The race for market share – with many laps still to go. peepo/E+ via Getty Images

Investment Thesis

The GaN market will grow significantly faster than the overall power electronics market. The acquisition of GeneSiC opens additional SiC lanes for growth. There will be room for multiple successful companies.

Navitas Semiconductor (NASDAQ:NVTS) is in the right place, at the right time, with the right technology to capitalize on the generational shift from silicon to GaN and SiC in power electronics and earn well above market returns.

Introduction

I recently wrote an overview article on Navitas Semiconductor, and another on Transphorm, Inc. (TGAN), both fairly similar small cap semiconductor companies.

In a December 2021 interview, Gene Sheridan, CEO of NVTS, said:

In total, there are probably a dozen companies with GaN programs right now… This is the Wild West and it’s kind of a land grab for market share right now – we estimate the GaN market could be worth more than $2 billion by 2026, so there’s a lot of room for a multiple companies to be profitable.

In this article, I want to take a deeper dive into the competitors in this race for market share.

To recap, the market we are talking about is for power electronics, and GaN and SiC power electronics in particular. Power electronics are the devices that control, convert, or manage electrical power.

The GaN power electronics market is today a very small subset of the total power electronics market. Essentially, every GaN device sold is displacing a Silicon “Si” or Silicon Carbide “SiC” device in a product, where there are established competitors already selling those devices. Winning those “design-ins” is largely dependent on the advantages GaN provides.

This article from EDN Asia, written by GaN Systems, nicely summarizes the advantages of GaN:

The value of GaN from a system perspective comes from size, weight, and cost reductions, the latter including BOM cost (the cost of other system components such as capacitors, heat sinks, and inductors), usage cost, and cooling cost. For example, changing from Si to GaN in a power supply can slash the size of magnetic components such as transformers. All of this can be accomplished while achieving better efficiency, or better power density, and possibly both.

The information here comes from Seeking Alpha, company websites, quarterly earnings reports and calls, and industry news reports.

Q2 Results

NVTS announced Q2 results on 15 August 2022. The big news was the acquisition of GeneSiC (discussed in the next section). Overall, very good progress.

Q2 revenues increase 58% year on year, and 28% from the last quarter. Success in the mobile fast charger market continued, with a 200 watt charger and with design-ins with all 10 of the top 10 mobile OEMs for next generation chargers.

NVTS also has multiple design-ins for data center and residential solar, and in the appliance motor drive market in Europe. In on-board charging for EVs, five major customer programs are now in process, and expected generate 2025 revenue.

Secular weakness was evident in the Chinese smartphone market, and is expected to continue for at least one, and possible several, quarters.

Non-GAAP net loss from operations was $8.9 million compared to a net loss of $5.8 million in Q2 2021. Cash was $240 million prior to the acquisition.

The GeneSiC Acquisition

The GeneSiC acquisition, effective 15 August, expands the scope for NVTS from GaN only to GaN and SiC.

Founded in 2004, with their first commercial product in 2011, GeneSiC brings 19 employees and a broad range of 50+ high power SiC MOSFETs, with proven performance, robustness, and reliability, and 500+ existing customers.

Navitas expects “the GeneSiC acquisition will accelerate its expansion into higher-power markets by two to three years, with immediate Q3 revenue in synergistic solar, energy storage and EV markets, among other industrial markets”.

Financially, GeneSiC is profitable, with current year revenues of ~ $25 million. NVTS paid a significant amount for GeneSiC; ~ $100 million in cash, $25 million in shares of NVTS stock plus a potential $25 million earn out. [Note: The press release says 25 million shares, the earnings call transcript says $25 million in shares.]

Market Size

There are multiple estimates of the market for power electronics in total and GaN and SiC in particular. In round numbers, the power electronics market is about $20-25 billion, with an estimated 5-7% CAGR for the next 5-10 years (see for example here, here, and here).

SiC will capture a significant share of the power market. See this MicroNews report for a summary of the state of play in SiC, which notes that “the SiC device market will reach US$6.3 billion in 2027”, with major players adopting a vertically integrated (i.e. own their own fabs) model.

In a December 2021 interview, Gene Sheridan, CEO of NVTS, said regarding the competition between SiC vs. GaN:

SiC is great for extreme high-power, high-voltage applications and is 10 to 15 years more mature than GaN, and therefore more accepted.

So the real battleground for GaN and SiC is going to be with traction inverters and motor drives.

