SDI Productions/E+ via Getty Images

Investment Thesis

Natera, Inc. (NASDAQ:NTRA) is doubling down on its growth initiatives as it looks to expand its product portfolio beyond non-invasive prenatal testing (“NIPT”). The company invests heavily in multiple projects in different areas of cancer diagnosis, from Minimal Residual Disease “MRD” solutions under the Signatera™ brand, cancer profiling tests under the Altera™ brand to organ transplant rejection solutions marketed as Prospera™.

In contrast to its competitors currently winding down capital expenditure in response to rising capital costs, NTRA is investing more in its pipeline in an effort to replicate its success in the NIPTs space, where it has enjoyed tremendous growth in recent years.

Since the previous article that downgraded NTRA to hold due to rising capital costs and increasing cash burn, the company’s ticker outperformed the market by more than 15%. I believe this is partly due to political dynamics, which saw the Democrats lose the majority in Congress, assuaging fears concerning potential regulatory oversight over Laboratory Developed Tests “LDT.” The industry narrowly escaped a regulatory crackdown last month when Congress temporarily halted the VALID Act vote that would have imposed stricter controls on the industry. This article discusses some of the key drivers of recent share price movements and reaffirms the previous hold rating, recognizing the discrepancy between NTRA and its peers, who have clearer paths to profitability.

Market Position

NTRA’s leading position in the NIPTs market exposes it to regulatory risks arising from questionable test accuracy. Mainstream media have been chewing on this issue for months now, with ProPublica being one of the latest media outlets covering the issue in an article last week. Beyond the regulatory sphere, we are starting to see some commercial impact. Pennsylvania-based healthcare insurer, Highmark sent a letter to NTRA in October asking for third-party inspections and quality controls to ensure testing accuracy.

The FDA issued a warning of the risks associated with prenatal tests in response to the barrage of negative publicity in mainstream media, including the WSJ, ProPublica, The Washington Post, and The New York Times. In previous articles, I cited Exact Sciences (EXAS) as an example of how disruptive the FDA can be to the molecular diagnostic testing market.

Beyond the letters of the law and sales figures, the ethical dimension of inaccurate tests creates reputational risk. A positive test result carries significant stress for pregnant women, who often face a complicated decision of whether to carry the baby to full term or terminate the pregnancy. Thus, a lab must be able to provide accurate test results with adequate counseling in order to avoid false positive results and further traumatizing already stressed patients.

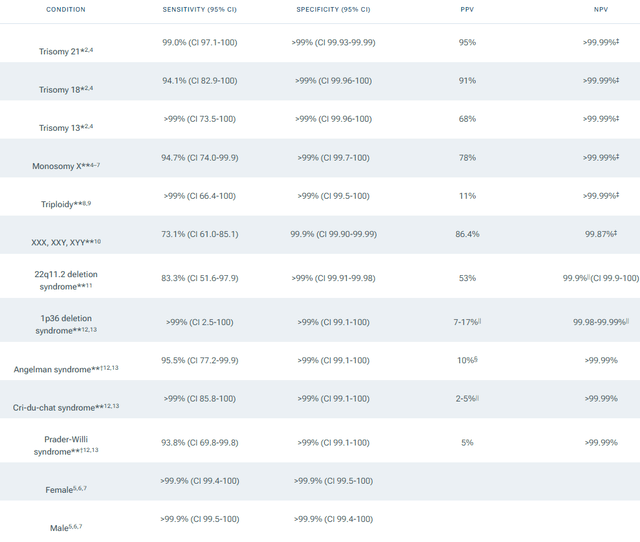

In the following paragraphs, we discuss what these dynamics mean for investors. First, Panorama, NTRA’s proprietary and market-leading non-invasive prenatal test, is designed to detect multiple indications, and each one has a different accuracy level, with Positive Predictive Values “PPV” rates ranging from 95% for Down Syndrome to 5% for Prader-Willi Syndrome, as shown in the table below. Any regulatory oversight will consider these discrepancies. From a commercial perspective, most of the company’s revenue stems from the three tests with the highest PPV; Down Syndrome (Trisomy 21), Edwards’ syndrome (Trisomy 18), and Patau’s syndrome (Trisomy 13).

