10174593_258/iStock via Getty Images

“The Wild Bunch”

Directed by Sam Peckinpah, The Wild Bunch was released in theaters in 1969. Rated as one of the all-time greatest Western movies, it’s a powerful tale of an outlaw gang bound by a code of honor in the changing world of the early twentieth century. Inspired by the title of this epic film, a monthly magazine entitled “Il Mucchio Selvaggio” was launched in Rome in October 1977. Its focus was primarily music, cinema, and books. The first issue was 36 pages long and included articles about Crosby, Stills, Nash & Young, David Bromberg, The Animals, Jesse Winchester, and an interview with Neil Young, to whom the cover was dedicated.

From that very first issue, I anticipated each month’s issue and immersed myself in it to discover groups and soloists I had only heard others talk about, maybe from an older brother of my high school classmates, but had never heard myself. At the time, I was just over seventeen years old and the pages of the magazine fed my adolescent desire to escape to distant worlds, imaginary or real. I dreamed of a musical America that featured rough, slow country voices, trailed and accompanied by tired guitars, which I imagined played under the scorching mid-west sun.

One day, I was discussing an article I’d read in the magazine about guitarist Norman Blake with an older boy who frequented the square in front of the high school where my classmates and I met every day. As it turned out, he owned an imported album by Norman, “Live at Mac Cabe’s.” He recorded the album on tape and gave it to me, making me a happy man. Anyone who came to my house was obliged to listen to it and “take a lesson” on the guitarist. Blake was relatively unknown in Italy and having a recording by him made me a rare and fine connoisseur… at least in my own estimation.

My Personal “Wild Bunch”

After more than forty years, I must admit that in certain moments I still feel like a rare and fine connoisseur when I speak of CEFs, which in my country are unknown even among many investment professionals. To tell the truth, at certain times I have the impression that CEFs are children of a lesser god in America as well. This impression is borne out by the fact that Morningstar recently eliminated a very useful chart showing the NAV performance from the “quote” page of every CEF. (Fortunately, the chart page is still available from this link; simply change the CEF ticker in the URL to the fund for which you want information and press Enter.)

My entire investment portfolio, which I think of as my “wild bunch,” revolves around CEFs, with some ETFs/ETNs and a few individual stocks thrown in to broaden the range of investment sectors and strategies covered. This article provides an overview of the overall composition of my combined portfolios after I made adjustments reflecting recent market movements. These adjustments affect both the portfolio composition as a whole and the weights currently given to individual positions.

My Guiding Strategy

As I’ve stated in previous articles, despite the negative returns due to inflation, I tend to lighten my positions and sit on cash for a while when the markets repeatedly mark new highs, as they did in 2021. Then during periods of decline I look for new investment opportunities.

I seldom use the proceeds generated by the lightening of my portfolio to repurchase securities that I sell unless they fall below my load price. When I do make a purchase, it is usually in small lots. With each purchase I try to take advantage of any sell-off and avoid mediating the load price upwards. Instead, I try to use any additional purchases to average the load price downward.

Obviously, this approach can lengthen the time required to create a new position or expand an old one, but this way I create a sort of “safety margin” to protect my portfolio.

The recent declines caused by the war in Ukraine allowed me to apply this strategy to all three of my portfolios. I expanded some positions that I had opened previously and opened new ones.

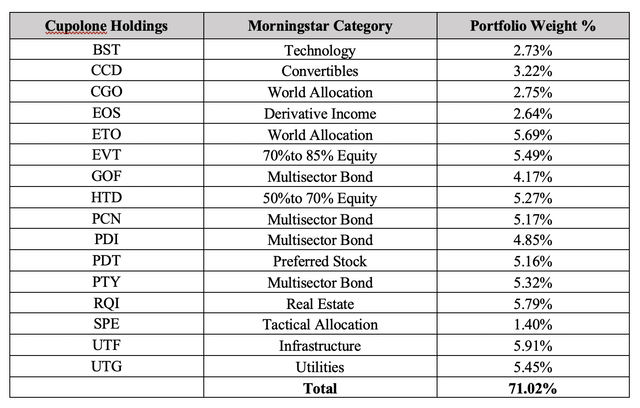

Cupolone Income Portfolio

My Cupolone Income Portfolio (named after Brunelleschi’s Florentine dome) is my primary investment portfolio. It now contains sixteen funds and is a mixture of securities representing various investment sectors. All sixteen funds pay a monthly distribution.

