Eoneren/E+ via Getty Images

The end of March marks the end of the first quarter, and, besides March itself, it hasn’t been a pretty one. All of the major indices are down, with the S&P and DJI both down over 4% and the Nasdaq 100 down over 8%. The ongoing unrest in Ukraine, in combination with the already disrupted supply chains (and subsequent high levels of inflation), has been weighing on the stock market.

Nevertheless, there are always stocks that look attractive, and I continue to add money to my portfolio. As for March, I had a total of 5 buys and 1 sell.

For the people that have not read my previous articles: I am a 24-year-old investor from the Netherlands who is trying to start early so that I will have the option to retire early or at least earlier (the current retirement age is 67 in NL and is trending upwards). If you are interested in previous updates on my portfolio, you can find them here:

March Update

March was, surprisingly, the first month with positive returns this year. I say surprisingly because we have elevated levels of inflation, there is a war in Europe, and rates continue to rise. In most cases, this would lead to lower stock prices, but so far the indices are holding up well. March could have been a dead cat bounce, but only time will tell. It is almost impossible to predict what the market will do in the coming months. A lot of asset managers and economists are trying to predict the markets by using certain indicators, but none of them perfectly predict the market. For that reason, I remain invested and will add to stocks that I think remain undervalued.

This month, I decided to sell one of my Chinese value stocks, Ping An Insurance (Group) Company of China, Ltd (OTCPK:PNGAY), as the information at that time pointed to a longer than expected recovery in the company’s stock price. The information at that time was the following: potential delisting of Chinese stocks in the US, China to lock down Shenzhen, and uncertainty about China’s economic recovery.

Ironically, the next day the Chinese government released a statement that they will comply with rules from the SEC. Even though this was bad timing, the sale of Ping An removed some volatility from my portfolio. As a replacement, I bought Morgan Stanley (MS), a stock that had been on my watch list for quite some time and that was trading close to its YTD low. I am not claiming that Morgan Stanley will be a good investment or that it isn’t volatile, I am just more comfortable holding it than Ping An at this moment in time. Thus, even though it was ill-timed, I think that was the right move.

The last update I want to give before diving into my transactions is about the investment competition from my student association. My team remains in the first place, and we currently have an M² (risk-adjusted return) of approximately 15%, while the number 2 is currently at approximately 5%. Our investment approach has been simple, yet effective, with our main focus being on macro plays which include commodities, defense stocks, and the energy sector. The competition runs until the beginning of July, but things are looking positive at the moment.

Transactions

Rules

|

Core |

Value |

Small-cap growth |

|

|

Buy |

|

|

|

|

Reconsider |

|

|

|

|

Sell |

|

|

|

1st of March

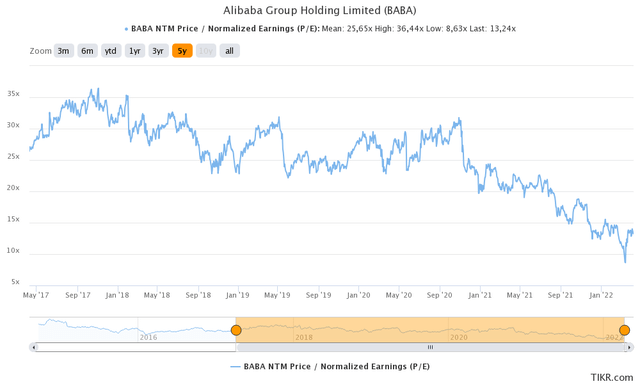

Alibaba Group Holding Limited (BABA) – Bought 2.5 shares for $109.44 each.

Even though I mentioned before that I sold one of my Chinese stocks, I remain confident in Alibaba. The reason for this is that Alibaba has multiple businesses, and not all of them are hugely influenced by the current economic environment in China. Additionally, the company’s international annual active customers have increased in importance from approximately 20% in Q3 2020 to 23.4% in Q3 2021.

Furthermore, the company’s cloud segment still has a large growth path. CAICT expects the cloud market to grow 5 times over 5 years, from 0.2 RMB trillion in 2020 to 1 trillion in 2025. This could drive income in this segment, as the company’s cloud income is dependent on economies of scale.

