emptyclouds/iStock Unreleased via Getty Images

|

Editor’s Note: This is the transcript version of the previously recorded show. Due to time and audio constraints, transcription may not be perfect. We encourage you to listen to the podcast embedded above or on the go via Apple Podcasts. Click here to join Tech Insider Network on the Seeking Alpha Marketplace. |

Transcript

Daniel Snyder: Welcome back to Investing Experts Podcast. I’m your host, Daniel Snyder. And we are joined today by Beth Kindig and Knox Ridley from Tech Insider Network. And man, do we cover a lot. We talk about Netflix (NASDAQ:NFLX), what their upcoming earnings might look like. We get their entire market overview outlook for the year. And not to mention we also talk a little bit about cloud infrastructure stocks and what to expect with their earnings coming up.

Just a reminder, anything you hear on this podcast should not be considered as investment advice. At times, myself or the guests might own position in the companies mentioned. But this is for entertainment purposes only and you should seek advice from a licensed professional before investing. And lastly, if you enjoy this episode, please do us a favor and leave a rating and review on your favorite podcasting app.

Now, without further ado, let’s get into the episode with Beth and Knox. Alright. Beth, Knox, it’s so great to have you on the program today. Thank you for taking the time to join us.

Knox Ridley: Good to be here.

Beth Kindig: Thanks, Daniel. Yeah, good to be here.

Daniel Snyder: So, want to dive in because you have a call that completely has blown me away. And I think our audience by now is seeing the title of the episode. They know what it’s all about. We’ve got to talk about Netflix because this seems to be the story of the rollercoaster of this last year.

Obviously, we saw what was going on with Ackman’s position, the subscriber misses, the freakout throughout 2022, and now the constant climb back going on. Just a little background though. So, your Netflix, first position you entered was towards the end of August and it’s up 47.6% currently and then you scaled in another in November. So, I’ve got to ask you, how did you know?

Beth Kindig: Yeah. That’s a great question. I — it was — you know, I’ll go into how we picked the stock and Knox can talk to about — talk to you about the timing of the entries. But what I can say is, it’s very bold around the time that we were heavy into a consumer stock, to be investing in a consumer facing company for sure, consumer being so very weak. And we had already said across the board, expect consumer companies to decelerate. We’re not surprised at all by Tesla (TSLA), for example, because so many were decelerating.

We picked Netflix out of the heap, out of the huge pile, for really three reasons: one is the ability to accelerate revenue, the ability to accelerate user growth, and that comes from the ad tier. And then the fact that it has a catalyst at all is pretty rare, across the consumer company right now. For example, Apple (AAPL), what’s their catalyst? We don’t know yet. We don’t see them being able to bring in a really big or what I should say, a sizable new revenue stream outside of the iPhone. I don’t see a catalyst there. Just as an example, Netflix has a huge catalyst right now because of the ad tier.

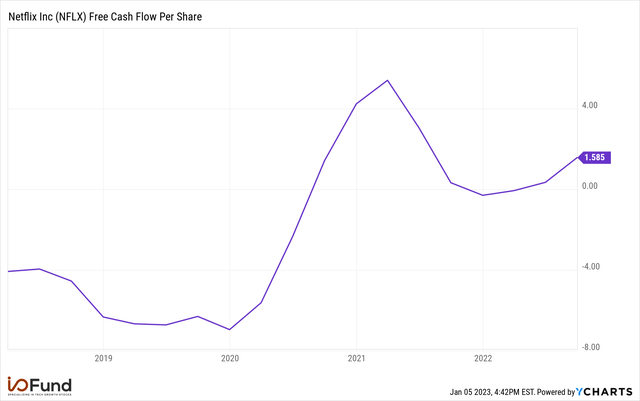

And then when you add that to the free cash flow, which is greatly improving, the Netflix that most public investors have come to know, anyone watching the things, is not the Netflix of today. Netflix has changed quite a bit on its free cash flow margin. It’s — anyone covering the stock or knowing the stock remembers probably that in 2019 it was losing $3 billion in cash and that was a substantial amount for a FAANG, because FAANGs are known for their strong bottom line margins.

Now, Netflix is $1 billion positive free cash flow this year and is slated to grow substantially in free cash flow next year. Those are the words from management. I assume that means somewhere around $2 billion to $3 billion next year. That’s my best guess. And so that’s a entirely different Netflix than what we’ve known before with the idea that the ad tier could potentially gain some traction. What we’re looking for on traction from Netflix is when they cut-off the 100 million password sharing accounts, so there’s 100 million people sharing passwords.

