hocus-focus/iStock Unreleased via Getty Images

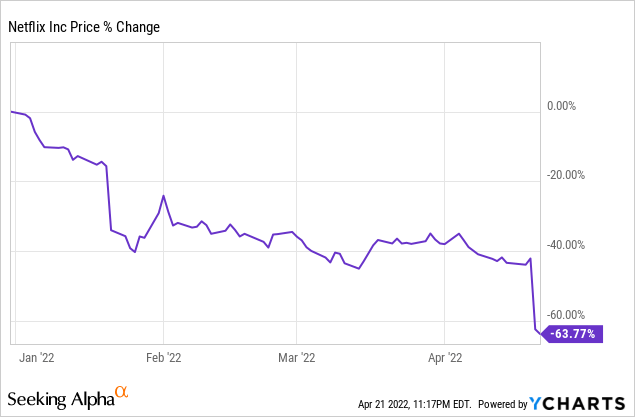

Netflix (NASDAQ:NFLX) shares got crushed after the company reported its first subscriber loss in over a decade in its most recent Q1 2022 earnings report.

The quarterly report scared away a lot of influential investors including Bill Ackman who dumped his entire 3.1 million NFLX stake after bears took control of the stock.

Losing subscribers is never a good thing but we must take a bird’s eye view on what’s going on and not overreact in the moment. However, Netflix shareholders hit the panic button and dumped the stock of a company with over 220 million paid subscribers. That’s more subscribers than the entire population of Africa’s most populous country, Nigeria.

Over the years, I earned the most money buying stocks when others were fearful and nobody wanted to own to touch them with a ten-foot pole.

I recommended beaten-down plays such as NIO (NASDAQ:NIO), Tesla (TSLA), Shopify (SHOP), AMC Entertainment (AMC), and Marathon Digital Holdings (MARA) when nobody on Wall Street wanted to buy.

Now, Netflix is sitting in a perfect position to swoop in and pick up shares at a heavy discount because investors are valuing Netflix incorrectly as a value stock instead of a growth stock.

In this article, I will explain why I’m still bullish on NFLX shares and provide a contrarian viewpoint that others may have overlooked.

Netflix Q1 2022 Results Were Positive If You Dig Deeper

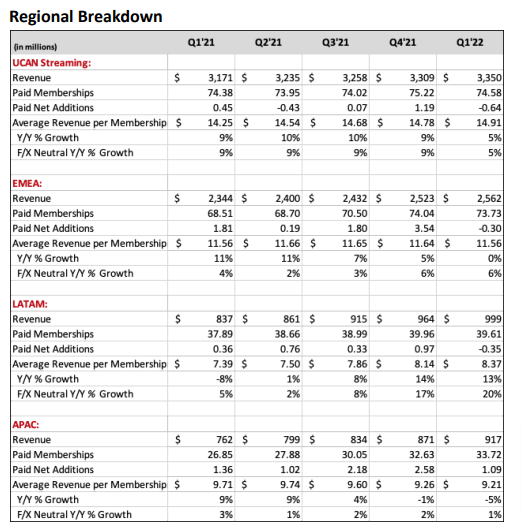

Netflix finished Q1 2022 with $7.8 billion in revenue (Up 9.8%) and generated $1.5 billion in net income. Global subscribers did decrease by 200,000 from Q4 2021 to 221 million but that’s still up 6.7% YOY from Q1 2021.

NFLX Q1 2022 (Netflix.com)

It’s important to remember that Netflix experienced a massive increase in subscribers during the global pandemic due to lockdown and stay-at-home orders. Mandatory masks have been lifted and people are spending more time outdoors this year than in 2021 and 2020.

Netflix suspended its service in Russia and lost 700,000 subscribers in the process. If you exclude Russian subscribers from the quarterly numbers, Netflix actually grew by 500,000 subscribers in the quarter! This is a key point that a lot of bears missed. The Russia-Ukraine War forced a lot of companies to pull out of the region and shut down their offices and services.

Other factors include rising inflation that contributed to a loss in subscribers in the North American and Latin American regions. Many people are faced with economic uncertainty and subscription services will get canceled in favor of basic essentials such as rent/mortgage payments, food, clothing, medicine, etc.

However, many economic analysts suggest that inflation peaked in March 2022 even though hyperinflation will become a major problem throughout this decade.

The Fed reached an inflection point with its recent March 2022 interest rate hike so I expect Netflix to bounce back nicely moving towards its strongest quarter historically, Q4.

Shared Subscriptions Is The Real Problem With Netflix

I applaud Netflix for allowing subscription sharing because it helped bring in more eyeballs and push forward the video streaming era. However, this convenience has cost Netflix a fortune in potential lost revenue.

The company estimates nearly 100 million households are using another household’s Netflix subscription to access the content. The average Netflix membership costs $10.95, which adds up to over $12 billion in lost annual revenue.

Netflix is offering an extra household feature on its plan but the company needs to invest more heavily in IP address limitations and cybersecurity to prevent this from happening.

I’ve personally had my Netflix account hacked at least twice and that’s where Netflix CEO Reed Hastings could beef up spending to solve the problem.

