Darryl Sutphin/iStock via Getty Images

Introduction

Recent jobless claims show a slowing growth in the economy, which has relieved some inflation pressures off of the Fed and also the Muni market. For the former, the rate cut hope is largely increased, and for the latter, the macro is more friendly because inflation is the worst enemy to the Muni bond market. This is good news for leveraged Muni funds like BlackRock MuniYield Quality Fund III (NYSE:MYI). MYI is cheap, with its NAV discount still over 10%. The rate-cut would help reduce the cost for its high leverage at 37.12%. Summer is a good season for Muni bonds, and I think now is a good time to buy MYI, enjoy a tax-free dividend at 5.96%, and look forward to a good total return in 2024.

Fund Highlight

MYI is a CEF managed by BlackRock focusing on the municipal bond market; the CEF fund of municipal bonds is also known as Muni fund. The fund’s objectives and strategy are summarized officially below

investment objective is to provide shareholders with as high a level of current income exempt from federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax). Under normal market conditions, the Fund invests primarily in long-term municipal obligations that are investment grade quality at the time of investment.

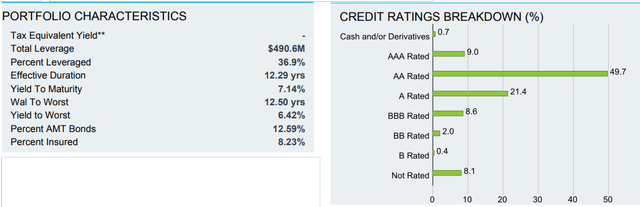

The portfolio consists of Muni bonds with long durations, averaged over 12 years, as shown below. The credit quality is very good with over 80% rated “A” or above.

MYI Portfolio from BlackRock

As also shown, the fund uses a high leverage at 36.9% (in borrowing debt) to boost the fund’s performance. While this is one main source of concern for many investors in CEF funds, the interest rates are the key factor to determine the actual impacts on the fund, because of the borrowing cost.

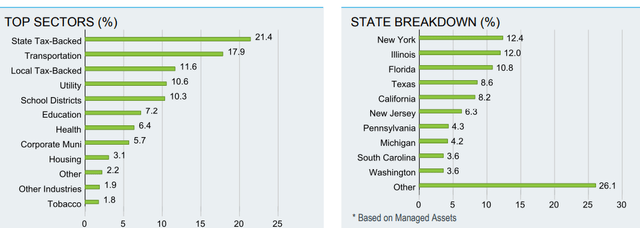

The following is the portfolio breakdown of the fund. It can be seen that the top 3 states with double-digit weights are New York, Illinois, and Florida. Texas and California follow closely with over 8% allocation each in the portfolio.

MYI Sectors and States from BlackRock

The top sectors show biases toward Tax-Backed and Transportation, which are over 50% with the top 3 sectors. The total number of holdings is 307, making it a well-diversified portfolio.

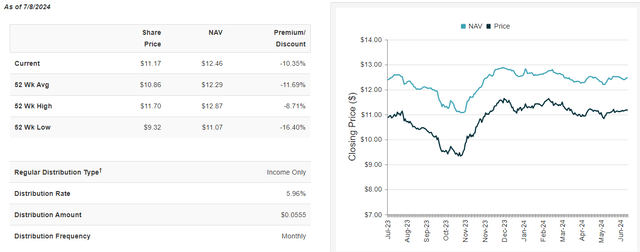

MYI’s AUM is $828M, which is a pretty good size for a Muni fund. The daily trading volume is decent, around 200K. The most notable feature is the NAV discount at 10.19%. I consider it a cheap price for a CEF of this size.

MYI NAV Information from CEFConnect

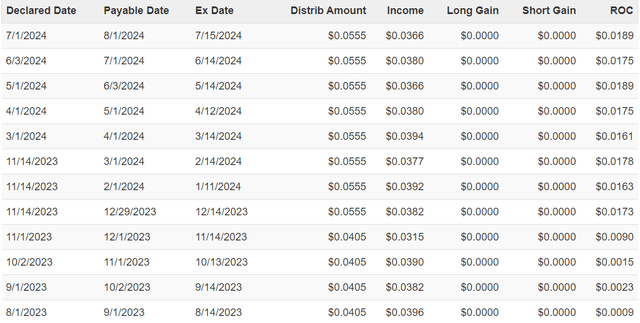

MYI sports a tax-exempted monthly dividend with a 5.95% distribution rate. It is an excellent rate for investors in a high tax bracket. The distribution hit the lowest level at 0.0405 in 2023, and it’s been back up in 2024 to 0.0555, which is the highest regular distribution since 2018. This is a good sign for the fund to have a better year in 2024.

The expense ratio is high at 1.37%. Notice that recently, BlackRock started to implement a “fee waiver” program, including a one-time waiver, as announced on May 20, 2024. MYI is part of the program, which will help “increase tax-exempt income to shareholders” as expected.