They’re testing and planning to cut those people off. We feel there will be maybe single percentage, maybe very low double percentage that will convert to the add tier. And so that would be a — that would be a boon for Netflix and their subscriber base.

Daniel Snyder: Yeah, not to mention I think management also came out and said that they’re watching their expenses on what they’re spending for the production of content, right? Their bread and butter, which they have to continue to spend on. But we also saw news coming out. I mean, they’re still investing in new film studios, now up in the Northeast, in the United States.

But to go over to the timing aspect, which you mentioned when starting the position, Knox, let me turn to you, what were kind of the signals. How did you guys know that now was the time back in August to pull the initial trigger? And where do you see we go from here?

Knox Ridley: Yeah, I mean, it’s a good question. I mean, there was — you know, if you’re paying attention, you’re noticing that there is a seismic rotation occurring within the markets right now. Just for example, the Dow Jones Industrial Average, the boring Dow is, you know 50% off its low and the exciting Nasdaq-100 is about 7% off its low. And so, whenever — you know, what we’re seeing is we’ve been trained for 12 years to — wherever the FAANGs go, the market goes.

And that’s just not the case anymore. Like, there is a rotation, there is value names that look like they’re setting up for new highs where many of the FAANG stocks do not look like they’re setting up for new highs right now. And just to kind of show you the weakness, the market bottomed on October 30th and every single FAANG continued lower from there, except Netflix. And in fact, Netflix actually bottomed in May of 2022.

And think about that. Think about the volatility we saw in September and August, all the way into October. I mean, that was some really strong volatility. And Netflix did not make a new low. It kept making higher lows. And you got to pay attention to that. The market was telling us that, you know, this stock’s valuation was too low, like they’ve talked about how a catalyst built into it. And so, to me, to disregard all of tech, would just be not a good play and not a good strategy because you have stocks like Netflix and there are a few out there that bottomed way before in the market.

They bottomed before a lot of these value stocks that are leading right now and they’re up way more than a lot of these leading value stocks off their lows. And so, because of that pattern it had us, you know, really paying attention to it. We identified the catalysts and then we just started doing just some technical analysis, identifying what structure is probably tracing. And we bought with that. We were targeted to low, which was what we usually do.

We usually will say this is the target box we’re looking for, [indiscernible] whenever it hits there, you’ll see us buy there. So, we target it beforehand. We had the pattern correctly and we ended up buying it at a really good price.

Daniel Snyder: Yeah. I just want to take a quick second since we’re diving in so quickly into all of this to mention that, while we’re recording this episode, it is Wednesday, January 11th. We have the Seeking Alpha Author’s grade as a hold. Wall Street analysts have a buy on Netflix, and the Seeking Alpha Quant System has a hold as well. And what’s interesting to me is, if you dive into the Wall Street Analysts, it seems like the — their average price target is $305 right now a share, but the highest is $405.

I mean, Beth, it almost sounds like analysts aren’t really seeing the value within this ad tier and the weakening dollar in this rollout of what’s to come. I mean, with earnings being, I think it’s next week, January 19th, right, are we expecting to be — raise and then all the analysts coming out saying that were wrong? What’s the — what’s the mindset there?

Beth Kindig: That’s a great question. And Knox can tell you how we’re handling our position going into earnings. But what I will say is that as an fundamental analyst who’s been pretty keen on the stock, I would say Q2 is more important to me. The 100 million password sharing has not been cut off yet, so I’m not expecting anything at all from the ad tier. So, this is going to be one of those where we use technicals to make sure that we’re basically doing some risk management throughout Q1 with wanting to have full exposure for Q2. I really expect Q2 to be when this story is better understood timing wise.

And it’s really important to understand timing, obviously, because macro and tech and growth and consumer are all just so shaky in general. So timing is a big deal. And I would say Q2 is when we’re hoping to be locked and loaded.

Daniel Snyder: Do you have any worry, though, about these discussions and talks about a global recession going on? Because I know Netflix strategy is they’re trying to expand their international market or is that more favorable for this ad tier?

Beth Kindig: That’s where I would say that it should be a stronger consumer play because it’s not very expensive. It offers great value. Obviously, you can stay home a lot with whatever it is, whatever your tier is, ten bucks, 15 bucks to stay home and it’s all you can view. So, as far as consumer purchase goes, we don’t believe Netflix was truly saturated coming out of COVID. I believe that was a pull forward. And so given that the Netflix that we know has also — always been the number one on engagement.