Could you imagine companies such as Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL, Facebook (NASDAQ:FB), or Microsoft (NASDAQ:MSFT) allowing people to share accounts? The good news is that Netflix management understands the problem and will work towards a solution that adds to the company’s bottom line.

Let’s say Netflix can convert just 20% of these 100 million households into a paid subscription. We’re now looking at a company with 241 million subscribers and investors can no longer spew the lies that “growth has peaked”.

Revenue And Net Income Continues To Rise Steadily

Meta Platforms (FB) stock got crushed in Q4 2021 and I mentioned in my Meta article that ad revenue is riskier than paid subscription revenue. Netflix still generates massive net income and free cash flow from its huge subscriber base.

The company plans to diversify its revenue stream with a lower-priced ad-supported model to attract lower-income households to its platform. Netflix could test this new business model out to see if it’s lucrative.

Here are my paid subscriber and revenue projections over the next 5 years:

| Year | Netflix Subscribers | Netflix Annual Revenue |

| 2022 | 241 million | $32.4 billion |

| 2023 | 262 million | $35.22 billion |

| 2024 | 285 million | $38.26 |

| 2025 | 311 million | $41.77 billion |

| 2026 | 338 million | $45.49 billion |

| 2027 | 369 million | $49.54 billion |

I generated this data using a conservative 8.9% streaming industry CAGR according to Statistica.

My projections will put Netflix over 400 million subscribers by 2030 as more consumers embrace higher internet speeds and transition to streaming content.

Netflix could generate $8 billion in annual net income by 2027, which means bulls will jump back on board once the dust settles and profits continue pouring in.

Don’t Bet Against Reed Hastings

Netflix CEO Reed Hastings launched the world’s fast ever global streaming service back in 2006 and now competitors are finally catching up years later. In my opinion, Hastings is the “Elon Musk of the Streaming Industry”. He identified a problem with traditional cable TV and gave consumers a better option.

Would you bet against revolutionary businessmen like Elon Musk, Jeff Bezos, Jensen Huang, or Bill Gates?

Nobody knows more about the streaming industry than Reed Hastings and he will help fix many of Netflix’s short-term issues.

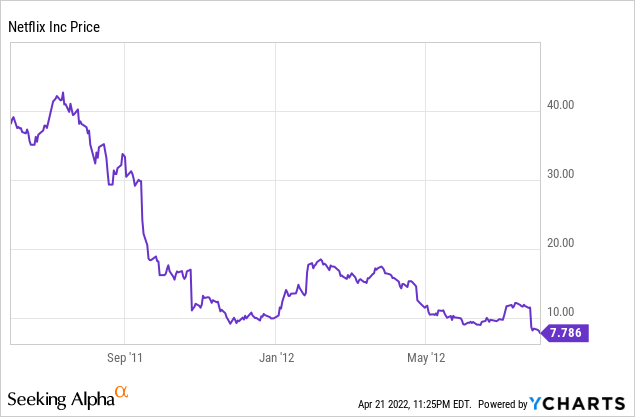

This isn’t the first time Netflix stock fell off a cliff. NFLX shares fell from as high as $40+ to just $7 and lost 79% between June 2011 and August 2012.

Patient investors who held NFLX stock during these rough times are now up 31x so sometimes it really pays to do nothing and hold your shares.

There is plenty of long-term technical support for NFLX shares around the $200 price range. NFLX shares broke past $200 resistance in 2017 and I expect a lot of technical traders to pounce on NFLX at its current price range.

NFLX long term chart (Tradingview.com)

Several other Seeking Alpha writers have bought the stock and NFLX currently trades at a P/E ratio of 32 and a P/S ratio of just 5. This is a good entry point for long-term holders.

Risk Factors

Competition is heating up in the streaming industry and companies such as Alphabet, Spotify, Roku, Disney, and Amazon are competing for watch time.

Netflix needs to focus on producing the best content in the world and replicate its successful originals such as Squid Games, Bridgerton, and Tinder Swindler.

If Netflix focuses too much on subscriber numbers instead of improving content, then Netflix may lose more subscribers in the future and add downward pressure to the stock.

Another risk factor is the health and longevity of Reed Hastings. Hastings is 61 years old and has been Netflix CEO since 1997. He’s been running Netflix alongside Marc Rudolph for 25 years and we don’t know how much he still has left in the tank.

Netflix may need to copy a page from Amazon and warm up the CEO seat for a younger executive to take over the reins by the end of this decade. Hastings is a genius and he could provide a lot of insight as a member of the board.

If Netflix relies too much on Hastings as he advances in age then the company could lose much of its appeal and fail to reinvent itself.

Conclusion

I have countless memories thanks to Netflix and really believe in its content first, political stance second agenda in a world full of censorship.

The company made an error with its account sharing model but management is working to fix the problem. Subscribers increased (excluding Russian subs) during the quarter yet everyone paper-handed and sold like a weenie baby.

Warren Buffett once said: “Be greedy when others are fearful and fearful when others are greedy.” There is so much fear surrounding Netflix now that I cannot help but load up on the stock.

I pounce when a wonderful company with an impressive track record experiences a short-term issue.

Form is temporary but class is permanent. If you’re looking for a wonderful company facing a period of uncertainty then Netflix is one of the best opportunities available right now.

Be the first to comment