Wachiwit

These are indeed interesting times for streaming giant Netflix (NASDAQ:NFLX). After a couple of difficult quarters, where subscriber numbers actually fell, the company posted a rather impressive third quarter with significant subscriber gains. Digging deeper, the picture becomes even more bullish for investors, even though there are still some issues to be worried over. Despite the improvement, I do still think that the enterprise is overly pricey compared to what you can get from other streaming-oriented firms. And with there being additional uncertainty about its place in the market at a time when its own offerings are near the high end of the range from a consumer pricing perspective, I think that the best-case scenario here is that the company warrants a ‘hold’ rating.

Some solid developments in Netflix

Much of the 2022 fiscal year has been rather painful for Netflix and its investors. At a time when the S&P 500 is down by 21.6% compared to what it ended the 2021 calendar year at, shares of Netflix have plunged by roughly 60%. Increased competition from other companies entering into and growing into the streaming space, combined with broader economic concerns, have led to a lot of this pain. But not everything boils down to sentiment. There have been some actual fundamental issues regarding the company this year.

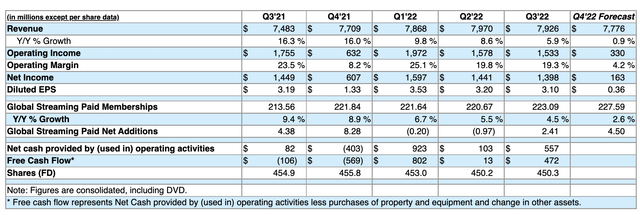

At top of mind, we have the number of global streaming paid memberships. In the first quarter of 2022, the company lost around 0.20 million subscribers, driven entirely by its decision to shut down operations in Russia. But then, in the second quarter of the year, the company ended up losing 0.97 million subscribers. While this was better than what the company previously anticipated, a number of two million or more, it still represented a significant amount of pain for investors. As I discussed in prior articles, such as this one here, the company’s offerings are priced near the high end of the range compared to similar firms and the company is dealing with a lower content budget than more diversified entertainment companies like The Walt Disney Company (DIS). Contending with a larger player that has more resources, a diversified income stream, with a more expensive product, and at times when consumers’ wallets are stretched, is not necessarily a recipe for success.

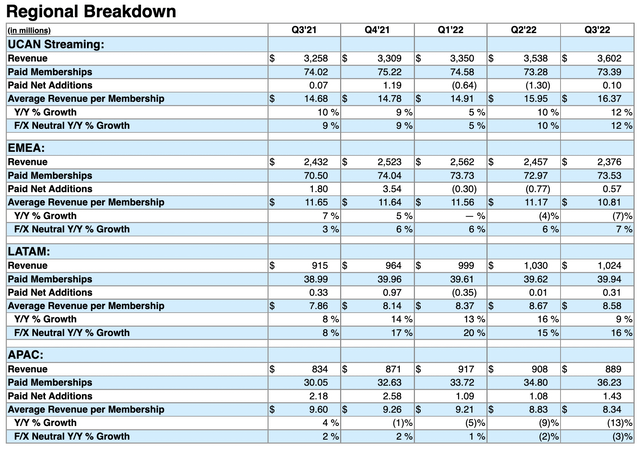

When it came to the third quarter, Netflix was forecasting that it would pick up around 1 million paid subscribers. You can imagine the market’s surprise when the company reported 2.41 million being added to its platform. But it’s more than just the number. What’s really interesting is that the company saw strength across all four major regions in which it reports data for. For instance, across the US and Canada, it reported an additional 0.10 million paid subscribers. And in the EMEA (Europe, Middle East, and Africa) regions, the increase amounted to 0.57 million. These are very important regions because they have higher price points than what the rest of the world does. For instance, in the US and Canada, the average revenue per membership totaled $16.37 during the third quarter. And in the EMEA regions, that came out to $10.81.

This is not to say that the other regions in which the company operates are not important. They certainly are. And growth continued in those areas as well. Throughout Latin America, for instance, the company added 0.31 million subscribers, generating average revenue of $8.38 per month. And in the Asia Pacific region, the addition was an impressive 1.43 million, with average monthly revenue of $8.34. Worth noting that while the company is seeing improvements in subscriber numbers, pricing is an issue in some of these areas. Yes, the US and Canada saw a year-over-year pricing increase of 11.5%. And in Latin America, the increase was 9.2%. But the company saw weakness in the EMEA regions, with pricing dropping by 7.2%, and in the Asia Pacific region with pricing down by 13.1%.