There are also a lot of negative things that can be said about BABA, such as the fact that the company’s revenue growth has been slowing and that the political environment is hard to predict. Nevertheless, at a PE of 13.2 and a price target based on a DCF of approximately $185, the risk/reward ratio remains attractive.

Reinsurance Group of America, Incorporated (RGA) – Bought 3.2 shares for $105.38 each

I have written about Reinsurance Group of America multiple times over the past few months. RGA is a strong company that has been negatively influenced by the pandemic. During the past quarter, the effect of Covid on EPS was approximately $3.56. With the number of deaths due to Covid rapidly declining, the company should be able to recover. Once Covid is completely behind us, RGA should start to grow again and rising interest rates should partially be beneficial to the company, as lower interest rates, in general, have a positive impact on the results of financial companies.

As an example, in 2020, Munich RE said the following about low rates:

Munich Re notes how the gradual erosion of rates and a softening of terms and conditions have been straining the profitability of reinsurers for years.

It further added that:

The global reinsurer notes how these circumstances mean that sustained profits, in long-tail business and elsewhere, will only be possible if prices match the assumed risks.

Thus, I think that the rising rates could be an additional tailwind for RGA. Lastly, the company trades at a significant discount to its book value (around 30%), making the shares look attractive.

15th of March

Ping An Insurance – Sold 59 shares for $11.91 each:

My most ill-timed sale of a stock ever. A day after I sold the stock, the Chinese government stated its support for foreign-listed stocks. Nevertheless, when I decided to sell the stock, the risk-reward ratio was not in favor of investors. The main reasons for the unfavorable risk-reward ratio were the fact that the government had just announced a new lockdown in Shenzhen, the SEC was (and still is) looking into delisting certain Chinese companies, and the Chinese economy is going through a hard time. Thus, I decided to limit my exposure to Chinese stocks. Given that I think that Alibaba has a brighter future and that Prosus is not only limited to China (even though it gets most of its profits from its stake in Tencent (OTCPK:TCEHY)), Ping An was the stock that I sold.

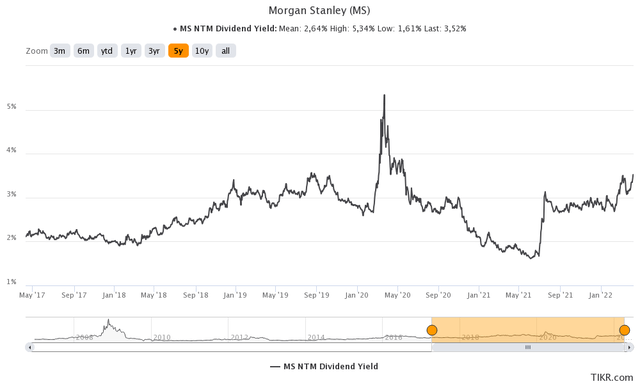

Morgan Stanley (MS) – Bought 8.2 shares for $86.24 each

I wanted to replace Ping An with a stock from the financial sector, to keep my sector allocation similar. The most appealing financial stock on my watch list was Morgan Stanley. Over the past few years, Morgan Stanley has returned a lot of capital to its shareholders, and last year it decided to double its dividend. In addition to this, Morgan Stanley is the bank with one of the highest returns on tangible common equity.

This year hasn’t been as good as last year for Morgan Stanley, as the market environment is a lot less favorable and there aren’t as many IPOs as last year. This has had an effect on the company’s share price as it is down over 10% this year. In my opinion, the shares are now undervalued by over 20% and, in combination with the reasons mentioned above, gave me enough confidence to start a position in Morgan Stanley.

Morgan Stanley NTM dividend yield (Tikr.com)

TJ Maxx (TJX) – Bought 5.3 shares for $62.11 each

TJX is one of my long-term holdings that I hadn’t added to in quite some time. The company was also the DGI company to which I allocated the least amount of capital. The main reason for this is that my fair value has been below the company’s share price for quite some time.

Over the past few months, the company’s share price has come down quite significantly, due to inflated labor prices and worldwide supply chain disruptions. However, during the last conference call, the company was quite optimistic. Scott Goldenberg, TJX’s CFO stated the following about higher wages:

The wage will, I think, peak this year, but will still be a headwind, as Ernie alluded to, but it will moderate next year. And supply chain, frankly, this year has already moderated, we peaked on that.

