double_p

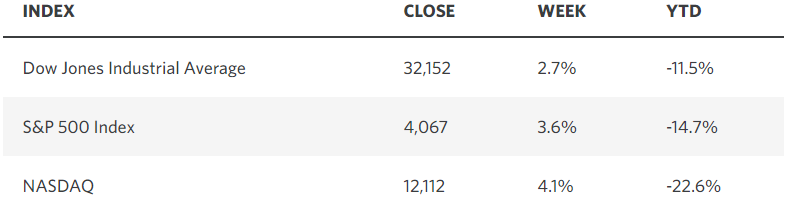

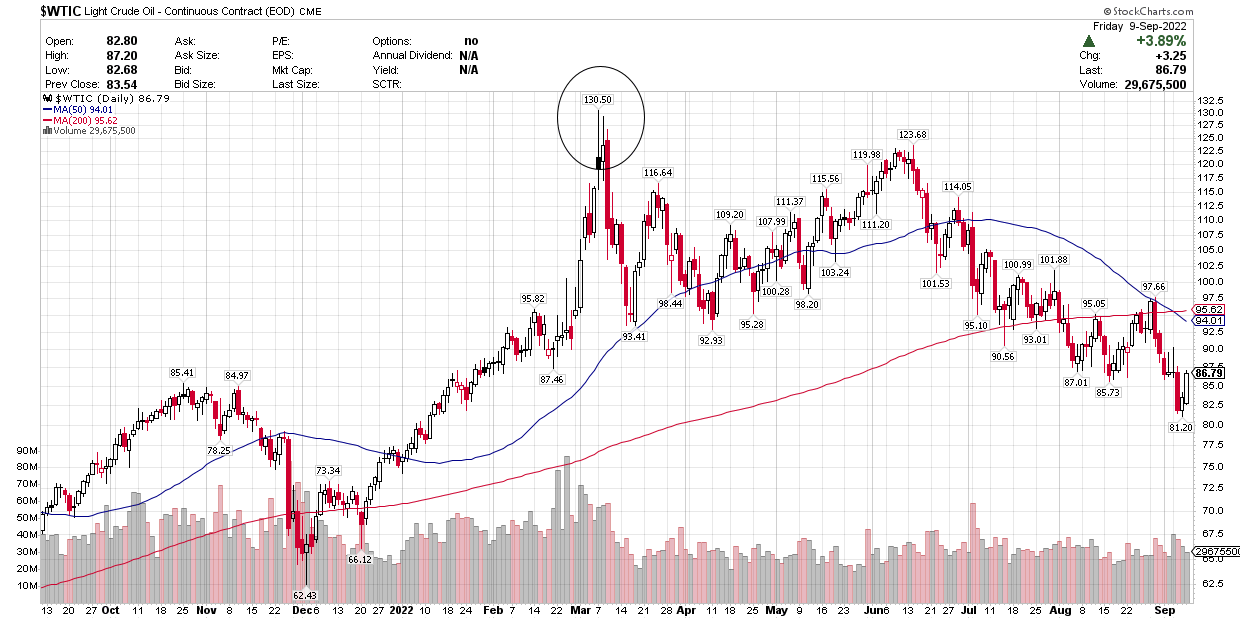

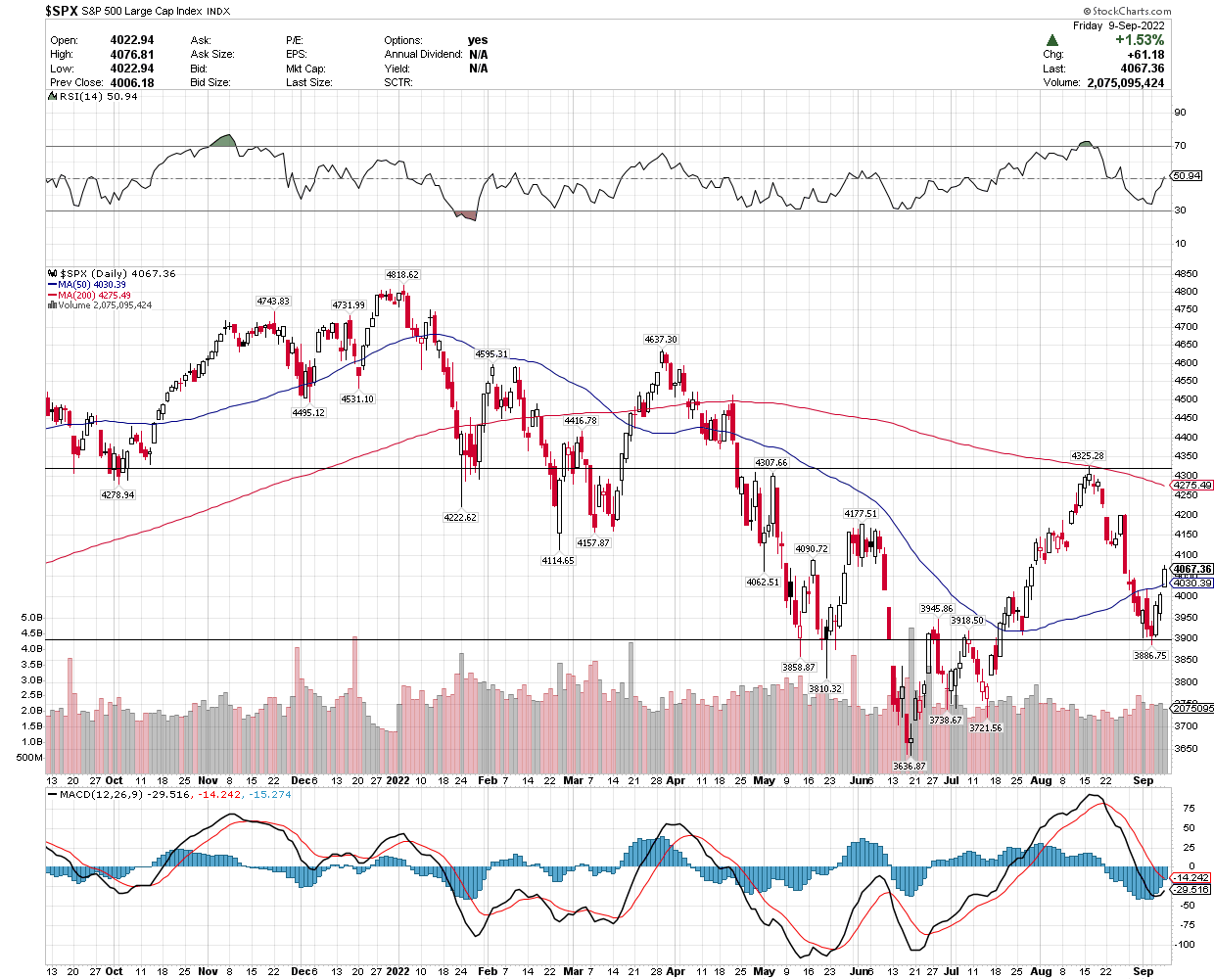

Stocks ended a three-week correction with gains in all the major market indexes last week. The S&P 500 successfully tested a significant support level before rallying above its 50- and 100-day moving averages. This came despite tough talk from Fed officials in advance of its September 20 meeting, during which the consensus expects the central bank to raise the Fed funds rate by 75 basis points to a floor of 3%. Last week’s market action strengthens my conviction that we just completed a pullback that refreshes the new uptrend, which started from what should be the bear market’s bottom in June. This week’s action will be dictated by Tuesday’s inflation report. The Consumer Price Index is expected to decline from 8.5% to 8% for August, while the core rate that excludes food and energy is seen increasing modestly from 5.9% to 6%. Regardless, the peak rate is behind us, and I expect as rapid a decline over the coming 12 months as we saw an ascent over the previous year.

Edward Jones

The battle between bulls and bears should keep the market range bound until we move past September into the seasonally strongest months of the year. Weaker-than-expected economic reports will continue to raise recession fears, while stronger-than-expected data will keep concerns about tighter monetary policy alive and well. Still, the path for a soft landing, whereby the rate of economic growth slows well below trend, while the rate of inflation falls to within a range of 2-3%, remains clear. That should allow stocks to outperform over the coming 6-12 month period.

