onurdongel

MYT Netherlands Parent B.V. (NYSE:MYTE) also known as “Mytheresa” is a global e-commerce platform focusing on luxury-goods, offering a curated assortment of high-fashion brands like “Gucci”, “Prada”, and “Saint Laurent” among others. Growth has been impressively fueled by strong momentum, particularly by customers in the United States, along with an expansion into new categories like luxury home goods and lifestyle products.

The company just reported its latest quarterly result, highlighted by climbing profitability and strong margins with positive guidance for the year ahead. On the other hand, shares in the stock have been volatile over the past year with concerns regarding the outlook for consumer spending amid broader macro headwinds. We like the stock with a sense that the platform is gaining market share with a compelling business model. Firming margins as the company scales along with plans to increase distribution capacity add to a positive long-term outlook.

Mytheresa Q4 Earnings Recap

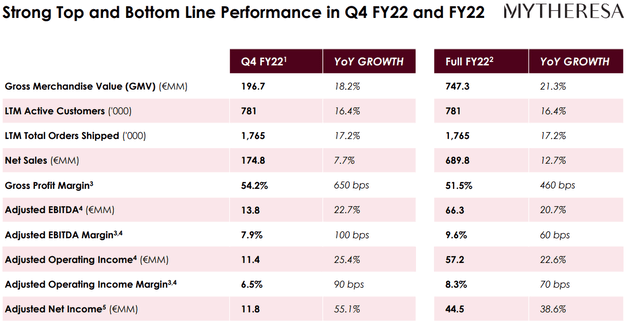

This was the company’s fiscal Q4 covering the period through the end of June. EPS of EUR 0.02 reversed a loss of EUR -0.09 in the period last year. The effort was achieved as net sales climbed by 7.7% year-over-year to EUR 175 million driven by an 18.2% increase in the gross merchandise value (GMV) across the platform to EUR 197 million.

Notably, this rate accelerated from 13.2% in Q3 which is also in the context of what was a strong 2021. Management explains that the spread between revenue and GMV growth is based on an ongoing transition of some brands to a different sales model where the platform fees are recognized as net sales.

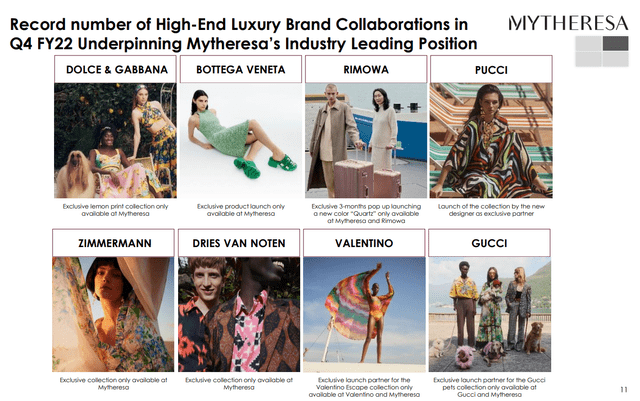

Favorably, the shift has been positive for margins as the gross margin climbed 650 basis points to 54.2%. Adjusted EBITDA increased by 22.7% y/y to EUR 13.8 million. Overall, the quarter capped off a strong year with global GMV increasing by 13% for fiscal 2022. Operational highlights include the launch of exclusive “capsule collections” with key partner brands. The number of active customers growth over the last twelve months at 781k is up 16% y/y including 120k first-time buyers in Q4.

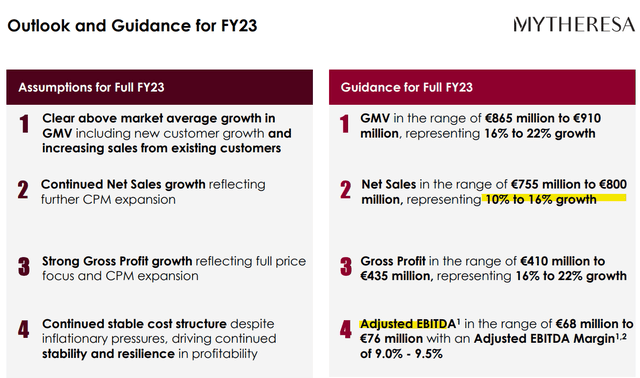

The company ended the quarter with EUR 77 million in cash on the balance sheet against zero long-term financial debt. In terms of guidance, the expectation is that the financial trends continue to improve. Management is targeting net sales growth between 10% and 16% for fiscal 2023. An adjusted EBITDA midpoint estimate of EUR 72 million, if confirmed, would represent an increase of 9% over 2022.