So, no matter what company has launched competing app Disney, HBO, we’ve heard it all right. Like anyone covering Netflix and Disney is going to be the end of Netflix, et cetera, et cetera. Nobody has touched Netflix’s market share on engagement. And in fact, most recently around the time we entered, they went up, which is incredibly hard right now with so many streaming apps online. They went from 6.6% of the market to 7.7%.

So not only are they the number one streaming app, they’re in the lead by wide margin and they’re continuing to take market share. That’s just pure Nielsen. That’s not necessarily me saying, you know, that means there’s going to be a big subscriber beat. I’m more concerned about Q2 and I like to get in early because I think institutional analysts and others are going to be able to model this pretty well once we start to see enough traction from the ad tier.

Knox Ridley: Another think I can add to that is, markets are always forward looking, right? Back in May, whenever Netflix bottomed, no one was really fully aware of the catalyst involved, but the market was fully keen that the valuation at the time was relatively absurd. And so, it doesn’t mean that Netflix is just going to go to the moon for a year. I mean, we’re expecting deeper pullbacks probably relatively soon and later in 2023. But we do believe that a major low was struck in 2022 with Netflix.

And so that’s a position where it’s as long as the catalyst remains intact as Beth is talking about, we have our criteria of what would have us bailed on this thesis, both technically and especially fundamentally, as long as it remains intact. We don’t want to get too cute with it. We may take some gains like we actually trend some today and took some really nice gains today just to raise a little bit of cash for expectations at a lower price relatively soon. But we want to you know, as long as that catalyst is involved, you know, and it’s still intact, you know, we’re likely going to not get too creative with that position.

Daniel Snyder: And I love what you’re talking — so you’re talking about the institutional investors and how they kind of lag a little bit, even though they’re trying to look forward. But just yesterday, Goldman Sachs came out. I mean, they pretty much just said, they’re boosting estimates for Netflix to account for a weaker dollar, but it’s still keeping its sell rating – they’re still keeping a sell rating on the stock. So, I mean, is there — but — is there a catalyst not the same as your catalyst?

I feel like there’s a kind of a split down Wall Street right now saying, look, their free cash flow is amazing right now, but can that be sustained? They’re laying off, cutting expenses, right. Management is doing what they know to do best. And their content is still key. I mean, people still rave about Netflix content all across social media. I mean, they definitely have a powerhouse brand name. And I’m wondering if people aren’t understanding what this password sharing cut-off could actually turn into within revenue dollars.

Beth Kindig: For sure. I would say I’m very comfortable going against institutional analyst ratings with tech companies. I would say that for most of our wins we do. And that’s because by the time that they say bye, I would say, Knox is usually looking to take gains and move to the sidelines or, you know, basically just trim the position, because by the time that, you know, smart money lets everyone else know, it’s kind of too late. So, I’m pretty comfortable going against even a Goldman Sachs analyst.

Not saying I’ll be right, but just saying more often times and now we are trying to be earlier than them. And then, you know, there’s a couple of things too. I just want to add, since we’re on the topic of Netflix reporting next week, one is my understanding is they’re actually removing subscriber numbers from their report and they’re just going to do revenue, obviously, whatever normal GAAP and non-GAAP.

But then the other thing is, they — even if — this is what I’ve seen the trend and we can talk about earnings trends, but even if, let’s say revenue is a little soft or we have, you know, depending on FX headwinds or tailwinds in this case, the free cash flow guide could potentially prop this stock up in the earnings because the management team should be giving more clarity around what they meant when they said we have 1 billion free cash flow this year and we will substantially increase it next year.

We should start to hear a little bit more granular detail on what that means and if that’s a notable number, that could be enough to create an earnings beat as well. And I don’t want to underestimate the power of a FAANG creating more cash when some of them are going the opposite direction. Obviously, it doesn’t have, you know margin that something like META does, but Meta having contracting margins is usually a concern, generally speaking, and with Netflix having expanding, that’s usually a good thing. So, if they’re going to expand year-over-year on free cash flow, the market will continually see Netflix in a different light.

Daniel Snyder: I loved when you brought that up. Sorry to interrupt, real quick, I mean, gross profit margin on Netflix right now is about 39.6% kind of level, but also what you’re talking about with the free cash flow, I mean, the trailing 12 months free cash flow for Netflix is $16.8 billion. They’ve definitely got something, right? Knox, go ahead [indiscernible] to say?

Knox Ridley: We also — I disagree pretty strongly that FX headwinds will be an issue in 2023. I mean – and just a basic charting will show you the dollar has put on a pretty major top. We may see a corrective bounce, which I think is lining up with some weakness in equities over the next month or so. But I mean, just look at the euro USD pair. I mean, it’s in a 45-degree uptrend for the first time in quite a long time. So, we think that that ultimately was a hindrance in 2022. Couldn’t act like a boon in 2023 for equities.