The estimates for the GaN market have much greater variance, reflecting in part that some estimates aggregate power electronics and other GaN markets (e.g. RF). The general market research estimates suggest 22-25% GAGR for GaN power electronics (see for example here, here, here, and here), i.e. at 3-4 times the rate of the overall power electronics market.

Semiconductor Today reported in October 2021 that the GaN power device market was estimated to reach $83 million in 2021 (e.g. ~1% of the power electronics market.)

The estimates from the actual GaN focused market participants suggest higher growth.

Infineon estimates “the GaN market is also predicted to undergo massive growth – from $47 million in 2020 to $801 million in 2025 (CAGR: 76%)”.

We notes above the NVTS estimate that “the GaN market could be worth more than $2 billion by 2026”.

Looking out 10 years, the overall power electronics market might be ~ $40 billion, and the GaN market ~ $6 billion, and the SiC market ~ $10 billion. Ten years is a long time, but it’s probably safe to say the market is going to be a lot bigger than it is today.

The Competitors

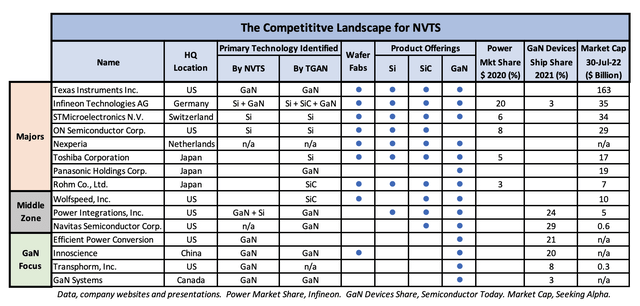

I put together a list of competitors by combining the 10 identified by NVTS, and the 11 identified by TGAN, and added one more, Nexperia. Both NVTS and TGAN also noted the technologies (Si, SiC, GaN) for each competitor.

The result was a list of 15 companies. By comparison, Seeking Alpha lists 66 stocks in the Semiconductor industry.

The information is summarized in the table immediately below. I’ve sorted he companies into the large “majors”, the smaller “GaN focused”, leaving three companies falling by size and focus into a third Middle Zone (I promoted NVTS into that zone today). See also the short summary of each company in the next “Elevator Pitch” section.

Chart by author. Data company website and presentations, news reports, Seeking Alpha.

The Elevator Pitch Summary

Texas Instruments, Inc. (NASDAQ:TXN)

Founded in 1930, a global semiconductor company that designs, manufactures, tests and sells analog (76% revenue) and embedded processing (17%) chips for markets with focus on industrial and automotive (62% of revenue); ~ 31,000 employees, ~ 80,000 products. Multiple fabs. Explicitly increasing vertical integration. Primary goals to “maximize long-term growth of free cash flow per share”. Appear to have a relatively small numbers of GaN products. TI notes their “decade-long investment in GaN technology” and “investments in internal manufacturing will allow new technologies like GaN to scale quickly”. See their GaN products here.

Infineon Technologies AG (OTCQX:IFNNY)

Founded in 1999 as a spin-off from Siemens AG, a global semiconductor company, and market leader in automotive and power semiconductors. History of significant acquisitions (International Rectifier in 2015, attempted to buy Wolfspeed in 2016, and Cypress Semiconductor 2020). The International Rectifier acquisition included GaN technology.

Major segments include automotive (44% of revenue), power and sensors systems (29%), and industrial power control (14%); ~ 50,000 employees.

Multiple fabs, including new 300 mm fabs for GaN (here, and here). Vertically integrated. Products include Si and SiC MOSFETs (3000+ SiC customers), and GaN CoolGaN™ HEMT transistors, and the “next step” integrated power stage CoolGaN™ IPS, which includes the EiceDRIVER™ gate driver. Target applications include chargers, consumer electronics, data center power supply, and telecom. Their website lists HEMT and IPS products. See their GaN products here.

STMicroelectorincs N.V. (NYSE:STM)

Public since 1994, a Franco-Italian global semiconductor company, ~ 48,000 employees. Vertically integrated, “the leading SiC company”, Markets automotive, industrial, consumer electronics, computer related. Discrete and power transistors; IGBT, Si and SiC MOSFETs, GaN power transistors. Tesla is a top 10 client; STM modules have been used in the Tesla Model 3 for some years. See Si and SiC Power Models here, and Power Transistors here.