- BlackRock Science And Technology Trust (BST)

- Calamos Dynamic Convertible and Income (CCD)

- Calamos Global Total Return (CGO)

- Eaton Vance Enhanced Equity Income II (EOS)

- Eaton Vance Tax-Adv. Global Dividend Opps (ETO)

- Eaton Vance Tax-Adv. Dividend Income (EVT)

- Guggenheim Strategic Opp (GOF)

- John Hancock Tax-Adv. Dividend Income (HTD)

- Pimco Corporate & Income Strategy (PCN)

- Pimco Dynamic Income (PDI)

- John Hancock Premium Dividend (PDT)

- Pimco Corporate & Income Opportunities (PTY)

- Cohen & Steers Quality Income Realty (RQI)

- Special Opportunities Fund (SPE)

- Cohen & Steers Infrastructure (UTF)

- Reaves Utility Income Trust (UTG)

In accordance with the parameters in my reformulated “rule of thumb,” which I described in a previous article (“CEF Focus Investing–Everything You Always Wanted to Know About Total Return”), I have recently increased my positions in the latest funds added to the portfolio (BST, CCD, CGO, EOS and SPE) while I decided not to increase my initial position in Cohen & Steers Select Pref & Income (PSF), so I liquidated it during the recent rebound, albeit with a small loss.

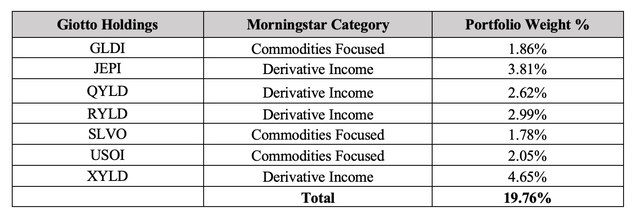

Giotto Covered Call Portfolio

My Giotto Covered Call Portfolio (named for the fourteenth-century painter and architect who designed the bell tower built next to the cathedral of Florence) is entirely dedicated to Exchange Traded Products ((ETPs)). It now contains seven securities, each paying a monthly distribution.

- Credit Suisse X-Links Gold Covered Call ETN (GLDI)

- JPMorgan Equity Premium Income ETF (JEPI)

- Global X Nasdaq 100 Covered Call ETF (QYLD)

- Global X Russell 2000 Covered Call ETF (RYLD)

- Credit Suisse X Links Silver Shares Covered Call ETN (SLVO)

- Credit Suisse X Links Crude Oil Shares Covered Call ETN (USOI)

- Global X S&P 500 Covered Call ETF (XYLD)

After the recent decline for Nationwide Risk-Managed Income ETF (NUSI), I decided to liquidate the entire position. The rise of dollar against the euro exchange rate following the events in Ukraine allowed me to come out at par. I used the proceeds from the sale of NUSI to increase my positions in JEPI, QYLD, RYLD and XYLD. I maintained my existing positions in GLDI, SLVO, and USOI (proceeds from GLDI, SLVO and USOI are the only ones that allow me to offset previous losses).

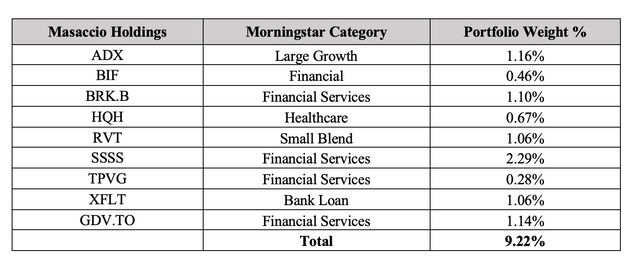

Masaccio Tactical Portfolio

My third portfolio, Masaccio Tactical Portfolio (named in honor of the Florentine painter who initiated the Renaissance), contains a completely different set of stocks compared to the first two portfolios, both in terms of strategy and type.

Masaccio is a malleable portfolio that will change from time to time in response to any needs that may arise; it may also be subject to stock rotation, new entries or sales at any time. I have not established any time horizon for this portfolio because I want to act without pre-established strategies.

I plan to use Masaccio mostly to take advantage of capital gains, with the goal of protecting my overall portfolio from the threat of inflation and only to a small extent for the returns it offers.

For now, Masaccio consists of the following nine securities, of which eight are American and one Canadian. This portfolio represents a big leap from the CEFs in which I usually invest, but therein lays the reason for its existence.

