Sundry Photography

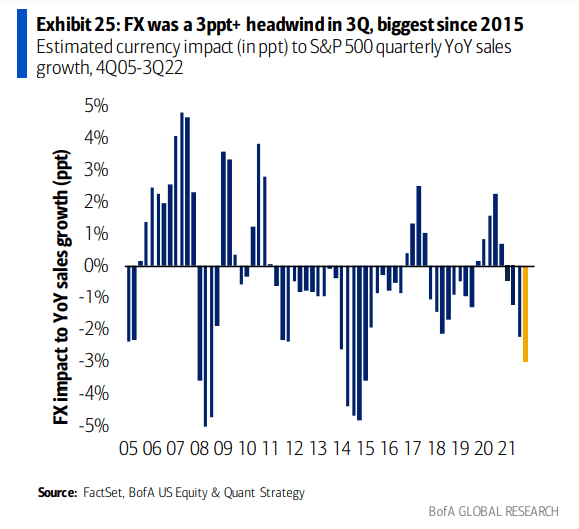

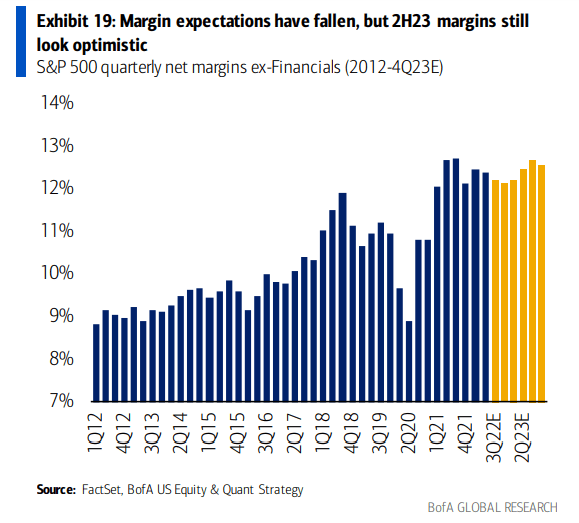

The third-quarter earnings season will be all about guidance. But also important are how margins verify and just how much a surging U.S. dollar will negatively impact revenue figures for large multinational corporations.

One tech-sector stock reports late this season, but expect share price volatility now through the next month as many macro and company-level events within its sector draw headlines.

Soaring Dollar, Souring Profits?

BofA Global Research

Can Margins Hold Up?

BofA Global Research

According to Bank of America Global Research and Fidelity, NetApp (NASDAQ:NTAP) is a leading provider of storage systems, software, and services that simplify the complexity of managing corporate data. It operates in two segments, Hybrid Cloud and Public Could. The company offers intelligent data management software, such as NetApp ONTAP and NetApp Snapshot.

The California-based $14.4 billion market cap Technology Hardware, Storage & Peripherals industry company within the Information Technology sector trades at a near-market multiple of 15.9 using trailing 12-month GAAP earnings and pays a high 3.0% dividend yield, according to The Wall Street Journal.

The firm has upside potential through its established public cloud recurring revenue streams, but rising operational expenses is likely, which could impede growth. At a macro level, more M&A could warrant high valuations in the space as market share gains against its competitors. Downside risks are highlighted by ongoing shortages in the components NTAP uses and a general economic slowdown or recession.

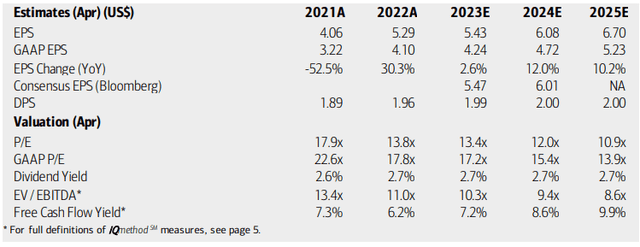

On valuation, BofA analysts see NetApp’s earnings growing by just 2.6% in its fiscal year 2023, which is already well underway. Per-share profits are seen as growing at a better clip come 2024 and 2025, though. Meanwhile, investors earn a strong yield compared to NetApp’s sector peers, and the payout amount should grow through next year.

NTAP’s operating P/E looks quite reasonable given decent expected earnings growth, while its EV/EBITDA, too, is not particularly expensive. Finally, the firm generates solid free cash flow, which should bolster shareholder accretive activities. Overall, this is an excellent value stock – rare in the I.T. sector.

NTAP: Earnings, Valuation, Dividend Forecasts

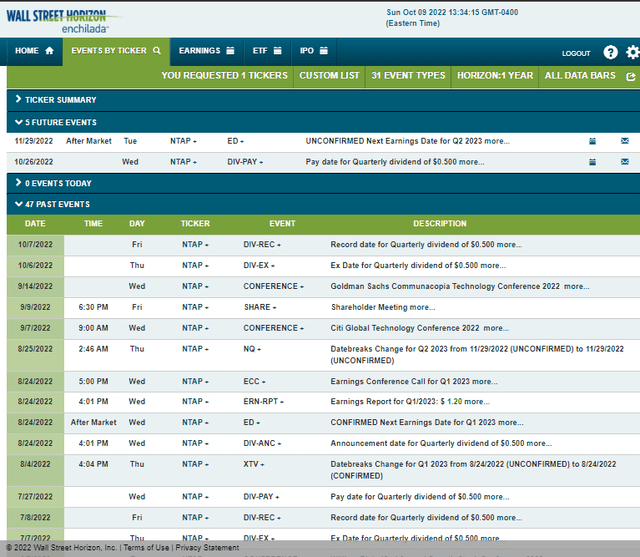

Looking ahead, corporate event data provider Wall Street Horizon shows an unconfirmed Q2 2023 earnings date of Tuesday, Nov. 29 AMC with a dividend payment date before that on Oct. 26.

Corporate Event Calendar

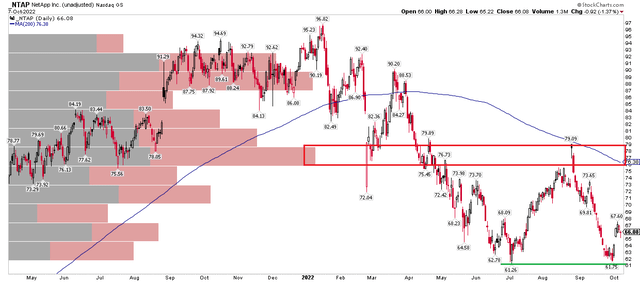

The Technical Take

NTAP declined by more than a third off its early 2022 peak, just shy of $100. Shares cratered during the first half, but the stock finally found its footing in early July – when so many software stocks also notched a low. What’s different and bullish about NetApp, though, is that it successfully held its early Q3 low at the end of last quarter. The stock looks like a good technical buy here, with a stop under $60.

Also notice where resistance is found – in the mid- to upper-$70s. Shares met sellers at the falling 200-day moving average in late August, and there’s a high volume of stock traded in that same range over the last 18 months. That is a natural area to take profits should NTAP continue to rebound toward year-end.

NTAP: Bullish Double Bottom, Resistance In The $70s

The Bottom Line

NTAP stock is a solid value here. I also like how the stock held its 2022 low on a recent retest. Short-term traders can use the $61 level as a bogey to be long above, while long-term investors can own this one for its low valuation and dividend.

Be the first to comment