OSTILL/iStock via Getty Images

In a recent Barron’s article, Andrew Bary wrote:

“Asset managers stocks have been hit hard this year… with some down 35% to 45%, almost double the decline in the S&P 500 index. No industry is more directly tied to stock and bond markets, and a bear market depresses assets under management, revenue, and earnings. Profit estimates for 2022 lately have been declining, and earnings are on track to fall below last year’s results.”

That’s smart. However, just like with homebuilder stocks, they look appealing in this complicated market.

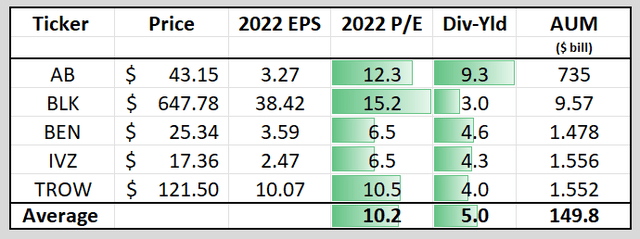

Many asset managers shares are trading for 10x projected 2022 earnings – or less – and yield 3%-5%. Most have strong balance sheets, and their dividends generally look secure.

(iREIT on Alpha)

Much like real estate investment trusts ((REITs)), asset managers can solve long-term investment and retirement needs – especially for millennials. Admittedly, unlike REITs that offer investors high yields and predictable income… they’re much less dependable in terms of the income they generate.

That’s because they generate massive fees instead of collecting rent checks.

They also trade for much lower valuations than the higher growth, higher-fee alternatives such as Blackstone (BX), which now trades at 18.9x.

As many of my readers know, I’m developing a suite of ETF indexes under “Wide Moat Indexes.” So I’ve become much more fixated on asset managers – as have many of my subscribers.

They want a tracker for them, much like we have for REITs and other categories. In which case, consider this our inaugural research report on the subject!

“There is nothing more deceptive than an obvious fact.” Sherlock Holmes

Asset Manager Evaluation #1: BlackRock

BlackRock, Inc. (BLK) has $9.6 trillion of assets under management (AUM) and the top exchange-traded fund (“ETF”) platform in iShares. This company further stands out from the crowd because it’s riding the secular shift into passive investments.

All told, BLK generates 3%-5% organic annual growth in AUM – at a time when almost everyone else is struggling to generate positive organic growth. Wolf Report wrote that:

“BLK is the quintessential dividend/safety stock, with significant fundamental upside based not only on premium but on a pure 15x fair value multiple.”

He’s right about safety. BLK has a fortress AA rating from S&P and a highly diverse platform. It generates a mix of fees, performance, and other revenue that somewhat insulates it from downward turns in the market.

As Wolf also explains:

“The company also sees that there are decades of growth ahead for ETFs and specifically its ETFs, which will allow for [it] to grow further… the company expects its ETF AUM to reach $15 [trillion] by 2025…”

BLK’s technology initiatives, such as Aladdin – a portfolio management system that’s gaining traction – sets this asset manager apart as well.

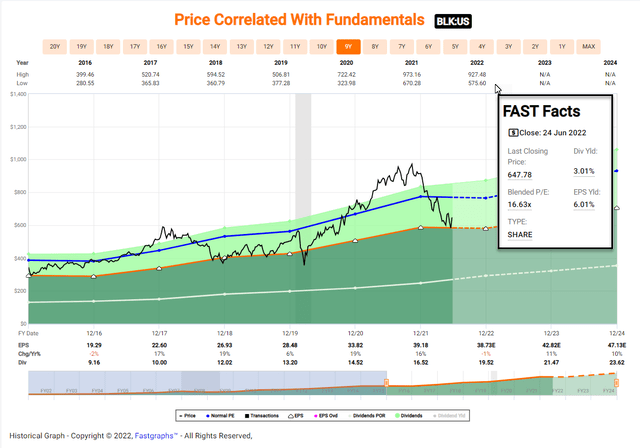

Shares trade at $647, with a price-to-earnings ratio of 15.2x. The dividend yield is 3%, and analyst growth estimates are 11% in 2023 and 10% in 2024.

BLK has an impressive dividend growth history – averaging a 26% compound annual growth rate (CAGR) over 20 years. Our 12-month price target is $815 per share, which translates into a 12-month total return forecast of 22%.

(FAST Graphs)

Asset Manager Evaluation #2: T. Rowe Price

T. Rowe Price Group, Inc. (TROW) is one of our highest-conviction recommendations for this overvalued market.

With over $1.5 trillion in AUM, its biggest peer-specific advantage has been the level and consistency of its investment performance. The firm currently has 59% of its rated U.S. mutual funds (across primary share classes) at four or five stars.