And Ernie Herrman added the following:

Yes, the — so here’s what’s good. As retail gets better, typically — remember, the wholesale market is mainly imported products. So they tend to buy more aggressively when retail gets better, and there tends to be more excess. So I think in theory, there’s going to be more availability over the next — as everybody — if things normalize, people will tend to cut goods a little more aggressively. There’s just been some — there’s a lot of availability right now, particularly coming out of holiday going into the first quarter.

In addition to this, I think that inflation will be a tailwind for the company. The reason for this is that inflation leads to lower disposable income. This makes TJX’s bargains more attractive and could lead to more people visiting the company’s stores.

Power REIT (PW) – Bought 4 shares for $44.45 each

This month, I also added to my position in Power REIT, albeit before a lot of negative information came out. The reason I added to my position is that the company remains attractively valued compared to other Cannabis REITs, grows very fast, and the spread between the company’s cost of capital and cap rates is significant.

Nevertheless, a few days after my purchase, the company released an 8K filing, and one member of the board of trustees is leaving the company. This in itself is not that uncommon and would have been routine but for the statement that she made. According to her, she was retaliated against after she and fellow trustee Mr. Werner passed resolutions for outside counsel regarding corporate governance and, in particular, the deals between PW and Millennium Sustainable Ventures Corp (OTCPK:MILC), which both have the same CEO. The reason why I think this is important to mention is that it could mean that some of the deals between Power REIT and MILC were not made at arm’s length. However, what is true about her statement remains to be seen.

Interactive Brokers Group, Inc. (IBKR) – Received 0.2295 shares

As I mentioned in previous updates, I switched to Interactive Brokers through a referral link. This means that I receive free shares whenever I put money in my account. I have to hold these for a certain time but I am not planning to add money to this position at the moment.

|

Company |

Shares |

Total price |

Effects on dividend pre-tax |

|

BABA |

2.5 |

$273.59 |

$0 |

|

RGA |

3.2 |

$337.22 |

$9.34 |

|

MS |

8.2 |

$707.17 |

$22.96 |

|

PNGAY |

-59 |

$702.69 |

-$41.30 |

|

TJX |

5.3 |

$329.19 |

$6.15 |

|

PW |

4 |

$177.8 |

$0 |

|

Interactive Brokers |

0.2295 |

$0 |

$0.11 |

Dividends

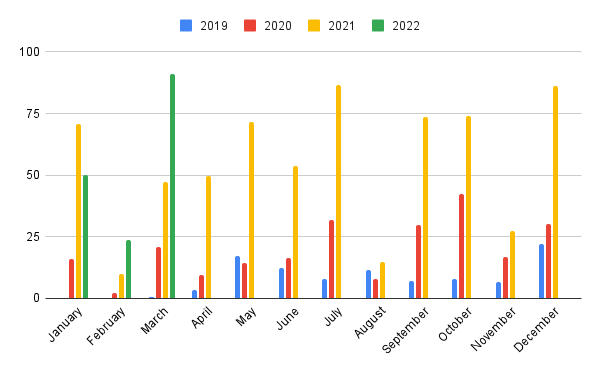

This month I broke the record for most dividends received in one month. The reason for breaking the record mainly lies in the new capital added to my portfolio and that Enbridge Inc. (ENB) (which is my largest position) paid out its dividends this month.

|

Company |

Dividend pre-tax 2021 |

Dividend pre-tax 2022 |

Difference |

|

Intel (INTC) |

$5.91 |

$7.41 |

$1.50 |

|

Visa (V) |

$1.60 |

$2.63 |

$1.03 |

|

Enbridge |

$2.68 |

$37.12 |

$34.44 |

|

Reinsurance Group of America |

$5.60 |

$10.88 |

$5.28 |

|

TJX Companies |

$4.16 |

$4.16 |

$0 |

|

Pfizer (PFE) |

$5.85 |

$0 |

-$5.85 |

|

Johnson & Johnson (JNJ) |

$3.03 |

$0 |

-$3.03 |

|

3M Company (MMM) |

$4.44 |

$0 |

-$4.44 |

|

Old Republic (ORI) |

$5.94 |

$0 |

-$5.94 |

|

CBOE Global (CBOE) |

$2.52 |

$7.49 |

$4.97 |

|

Unilever (UN) |

$9.82 |

$0 |

-$9.82 |

|

L3Harris (LHX) |

$4.08 |

$8.81 |

$4.73 |

|

Netstreit (NTST) |

$0 |

$13.08 |

$13.08 |

|

Prudential Financial (PRU) |

$0 |

$15.36 |

$15.36 |

|

Interactive Brokers |

$0 |

$0.32 |

$0.32 |

|

Total |

$55.63 |

$107.26 |

$51.63 |

Dividends received per month (Author)