Macro conditions favor Muni bond market

According to an article published by BlackRock on Apr 4, 2024, the bond “market pricing is more closely aligned with the Fed’s rate cut projections for 2024, creating a better entry point for duration. And fading recession and default fears have improved the outlook for credit.” The current macro conditions remain similar to what was described 3 months ago, and the rate cut from FED is still on the table for 2024. Based on the employment data reported on July 5, June’s unemployment rate was 4.1%, which is higher than the expected 4.0%. The job data has prompted some analysts to “call for two rate cuts in 2024“.

Inflation continues to move in the right direction, which is lower at a slow pace. It is supportive to the bond market. The Muni bond market continued the rally in early 2024 but has since stayed sideways, bouncing in a price range. I believe it will start to move to the positive side again once the rate-cut materializes. Keep in mind that the rate cut hope is much higher now, thanks to June’s weak unemployment data.

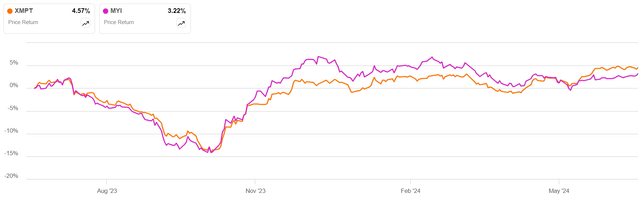

Muni CEF 1-Year performance from SA

In the above one-year comparison, VanEck CEF Municipal Income ETF (XMPT) is used to benchmark the price changes. XMPT has 55 holdings of Muni funds and is a better presentation of the general trend for Muni’s range-bouncing behavior.

The time can’t be better to own quality Muni funds this summer

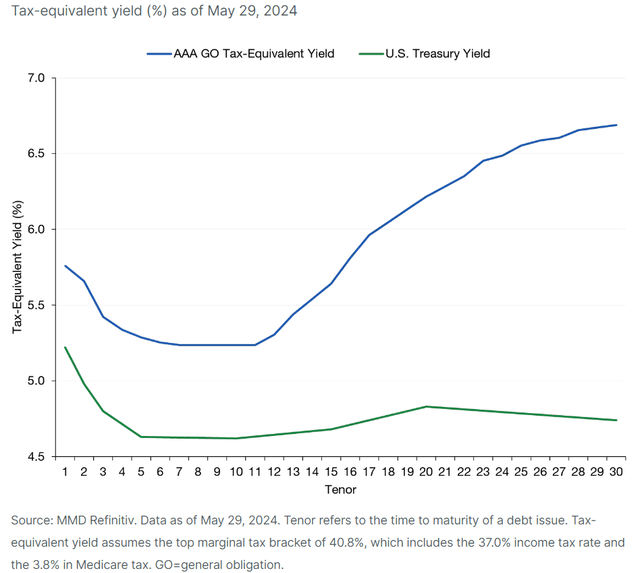

In the fixed income bond market, Municipal bonds outperform US Treasuries and the corporate bonds in long duration end. The following Muni yield curve shows the opportunity compared to the Treasuries.

Muni yield curve referred from lordabbett.com

I believe Muni funds currently represent some of the greatest alternatives in fixed income bond assets. The advantage can be seen with the increasing yield gap after the duration is longer than 12 years or so, as indicated in the chart above.

Historically, the summer shows a strong seasonality for the Muni market, which tends to have good performance from May to August; July is the best month of the year, statistically.

With all these tailwinds, MYI is poised for a strong rebound in the near term, with its cheap price based on the steep NAV discount exceeding 10%. I have been actively picking up shares of some Muni funds in 2024. MYI is the most recent one added to my buy list because I see the rate cut as a real catalyst to propel the fund to close down the NAV discount. Therefore, it looks very promising in the remaining part of 2024. I plan to open the MYI position in my income portfolio and expect it to provide me a handsome total return in the next 12 months. MYI pays a tax-free dividend close to 6%, which would be translated to a higher taxable dividend. I believe that it is also a very good long-term holding based on the current yield level.

Risks & Caveats

MYI has ROC in its recent distributions, which is a bit high, as shown below. It is a source of concern from many investors. It may not indicate a structural issue (yet) for the fund, but it is certainly worth closer monitoring.

MYI distribution history from CEFConnect

The high leverage is always a risk factor in the current high interest rate environment. MYI’s leverage is higher than the CEF average. The interest rates will have a bigger impact on the fund. It is always possible that the Fed may not cut the rate, so the leverage cost could remain high enough to hit the fund performance.

The default rate is typically not a concern for the Muni due to high credit quality. However, if the economy turns south really badly, like hitting a serious recession, it would definitely hurt the bond market, including Muni bonds. This risk is rather remote based on the current state of the US economy.

Conclusion

The high leveraged Muni fund MYI offers a high yield 5.95% with tax exemption benefit and a current NAV discount at 10.2%. The current macro conditions remain highly favorable to high-yield and high-leverage Muni CEF funds. The seasonal strong summer is a powerful tailwind for the Muni funds to continue narrowing down the NAV discount gap and perform well. I highly recommend MYI to income investors who see the strength of municipal credit and look to capture the opportunities in the high-yield municipal market in 2024.

Be the first to comment