Drew Angerer

A new year is approaching and it seems a majority of experts now expect a recession. I personally have expected a recession since May, 2022, when I wrote three articles detailing why. These articles can be found here, here and here.

In those articles I gave 17 reasons, of which inflation and high interest rates are just two. There is of course, no certainty a recession will occur. But as an investor it is best to have investments that will work in a recession, when one appears likely. That is because most investments do poorly. This investment can be a hedge for your portfolio, or strictly offensive, to take advantage of the situation.

The Investment

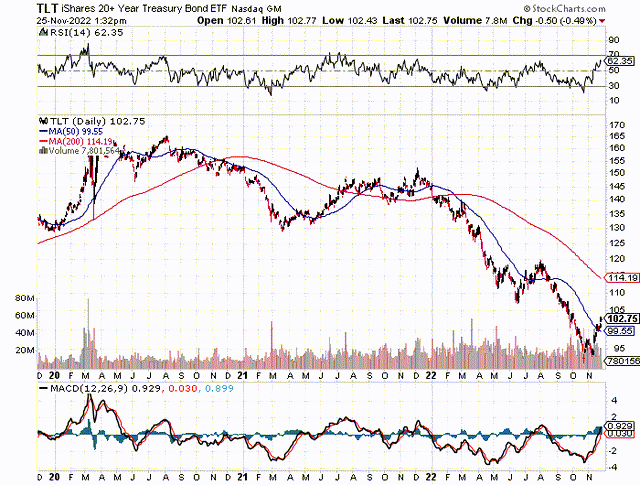

The investment is the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT). This is an investment opportunity that is relatively safe and primed to do very well in a recession. A three year history of TLT is shown below.

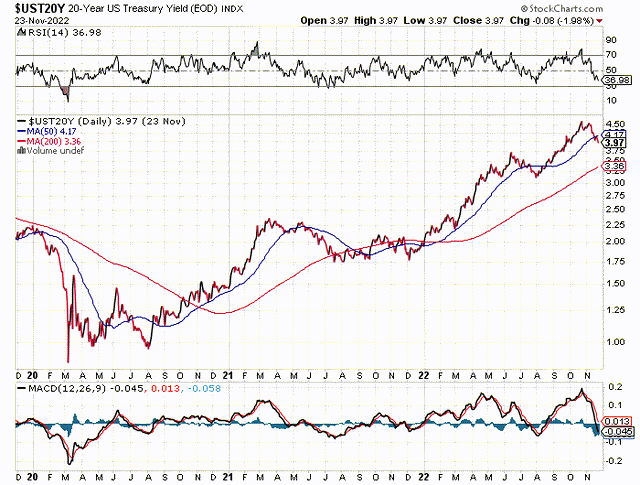

Below is a 3 year history of the 20 year Treasury yield. You will notice when comparing the two charts, the yield is the inverse of the price. That is, the price goes down when the yield goes up and vice versa.

A year ago, the 20 year treasury yield was 1.90% and the TLT price was $150.53. As of November 25, 2022, the yield is 3.97% and the TLT price is $102.90. A return to yields of a year ago would provide a 46% return plus interest.

One positive thing about this investment is, if rates don’t go down, you can just hang on to it and collect what is currently 2.56% interest while you wait for rates to come back down.

Why Lower Rates are Coming

What almost always happens in a recession is long and short term interest rates go down. This is due in part to the Fed, but also less demand for loans. Keep in mind, pricing is supply and demand. Recessions reduce demand for loans as less businesses are trying to expand and consumers scale back purchasing. Less demand for loans results in a lower yield. This is partially offset by more demand by the government to fund a higher deficit.

Regarding the Fed, they almost always lower interest rates once it’s clear we are in a recession. There is a complicating factor this time with inflation. The Fed has signaled they will keep rates high until they lower inflation to around 2%. However, the two most likely scenarios in my opinion have the Fed lowering rates in 2024 if not earlier. The first is the Fed succeeds in lowering inflation to its target so has no need to continue its restrictive monetary policy. The second is, in a recession political pressure intensifies for lower rates forcing the Fed’s hand to lower interest rates. The deeper the recession the more pressure builds.