Daniel Snyder: Yeah, that’s a great point as well. And I think, Beth, maybe you know this off the top of your head, I think isn’t the password sharing crackdown already happening in South America? I mean, we’re talking about dollar and they’re testing this right now. And of course, the US dollar pulling back from that self-fulfilling prophecy. Central banks around the world are increasing interest rates as well. It sounds like this is kind of brewing up to be a perfect storm, even if there is a recession, that Netflix is almost recession proof.

Beth Kindig: Exactly. I agree there. We could have a perfect storm. So, we did see some negative headlines that Netflix was returning ad dollars in Q4. That was the ad tear being rolled out and tested and being rolled out before the password sharing was being cut off. So, again, like what you’re saying, the perfect storm for, in my opinion, would be once the ad tier has been tested and it’s rolled out, you know, pretty much around most of the top geographic areas, geos.

And then the other would be to cut-off password sharing in those geos at the same time. And that’s the combination we want. But I do believe it will take Q1 for that. And being an early report in the earnings calendar, Netflix has a little bit of a disadvantage in this case because they don’t really have Q1 results yet from some of this testing in order to talk about it next week. It’s being so early in the quarter.

Daniel Snyder: Let’s just talk — last question on Netflix for you real quick as well. So, the revenue growth year-over-year for Netflix most recently was only 9.9%. I mean, does that worry you at all or do you think that I mean, they’ve risen, they’ve risen prices of their subscription, I think like ten times over the last decade. I mean, would you anticipate seeing that happen again right now, or is that kind of maybe a further down the line?

Beth Kindig: Another great question. I guess what I would say is we did this with NVIDIA where what we were looking for is a bottom. And what we’re looking for is enough of a catalyst to create that bottom, because these are mega-cap large cap companies. These companies are not going out of business. So, we were very keen to find quality companies not going out of business, likely to execute well, strong management teams that are at steep, steep discounts.

I mean, you know, a lot of people are in shock and they’re in panic over last year. I think the appropriate psychology around this is what’s on sale that may never be this deep of a discount again, at least not for the foreseeable future. What are some of these quality companies that have zero bankruptcy risk, that have zero, you know, very low I should put, execution risk. And then — and why not look at those, for those catalysts and those ability to accelerate off the bottom?

So, what I’m saying is that these revenue estimates probably do not take into account anything with the ad tier. And it is speculative at this time as to how well the ad tier will do for sure. But is it, how speculative is it when we’re dealing with the number one media company of all time, no competitor has ever dethroned Netflix. In fact, it’s only getting stronger. And they have 100 million people in their pocket that may be able to be monetized again, looking for low single digit. I mean, high single digit, low double digit, is still going to be a — it’s still going to make for a good 2023 and 2024.

Knox Ridley: If I could add something to that is, you know, regarding the relatively low top line growth, you got to take a look at what the market is favoring right now. There’s been a genuine sea change. You know, grow at any pace, doesn’t work anymore. A lot of your high beta, high fliers, high growers are continuing to make new lows even today. And then you look at, you know, some of your blue-chip stocks in Europe, for example, and Europe has the same problems we have, less in energy crisis and they’re making new highs.

So, there is a true divergence on what the market really wants right now. And it’s not necessarily, grow your revenue at a high pace. It’s more about consistent profitability, safety, defensive nature, cash flow. That’s what the market is really favoring right now, as opposed to like your top line grow at any cost.

Daniel Snyder: I love that. I love that viewpoint. And so, let’s go ahead and take a step back from Netflix for a little bit. And let’s maybe talk about what you guys are thinking for the overall market, for either the first half of this year or the full year? Knox, why don’t you kind of — if you don’t mind, just kind of share with us what you’re kind of considering going into 2023?

Knox Ridley: Yeah, you know, it’s very rare to see two years in a row of negative returns, the S&P 500 [indiscernible] what happened. But it’s very rare. However, I think the odds of a recession are relatively high. We’re seeing the yield curve more inverted than any time. You have to go back decades to see this inverted. We’re seeing manufacturing and contraction services or I think they came in at 50, very neutral. But the new orders and services are in a contraction which really pretends, you know, future growth.

And so, we’re heading — we’re in the late cycle regime. I mean, we’re talking about the jobs report being great. It’s like, no, it really wasn’t great. If you look under the hood, the total hours work actually has been in decline, which once again is characteristic of a late stage or late cycle scenario. And also, temporary jobs fell 35,000 in December. It’s the fifth month in a row. And that is the very characteristics of a late-cycle situation that we’re in.

