PM Images/DigitalVision via Getty Images

Elevator Pitch

I assign a Hold investment rating to NCR Corporation’s (NYSE:NCR) stock. NCR refers to itself as “a software- and services-led enterprise technology provider that runs stores, restaurants and self-directed banking” for its clients in the company’s fiscal 2021 10-K filing.

The focus of the current article is NCR Corporation is the company’s recent announcement to split itself into two separate companies, and the market’s negative reaction to NCR’s decision.

It is disappointing that NCR Corporation didn’t manage to sell itself or divest its business units as part of the strategic review. I remain unconvinced that the plan to separate NCR into two independent entities will be able to drive a re-rating of the stock’s valuations. The market agrees with my views, as seen with NCR’s poor post-announcement stock price performance. But NCR is a Hold rather than a Sell, as its share price correction on September 16, 2022 and its current valuations suggest that the negatives are already priced in.

Separation Announcement Drove A Substantial Drop In NCR’s Shares

NCR Corporation announced on September 15, 2022 after trading hours that “its Board of Directors has unanimously approved a plan to separate NCR into two independent, publicly traded companies.” The company aims to complete the split by the end of the next year.

An Overview Of The Two Separate Companies Following Proposed NCR Split

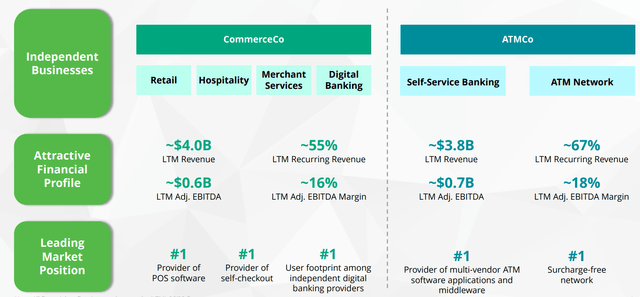

NCR’s September 15, 2022 Investor Presentation

On the day following the announcement, September 16, 2022, NCR Corporation’s stock price fell by -20.3% to close at $23.20 at the end of the trading day. The significant decrease in NCR’s share price after the separation announcement sends a very clear signal that investors weren’t impressed with the company’s decision to split itself up.

In the subsequent section, I touch on what investors had previously hoped for NCR Corporation to achieve with its strategic review.

High Expectations For NCR’s Strategic Review Weren’t Realized

On February 8, 2022, NCR revealed that the company will start a strategic review to “evaluate a full range of strategic alternatives” to “enhance value for all shareholders.” The market was excited by the prospects of value-unlocking actions for NCR Corporation, and NCR’s stock price jumped by +14.3% from $38.30 as of February 8, 2022 to $43.78 as of February 9, 2022, the next day following the disclosure.

News flow with regards to NCR Corporation’s strategic review was extremely positive leading up to the recent split announcement.

At the end of April, it was reported that there were a number of potential buyers who were keen to acquire the company in full. Prior to that, NCR Corporation emphasized at its Q1 2022 earnings call on April 26, 2022 that it has “made good progress to date” with respect to the strategic review.

By late-June, private equity firm Veritas Capital emerged as the frontrunner to buy over NCR Corporation. A July 19, 2022 Seeking Alpha News article cited a Wall Street Journal report highlighting that “Veritas is in exclusive talks to purchase the company (NCR Corporation).” Towards the end of the prior month, there was speculation that Veritas had already obtained the capital commitments needed to go ahead with the acquisition of NCR, according to an August 25, 2022 Seeking Alpha News report.

An earlier August 5, 2022 research report (not publicly available) titled “Recent Headlines Suggest Financing Being Pursued for Potential NCR Buyout” published by Morgan Stanley (MS) highlighted that “reported moves by Veritas to secure financing gives us a confidence a deal to acquire some or all of NCR is more plausible than not.” The analysts from MS also added in the report that “a full sale to a sponsor could be the cleanest ,and most sought after, solution for NCR.” As such, it is reasonable to assume that both sell-side analysts and buy-side investors had high expectations that a takeover of NCR Corporation was more of a “when” rather than an “if.”

