smodj

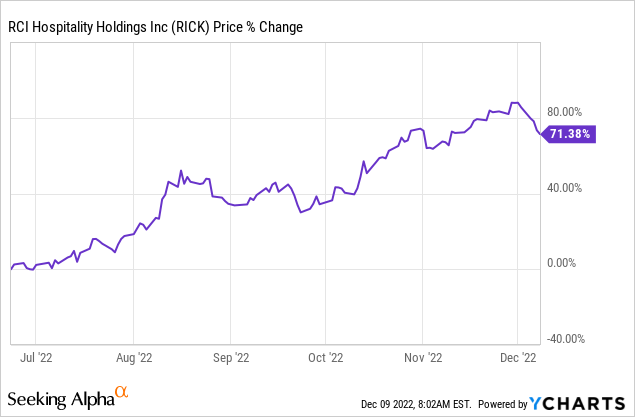

One of our best-performing investments of this year has been RCI Hospitality Holdings, Inc. (NASDAQ:RICK). It is up 71% since we initiated a position in late June for our Core Portfolio at High Yield Landlord:

Even then, I have not stopped accumulating shares. I think that it remains heavily discounted and presents one of the best opportunities in today’s market for long-term-oriented investors.

These are not just empty words, as RICK is by far my largest investment. I believe that the company has the potential to triple your money over the coming 5 years and much more in the decades to come.

What is RICK?

RCI Hospitality Holdings, Inc. is the only publicly-listed company that specializes in the ownership and management of adult nightclubs (=high-quality strip clubs). Just like a real estate investment trust (“REIT”) (VNQ), it buys real estate and grows organically by improving the operations of its assets, and it also grows externally by acquiring new properties.

RCI Hospitality

However, the economics of RICK are far superior to those of a regular REIT because it specializes in a sector that’s highly inefficient.

The organic growth is superior because of two main reasons:

Firstly, most owners of these clubs are not sophisticated and it is a fragmented market. As a result, RICK is able to significantly grow cash flow by improving operations and integrating individual clubs into its portfolio that enjoys significant economies of scale. A REIT like Mid-America Apartment Communities, Inc. (MAA) will commonly be happy if it can grow the NOI of a property by 5-10%, and that’s after significant value-add investments. In comparison, RICK will commonly acquire a property and grow its cash flow by 15-20% within a year with minimal investment.

Secondly, the supply of adult nightclubs is strictly limited due to licenses, which are today nearly impossible to obtain because no one wants a new adult nightclub in their backyard. Smaller and less desirable clubs are also closing, so the supply is actually decreasing, which benefits the remaining high-quality clubs that are well-located and professionally managed. Meanwhile, the demand for experiences is ever-growing, especially in rapidly growing sunbelt markets. People are getting married at a later age and everyone wants to party. Declining supply coupled with growing demand results in superior organic growth.

But even more important to our thesis is RICK’s external growth prospects, which are a multiple greater than that of most REITs. REITs like Realty Income Corporation (O) will typically grow externally by acquiring assets at a 100-200 basis point spread over their cost of capital. What this means is that they will buy a property at a 6% cap rate and finance it with capital that costs 4%, as an example.

RICK does the same thing, but instead of earning 100-200 basis point spreads, it earns 1,000-2,000 basis point spreads or more!

RCI Hospitality Holdings, Inc. is able to earn such incredibly large spreads because it operates in a sin industry with very few competing buyers, but lots of sellers.

There are lots of adult nightclub sellers because the average owner of an adult nightclub is approaching retirement age, and this is not the type of business that you typically want to pass on as a legacy to the next generation.

But there are very few buyers for these assets. If you are a private equity firm, you surely have at least some limited partners who don’t want you to invest in strip clubs. If you are a wealthy local business owner, your wife or husband probably does not want you to buy the local strip club. If you are a public company, you also can’t buy these assets, as it would hurt your ESG ratings. And even if you could buy these assets, you probably wouldn’t have the unique skill set that’s needed to deal with risks such as prostitution, drug dealing, and racketeering.

So there are lots of sellers… but very few buyers due to the unique nature of the assets… and this market inefficiency has resulted in an exceptional opportunity for RICK, as the only company of scale with access to public capital, to consolidate this sector at very high rates of return.