In 81% of quarters for the last 20 years, TROW has been growing organically. And actual AUM has grown far faster.

From 2010 to 2019, it rose 12% CAGR… 6x as fast as net inflows. Over time, management thinks it can sustain 2% organic growth.

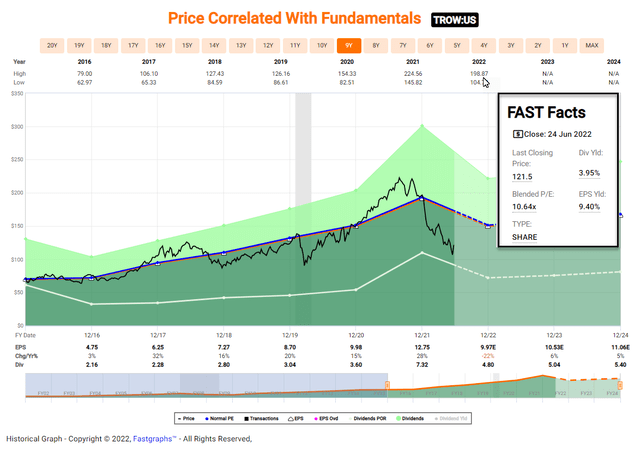

TROW has an impressive record of delivering for shareholders, with 17% annualized growth in earnings and dividends over the past 30 years. Shares now trade cheaply at 10.5x projected 2022 earnings and yield 4%.

TROW also has one of the best balance sheets with $3.5 billion, or $16 per share, of net cash and fund investments. When you consider the $2.2 billion in cash on its balance sheet and $3.5 billion in 2021 consensus free cash flow…

You effectively have an AAA balance sheet. That’s far superior to the AA rated BLK.

Shares trade at $121.50 with a P/E multiple of 10.5x. Their dividend yield is 4%, and analyst growth estimates are for 6% in 2023 and 5% in 2024.

TROW’s dividend history isn’t impressive, admittedly. And its current price weakness goes along with the underperformance of its flagship fund: New Horizons Fund (PRNHX) is down 40% year-to-date.

Personally, I prefer BLK. But TROW is certainly tempting, as shares historically trade at 15x. Our fair-value target is $155, and our 12-month total return target is 12%-15%.

(FAST Graphs)

Asset Manager Evaluation #3: AllianceBernstein

AllianceBernstein Holding L.P. (AB) is 65% owned by Equitable Holdings (EQH). The smallest of the five asset managers in this article, it has just $700 billion in AUM.

As Daniel Varga points out:

“… the company launched a new ETF in Australia in April 2021, and it was a massive success. Now the company is ready for the U.S. market… [it] hired several talents from top-tier ETF companies and [is] planning to launch a brand-new ETF in the U.S. later this year. In my opinion, this will also help inflows after the launch in the short term.”

Notably, AB filed to launch an active ETF in 2010 and got exemptive relief from the SEC in 2013. But it never moved forward from there.

Here’s another aspect that’s interesting to note: The “hesitation about moving into ETFs at that time is considered a factor that led Cathie Wood to leave the asset manager in 2012 to launch the wildly successful ETF shop Ark Invest.”

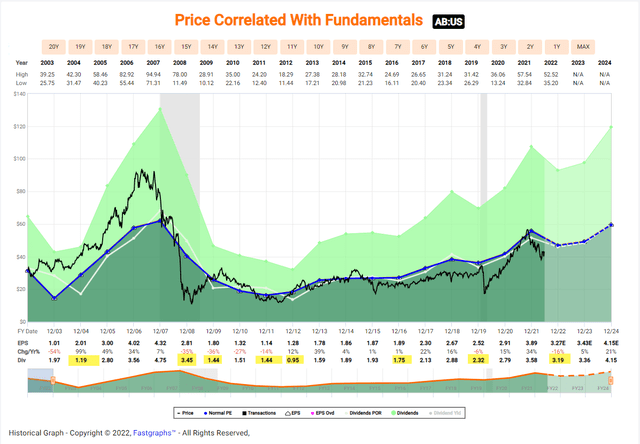

AB has a high-paying dividend with a tasty 9.3% yield. But before you get too excited, the firm has a very poor track record for growing dividends. That shows in the yellow-highlighted cuts below.

With that said, analysts’ 21% growth forecast for 2024 is intriguing…

This one deserves more due diligence, so I’ll definitely add it to my iREIT on Alpha deep-dive list. Members should stay tuned.