So, yeah, we do believe a recession is likely. However, this is the most televised recession arguably in history. Everybody knows about it. Every article out there is, what to own a recession, how to prepare for it. I think you’re seeing a lot of people probably preparing for it prematurely. It’s one thing to make the right macro call. It’s the other thing to make the right market call. Sometimes they don’t always make up.

And a good example is 2019. I mean, the macroeconomics were horrible. They continue to decline. We actually went into a contraction in 2019 and the market just continued to power higher. It didn’t make any sense. And so, we see those moments when markets don’t make sense in relation to what the macro is telling us. And so, we’re not necessarily preparing for the recession right now. Our viewpoint is that we’re probably going to see some volatility and to early, you know, late Q1, February, March, and we believe that will set up as a pretty tremendous buying opportunity.

Like I said, there’s been a rotation in the value. So, the Dow Jones is an index track. It’s not the Nasdaq-100. You can see the Nasdaq-100 make a new low. That doesn’t matter to me. What matters to me is, is the Dow going to hold its October low? As long as that happens, even if the S&P 500 makes a new low, as long as that Dow holds that low, we see any volatility in Q1 is a tremendous buying opportunity. We expect Q2 and Q3 to be a gangbuster uptrend.

And you know, start getting into later 2023, that’s when we’re really going to start kind of preparing for the coming recession, one of the better idea of how deep it might be. Now, right now, you’re seeing a little bit of bifurcation. You know, businesses are much better capitalized than US consumer. US consumers are in a really bad spot right now. You know, 21 months in a row of real wages being negative, savings rate at 2.3%. You know, that’s not very good.

And so, you get another six months of that. That’s going to filter into businesses, you know. So anyway, that’s our expectation. We think preparing for the recession right now is premature. We don’t think — we do think we’re going to see some volatility, but it’s likely going to be a pullback in a bigger uptrend that should last through, you know, probably fall of 2023.

Daniel Snyder: There is a lot to unpack there. I mean, you brought up a lot of good points. I mean, first off, you know, you’re talking about, say, the inversion of the bond yield curve. Right? And I think it was just the other day I saw Jeffrey Gundlach who is saying, look, the bond market has never gotten this wrong. Like the bond market is telling you a recession is coming, recession is coming even though the Federal Reserve over here is saying we’ve got this soft landing, trust us, the whole thing.

But we’ve also heard time and time again interest rates had to be higher for longer, right? Higher for longer. Get them — get them up, park them, let them stay, wait for all of this well-capitalized businesses that took on all these, you know zero interest, close to zero interest. Pretty much debt over the last few years to kind of ride out a few years of cash flow expenses, et cetera. I mean, they’re going to have to start either re-raising debt, cut expenses.

And so is that why there is, in your view is going to be a delayed recession, is we’re going to get the interest rates higher, we’re going to park them, and then knowing that the savings rate for consumers is low, they’re going to start to feel the squeeze and then businesses will ultimately start to feel the squeeze. And that’s why the delay effect is there.

Knox Ridley: Yeah, I mean, the — you know, anticipating a recession is very complicated and the timing of one is even more complicated. Yes, the bond market has a near perfect — I mean, just take, you know, the two 10-year yield curve. It’s predicted every single recession going back fifties. It had two false positives. But then you take the three month and ten year and it has predicted every single recession perfectly.

And so, you take that track record and then compare it to the Fed’s track record, which is just, I think a deplorable — I think is probably a nice way of putting it. I think they’ve been wrong on everything they’ve said. Rarely do they get it right. I always would trust the bond market. But I will say this one thing and this is something that really has me intrigued, this is the first bear market that I could find where the equity market led the bond market.

Usually, the bond market is leading the equity market by about 24 months to year and a half to two years before the equity market gets the picture. But this time around, the equity market led the bond market. And that is a strange anomaly. And so there have been nothing but anomalies since the COVID. Well, I mean, on a macro scale, on an economic scale, we have seen just anomaly after anomaly. And so, you know, if you would have told me, what are the odds that the equity market would leave the bond market, close to zero.

But it happened. And so, for that reason, you know, anticipating and building a really well thought out thesis on the macro could be great. But price disagrees with you. That’s what matters to me more. This is why we really pay a lot more attention to price action. And so that’s what really, you know, is guiding us. And I’ll say this last thing in terms of price action, if you just look at global markets, I mean, you look at like I’ll just name a few of them Canada, Europe, Italy, France, Germany, Australia and probably Japan all of them are suggesting that they want to go to new highs, that the uptrend from the COVID low in their markets is not completely over.