REITs will commonly buy properties at a 5-7% cap rate with limited value-add potential, resulting in relatively small spreads and limited external growth.

In comparison, RICK will commonly buy high-quality strip clubs at a 25-33% EBITDA yield with significant value-add potential, resulting in exceptionally large spreads and rapid external growth. Even better: sellers are often willing to provide RICK favorable seller financing deals because there are few buyers and RICK is the buyer of choice for them. It boosts returns even further because RICK typically only has to pay a portion of the acquisition price in cash.

What’s the catch?

You may think that these high returns are the result of high-risk and low-quality assets, but in reality, adult nightclubs are actually quite attractive as businesses because they are moated due to the license, enjoy high-barriers-to-entry, high margins, and are somewhat resilient to recessions.

So the massive returns are not just a function of risk. They are more the result of market inefficiency (sin industry with many sellers but few buyers), and RICK is truly earning alpha-rich returns with this unique investment strategy.

The proof is in the results.

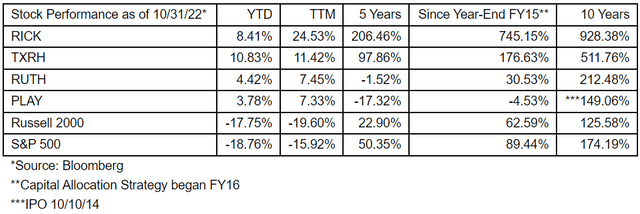

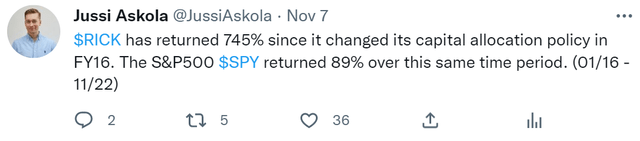

Ever since they changed their capital allocation strategy in FY16 to focus on accretive growth, they have earned a 745% total return for shareholders. That’s 8x more than the returns of the S&P500 (SPY) over the same time period:

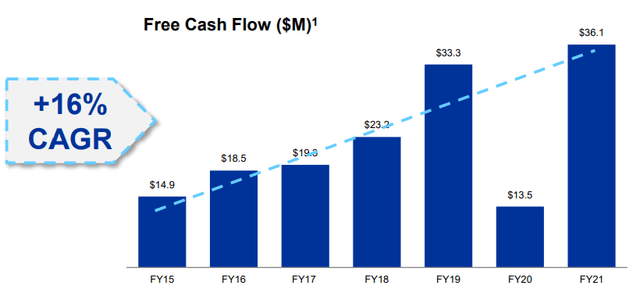

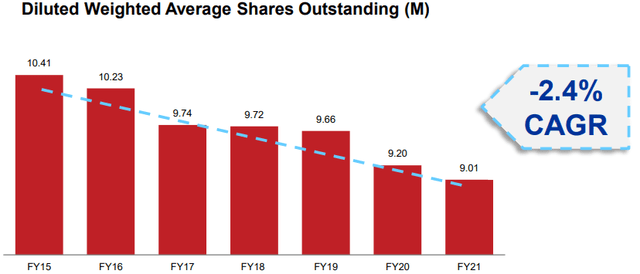

These returns are the result of the company’s rapid growth. RICK managed to grow its total free cash flow by a 16% CAGR all while reducing its share count by a 2.4% CAGR. Quite an achievement!

RCI Hospitality RCI Hospitality

But are we too late to the party?

Not at all. I think that we are still catching the wave early.

RICK is today barely starting to gain recognition for its achievements. It has grown in size, proven its concept, and its valuation has expanded a bit.

But it remains small, has a long runway of growth ahead of it, and its valuation remains low even today.

It owns only 52 clubs, but this year alone, it bought another 15 already, and its growth is now accelerating. RICK is able to acquire so many clubs because it generates a lot of cash, it gets favorable seller financing terms, and it can often also add a mortgage on the real estate that’s associated with the club. Finally, increasingly many club owners are now also starting to accept equity in RICK in exchange for their club, lowering the cash component of their acquisitions even further.