This month, Vonovia SE (OTCPK:VONOY) cut its dividend by €0.03, from €1.69 to €1.66. The company stated in its annual report that it is actually an increase, if you would take into account the capital raised for the acquisition of Deutsche Wohnen (OTCPK:DWHHF). In my view, a cut is a cut and, as such, I have moved Vonovia from DGI stocks to Core other, as I remain confident that the company will do well in the long run. After the addition of capital and the decrease in dividends by Vonovia, my new forward dividend yield is now €843.51 ($914.31) after tax.

|

Company |

Change in dividend quarterly |

Dividend per share pre-change |

Dividend per share post-change |

|

Vonovia |

-€0.03 ($0.033) |

€1.69 ($1.83) |

€1.66 ($1.80) |

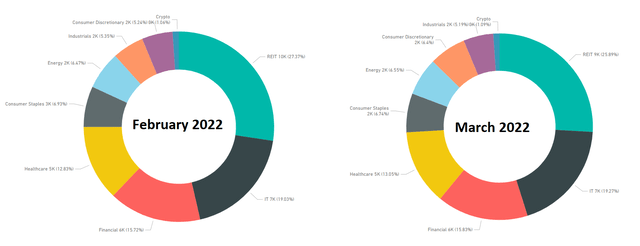

Sector Overview

Allocation per sector (Author)

In the pie chart above, you can see the allocation per sector. Not a lot has changed compared to last month. The largest change is the decrease in REITs as a percentage of the total portfolio. This can be partly explained by the fact that I only added a small percentage of new capital this month to REITs. Nevertheless, I remain confident in the REITs that I have a position in as inflation continues to run riot. As an example, apartment REITs will benefit from the increase in mortgage rates, as it will be harder for people to buy houses (which decreases demand and thus the value in the prices of the apartments/houses) but increase the demand for rental units.

Current Holdings

| Company | Qty Held | Portfolio % |

| AbbVie (ABBV) | 16 | 6.56% |

| Enbridge | 55 | 6.55% |

| VICI Properties (VICI) | 73 | 5.33% |

| L3Harris (LHX) | 8 | 5.19% |

| Reinsurance Group of America | 18 | 5.08% |

| Vonovia | 39 | 4.78% |

| CBOE | 16 | 4.54% |

| Ahold (OTCQX:ADRNY) | 53 | 4.36% |

| Visa | 7 | 4.07% |

| Prudential Financial | 13 | 3.85% |

| Netstreit | 65 | 3.84% |

| Aroundtown (OTCPK:AANNF) | 251 | 3.68% |

| CVS Health (CVS) | 13 | 3.40% |

| TJ Maxx | 21 | 3.38% |

| DIC Asset AG (OTCPK:DDCCF) | 78 | 3.23% |

| Broadcom (AVGO) | 2 | 3.16% |

| Fresenius SE & Co. KGaA (OTCPK:FSNUF) | 33 | 3.09% |

| Armada Hoffler (AHH) | 70 | 2.59% |

| Brookfield Asset Management (BAM) | 17 | 2.55% |

| Intel Corporation | 20 | 2.51% |

| Power REIT | 25 | 2.43% |

| Associated British Foods (OTCPK:ASBFY) | 43 | 2.39% |

| Prosus | 13 | 1.92% |

| Alibaba | 7 | 1.86% |

| Morgan Stanley | 8 | 1.80% |

| Linkfire | 1121 | 1.50% |

| CoreCard (CCRD) | 22 | 1.49% |

| CareCloud (MTBC) | 86 | 1.08% |

| StoneCo (STNE) | 35 | 1.06% |

| The Hut Group (OTCPK:THGHY) | 189 | 0.61% |

| Interactive Brokers | 3 | 0.56% |

Going Forward

In April I am going to add around €1000 ($1083) to my portfolio, and I am looking to add to my stake in the following companies.