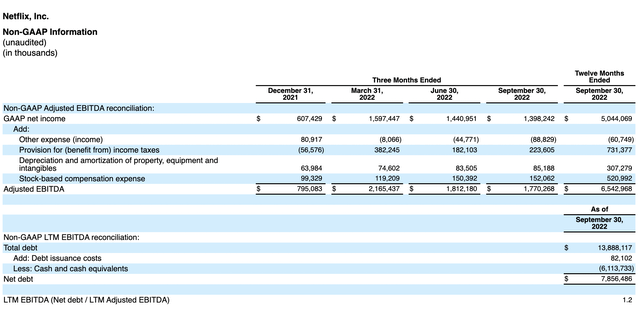

Outside of subscriber numbers, management also reported some other interesting figures. Revenue, for instance, came in at $7.93 billion. In addition to representing a year-over-year increase of 5.9% compared to the $7.48 billion generated the same time last year, the company also beat the $7.84 billion in revenue that analysts were anticipating. Other profitability metrics also came in stronger compared to expectations. Although earnings per share dropped from $3.19 in the third quarter of last year to $3.10 the same time this year, that number was still higher than the $2.13 that analysts thought the company would generate. We did see some weakness in EBITDA, with the metric falling from $1.92 billion to $1.77 billion. But at the same time, operating cash flow soared from $82 million to $557 million.

When it comes to what the future holds, management has provided some guidance. For instance, in the fourth quarter of this year, the company anticipates revenue of $7.78 billion. That would compare to the $7.71 billion generated one year earlier. Earnings per share, meanwhile, should be fairly low at $0.36. That would be down from the $1.33 reported in the final quarter of its 2021 fiscal year. Truth be told, none of this is really impressive. But what is impressive is that management anticipates adding 4.50 million paid subscribers in the final quarter of this year. This would still be lower than the 8.28 million reported in the final quarter of 2021. But other than that quarter, it would be higher than any other quarter the company has reported over the past six quarters.

Outside of the fundamentals, management also has some other interesting developments. Previously, the company announced that in November of this year, it would be launching its lower-priced ad-supported plan across 12 different countries. The initial cost here will be $6.99 per month. Plus there is the potential revenue the company can generate from the ads it actually exposes users to. Personally, I view this as a rather risky move on its own because of the possibility of cannibalization. However, the company is also launching, in early 2023, a monetized version of account sharing at what seems to be an undisclosed price at this time. As part of its content creation strategy, the company is coming out with other shows for users to enjoy. At the start of the third quarter, for instance, the company started airing season four of Stranger Things. In August, the company also aired The Sandman, attracting 351 million hours of viewing time on its own. Other major hits included season five of Cobra Kai and Monster: The Jeffrey Dahmer Story. The company’s original film initiative, The Gray Man, attracted 254 million viewership hours. The list goes on.

| Company | EV / EBITDA |

| Netflix | 19.1 |

| Warner Bros. Discovery | 8.1 |

| Paramount Global | 4.6 |

| The Walt Disney Company | 19.5 |

Although the picture for Netflix was rather robust for the quarter, I do believe that investors should still be cautious. The company does not have the same degree of diversification that a rival like The Walt Disney Company has. But yet, using trailing 12-month data, it’s priced at a similar rate to the behemoth. By comparison, when you look at other competitors like Warner Bros. Discovery (WBD) and Paramount Global (PARA), shares are rather pricey. Admittedly, Netflix does seem to have a competitive advantage over those firms, relegating them to third-tier status while it belongs second only to The Walt Disney Company.

Takeaway

Personally, I am a huge fan of the streaming business model. I believe that the industry has significant long-term potential. Having said that, I do not think that Netflix is the best way to play this. Admittedly, management did report some rather impressive results for the latest quarter. And it looks like the fourth quarter of the year will be even better from a user adoption perspective. This does show that the space has additional appetite even during uncertain economic conditions. More importantly, I see how this might apply to a more robust prospect like The Walt Disney Company, which is an all-around better entertainment play that is trading at a similar price to what Netflix is trading for. Given these factors, I do still feel comfortable rating Netflix a ‘hold’ at this time.

Be the first to comment