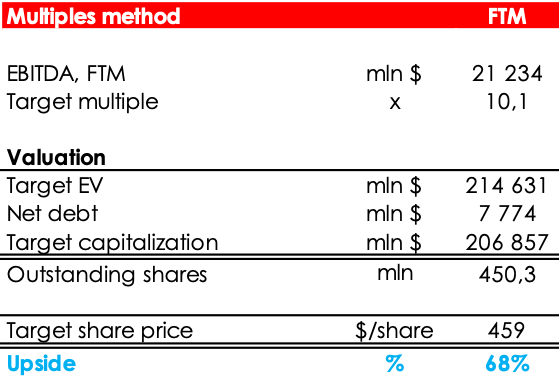

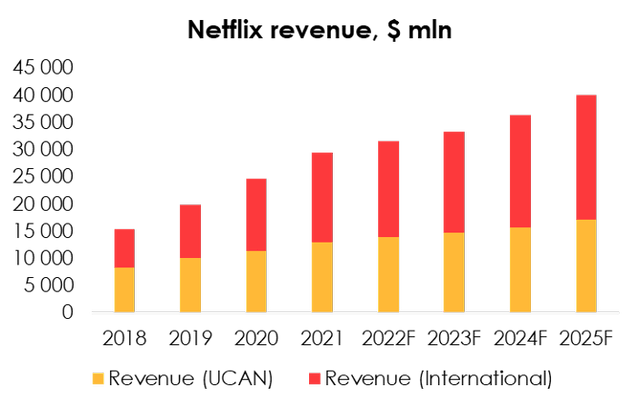

We expect Netflix revenue to grow at an average annual rate of 7.9%, driven by subscriber growth and ARPU increase. Given intense competition and the anticipated economic slowdown, our forecast of financial results is quite conservative.

Based on the Q3 results, we revised upwards our 2022 EBITDA forecast from $19 826 mln (+6.4% y/y) to $20 181 mln (+8.3% y/y) and from $20 626 mln (+4% y/y) to $21 565 mln (+6.9% y/y) for 2023 due to the following:

- The revision of the forecast for subscriptions growth from (0.7) mln to 3.65 mln in 2022 and from 3.76 mln to 3.69 mln of new users in 2023. We expect a greater growth of subscriber numbers in 2022 thanks to a new version of the cheaper subscription and the high-profile releases in the fourth quarter, but we still hold the view that economy will slow in 2023.

- A decline of the forecast for the ARPU in the international business due to a strong adverse impact from the dollar exchange rate relative to world currencies.

We are evaluating NFLX target price based on FTM EV/EBITDA multiple forecasts and raising the fair price for the shares from $425 to $459 due to:

- The higher EBITDA forecast in 2022-2023;

- The reduction of net debt from $8 414 mln to $7 774 mln;

- The shift in the FTM valuation (we earlier included the period from 3Q 2022 through 2Q 2023 into the forward 12 months EBITDA forecast, while now the forecast period runs from 4Q 2022 to 3Q 2023).

Invest Heroes

Since we included Netflix in our analytical research, the company’s stock has surged (+76.6%), but there is still a persistent upside. The company has beaten market expectations for 2 quarters in a row, and we see that the updated management strategy is already paying off. Rating is BUY.

Conclusion

Netflix has performed a tremendous work on its mistakes, and investor confidence in the company is gradually recovering. Due to its size and pervasiveness, Netflix will have a hard time maintaining the previous growth rates, but even so, the stock remains severely undervalued.

We believe Netflix is one of the companies to hold long in a portfolio, but we expect the entire market to be cheaper in the medium term. Netflix is in many ETFs, so a better entry point is likely to appear.

For those investors considering buying Netflix now, we recommend taking a position in small increments. To manage the position, we suggest keeping an eye on Netflix financials and industry research (JustWatch, Nielsen, Parrot).

Be the first to comment