And so, if that’s true, what does that mean for U.S. markets? That means that they’re setting up as well for maybe a lower high, but a bigger uptrend that most people are anticipating right now. And so that’s kind of guiding our guidance over the intermediate term right now. And I also, I heard somebody say the other day, which is I think worth mentioning, is you’re talking about the anomaly, the anomaly of the bond market and what’s going on right now.

It is because the Fed speakers are speaking more than ever. Right. They’re not letting the bond market have any doubt of what’s going to happen. They’re saying, hey, this is what we’re going to do and we’re going to show you that we’re going to do it and then the bond market believes it. So, I want to go ahead and take a second, though, and transition a little bit over into upcoming earnings. Right. We’ve got tech earnings coming down the runway.

And I mean, knowing how interest rates can affect tech companies, we’ve seen all the layoff announcements. We see the tech sector getting hit pretty hard. And obviously you guys run tech insider network. So, I’m kind of like very curious about what you guys are expecting for the upcoming earnings. Do you guys want to kind of give any overview of maybe cloud, maybe a name like Microsoft (MSFT)? I mean, think about your Microsoft call, right?

You told people to stay in Microsoft back when everybody was saying, get out of Microsoft. And now we’re hearing Microsoft chatter about A.I. in chat, the OpenAI Chat BGT and the investment there and stuff. I mean, it seems like there’s still areas within the tech industry that are still worth while holding. I mean, we talked about Netflix earlier that maybe you have an idea of going into this earnings, what are you guys watching in particular?

Beth Kindig: Yeah, I just real quick note on Microsoft before I go into the earnings. As you know, I get a lot of questions on that. We we’ve been covering a long time in our premium side that this is a big AI powerhouse and it’s a strong buy on any weakness. But I would almost — I think a lot of people are thinking OpenAI is making Microsoft an A.I. stock, which I would just encourage anyone listening that Microsoft has a large, long, long runway on AI.

And this is one of many things that Microsoft will be backing or will be bringing to market in AI in our world. So, I see Microsoft as definitely a top-3 AI pick, and I would say that I think a lot of people are thinking open this investment and backing – open your eyes, what makes Microsoft a strong AI choice. It’s not. Microsoft has been inherently a strong AI choice for a long time and this is one example of it.

So, I just want to throw that out there because there’s all kinds of AI going on there and we write about it. Anyways, long story short about earnings. I would say in May, I think it was, I put out something called compartmentalizing cloud stocks, and it was really in that month that tech insider network completely changed our portfolio. It took a little bit of time, but our returns are much better this year. We’re going to — we’re actually audited and we wait for have an auditor look at them.

And when we put them out they’re better than other all tech portfolios because we were really tough on ourselves and we were like, listen, this isn’t working anymore. This old way of investing in tech stocks is over. And when cloud started to miss and go down 20%, 30% after ours in May, I knew something big was going on because cloud is a – is almost like a — it’s a little darling within the industry because it’s resilient. It drives – it’s deflationary, it drives down costs, increase productivity. It should have been the last, the most resilient piece within the tech industry in a recession.

Why is cloud being weak is because it’s not very cash efficient. There’s — the bottom line is never — is not very good. Very few companies that are cloud companies are GAAP profitable. I mean, I think I can count on one hand those that have a strong growth rate above 20% that are GAAP profitable. Did they reach adjusted profitability? It’s with a lot of stock-based compensation packed in there. Even with that said, many are not adjusted profitable either.

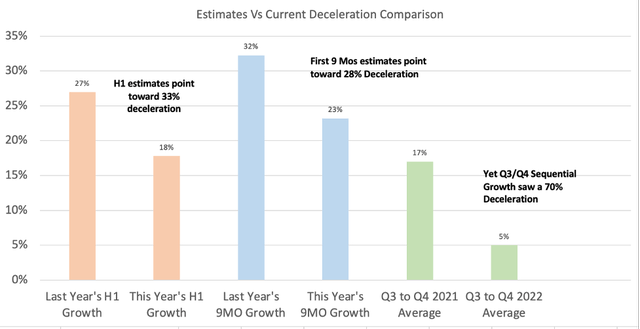

And then free cash flow is another issue for these companies. So, in general, I would say not much has changed. The only thing that change is that the market will kind of attempt to resume some confidence in these areas and then it will pull the rug back out under for people. So, we’ve then — I’ll just give you a little bit more information here. In the Q2 earnings, there were beats in cloud and there were raising guidance for Q3. What got our Spidey senses up and we started to pull back from cloud around that time is that they were not pulling forward those beats for Q4 and fiscal year.