All in all, we think that RICK has a clear path to ~20% annual FCF per share growth as it keeps consolidating the adult nightclub industry.

As it keeps executing this strategy, and more investors catch on to the story, we think that the company’s FCF (free cash flow) multiple will also expand materially. Even after all the recent appreciation, the shares are still priced at just 8.5x FCF, which is exceptionally low for a company that’s expected to grow so rapidly. Its multiple could double and it would still be reasonable.

If you expect the company to grow its FCF per share by ~20% CAGR over the coming 5 years and also expect its FCF multiple to expand to 17x FCF, then it would 5x your money. I think that this is quite realistic, but even if the multiple remains unchanged, you would still nearly triple your money.

That makes RICK an utterly attractive investment opportunity for long-term-oriented investors who understand the advantaged economics of its business and have the patience to wait for the thesis to play out.

This is why RICK is my largest holding by a large margin. My second largest holding is not even half the size of my holding in RICK. (Quick side note: most of my shares are held in a separate account of my company. Our Core Portfolio also holds a position but it is not as large because the dividend yield is too low for our yield-focused strategy).

And because I own so much of it, I was especially happy to get the CEO, Eric Langan, on the phone to discuss their future plans.

Eric built the XTC Cabaret nightclub brand and later merged it into RICK in 1998, which is when he became the CEO of the company. Two decades later, the company is still owner-operated, and Eric has the vast majority of his net worth invested in the stock of RICK (more on this in our interview below!).

Eric Langan is on the left (RCI Hospitality)

We first provide a summary of all the main takeaways. We then also share a transcript of our call. Finally, we discuss the valuation and risks of the thesis. Please note that some responses have been slightly edited for improved clarity:

Main Takeaways:

- I am more bullish than ever.

- They expect to grow their FCF per share by up to 30% per year in the next three years.

- They have a window of opportunity to acquire many adult nightclubs right now and have the money for it.

- They are in advanced talks for a few new deals already.

- They are able to grow the cash flow of new assets by 15-20% within a year from the acquisition, which is very significant when you consider that they are only paying 3-5x EBITDA for these assets.

- Despite rising interest rates, they are still getting very favorable seller financing rates because they are the buyer of choice.

- They expect to open 6 new Bombshells sports bars in 2024 and are buying the dirt for them right now. They are delaying construction for now because construction prices are too high and they have better opportunities on the club side of their business.

- RICK’s CEO has 84% of his net worth invested in the stock and has no plans to sell because he cannot get better returns elsewhere.

- They will continue to go after retail investors to grow the multiple of the company.

- Adult nightclubs aren’t going anywhere.

Q&A with Eric Langan, CEO of RICK:

1) My first question is regarding your acquisition pipeline. I would like to know if all the recent uncertainty (the talks of a recession, the war in Ukraine, and the rising interest rates,…) has pushed more club owners to consider selling? Perhaps they may think that now is a good time to sell before we potentially go into a recession. Has this led to more calls from club sellers that are looking to sell?

I mean, I don’t know why we’re getting the calls, but I just know we’re getting them. Everybody has different motivations. I think guys are older and they’re considering their options. I think Covid helped a lot with that cause guys were closed down and they realized without their clubs how different their lives were. And so, I think as they’re older now, they’re looking for more certainty as most people would do. And getting a 20-year annuity or 15-year annuity from RICK (seller financing) seems like a pretty good idea to most of them that we’re talking to right now.

Some of them you’re going to see a deal with a 7-year payout and it’s because the owners are all in their 80s and they’re like, “I don’t know if I’ll be here 15 years from now. I need my money now”. So, we negotiate the term to meet their needs. The beauty is that we are able to negotiate basically anything we want to meet the needs of the seller. I think that’s why more and more are coming to us. We always like to say we’re the preferred buyer for most of these sellers and that’s becoming more and more true as they’re learning about our ability to be flexible.

2) How are the talks going with the potential sellers at the moment?

We’re working on several deals. I’ve probably talked to a new owner every week. We have many brokers calling me right now. A lot of these are clubs that we are not really that interested in. They are in markets like California. Everybody in California wants out which is a tell-tell sign of why I don’t want to go to California. If everybody in the market wants out, why would I want to go there?