There is also the issue of the impact of high interest rates on the U.S.’s massive debt. The longer interest rates stay high, the larger our deficit gets. There is only so long they can stay high before it does too much damage. There will be pressure for that reason alone to get rates back down.

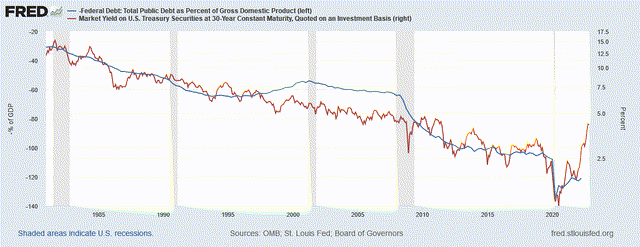

Further, one of the most powerful economic factors out there is reversion to the mean. The mean for long-term bonds is a yield of 2-3%. The chart below shows long-term yields have jumped well above the mean and its historical correlation to the amount of public debt. It also shows long-term rates have been on a 40 downward trend.

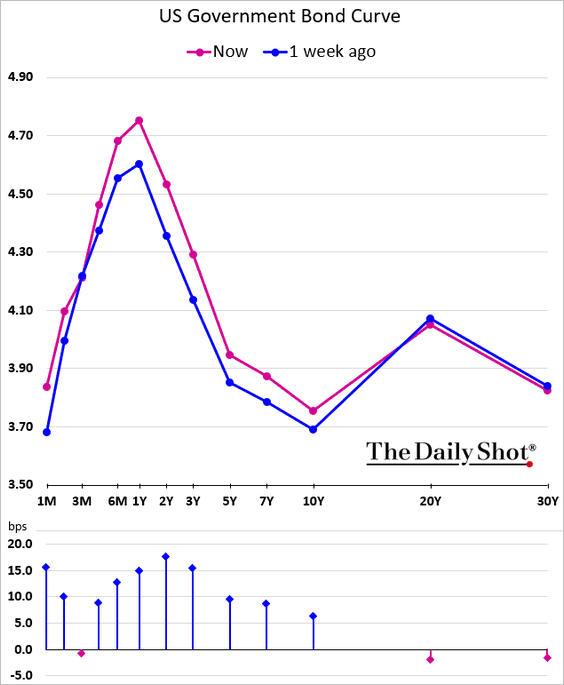

So you might ask, why the TLT which is a billed as a 20 year+ treasury index, instead of say the 10 or 30 year? First of all, look at the chart below (as of November 23, 2022). For some reason, the 20 year has a higher yield right now than the 10 and 30 year treasuries. That means it has more room to drop.

The Daily Shot

Another reason is, there is an ETF for the 20 year+ treasury, the TLT, and not one for the other two. However, you can always buy an individual 10 to 30 year treasury bond. The TLT is slightly more liquid. It is a little easier to buy and has less of a spread between the bid and the ask. But all are very liquid. The main reason is the 20 year yield has more room to fall, indicating more profit potential. The 20 year treasury also will go up in value much more than the 10 year due to effect of time on yields. The 30 year will go up more than the 20 year but is starting lower, and usually ends higher. Buying a 30 year individual treasury bond is also a good choice.

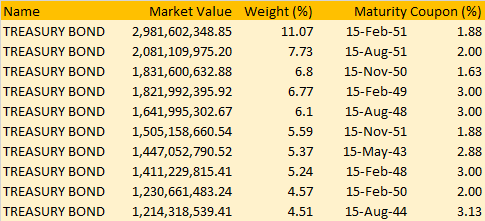

If you look at the holdings of the TLT itself, it has about an average of 25 years to maturity on its treasuries as shown by the ten largest holdings below.