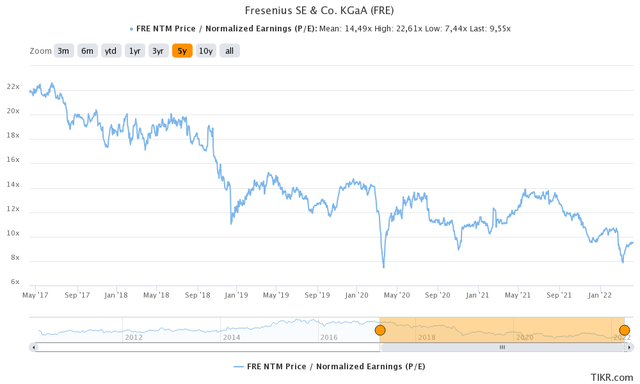

Fresenius SE & Co. KGaA (OTCPK:FSNUF)

Fresenius is a diversified German healthcare company that supplies hospitals, operates hospitals, and produces biosimilars among other things. After the annual report, the company’s share price went down, as the results were not that great. Unfortunately, due to the Covid situation, the company had to postpone surgeries that could have brought the company more revenue, and instead it had to take care of Covid patients (it received compensation for this from the German Government), which was less profitable.

During the conference call, the company did say that it potentially wants to break partially break up its business:

Helios and Vamed can continue to rely on Fresenius Group funds to finance smaller growth projects. For larger growth opportunities, though, Fresenius is now open to external equity investments at the level of that respective business segment, whether via a contribution in kind or a cash injection in any case, we want to broaden and strengthen those businesses and create synergies at a much more appropriate valuation relative to the discounted level currently implied in the FSE share price and also to increase the debt financing potential for the group as a whole and the enhanced value transparency potentially reducing the discount at the FSE level. Ultimately, this may, but will not necessarily lead to an IPO. We’d obviously prefer to preserve some exclusivity for Fresenius Group as a listed entity.

This could potentially unlock a lot of value for shareholders and at an NTM PE of 9.55 vs an NTM PE 5 year mean of 14.49 you are able to acquire the company at a nice discount. Thus, I am looking to add to this position in the coming month.

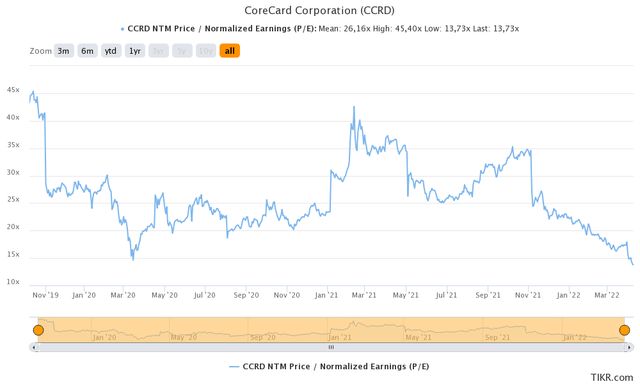

CoreCard Corporation (CCRD)

CoreCard is a small-cap that has a huge licensing deal with Goldman Sachs (GS) that includes the Apple (AAPL) Credit Card. In March Bloomberg posted a story that Apple wants to reduce its reliance on third parties for financial services. This could have an impact on CoreCard but this would most likely have no impact in the short term. Additionally, the deal that CoreCard has is with Goldman Sachs and not with Apple. This could alleviate some of the pain, as GS could add a different brand to the CoreCard portfolio. Furthermore, getting rid of Goldman Sachs as its issuing bank might be very costly for Apple and thus there is no certainty that this will happen at all. For that reason, I think that the current drop is overdone, and at an NTM P/E of 13.73 the company is undervalued compared to its own mean of 26.16.