ON Semiconductor Corp. (NASDAQ:ON)

Founded 1999, ~ 33,000 employees. “Leader in silicon, investing in SiC”. Stress synergy between power and sensing. Estimate $750 of onsemi addressable power content per EV. Shifting to fab-liter model, targeting 45% external foundry, internal fabs to 300 mm. No mention of GaN in last Investor Day. See SiC Power Modules here.

Nexperia

Founded in 2017, spinoff from NXP, ~ 14,000 employees. Owned by Wingtech Technology Co.Ltd., ~ 30% controlled by the Chinese government (see this CNBC report). Significant focus on auto market. Purchase Newport Wafer Fab in Wales U.K. in 2021. Entered SiC market in 2021. See Si products here, GaN products here.

Toshiba Corporation (OTCPK:TOSYY)

Large conglomerate, currently undergoing strategic review, with multiple bids to go private. This recent Seeking Alpha article offers a very good summary. The Semiconductors group accounts for ~ 12% of revenue. See Si power products here, SiC here, and GaN here. GaN applications include RF. Announced plans in February 2022 to build 300 mm fab to expand power semiconductor capacity by 2.5x.

Panasonic Holdings Corp. (OTCPK:PCRFY)

Founded in 1981, very diversified global consumer electronics, ~ 240,000 employees. Business in components, and circuit boards, packaging, and assembly materials. Collaborating with Infineon on second generation GaN HEMT, with 2023 availability. It appears that Panasonic has been out of the fab business for several years.

ROHM Co., Ltd. (OTCPK:ROHCY)

Founded 1958. Emphasis in power electronics seems to be on SiC; acquired Si Crystal, which supplies SiC wafers to STM. Fabs.

Products include SiC MOSFETS and Power Modules. Appear to have small number of GaN HEMT products. Collaborative agreement with GaN Systems in 2018. Website here.

Wolfspeed, Inc. (NYSE:WOLF)

Founded 1987 (formerly was Cree, new name October 2021), ~ 3500 employees. Very strong focus on SiC. Three segments, Power (SiC MOSFETs), and RF (GaN HEMT on SiC substrate), Materials (SiC wafers). Target power markets are auto (70%) and other high power applications. Long experience in RF. Offer die (for customer packaging), discrete components, modules. New 200 mm SiC fab in New York, materials expansion in North Carolina, estimate 60% SiC wafer market share. Not yet profitable, cash flow positive 2024. Se SiC products here. See GaN on SiC RF products here.

Power Integrations, Inc. (NASDAQ:POWI)

Founded in 1988, public since 1997, “a leading innovator in semiconductor technologies for high-voltage power conversion”, ~ 800 employees. Fabless. Si, SiC, and GaN. Four segments, industrial/auto, consumer, computing, and communications. Introduced GaN products in 2019, expanding GaN use, “GaN is better than Si”. More integration is better; notes value of reducing component count. Shipped one millionth GaN transistor in September 2019. See their PowiGaN products here.

Innoscience (private)

Founded in 2015, main investors CMBI, ARM, SK Group and CATL; 1400 employees. Design, develop, and manufacture GaN on Si products. Strategy is to address price, volume, and security of supply to accelerate transition to GaN. With two 8-inch fabs, in Zhuhai (2017) and Suzhou (2020), they believe they are “the largest 8-inch Integrated Device Manufacture (IDM) fully focused on GaN technology in the world”, 10,000 wafers per month, targeting 70,000 in 2025. Products include InnoGaNTM GaN HEMT, see here.

Navitas

See full writeup here.

Transphorm

See full writeup here.

GaN Systems (private)

Founded 2008, claim to be “the global leader in GaN power semiconductors”. Fabless, use TSMC foundry. Shipped 20 millionth transistor in February 2021, subsequently implemented 40X capacity expansion. Target markets include chargers, wireless chargers, audio, data center, auto, and industrial; e.g. see this teardown showing 2 GaN Systems products in Apple’s 140 watt charger last year. See examples here. Research and design center in Taiwan with 100+ people. $150 million funding round November 2021. See products here.

Efficient Power Conversion (private)

Found in 2007. Entirely GaN focused. Fabless. Goal is single chip power conversion. Offer 100+ products, enhancement-mode GaN (eGaN®) FETs and ICs with integrated driver; also unpackaged devices by the wafer. Markets include data center, autonomous vehicle LIDAR, DC motor drives, and space. Offer specialty radiation hardened products. Believe GaN now cost competitive with Si. Website shows products and prices, here.