But yeah, there’s plenty of stuff on our plate to keep us busy for the foreseeable future. And then in case it dies down, I’m really heavy loading new stuff like Bombshells into 2024 openings [Jussi’s addition: Bombshells is a sports bar and restaurant chain that RICK also owns. Our thesis is focused mainly on the clubs but it is a nice addition to the business. You can learn more about it by reading our full investment thesis.]

So I want to be able to consistently grow at between 20% to 30% per year. Now I know we’ve guided for a 10 to 15% growth rate but I think we’ve got this little window of opportunity here where we can grow faster.

But it takes a lot to grow 30% now, right? When you’re doing $300 million in revenue, 30% is a lot of revenue. It’s not like, oh I just need to go buy $30 million or $40 million more dollars in revenue. It’s $90 million and that’s soon going to be $120 million so it starts becoming pretty large numbers.

I would like to do consistently 30% over the next three years. We got 2023 and I think we’re going to have 2024 in the bag with the people we’re talking to and we got a lot of time to hit that 30% in 2024.

I think from there, as we get 12 months down the road and we start looking at 2025, then I’ll have a better feel of whether it is going to be easy or is it going to be hard to give you that same growth rate. And look, we may roll back and say, look guys, we’re going to go back to 10% or 15% growth for a little while.

3) Assuming you find enough deals to grow at the 30% place at 20 to 30% per year, would you be able to finance all of them organically? My understanding is that you wouldn’t really need to tap the equity market since you have so much cash on hand, retain cash flow, you have the seller financing option. Is it fair to assume that you could grow at a 20% to 30% rate, if you find the acquisitions, without raising any more equity?

Yes. I think we can spend $200 million a year for the next three years between debt and cash without issuing any new equity. After that, it could get difficult because I don’t want to go over three times debt to EBITDA ratio.

Even though because of our real estate ownership, we could support a 4x because we don’t pay rents. But I’m much more comfortable with the 3x. I mean our debt is so easy to manage right now. We even managed it through covid, right? I mean we were closed, and we still managed to pay our debts and we didn’t have to sell any equity. We also didn’t have to sell any assets with no revenue for over five or six weeks. So, some stuff wasn’t up for 14 months. New York and some of the Northern clubs. So that’s why when people say, “Oh your debt, your debt”. I’m like: what debt? Our debt is so manageable. It’s more manageable than it’s ever been. It’s the lowest debt-to-EBITDA level I think this company has had since I took over in 1999.

4) You recently announced the acquisition of a new club, and your seller financing portion only had a 6% interest rate. I think a lot of people were surprised at the low interest rate, given the recent surge in interest rates. Do you think that you’d be able to keep closing these deals with these relatively low interest rates? Or do you expect your seller financing rates to go up materially from here?

I mean we’re negotiating another deal right now that will be 7% but it’s 20 years. So, I give them the extra point and they give me five more years. So, I was like yeah, I’ll give you a 7% but I said let’s make it 20. The guys were like, that’s fine, I want money for the rest of my life. So what’s one point when I get five more years? Right? Cause to me, it is not how much is the interest rate. It is how much I can make each month. I’m in the cash flow business. The more I give him, the less cash I get to keep from the operation. So, if I extend it and pay him a little more interest but I pay it for five more years, the actual cash per month that goes out is less. So, I actually increased my cash flow by paying more interest and the interest is deductible anyway. So not a big deal for us.

5) How much value added is there typically in a strip club acquisition? My understanding is that it is quite a bit since a lot of owners are not sophisticated, you have synergies, and economies of scale. There may also be some cash leakage that’s not reported. How much can you really expect to typically grow the cash flow as you take over?

15% to 20% is typically what we’ve seen over the course of a year.

You got to keep in mind a lot of times, and this is in no way knocking the business operator, but they’re not very sophisticated. They’re basically gentlemen club operators so they’re not too sophisticated.

We don’t just take over, we change some of the concepts, we change the pricing, the menu, and things like that. When you go to an ice cream shop, they sell one scoop for $1, two scoops for $2, and three scoops for $3. When we come in, we don’t do that. We’re like you get a cone, single scoops for $5 and you get sprinkles as well. You get a double scoop for $6.50; you get a triple scoop for $7.50, right? We raise that bar at the very minimum and we change concepts like that. We introduce new things like waffle cones and things like that.