(FAST Graphs)

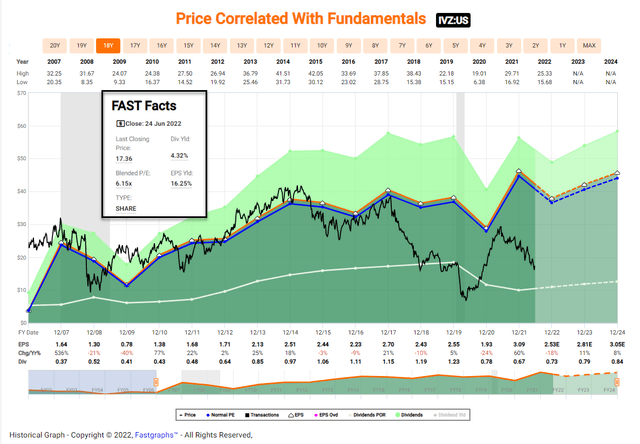

Asset Manager Evaluation #4: Invesco

Invesco Ltd. (IVZ) has a broadly diversified platform that includes active and passive vehicles with around $1.6 trillion of AUM. Its primary business model focuses on ETFs, led by the $150 billion gorilla known as Invesco QQQ Trust (QQQ).

IVZ is ranked #4 in ETF assets behind iShares, Vanguard, and State Street (STT). A few days ago, Wolf Report wrote on IVZ, where he explained:

“Invesco is an investment management company out of Atlanta, [Georgia]. Aside from its American operations, it has branch offices found in 20 different countries worldwide and operates brands such as Invesco, Trimark, Invesco Perpetual, PowerShares, and others. The company has been around for over 40 years and was originally the spinoff of a bank’s money management operations.”

Although not as financially sound as BLK and TROW, IVZ has a BBB+ credit rating and only 37% long-term debt to capital.

It also offers investors a dividend yield of 4.3% – although it did cut that dividend in both 2020 and 2021 from $1.23 to $0.78 to $0.67.

Maybe it’s just the REIT dog in me, but I despise dividend cuts… especially when I compare it to BLK’s successful policies.

Even so, I have to admit that IVZ is cheap, trading at 6.5x projected 2022 earnings. Its $22 target puts our 12-month annual return forecast at 20%.

(FAST Graphs)

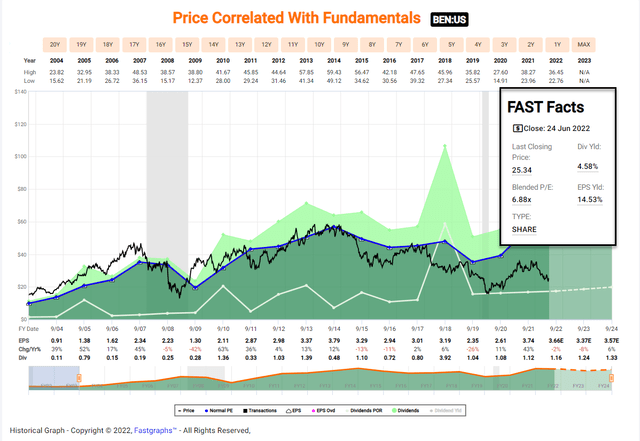

Asset Manager Evaluation #5: Franklin Resources

Finally, there’s Franklin Resources, Inc. (BEN), with around $1.5 trillion in managed assets composed primarily of:

- Equity (35%)

- Fixed-income funds (42%)

- Multi-asset/balanced funds (10%)

- Alternatives (9%)

- Money market funds.

BEN is also one of the more global firms of the U.S.-based asset managers. More than 35% of its AUM is invested in global/international strategies. And just over 25% is sourced from outside the U.S.

It’s made several acquisitions in recent years. Take its $6.5 billion deal for Legg Mason this year, that roughly doubled AUM. In an article back in December, Dividend Sensei said:

“Because BEN is a turnaround story, it’s considered a speculative blue-chip and has a 2.5% max risk cap recommendation. That’s because BEN misses growth estimates half the time, and its historical margin-of-error adjusted growth consensus range is 3% to 11% CAGR.”

In addition, BEN has a much less attractive dividend history that includes lumpy earnings and distributions. Still, shares trade at $25.34, which is 6.9x projected earnings in its September 2022 fiscal year.

The stock yields 4.6%, and the payout ratio is just 35%. Negative growth is forecasted in 2023, and I see no analyst buys on my FactSet terminal. Just holds and sells.

(FAST Graphs)

In Conclusion…

This completes Round 1 of my search for the best asset managers. In this first edition that focuses on asset-light business models, BlackRock is the clear winner.

This means that it’s time for me to also put together a deep-dive on BlackRock. And, for the record, I’ll most likely become a shareholder withing the next 48 hours – if I haven’t already bought in by the time you read this.

Stay tuned for my next series, where I’ll focus on Blackstone, Cohen & Steers (CNS), KKR (KKR), and others.

As always, thank you for reading, and I look forward to your comments.

Be the first to comment