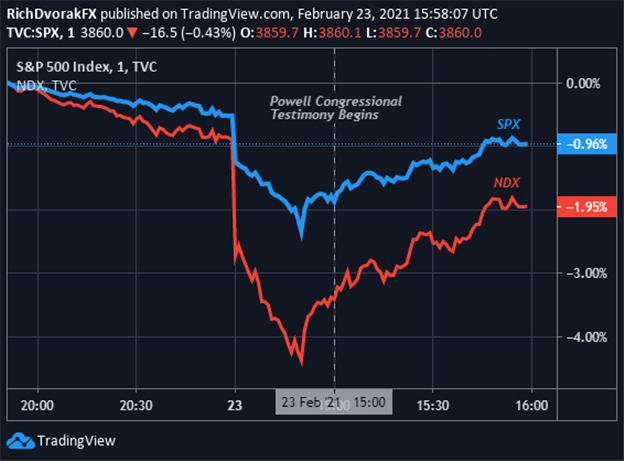

STOCK MARKET OUTLOOK: NASDAQ, S&P 500 CLAW BACK LOSSES AS FED CHAIR POWELL REITERATES ACCOMMODATIVE STANCE

- Nasdaq, S&P 500 attempting to erase intraday downside as investors race to buy the dip

- Federal Reserve Chair Powell helps calm market angst with his congressional testimony

- Powell echoes how the Fed remains committed to keeping conditions accommodative

Fed Chair Jerome Powell is in the spotlight right now with markets tuned into his semi-annual congressional testimony. Stocks faced heavy selling pressure at the New York opening bell on Tuesday, but it appears that risk appetite is recovering in the wake of Powell’s latest remarks. Fed Chair Powell pledged to the Senate banking committee how the FOMC remains committed to its dovish policy stance.

Recommended by Rich Dvorak

Traits of Successful Traders

Specifically, Powell stated how the Federal Reserve won’t remove monetary support until both of its objectives – maximum employment and inflation moderately above 2% for some time – are met. This means that the Fed intends to continue using its full range of tools including quantitative easing to the tune of at least $120-billion a month. In response, Treasury yields and the US Dollar dropped while the Nasdaq and S&P 500 rebounded off session lows.

NASDAQ, S&P 500 INDEX PRICE CHART: 1-MINUTE TIME FRAME (23 FEB 2021 INTRADAY)

Chart by @RichDvorakFX created using TradingView

Powell deferred to comment on the fiscal stimulus debate, but noted that the recent move higher in sovereign interest rates reflects better growth expectations and more confidence in the economy. The head central banker does not anticipate inflation to rise to troubling levels, adding that the risk of not providing enough support to the economy outweighs potential inflation risk.

| Change in | Longs | Shorts | OI |

| Daily | 2% | -12% | -6% |

| Weekly | 17% | -21% | -8% |

Fed Chair Powell also mentioned how the covid vaccination rollout stands out as the single best policy for the economy and returning to normal. That all said, and in light of the more than 60-million vaccine doses administered across the US, it seems most likely that the latest pullback in equities will chalk up to a mere consolidation rather than a reversal of the broader bullish trend.

Keep Reading – EUR/USD Outlook: US Dollar Eyes Fed Chair Powell, Stimulus

— Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

Be the first to comment