When we take over what I’m seeing immediately is instant optimization on the revenue side because we change the pricing format, we change what we’re offering, we change how they run the business and then we change their vendors and get cost synergies to squeeze more EBITDA. There’s probably also some shrinkage, especially when the owner is absent, and we know how to stop that.

It’s the forced appreciation aspect of our business.

6) Previously you’ve had this $65 share price threshold for buybacks. Is that threshold still in place or are you planning to increase it sometime in the future? What do you think of it?

It is still in place. I haven’t raised the price yet at this point. I probably should. But we have so much on our plate for acquisitions that I don’t want to get to the point where I take on too much debt or new high interest debt. So we’re letting the cash just kind of build but we are also putting that cash to work all the time.

We’re getting a lot of assets that we’re paying cash for right now and at some point, we may take a bank loan out and pull all that cash back in. It’s like a safety account to me. I mean we’re not earning any interest to the bank, so it doesn’t do us any good to keep it on the balance sheet and there’s no sense of paying interest expense on debt that you don’t need

When I’m earning zero and I’ve got $44 million in cash, let’s just go spend the $4 million bucks to buy some dirt (for new Bombshells) and we’ll sit on. The dirt is appreciating and I’m not paying any interest while I’m waiting to build. When I do the construction loan, we’ll pull the cash back out and use the cash as a down payment for the construction cost.

7) Now that you mentioned Bombshells, I had one question on this topic. My understanding is that you’ve turned your focus on the strip club acquisitions in recent quarters since you seem to have a lot of opportunities there. Is that correct?

It is correct, but I am still doing Bombshells as well. I’m lining the bombshells to open every two months in 2024. So, I’ll open up six in 2024. We slowed down because construction costs went through the roof. I held construction for four months. We saved $700,000. The original bid was like $4.2 million on it and now we’re going to be all in probably at $3.5. So I just wouldn’t spend that much money. The ROI wasn’t there. We don’t have to start construction on any particular day unless the price is right. And so we’re running about four months behind my original plan of opening a store every two months.

8) Do you have any update on potential talks with franchisees or are those on pause right now?

No, we’re talking with them. Obviously, we haven’t been as aggressive because their building costs were too much. Right? The ROIs weren’t working. But now that things are coming back in line, if we go to a recession, I think it’s going to be great for us as I’m building seven bombshells and all these construction workers are going to be begging for work. My price is going to come way down. In fact, they are coming down already. They’re heading in the right direction for us.

The only thing I I’m worried about is obviously we’re not going to match the Bombshells sales of when the government was giving everybody free money. We’re going to get a lot of flak I think in the next few quarters. I mean our comps were up like 40%. So now we’re down. And so say they were down 15 to 20% year over year numbers. But what they don’t realize is that was after a 40% increase. So yeah, we’re giving part of that back but we always knew we were going to give that back. Those numbers were not sustainable. But we’re still doing ~$5.5 million per unit. Those economics are still very good when compared to peers. They just aren’t great compared to the free money era of 2021. Of course, Bombshells sales were up as people were going out drinking more, they were partying. It was a much larger number of people that could afford to come to our establishment. We’re going back to normal.

But I think December is going to be unbelievable for us. I mean I could be wrong, but I think that the amount of corporate and work-related parties that are going to go on this December at our clubs and restaurants are going to be huge because you got those return to the office and everybody hates the office.

In October they started making everybody come back. They say New York is supposed to be at 80%, 85%, but I’m hearing from people that it is around 65% because they’re still having a lot of people that are pushing hard, still working from home and companies aren’t firing them yet. But as we enter this downturn, companies are going to gain some of the power back. All these people are getting laid off. You want to work from anywhere. Program is over. Get your ass to work if you want your job.

That’s going to come to an end at some point and I think companies are going to do something for the employees to show appreciation for the ones that are showing up. You got to hold hands a little bit. You got to pat them on the back. And I think a lot of that’s going to be with Christmas parties and events.

More people at the office will also lead to more people going to Bombshells for lunch, but that’s not a big profit center for us. The 10pm to 2am window is the biggest. Lots of appetizers and lots of drinking.