In summary, the market was initially anticipating a buyout offer for NCR to be materialized soon. Instead, investors got hit with the news that the rumored acquisition of NCR Corporation was off the table, and it isn’t a surprise that NCR’s shares reacted negatively to the separation announcement.

Also, the plan to split NCR into two companies isn’t necessarily a good decision, as discussed in greater detail in the next section.

A Split Isn’t The Best Outcome Of The Strategic Review

It is important to appreciate that the recently announced separation plan was probably not the best outcome for the strategic review. Furthermore, I think that the proposed split might not create as much shareholder value as expected.

In its September 15, 2022 press release disclosing the split, NCR Corporation stressed that it “cannot deliver a whole company transaction that reflects an appropriate and acceptable value for NCR to our shareholders”, considering “the state of current financing markets.” NCR also mentioned at its September 16, 2022 investor call that “everybody can speculate what might have happened to could have otherwise happened in a different financial climate.”

In other words, assuming that the market environment was more forgiving and accommodating, it is reasonable to conclude that both investors and the company would have preferred that NCR Corporation be bought out by Veritas Capital to realize the full value of NCR.

Moving beyond the strategic alternative of a full acquisition by a third party, it is critical to evaluate the separation plan on its own merits.

NCR Corporation noted at its investor briefing on September 16, 2022 that “the ability to articulate and tell a strategy and the story around NCR got hard under the NCR umbrella” and highlighted that it was necessary to take actions “simplifying that message” for investors. This indicates to me that NCR Corporation believes that there is a sum-of-the-parts valuation discount assigned to the company’s shares as a result of the complexity of NCR which can be narrowed with a split. Notably, NCR Corporation had as many as four business segments, Banking, Retail, Hospitality, and Telecommunications & Technology (T&T), as per its FY 2021 10-K filing.

Nevertheless, I am of the view that the separation of NCR into two entities is the best decision from a shareholder value creation perspective.

Firstly, there is significant customer base overlap between the CommerceCo and ATMCo, so it might not be effective and efficient to have two separate companies.

According to the company’s September 15, 2022 investor presentation, the clients that both CommerceCo and ATMCo serve financial institutions. Separately, one of the attendees at NCR Corporation’s September 16, 2022 investor briefing called out the fact NCR Corporation had previously highlighted that there are “synergies involved with having similar customers as ATM customers (business to be a part of the new ATMCo) and digital banking (business to be held under the new CommerceCo) customers.”

Following the split, CommerceCo and ATMCo on a stand-alone basis could possibly be less competitive in retaining existing clients and winning new customers, and it is uncertain if additional costs will be incurred to have a separate sales team to service the same group of clients.

Secondly, NCR Corporation’s businesses won’t be able to enjoy the economies of scale associated with shared corporate overhead costs, and there will be additional expenses associated with having two separate listed entities.

NCR acknowledged at its investor briefing on September 16, 2022 that there will be some “dissynergies” relating to “corporate functions”, but the company thinks that these can be offset by synergies and cost savings in other areas related to the split.

NCR Corporation also noted in its September 15, 2022 media release that both ATMCo and CommerceCo will remain “publicly traded” following the split. This will inevitably translate into increased costs (e.g. auditing fees, listing expenses etc.) relating to compliance for both CommerceCo and ATMCo.

Thirdly, it is usual to expect that any corporate actions or corporate restructuring moves are accompanied by positive changes in the area of shareholder capital return policies.

If the Veritas deal had worked out, NCR’s shareholders might have either received special dividends for the sale of a specific business unit or an offer for their shares as part of a buyout.

In contrast, it is disappointing that NCR Corporation replied that the planned split “doesn’t change any”, when asked about the company’s “thoughts on kind of capital return in the near term.” As it stands now, NCR doesn’t pay out any form of dividends.

Closing Thoughts

I rate NCR Corporation’s shares as a Hold. The risk-reward for NCR is fair now, which supports my Neutral view for the stock. The negatives relating to the speculated takeover offer failing to materialize, and the unexciting separation plan have been factored into its stock price to a considerable extent. NCR Corporation currently trades at a consensus forward next twelve months’ normalized P/E multiple of 7.2 times, which represents a hefty -36% discount to its five-year mean forward P/E of 11.2 times, as per S&P Capital IQ.

Be the first to comment