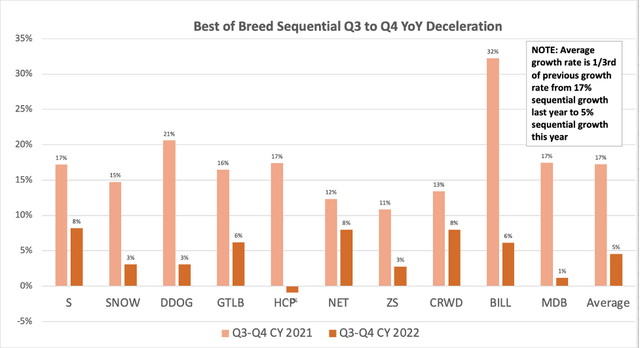

They were keeping the fiscal year the same and they were beating on Q2 and raising guidance on Q3. That’s a huge flag that Q4 is going to be weak. And if you look at some of the graphs data that we sent you, I think they’re included with this interview.

You’ll see that that indeed is what happened. In fact, Q4 sequential growth average across the top ten best of breed averages 17% from Q3 to Q4. And now it’s 5%. So, it’s a 70% decline.

This is actually a picture of that, Daniel, showing of how much of a deceleration we’ve seen across best of breed from Q — from last year’s Q3 to Q4 to this year’s. I mean, it just takes one quick glance to see a slowdown is occurring. Now – so what they were looking for clearly is how strong is cloud? We’ve felt it was safer to move to the sidelines to see how this plays out, which means we’re happy to move back into cloud once it’s set. Once it gives us an acceleration.

We don’t want to catch a falling knife. We don’t want to predict a bottom when there’s this much of a deceleration going on in a sector that rarely has this level of deceleration, especially in Q4, which more times than not is the stronger quarter for these companies. It’s by far the weakest. And year-over-year there’s an obvious issue going on. Of course, this is probably being driven by enterprise budgets. Enterprise budgets are being pulled back.

We saw that with marketing and sale — sales and marketing budgets from ad tech. So, in general, we’re not sure where enterprise budgets will be this year and we’d rather not gamble. So, we’re on the sidelines patiently waiting to see what that information gives us this quarter. So, we are on the sidelines primarily with cloud, except for Microsoft, really. And then one other cloud stock and what we’re looking for in this or these earnings is kind of what we talked about with Netflix, revenue growth is less important to us.

What we want to see is margins expanding and some revenue acceleration would be great. There’s no doubt. But what has to be a must is margins cannot be contracting. That’s what we’re looking for in a nutshell. And I think you could say this in a conversation and it sounds obvious and it sounds logical, but how many tech investors are holding companies in their portfolio that have really weak margins? I would say looking at most all tech portfolios, quite a few of them are just hodling.

I wouldn’t hodl. We stopped hodling and it’s done as well to not hodl anything that doesn’t have really strong margins. Our entire portfolio is either adjusted profitable free cash flow positive and some double digits or higher across the board.

Daniel Snyder: Knox,I want to give you a second to add on to that. But for anybody listening to the podcast, if you want to see the chart that Beth was just referring to, head over to the Seeking Alpha Author page for Investing Experts Podcast, I’ll make sure that we get these charts up on the article because I mean this shows Snowflake (SNOW), Datadog (DDOG), CrowdStrike (CRWD), BILL, MongoDB (MDB), Zscaler (ZS), I mean, you this is a lot of great information. So, check that out. So, Knox go ahead. What have you got to give us on the add on for that?

Knox Ridley: Yeah, I mean — I think Beth covered it very well. What I would add is, one thing I’ve been investing in the market since 2007. And the one thing I can tell you definitely, I’ve been doing this for a long time, as markets change, characteristics change. There’s changes that are occurring. You know, we’re seeing, you know, rates — the market — if you look at the volatility market as well and how it’s reacting with the equity market, it’s suggesting that the market is getting okay with higher rates.

You know, we’ve been in zero rates for a very long time and that’s led to some very interesting plays and high beta stock. But all of a sudden, if you don’t have to take the kind of risk you had to take to get returns and you can actually get a nice yield and the market’s telling you that it’s okay with these higher yields that’s a really significant sea change that one needs to pay attention to. And we’re trying to pay attention to it. And it’s telling us we’ve seen stocks go up significantly who have very low revenue growth.

But like that, talk about their other metrics that are characteristic across the board that the market is now favoring. And so, we’re just – we’re pivoting with it.