9) I think I’ve read somewhere that you have a very significant portion of your net worth tied to the stock of RICK. I think it was something like 90%. It is typical for executives to have come concentration to their own company but in your case, it is quite extreme. How do you think of it?

I just had to do a personal financial statement for the banks and about 84% of my net worth is my RICK stock right now. And that’s based on my October 28th financial statement.

I picked up some real estate. So I’m getting some value in some commercial real estate development stuff that I’m doing. But the majority is RICK and my focus has always been RICK.

Where am I going to put the money where I’m making the returns?

If I’ve sold the stock and put the money elsewhere, where could I have made 900% in the last 10 years?

Everybody says, well yeah, but all your money’s in one basket. I say, yes, but I guard that basket well. I have the best attorneys and I have a great team. I’m the most motivated person to protect our assets because they’re mine. All of my net worth is in those assets. I got to make sure those assets are taken care of.

It just took me a lot of years to realize and get the right financial advisors. I was never a public company guy. I was a true club operator. I mean my whole youth, I worked in strip clubs 17 hours a day. I got paid to party every single day. I was up till six o’clock in the morning, four o’clock in the morning, slept till noon, got up, worked, did it all again, get over and over and over again, right? Wash, repeat. That’s what I always say. And then all of a sudden one day I decided I want to be a public company.

10) I’ve seen a lot of the work that you’ve done on social media with Mark Moran. As an example, you were recently on Barstool Finance. Do you have any other things like this lined up in the near future?

Yes, we’re talking to some guys about some podcasts but I’ve gotten very busy. I’ve been home for about 11 days and in the last eight weeks cause I’ve been traveling so much, but my schedule should slow down a little bit through the holidays. I will be home a little bit more. So yes, I’ll definitely start reaching out. I’ve got a bunch of direct messages on my Twitter that I have said “look, I’ll come back to you eventually.”

The nice thing is from December 14th through February 14th, a lot of news comes out for us, right? You’ve got the 10K, then you’ve got the first quarter sales figures on January 10th, and then February 9th or whatever, the earnings for that the first quarter comes out. I think we’ll also hopefully have two acquisitions that will pop somewhere during that time period or right before or after. One will be a decent size acquisition. And so there’s going to be a lot of news in that time period and it will be a good time to do shows and get out there and I’ll try to reach more retail investors.

And everybody says “but what about the institutional investors?” I say we’re picking up the institutional investors because they’re watching these retail investors buy our stock and they get FOMO. They go, “oh if this thing goes meme. I’m going to miss out. Oh I better own some of this. It’s going to hurt my performance if I don’t versus my peers who do.” And so it just all feeds itself.

11) I think it’s brilliant. I think it’s really good what you’re doing with Mark to get more people talking about your stock and it seems to be working. You probably would have a bit of a hard time convincing some of those institutional guys anyway given the nature of your business. You may as well go after retail investors who are not subject to the same institutional constraints.

What really convinced me to do this is the number of fund managers that I meet who tell me that they own my stock in their personal IRA, but can’t put it in their fund.

They say your stock is great. I own it but my fund can’t own it. And I thought, well how do I reach to all these guys and just get a bunch of small guys just own 5,000 shares, instead of trying to get some fund to own 250,000 shares of my stock? Why don’t I just go get 5,000 people to own 500 shares of my stock?

I think I need 9 million people to own one share and all my stock’s gone. If 9 million people bought one share and would never sell it, our stock would trade at a much higher multiple. I mean that’s just the reality because of supply and demand. Somebody’s going to want to own it. Somebody else is going to come to pay more for it because they have to.

12) Yes it’s very doable with social media these days.

Yeah, 9 million is nothing, right? I mean, Elon Musk has 135 million followers. If he comments on one thing I post ever, I’m going to jump 30,000 followers over tonight. I interact with him all the time. I get so many of his followers and then they see what I post and then they start posting or commenting and it just grows.

13) One of the risks that I think some people worry about is whether strip clubs will lose in popularity in the long run. What’s your counterargument to that?