The core assumption is to capture higher margins alongside new customer growth and increasing sales from existing customers. We mentioned a new warehouse facility under construction that will expand distribution capacity. The project in Leipzig, Germany is expected to be completed in fiscal 2024 and is set to be 3x larger than the existing warehouse in the region, allowing for faster global delivery times.

Is MYTE A Good Long-Term Stock?

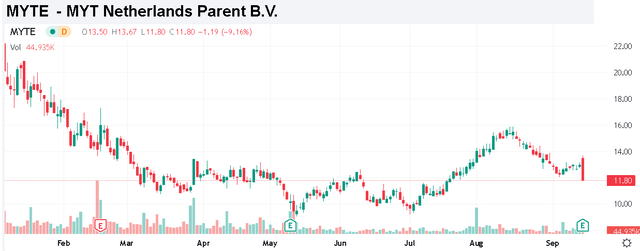

The initial market reaction to the earnings release has been a selloff, coinciding with broader volatility in equities on the day. Shares are now down more than 40% in 2022 and even 20% just from their high in mid-August.

We sense MYTE is simply caught up in macro pessimism against the headwinds of persistent global inflation, rising interest rates, and a generally softer economic outlook. By this measure, there appears to be some skepticism that Mytheresa’s operating strength and earnings outlook will be able to sustain the recent momentum.

The main risk here is the company’s exposure to declining discretionary consumer income hitting demand for luxury goods. Favorably, that scenario hasn’t played out yet with anecdotal evidence that this segment of the market has thus far been “recession-proof” considering reports from leading brand manufacturers like LVMH Moët Hennessy (OTCPK:LVMHF), which controls “Louis Vuitton” that has reported a surge in sales this year. Similarly, high-end sports car maker Ferrari N.V. (RACE) set a Q2 record for orders.

At the same time, the attraction in MYTE comes down to its brand agnostic profile as an online retailer that fills the demand for luxury goods and premium apparel shopping. This means that whether “Gucci” or “Dolce & Gabbana” is in vogue and clicking with consumers, MYTE is the one-stop shop online destination. Here we draw contrast to Farfetch Ltd. (FTCH) which has a similar profile as MYTE.

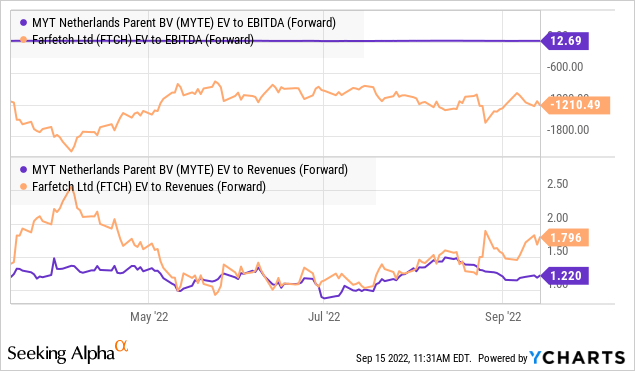

While MYTE is smaller in terms of market cap and 2022 GMV, MYTE is currently profitable while FTCH has negative adjusted EBITDA. MYTE GMV growth in the last quarter was also ahead of FTCH which reported a 1% y/y increase, suggesting Mytheresa is capturing market share. We argue that MYTE is the higher-quality stock of the two with more positive fundamentals. Notably, MYTE trades at a discount to FTCH in terms of its sales multiple which could have room to reverse higher into a premium going forward.

Final Thoughts

It’s a difficult moment to be bullish on consumer discretionary names and even luxury online retailers. In this case, we see an upside in MYTE over the long run and expect shares to trade higher as macro conditions stabilize and market sentiment improves. The potential that the stock reclaims its August high near $16.00 per share implies around a 35% upside from the current level. On the downside, it will be important to hold the Q2 low when shares briefly approached $9.00. Monitoring points over the next few quarters include the trends in financial margins, GMV momentum, and the level of active customers.

Be the first to comment