Bloomberg

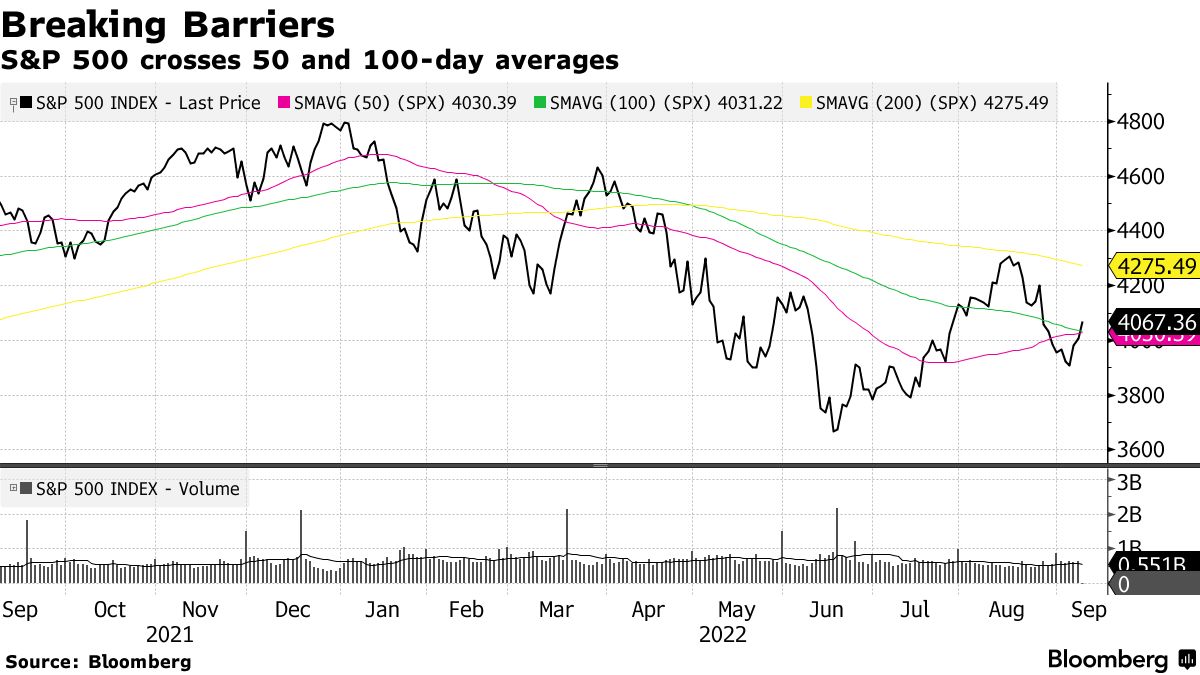

Concerns about a recession continue to resurface, despite the strength of the labor market. Unless we start to see monthly job losses, I see no risk of recession. The monthly rate of job creation is bound to slow, as sectors more sensitive to tighter financial conditions shed jobs, but we are not close to the monthly net losses consistent with recessionary conditions.

Yahoo Finance

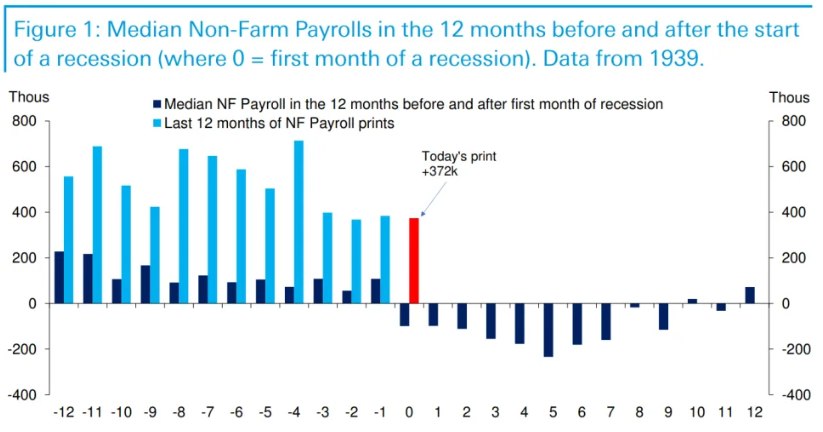

Meanwhile, the case for lower prices for goods and services in the coming year strengthens. Within days of crude oil eclipsing $130 per barrel in early March, I wrote that Oil Looks A Lot Like A Meme Stock on the basis that speculators in the futures market were running up the price of the world’s most important commodity in hopes of profiting from the alarm caused by Russia’s invasion of Ukraine. The rise in price was based on sentiment far more than the fundamentals of supply and demand. There were similar price increases for many other commodities, but nearly all of them are now approaching their lows for the year.

Stockcharts

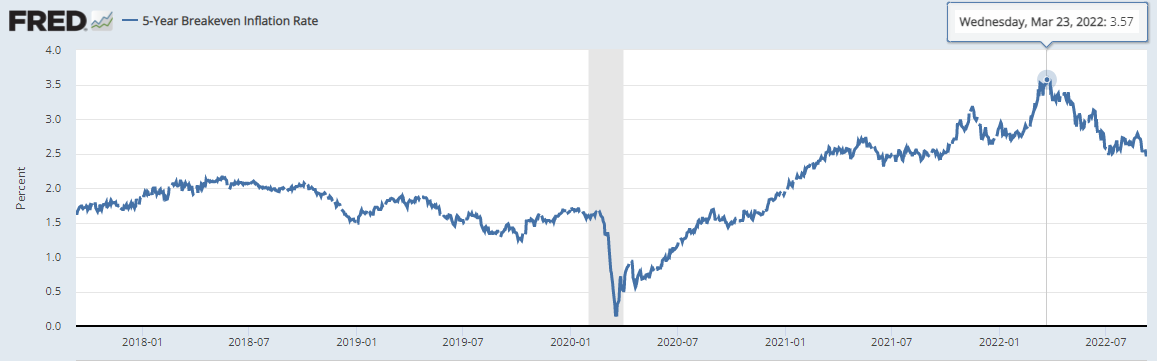

The peak in inflation expectations coincided with the peak in oil last March. The Fed has worked hard, mostly through rhetoric, to lower expectations and prevent higher rates of inflation from becoming entrenched. I think that mission has been accomplished.