Let’s put it this way: marriage has a higher probability of going out of style than my business. That’s because there’s no upside in marriage. The beauty is there’s always upside in men chasing after women. We’ve done it since the beginning of time. It’s in our DNA. We can’t change it. And until that goes out of style, all of a sudden men don’t want women anymore. I don’t think my business is going anywhere, as long as I package it correctly. The underlying thesis is there forever.

And I think what people are missing about technology is that we need human interaction. Humans need it. All you got to do is look at the prisons and what do they do to torture people? They put them in solitary confinement and then when they come by solitary confinement, they are the model prisoner. Why? Because they’re starved for human interaction. I read these stories. I hate to use this as an example, but there are abuse victims who start developing a relationship with their abuser because it is the only human interaction they’re getting. So human interaction’s never going out of style. Never. They’re never going to end human interaction because we need it. Our veins, our bodies physically need it to function and so the trick is to get these kids off their computers, away from their screens, or even better bring your phone to the club.

You’re not supposed to record but even that’s getting more normal. A lot of these younger kids, if you’re 25 years old or under, your video is all over social media. Some TikTok, Instagram, Facebook, Twitter, wherever. You’re already out there. They’re not afraid of it. They embrace it, they welcome it. “Oh, can I tag you? Can I tag you?”

The new generation is a remarkable generation for industry. People are not realizing it because everybody keeps saying “Oh all these old men are going to quit going to your places and your customers aging out.” They say this because they have seen it happen to other adult stuff that failed to change and adapt. But what they miss is that the new generation doesn’t typically get married till they’re 35 years old typically, right? So that’s a lot of free time for them to be single to go out and spend money and they want to flex. The difference is the old clubs used to take the big money spenders in the back rooms, right?

Private rooms, dark corners. Cause they didn’t want anybody to see them. They didn’t want anybody to know they were there because they were married. These young kids aren’t married, they don’t want to lie. They want to be up in front of the main stage. They want to throw thousands of $1 bills up in the air, making it rain, and want everybody to see them. When the bottle service comes, they want everybody to know that I’ve got a bottle on my table. And we just had to adapt to that. It’s a nightclub now. It’s more nightclub than what I consider to be an adult entertainer strip clubs. But it’s super easy. It’s not a different model. At the end of the day, you’re just repackaging the same product, which is the entertainers, and how you package and present is all that matters. And this demographic wants their entertainment packaged in this way. So we just package it in their way and bring them in.

14) Obviously, you need human interactions and people will chase after women. That’s not changing. But you don’t need to go to a strip club to do that. In fact, you probably don’t want to go to a strip club to chase after women. The few times that I have ended up in a strip club have typically been after a night out. Perhaps it has been a bit boring and a friend might joke about going to a strip club and that’s how you end up there. But is that here to stay?

No, you’re not chasing the women. See that’s the misconception. It’s like trout fishing. It’s all catch and release. Nobody wants to actually catch the fish. You really catch it, but you don’t want to take it home. You don’t want to eat the fish, you just want to catch the fish and let it go. The key, right?

But that’s why our industry has become so late night. In the 1990s all strip clubs closed as soon as you stopped selling liquor at 2am in the morning. Today, most of our clubs close at 4, 5, 6am two or three hours after liquor sale stopped. And why? Because like just said, I don’t go to strip clubs all the time, but when I do go is because I went out to a club, my date didn’t work out, or the club was just not happening that night and I don’t want to go home.

I’m not ready to go home. In other words, I haven’t had enough human interaction. I didn’t get my feel of hitting on women or women hitting on me or whatever it is.

RCI Hospitality

Valuation

Ever since it changed its capital allocation policy in 2016, RICK has grown its FCF per share by ~20% per share and that’s despite the pandemic, which was arguably the worst possible crisis for RICK.

Even better, the management thinks that they could grow their FCF per share by closer to 30% per year in the next few years.

How much would you be willing to pay for such a rapidly growing business? Not just that, this is also a business that enjoys a strong moat, high barriers to entry, near-monopoly-like economics in its local markets, and a very predictable path of growth via consolidation.

I would argue that it deserves a fairly high multiple, and yet, the company is priced at just around 8-10x FCF depending on the assumptions that you use.