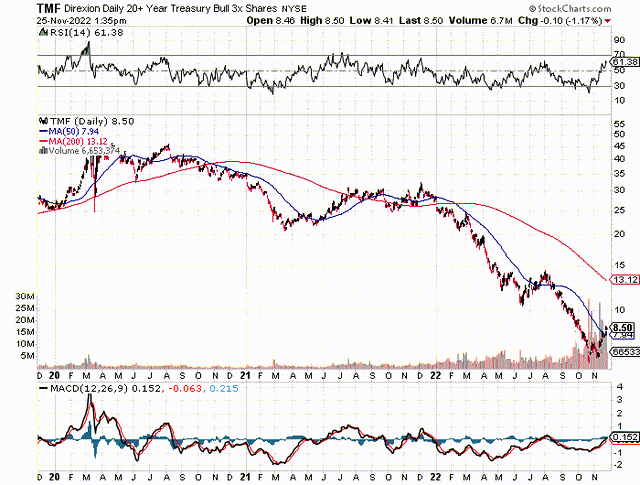

Direxion

Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF)

There is another alternative to the TLT some investors might consider to further leverage their return under the ticker TMF. This ETF by Direxion leverages the TLT 3 times. Theoretically you can get 3X the return over the TLT. However, Direxion cautions this ETF is for short term use only due to the complications of readjusting debt and compounding daily. I actually called them, and without my prompting, the rep made it clear this is just for short term trading. For that reason I do not recommend it for a one to two year time horizon.

Concerns

Less liquidity in treasury market can be an issue for lowering longer term interest rates due to less buyers. For example, the Chinese have been selling their treasury holdings, reducing demand and increasing supply. With more and more supply of treasuries (due to our massive deficits) there is a question of where the buyers are going to come from. This should be partially mitigated by a flight to safety in a global recession and quantitative easing.

The Fed impacts longer term interest rates primarily by quantitative easing or quantitative tightening instead of by fed funds which are a daily rate. Fed funds do have some impact on longer term rates. Quantitative easing is a much more difficult tool for the Fed to effectively use than fed funds.

If inflation is not subdued, there is the risk long-term interest rates can go significantly higher. While many types of commodities and shipping costs are actually dropping right now, wage and services inflation are barely budging. These make up a large portion of inflation. Wage inflation in particular is sticky, meaning it is harder to tame. I recently wrote an article titled Higher Wage Inflation Is The New Normal. It concludes that due to demographic and secular trends, we are probably stuck with historically higher wage inflation, except during recessions. The initial jobless claims number of 240,000 last week appears to show beginning of a weakness in the labor market.

Takeaway

The most likely direction of longer term U.S. interest rates in 2023 is down for a number of reasons. These include the Fed pushing it down, our huge public debt, a 40 year trend of lower rates, and reversion to the mean.

As mentioned earlier, the two most likely scenarios are

1. Inflation is tamed and the Fed pushes rates come down within 18 months

2. Inflation stays relatively high, but a recession politically forces the Fed to push rates down

Once a recession gets going, I expect longer term interest rates to drop quickly, with fed funds going close to zero. The Fed is known for pushing interest rates down quickly in a recession. The TLT is currently trading at $102.90. A return to where it was a year ago, before the Fed started raising rates to fight inflation, takes it to $150.53. That is a 46% return plus interest income. My timeline for this is 18-24 months.

You of course can also buy an individual 20 year treasury with a coupon of 1.80 to 2.00% (those that were issued a year ago) for about 65 to 70 cents on the dollar, and get a similar return. A 30 year individual treasury bond provides even more upside. If you want to take more risk consider the same for investment grade corporate bonds.

TINA is Dead

In March of this year, I wrote an article titled The TINA Era Is Over: Time To Buy Bonds Again.

Until this year, interest rates had been on a 40 year downward spiral for secular and demographic reasons. For those reasons, and our massive government debt, they are likely to stay low except during economic overheating. The current 4.0 – 6.5% yield for longer term investment grade government and corporate bonds is an anomaly unlikely to last. Now is the time to lock in long-term bonds. If you buy a 20 year bond, even if rates temporarily continue to go up, over 20 years it’s likely you will have locked in an above market rate. I always get call protection on my corporate long-term bonds for this reason.

Be the first to comment