Panorama Test Specifications (Natera)

Second, the main problem is not the clinical value of Panorama. The whole field of medicine rests on probability theory. Drugs are not 100% effective, whether it’s $3.75 panadol pack or a $3.5 million Hemgenix kit. Panorama, or any molecular test for that matter, is no different. The problem lies in the way it is presented by company officials, sales personnel, and genetic counselors, who ironically are the primary target of NTRA’s marketing efforts. NIPT is not a diagnostic test but rather a tool to screen those who would benefit from further diagnostic investigation.

The United Kingdom has recently implemented a national NIPTs program, and the way it is advertised to the public is completely different from the U.S. The National Health Service “NHS” websites include patient and physician brochures clearly explaining the test, followed by a clear and precise explanation of its benefits, limitations, and how to interpret the results. A clear and unbiased presentation of the tests is a requirement to attract patients and physicians alike.

This is not true for commercial US companies who often tout the accuracy of the tests. Thus, the response from the Media is warranted to balance the rhetoric, in my view.

Nonetheless, I believe the tests have clinical utility and usefulness to the public. NTRA is not Theranos. On the other hand, investors should be mindful of the political dynamics shaped by the nation’s public discussion over NTRA’s tests.

Political Dynamics

Earlier this year, Congress was about to pass a law that would extend the FDA’s oversight over LDTs. However, it succumbed to intensive lobbying pressure from the molecular diagnostic market, represented by numerous professional associations.

This is not the first time that the FDA’s attempted to extend its regulatory arm over the market. During the Obama administration, it issued draft guidance on the use of LDTs but soon after, the republicans won the lower House of Congress, implementing a business-friendly agenda, emphasizing deregulation of the economy as much as possible. In 2016, Trump won the presidency, further cementing a lax regulatory environment in the U.S., indefinitely shelving the FDA’s regulatory plans.

Last year, with a democratic majority in the lower House of Congress, and the White House under democratic control, the FDA pushed forward with new proposed regulations over the molecular diagnostics industry. The industry narrowly escaped regulation after the House decided not to pass the VALID act with a vote in October. The midterm election saw the Democrats winning the senate but losing the lower House. How these political dynamics will impact the LDT market is still to be seen.

There also comes the issue of abortion, which is already changing how providers and gene counselors discuss test results with patients. The question is, how would the new laws on abortion impact the usefulness of genetic screenings? Let us face it: whether it is right or wrong, providers discuss abortion for positive test results. If abortion is illegal, what is the point of the test? Texas has the strictest abortion limit in terms of time, making it illegal to abort after six weeks of pregnancy. Panorama is suitable for pregnancies in weeks 9-10. Oklahoma doesn’t allow abortions at any stage. Most red states allow up to 20-22 weeks before an abortion is illegal, leaving a mere ten weeks from the Panorama test result (5 – 7 days turnaround time) to confirmatory diagnostics (e.g., Chorionic villus sample obtained from the placenta through a surgical procedure) and abortion decision. We haven’t seen the full extent of the new abortion regulations. Policies have a long-term impact on consumer behavior, gradually shifting attitudes toward the policies in question.

Summary

NTRA is investing aggressively in multiple areas, including Hereditary cancer risk under the Empower Brand, Cancer recurrence risk under the Signatera brand, and Cancer profiling, under the Altera brand. Most of the revenue currently stems from its Women’s health segment, namely its Non-invasive prenatal screening, which accounts for approximately 90% of revenue. Despite the rising cost of capital, the company is investing aggressively in new growth initiatives, which underpinned our rating downgrade last month. The recent equity offering shows management’s disregard for share dilution.

Most of the growth is profitless, and NTRA and its peers have yet to generate a profit, accumulating losses through aggressive pricing strategies. The timeline of Invitae Corporation’s (NVTA) restructuring initiatives and profitability path is an example of how hard it is to pivot to profitability. R&D projects in the molecular diagnostic space carry long-term obligations to patients and healthcare providers. Given the robust and expanding growth initiatives of NTRA, it is in a worse condition compared to peers with clearer profitability paths.

Be the first to comment