Longer Term

Longer term, China looms. China’s 14th Five Year Plan (2021-2025) specifically targets semiconductors, including “wide-gap semiconductors (e.g., silicon carbide, gallium nitride”. ESN Asia notes that:

A Bloomberg report shows that 19 of the world’s 20 fastest-growing semiconductor firms are in China, which amounted to 8 just a year ago. Moreover, according to the China Semiconductor Industry Association, total sales of chip firms in China rose 18% to more than $150 billion in 2021.

New fabs are being built for power semiconductors, among them a CR Micro fab in Chongqing, China for power semiconductors, and the other fab in Xiamen, China, owned by Silan Microelectronics, to produce power discretes and sensors.

It seems likely that at least one major state owned/controlled firm will emerge.

Analysis

After looking at these competitors in power electronics space, I will offer some speculation.

One might draw a parallel here with the oil industry, with major oil companies and smaller independents. The majors are big, with deep pockets, broad scope, and long term strategic plans. The independents are small, with limited financial resources, more focus, and dynamic and opportunistic plans.

In our case, the competitors similarly group into the established majors and the GaN focused independents, with a three (including NVTS after the GeneSiC acquisition) falling into a middle zone.

The power electronics space in 10 years will be ~ $40 billion, and will include Si, SiC, and GaN technology. There are big investments by sophisticated players now being made in both GaN and SiC.

It’s unclear how much of the market GaN will capture, but a $5-6 billion GaN market seems consistent with many projections. SiC will probably be larger. There will be multiple companies in the GaN and SiC power electronics spaces. I think not more than three will have more than 10% market share. Infineon and someone in China will likely be two of those.

The competitors are in land rush mode for the GaN share of that market; this is likely to last for several years. If you think of a quarter per lap; we probably have 20-30 laps before the winners will be evident.

The Current Lap

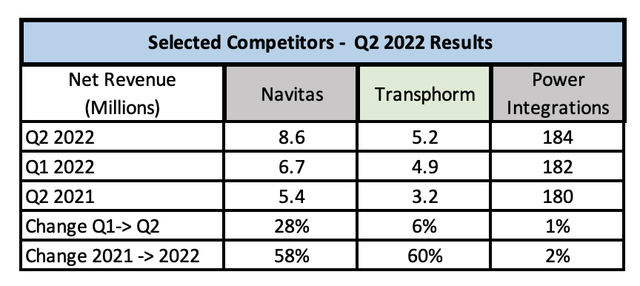

Measure by revenue, the table below suggest how the customers think the race is going for select competitors (the public GaN focused plus the two in the grey zone).

Table by author. Data from company websites.

Risks

Three risks to this competitive analysis stand out.

1. Strategic shift by a major player. Any of the majors could make a strategic decision at any time to get into GaN in a big way. Most of the smaller GaN focused companies are basically ~ a hundred key people – managers, engineers, marketing and sales – and a set of relationships with suppliers and clients. A major could match this relatively quickly if it became a priority, perhaps aided by one or more acquisitions, and significantly change the competitive landscape.

2. Geopolitical risk. Production and sales both cross geopolitical boundaries today. That could become very problematic at any time; some of the smaller players might not survive such a disruption.

3. There is very limited visibility into the non-public companies.

Investor Takeaway

The GaN market will grow faster, perhaps 3-4x or more faster, than the overall power electronics market. The SiC market will grow somewhat slower than GaN, but from a larger base. There will be room for multiple successful companies.

The acquisition of GeneSiC should accelerate NVTS growth and market share capture. TGAN may need to step up their game.

GaN Systems and Efficient Power Corporation will probably need to go public to raise the capital to effectively compete.

In a November 2021 interview CEO Jim Witham of GaN Systems said, speaking about their recent $150 million funding round with lead investor Fidelity, previous investor BMW iVentures, and new investor Vitesco, said:

I see a lot of benefits having a nice big private round, we can really concentrate on customers and growing the revenue line and really take advantage of this tipping point so it was a conscious decision for us to go to Fidelity.

What I am trying to is build a great company, taking advantage of this transition and… you have to do is you have to have the capital to get it done.

It’s difficult to predict at this stage who will take the Gold, Silver, and Bronze in this race. A wise investor might consider a portfolio approach.

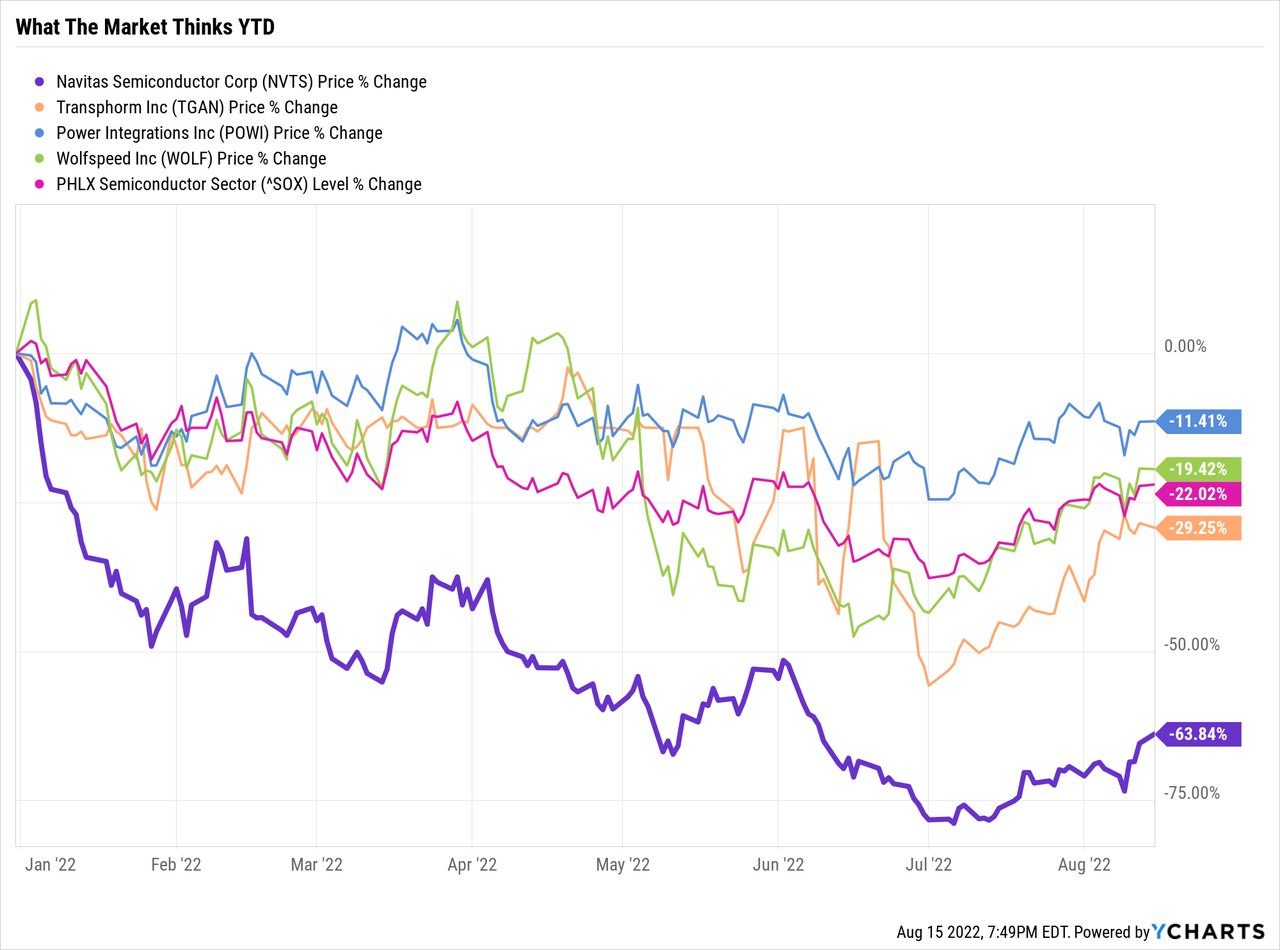

Here’s what the market thinks about the progress of the race year-to-date.

If NVTS and the independents can grow materially, they will become increasingly attractive acquisition targets of the majors. I believe they would be more attractive as a profitable business with a positive cash flow than as a technology hedge. I’d expect the winners to reach this point ~ 2025-2027.

Personally, I have small investments in NVTS and TGAN. Ideally, I’d like to split my chips among NVTS, TGAN, and GaN Systems. I think there is a fair chance of one or more of them taking home a Gold, Silver, or Bronze.

Be the first to comment