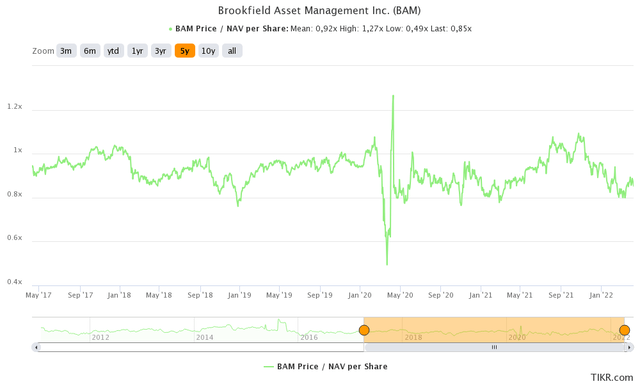

Brookfield Asset Management Inc. (BAM)

Brookfield Asset Management is a company with a very strong management team. CEO Bruce Flatt, who is sometimes also referred to as the Canadian Warren Buffet, is, in my opinion, one of the smartest guys in asset management. In bull markets, almost everyone can pick a winner but a good asset manager is someone that creates value in times of trouble. In my opinion, Bruce Flatt and BAM are very good at finding The current valuation also remains attractive as the company’s estimated NAV is currently 66.05, which means that it trades at 0.85x its NAV versus a mean of 0.92x.

BAM 5 year Price to NAV (Tikr.com)

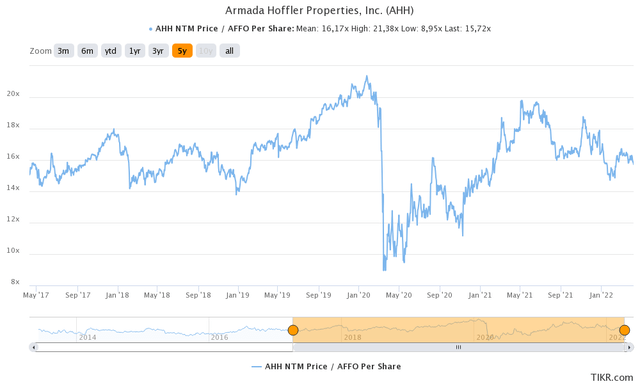

Armada Hoffler Properties, Inc. (AHH)

Armada Hoffler is a company that I started a position in a couple of months ago. There are three main reasons why I like the company: AHH has been shifting its portfolio focus to Multifamily buildings, the company has strong ties with the local government, and is well-positioned for the current inflationary environment. For more information regarding the company, you can read my recent article about Armada Hoffler. As for the valuation, I currently estimate the company to be worth $19.56 based on an estimation of the company’s NAV, discounted AFFO and the company’s P/AFFO.

Armada Hoffler P/AFFO (Tikr.com)

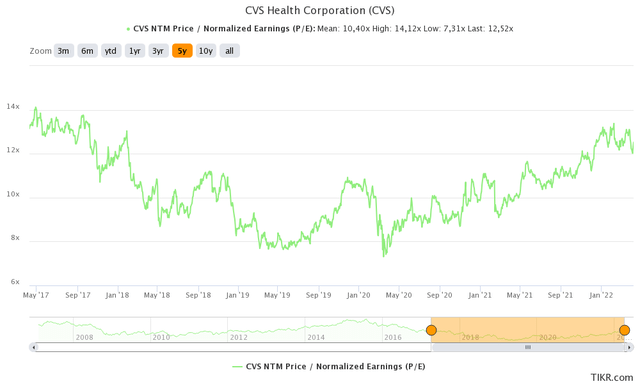

CVS Health Corporation (CVS)

The last company that I have my eyes on for this month is CVS Health. I think that CVS is a very good company to own in times of trouble. Currently, there are a lot of macro headwinds such as inflation, and supply chain issues, and these have been dominating the headlines. The fact that CVS provides services that are necessary, and that the demand for most of its goods is inelastic could provide a cushion in case we end up in a recession. Additionally, the company recently started to increase its dividends again and its debt levels have come down considerably since the acquisition of Aetna. Unfortunately, the company is trading at the higher end of its multiples but based on my DCF the company has some room to run and my price target is currently around $120.

Conclusion

Another month has passed, and it was the first month with positive stock returns in 2022. Unfortunately, most indices are still down YTD and I think that we are in for a volatile ride. The volatility also leads to opportunities and, as such, I continue to add to my portfolio. Nevertheless, I am not immune to the current macro environment and, as a result, I decided to cut one of my Chinese stocks, as I expect the Chinese economy to hit a rough patch.

My dividends this month came in at $107.26 pre-tax and this was the highest amount I have ever received in one month. My forward dividend yield is currently at €843.51 ($914.31) after tax and I expect this to increase over the coming months.

I hope you enjoyed the update about my progress, and I would love to hear your thoughts on my portfolio and what you would like to see in future updates.

Be the first to comment