- Adams Diversified Equity (ADX)

- Boulder Growth & Income (BIF)

- Berkshire Hathaway Inc Class B (BRK.B)

- Tekla Healthcare Investors (HQH)

- Royce Value Trust (RVT)

- SuRo Capital Corp (SSSS)

- TriplePoint Venture Growth BDC Corp (TPVG)

- XAI Octagon FR & Alt Income Term Trust (XFLT)

- Global Dividend Growth Split Corp Ordinary Shares (GDV.TO)

I decided to liquidate, albeit at a loss, my previous position in China Fund (CHN) and I used the proceeds to buy positions in HQH and TPVG. TPVG is the first BDC to join the team in many years. (My very first portfolio contained BDC’s Prospect Capital and Gladstone Capital funds).

XFLT and GDV.TO (the latter is listed on the Canadian stock exchange) pay monthly distributions. TPVG pays quarterly distributions while ADX, BIF, HQH, and RVT pay quarterly distributions plus potential year-end distributions in December. The Warren Buffett holding (BRK.B), instead, traditionally pays no dividends.

SSSS paid six dividends at different times during 2021: its price has gone down a lot lately and I built a position at around $ 10 but the price has continued to drop. I will wait for developments before deciding whether to increase it.

Of the CEFs in this portfolio, three are leveraged, but two of them only minimally (BIF 11.63%, RVT 3.55%, XFLT 40%), while the other two (ADX and HQH) use no leverage. This is probably why the Masaccio portfolio showed less volatility compared to my other two portfolios at the outbreak of the war in Ukraine. And this is also the reason why some of my purchases have been a bit slow, given the difficulty of finding favorable entry points. It takes patience.

Weighing the Wild Bunch

Portfolio weight is the percentage of an investment portfolio that a particular holding or type of holding comprises. The most basic way to determine the weight of an asset is by dividing the dollar value of a security by the total dollar value of the portfolio. Of course, if the portfolio contains stocks or stock funds, the numbers change constantly as the price of the assets and the value of the entire portfolio changes with the movement of the markets. (Investopedia)

The following three tables show the weight percentage of each security in my portfolios, the “Wild Bunch,” as well as each portfolio’s weight in the combined portfolio.

As already mentioned, together, the three portfolios hold 32 securities: the Cupolone and Giotto portfolios hold 23 of these 32 securities and, with XFLT and GDV.TO in Masaccio, pay monthly distributions with a combined yield on cost of around 10%. (All data is as of April 1, 2022.)

Cupolone Portfolio (Author) Giotto Portfolio (Author) Masaccio Portfolio (Author)

Note that some positions for the recently added securities in all three portfolios are very small. In keeping with my overall investment strategy, I plan to complete them with future purchases in small increments when the opportunity arises.

With the financial markets facing global challenges in 2022, finding those opportunities promises to be an uphill battle. I do not want to use up my liquidity in one fell swoop, even knowing that lump sum investing makes it possible to fully benefit from an eventual rise in price. Under the current circumstances I prefer to be cautious and dollar-cost average on possible downturns.

I have no precise strategy for the weight assigned to each security other than to balance them within each portfolio. Because I consider the Cupolone my primary income portfolio, it carries more weight than the other two portfolios. However, the securities in Giotto actively contribute to the monthly income, while those in Masaccio diversify my overall investment exposure, also offering returns that I can use to “round up” my earnings over the course of the year.

Will the Circle Be Unbroken

The magazine “Il Mucchio Selvaggio” often spoke of the Nitty Gritty Dirt Band, which in 1972 released an unforgettable album: “Will The Circle Be Unbroken.” This album reflected how the band was trying to tie together two generations of country musicians and fans, linking the genre’s community today to its long-gone heroes.

When I managed to raise the necessary money, I bought the double LP, the cover of which, in my teenage eyes, represented the quintessence of America. In my imagination, the cameo with the photo of General Porter in black and white in the center, the flags, the handwritten cursive listing of the artists represented on the album… every element worked together to recreate the epic of the West and the legendary musicians who were part of it.

The iconic song that gave the album its title is an anthem of hope and perseverance, a message that life –and music– continues in the face of adversity. I modestly hope that my personal “wild bunch” portfolio, carefully designed and nurtured daily for months now, will be able to withstand all the adversities of the market for years to come. That should be the goal of each long-term investor, so that the circle will remain unbroken.

Be the first to comment