St. Louis Fed

The breakeven rates for Treasury inflation-protected securities show us what the bond market’s expectations are for the annual rate of inflation over different time periods. Today, all of these rates are collapsing towards the Fed’s target of 2%. I prefer to take my cues from the bond market rather than the growing list of bearish Wall Street pundits. Despite the progress on reducing inflation, the Fed will remain hawkish in its rhetoric to prevent financial conditions from loosening until a more definitive downtrend in prices is seen. Still, the progress I expect to see should allow the Fed to stop tightening monetary policy in advance of today’s consensus expectations. That should also support risk asset prices in the year ahead.

Bloomberg

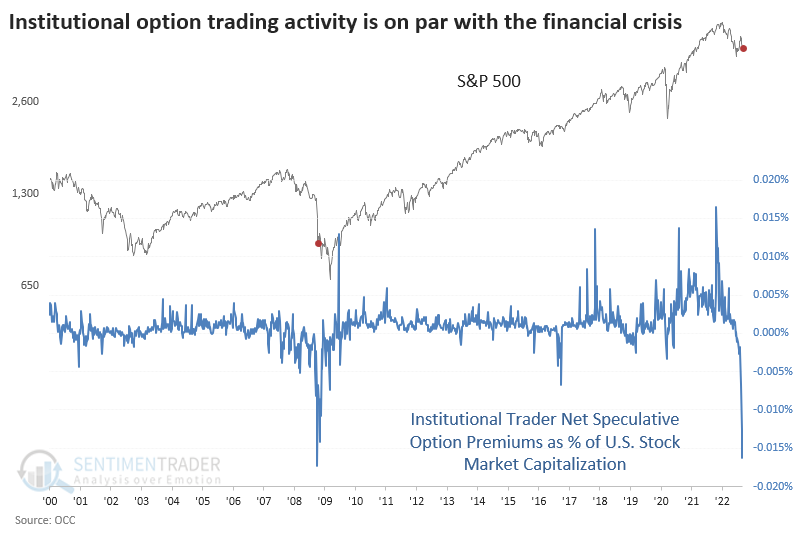

Another supportive factor is the astonishing level of negative sentiment and positioning. Institutions are positioned as though we are on the precipice of another financial crisis. Assuming we do not have a financial crisis, this negative sentiment should unwind and lead to an increase in demand for risk assets, as it did the last time the consensus was positioned for Armageddon.

Bloomberg

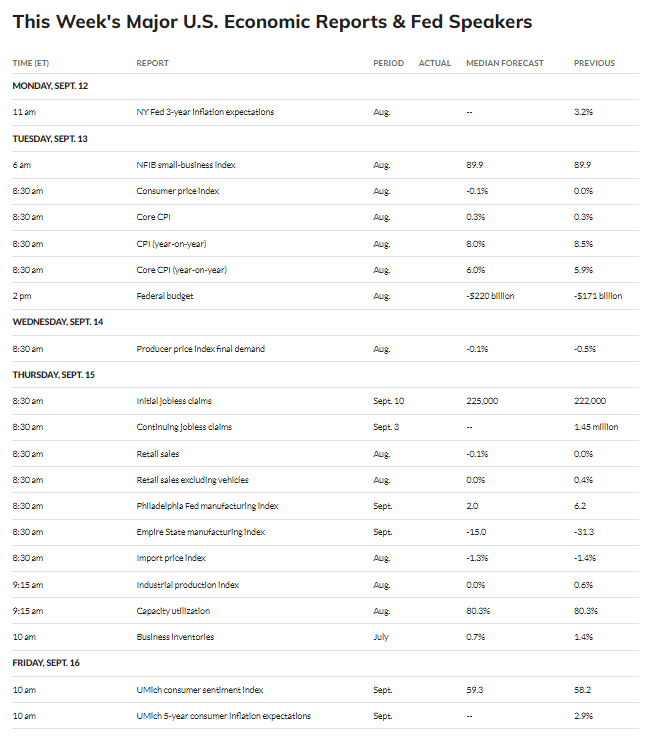

Economic Data

Tuesday’s Consumer Price Index report will set the tone for the week as it is the last major datapoint that the Fed will consider before its meeting the following week. A weaker-than-expected number should drive risk asset prices higher, while a higher one will result in selling pressure. Retail sales for August on Thursday will also be market moving.

MarketWatch

Technical Picture

I suspect we will remain mired in a trading range between 3,900 and 4,300 on the S&P 500 through September, but my expectation is a breakout to the upside during the fourth quarter as we approach the midterm elections.

Stockcharts

Be the first to comment