Daniel Snyder: I love it. I love it. Before I let you guys go, I mean, I’ve taken way too much time from you. Beth, one follow-up question for you, because we’re talking about cloud and especially clouded with earnings coming up. And a few weeks back on this podcast, Austin Hankwitz and I were discussing about how we’re seeing more companies want to rein in the number of cloud vendors that they’re using and consolidating that.

Do you have any thoughts or opinions? Is that kind of might what might be happening here? I mean, with cybersecurity and packaging, I mean, Datadog does that? So that’s why I kind of asked.

Beth Kindig: Yes, great question. Consolidation is a natural part of the tech hype cycle. It affects every large, burgeoning emerging trend over time. So, what happens is, you have the startup — the startup — culture of the startup economy basically creates, let’s say, thousands of companies. Let’s say from that, you know, 50% go public or I don’t know what the percentage is, but let’s just say a percentage of those go public. Some of them fail. I mean, they say the failure rate of startups is 10%.

But let’s say we’re talking cream of the crop. Strong companies, they’re not mom and pop where there’s only two people working. I’m talking like, you know, let’s say they’ve gotten to series A at least or Series B, cream of the crop to level startup. From there, you know a large amount go public. From there, to be clear, it’s not necessarily a goal to stay in business forever. That’s — I mean, you know, venture capitalists got their exit, the insiders got their exit, the public markets absorbed that, paid them off.

And now whether that company survives or not, nobody really cares and nobody really tracks that. We saw — you know, this is your Yahoo type stuff. This is your Zynga. I mean, I don’t know if many people were called gaming. Gaming was — surpassed Hollywood and there was huge consolidation that occurred. Massive Amounts of gaming companies, large amounts, I should say, that had 100 plus employees went out of business through the consolidation process.

Mobile apps, how many mobile apps have you put on your phone when the iPhone first came out that are no longer, you know, no longer valid and so are no longer even in business? So, basically the point that I’m making is cloud is next. It has to be because it’s there in the hype cycle. There are for sure, I believe that we’ve run the numbers and there’s into the hundreds is what a corporate, a large corporation uses across all cloud tools, all cloud software. I mean, it’s mind numbing. The amount of cloud tools that a very — I’m talking your top Fortune 500 companies will use.

So, it’s just going to be easy to get rid of a lot of those because there’s a ton of overlap. So, I have actually made the statement that if you look at your best of breed and you take the top 20 or 30, some of those will not be in business. And how do you determine how many won’t be? It depends on how deep the recession is. We’re talking about — on top of where mobile apps and ad tech went through a huge consolidation period when Facebook and Google dominated, thousands of companies went out of business, literally thousands within a year or two.

I don’t think it’s going to be quite that dismal or monopolized, I should say. But I do believe that, you know, the public markets are going to see this consolidation. And out of the 30 top best of breed growth cloud companies, you should expect some of them not to be in business.

Daniel Snyder: Yeah, not to mention that every new vendor is a potential point in the security chain that might get hacked into. Right. And I think that’s where we hear about like the CTOs kind of freaking out about cyber security. I remember a couple of months ago, was it when or last year when cybersecurity became a boom, and you don’t really hear so much about cybersecurity as much as we did at one point in time.

So obviously, Beth Knox, thank you so much for your time today. Your analysis on Netflix and everything else that you’re doing is amazing. I encourage everybody to go check you out on Tech Insider Network if they haven’t already. Is there anything else you would like to say before we hop off here?

Beth Kindig: I would just add that Tech Insider Network offers real-time trade alerts. Everything we do is the day that we enter or exit. And then Knox actually has hedged up to 100% of the portfolio very successfully last year many times. So, we just offer a lot of risk management tools for tech, which I think is rare, and our allocations are very strategically chosen as well. And that has helped us outperform and it’s because we put risk management in the driver’s seat.

Knox Ridley: And we also offer macro analysis on top of what guides or technical decisions or tech decisions.

Daniel Snyder: And the IPO fund is incredible. I mean, as you mentioned, you get it audited, the proven track record is there, highly encourage everybody to go check it out, read some of your analysis. All of that can be found on Seeking Alpha. Thanks again for your time today and we’ll talk again here soon. All right.

Beth Kindig: Thank you to hear.

Knox Ridley: Thanks Daniel.

Daniel Snyder: Just a reminder, everyone, if you enjoyed this episode, head over to your favorite podcasting app. Give us a rating or review and we’ll see you next week with a new episode and a new guest.

|

We encourage you to listen to the podcast embedded above or on the go via Apple Podcasts. Click here to join Tech Insider Network on the Seeking Alpha Marketplace. |

Be the first to comment