Last June, when we initiated our position, we explained that the company was expected to exit 2022 with ~$100 million as its run-rate EBITDA. Remove ~$10 for taxes, ~$5 for maintenance capex, ~$7-8 interest expenses, and you are near ~$80 of FCF.

But this math is changing rapidly with the recent acquisitions.

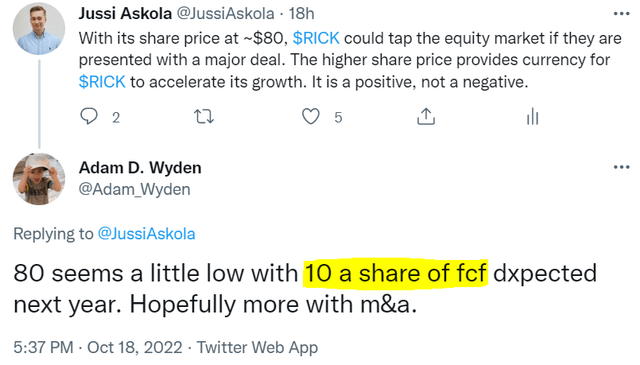

The EBITDA run-rate has already probably jumped to ~$105 million and potentially a lot more by next year. The company’s largest shareholder, Adam Wyden, believes that the company is set to deliver $10 of FCF per share in 2023:

If you use our more conservative assumptions, RICK is currently trading at around 10x FCF.

If you use the more aggressive assumptions of Adam, then it is priced at closer to 8.5x FCF.

Either way, it is very cheap relative to its growth prospects.

How many companies do you know that trade at <10x FCF and can grow their FCF per share by >20%?

I don’t know any other.

Risks

The biggest risk is that strip clubs lose in appeal in the long run. But did you notice that I did not even use the term strip club in this article? That’s intentional. It is because RICK has adapted to the changing world and their assets have become what they call “adult nightclubs.” They are closer to a regular nightclub with additional adult entertainment. I believe that this risk is also greatly mitigated by the fact that RICK only buys high-quality clubs that are dominant in their markets. A small club in a declining city will do poorly over time. But the biggest adult nightclub in the world, Tootsie’s, will do fine as Miami keeps on growing. It still remains a risk to keep an eye on.

Secondly, a lot of investors worry about legal risks. As an example, what if a club loses its alcohol license? Obviously, that would be bad news for RICK. Fortunately, RICK is well-diversified with over 50 clubs, each put in a separate LLC, and they are located in many different municipalities. They also have decades of experience dealing with legal risks.

Thirdly, RICK also owns a sports bar and restaurant concept called Bombshells. This business is successful today, but it is riskier since it does not enjoy the same barriers to entry. If Bombshells eventually failed, it could hurt the credibility of the management and cause its share price to decline. Ultimately, I think that the biggest story is the nightclub business and investors should focus on that.

Finally, the most obvious near-term risk is a recession which could hurt discretionary spending, including nightclubs. I think that it could cause a dip in cash flow, but it does not concern me that much because RICK has a fortress balance sheet with $35 million in cash and low debt. Moreover, it would only be temporary and it would also provide many opportunities to acquire peers at even lower valuations. Finally, adult nightclubs are not as cyclical as you might think. Alcohol sales tend to go up in a recession and people still want an escape. RICK’s CEO has previously said that its business is not “recession-proof, but recession-resistant.” RICK’s CEO will host a Twitter Space call on Wednesday at 4:30PM EST in case you are more curious about this topic.

Bottom Line

RICK is my largest position and I am happy to keep it that way. I will continue to accumulate more shares month after month because I think that it will earn me a multiple of my investment in the coming years.

They have an economically advantaged business that earns alpha-rich returns and they have a clear path to rapid growth. The market is still pricing it at just ~8.5x forward normalized FCF, but as RICK keeps growing at 20%+ in the coming years, we expect the multiple to eventually expand closer to 15x.

Without any multiple expansion, investors have the potential to triple their money over the coming 5 years. If the multiple expands, they could get closer to a 5x and that’s actually far short of what they have achieved in the past:

We are increasing our Buy Under Price from $90 per share to $120. As a reminder: I have no clue how RICK or any other stock will perform in the short run. All I know is that its business is likely to generate significant returns over the coming 5-10 years and that’s all that matters to me.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment