Kobus Louw

Nathan’s Famous, Inc. (NASDAQ:NATH) is growing at a strong pace. Recent progress has been made in EBITDA margin improvements, where growth is seen across all drivers of revenue. The share price is currently fair valued given that the company has significantly higher EBITDA margins compared to its peers, which allows it to trade at a slight premium.

Background

NATH is a branded player within the food industry that distributes products and services under the Nathan’s Famous trademarks. This includes both owned and franchised restaurant units, and their branded hot dogs that are sold under the foodservice channel as well as licensed and sold to retail for off-site consumption. The company has 234 franchised restaurants across the U.S. and internationally (up from 224 last year).

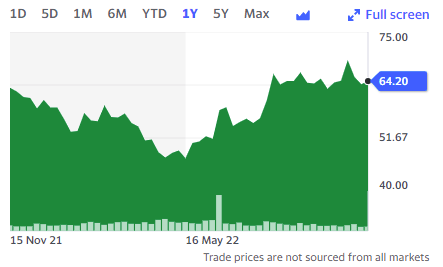

The share price has been trading up and down in the past 12 months, and is roughly flat on the year:

Yahoo Finance

Financial Analysis

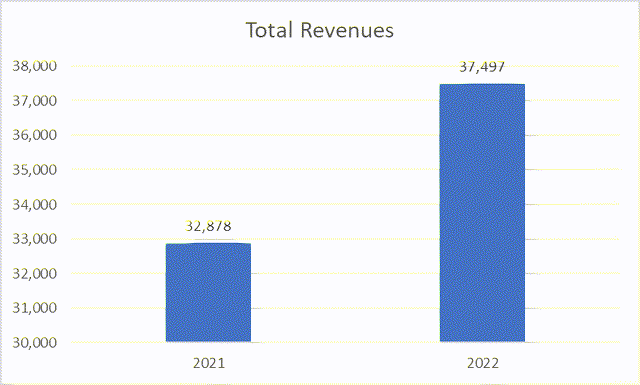

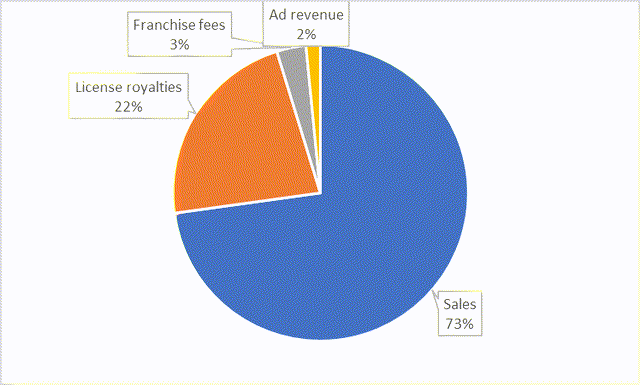

NATH has been growing in a troubled market with high inflation. Total revenues increased by 14% to $37.5m in the three months ended September 2022. The primary contributor to this sales growth was branded sales. This was successfully driven by both volume and price, where the company has managed to shake off inflationary pressures. The volume of hot dog sales grew by 9% and prices grew by 4%.

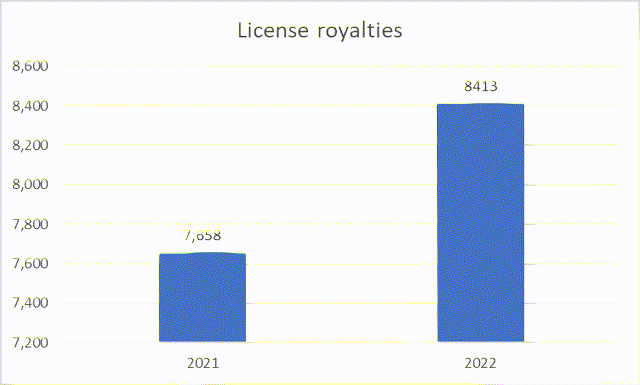

License royalty sales grew 10%. Franchise fees and ad funds revenue grew 3% and 6%, respectively, but only amount to a fraction of total sales.

The company’s royalty fees originate from the sale of hot dogs via their licensing agreement with John Morrel & Co. This is the case for both retail and food service channels – for example, sales to Walmart (WMT). Despite this revenue growth, NATH remains highly dependent on John Morrell & Co., with a very concentrated customer portfolio.

In other good news, despite the cost of sales increasing by 9%, top-line numbers outgrew costs, which led to an improvement in profit margins. Cost of sales grew to almost $22m for the period, led by a 9% increase in the branded cost of sales. The increase in cost is attributed to the higher cost of key inputs, such as raw materials, labour, packaging, and logistics (as expected from the current environment of inflation and supply chain disruption).

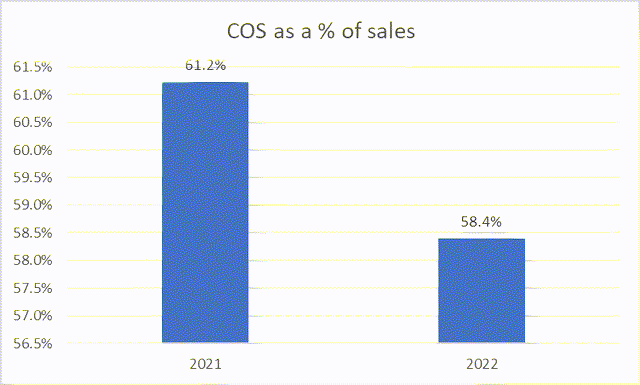

As sales growth outpaced growth in costs, the cost of sales as a percentage of sales decreased from 61% to around 58%. This is an exceptional performance given inflationary pressures are significantly higher now compared to the same period a year prior, especially key commodities (such as beef).

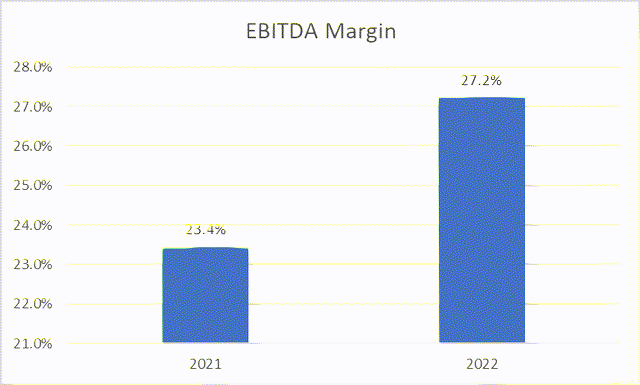

Overall, in the last three months compared to the same period a year prior, the company has successfully grown sales, outpaced costs, and increased its bottom line. EBITDA for the quarter grew more than 32%, resulting in an improvement in the EBTIDA margin from 23% in 2021 to 27% in 2022.

In terms of balance sheet health, while the company is sitting on a large amount of cash (around $50m as of September), it is fairly indebted with $110m in loans outstanding (due 2025 with an interest rate of 6.625%), giving an interest expense of around $2m per quarter. On the other hand, the coverage ratio is substantially high due to a strong EBITDA margin, so cash flow remains strong. Debt to EBITDA is also not substantially high, only just above 3x, with net debt to EBITDA at a significantly lower ratio.

Valuation

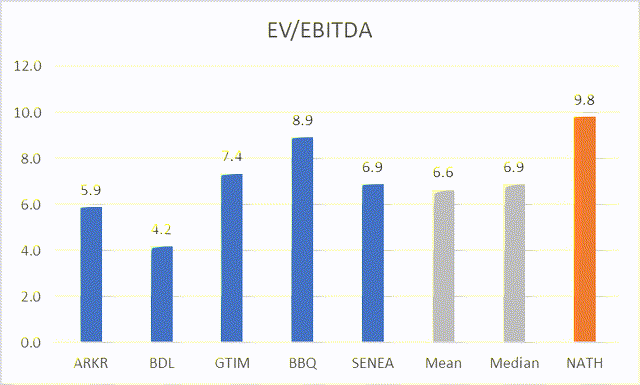

If we collate a list of comps to form a peer group and compare EV/EBITDA ratios, NATH looks to be slightly overvalued.

NATH is currently trading at just under 10x EBITDA, whereas its peers are closer to 6.5-7x. If we use this methodology alone, NATH’s share price might fall by around 30% to become more in line with its peers, as they are currently overvalued.

This might be explained by the profit margins. While the company’s peers are also growing at a strong pace in quarterly revenue growth, their EBITDA margins are substantially lower compared to NATH. As already stated, NATH’s EBITDA margin is nearing 30%, whereas its peers Ark Restaurants (ARKR), Flanigan’s Enterprises (BDL), and Good Times Restaurants (GTIM) have EBITDA margins of 3.3%, 6.3%, and 5.6%, respectively – far lower than NATH.

Due to this margin difference, one could argue that NATH is fairly valued, given that it deserves a slight premium due to stronger EBITDA margins.

Risks

One risk would be a major decline in EBITDA margins. As already discussed, NATH is currently trading at a premium compared to its peers due to its far larger EBITDA margin. However, if this margin were to be squeezed, then we could see the share price drop and fall more in line with its peers. Risks to profit margins are currently very high, as we’re seeing inflation across many different input costs, from the price of beef and other commodities that go into the cost of sales to increases in labor costs (due to labor shortages) and logistics costs (from higher energy prices), potentially leading to higher operating expenses. Even if revenue was to drop back slightly in growth, but cost growth remains, then we would see the profit margin being squeezed.

A second major risk is the current customer concentration. A large amount of profit is dependent on the company’s agreement with John Morrell & Co. If any issues with this contract were to arise, or even issues on John Morrell & Co.’s side of things, then we could see a hit to sales, which will trickle down into a hit to the bottom line.

Conclusion

Overall, NATH is growing both its top and bottom lines, with exceptional performance in the latest quarter despite inflation being seen across a number of different input costs. Sales grew 14% and the EBITDA margin hit 27%. Despite this strong performance, NATH is not undervalued. Its EBITDA margins are far above its peers, which has resulted in NATH trading at a slight premium compared to those peers, and is currently fairly valued. However, risks remain.

Be the first to comment