Funtay/iStock via Getty Images

A Quick Take On Multi Ways Holdings Limited

Multi Ways Holdings Limited (MWG) has filed to raise $16 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm rents and sells heavy construction and related equipment in Singapore and overseas.

With MWG attempting an IPO at $2.50 per share, I’m skeptical of the stock’s post-IPO performance over the medium term, as many Asian company IPOs at $5.00 or less have performed poorly.

While the low price may attract day traders seeking volatility, I’m on Hold for the IPO.

Multi Ways Overview

Singapore-based Multi Ways Holdings Limited was founded to provide sales, rental and refurbishment of heavy construction and related equipment in Singapore and the surrounding region.

Management is headed by founder, Chairman and CEO Mr. “James” Lim Eng Hock, who has been with the firm since its inception in 2002 and has extensive experience in the industrial machinery and heavy construction industry.

As of June 30, 2022, Multi Ways has booked fair market value investment of $5.44 million from investors including the founder.

Multi Ways – Customer Acquisition

The firm seeks customers in Singapore, Australia, the UAE, Maldives, Indonesia and the Philippines.

The company’s customer base operates in the infrastructure and building construction, mining, oil & gas and marine industries.

Selling and Distribution expenses as a percentage of total revenue have trended slightly lower as revenues have increased, as the figures below indicate:

|

Selling and Distribution |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

3.7% |

|

2021 |

3.3% |

|

2020 |

3.9% |

(Source – SEC)

The Selling and Distribution efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Distribution spend, rose sharply to 9.8x in the most recent reporting period, as shown in the table below:

|

Selling and Distribution |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

9.8 |

|

2021 |

3.2 |

(Source – SEC)

Multi Ways’ Market & Competition

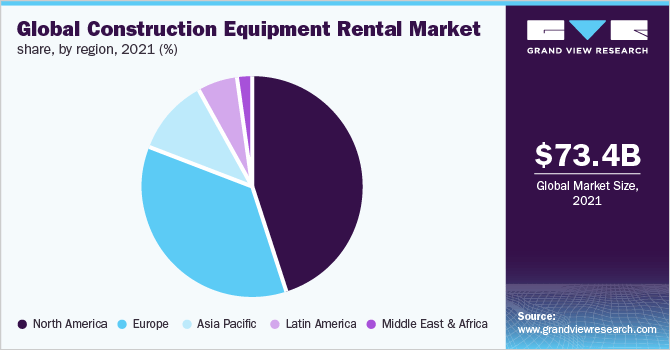

According to a 2022 market research report by Grand View Research, the global market for construction equipment rental was an estimated $73 billion in 2021 and is forecast to reach $103.6 billion by 2030.

This represents a forecast CAGR of 3.9% from 2022 to 2030.

The main drivers for this expected growth are an increase in government spending on public infrastructure in emerging markets worldwide.

Also, the chart below shows the global breakdown by market value and region:

Global Construction Equipment Rental Market (Grand View Research)

Major competitive or other industry participants include:

-

Tat Hong Holdings Ltd

-

Sin Heng Heavy Machinery Ltd

-

Antar Cranes Services Pte. Ltd

-

INA Heavy Machinery & Equipment Pte Ltd

-

Ahern Rentals Inc.

-

AKTIO Corporation

-

Caterpillar Inc.

-

Byrne Equipment Rental

-

Cramo Plc

-

Finning International Inc.

-

Liebherr-International AG

-

Kanamoto Co., Ltd.

-

Maxim Crane Works, L.P.

-

United Rentals, Inc.

Multi Ways Holdings Limited Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing gross profit and gross margin

-

Higher operating profit

-

Reduced cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 20,094,000 |

58.2% |

|

2021 |

$ 33,406,000 |

11.8% |

|

2020 |

$ 29,886,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 5,602,000 |

22.5% |

|

2021 |

$ 9,357,000 |

36.8% |

|

2020 |

$ 6,842,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2022 |

27.88% |

|

|

2021 |

28.01% |

|

|

2020 |

22.89% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$ 1,570,000 |

7.8% |

|

2021 |

$ 1,634,000 |

4.9% |

|

2020 |

$ (605,000) |

-2.0% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$ 1,212,000 |

6.0% |

|

2021 |

$ 1,456,000 |

7.2% |

|

2020 |

$ 1,319,000 |

6.6% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$ 501,000 |

|

|

2021 |

$ 5,630,000 |

|

|

2020 |

$ 1,656,000 |

|

(Source – SEC)

As of June 30, 2022, Multi Ways had $952,000 in cash and $42.8 million in total liabilities.

Free cash flow during the twelve months ending June 30, 2022, was negative ($587,000).

Multi Ways Holdings Limited IPO Details

Multi Ways intends to raise $16 million in gross proceeds from an IPO of its ordinary shares, with the company offering 5.2 million shares and selling stockholders offering 1.2 million shares at a proposed midpoint price of $2.50 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

The company is also registering a Resale Prospectus for two selling shareholders to sell up to approximately 3 million shares.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $90.5 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 21.3%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

We currently intend to use the net proceeds from this offering to expand and renew our fleet of heavy construction equipment, seek expansion opportunities through merger and acquisition activities, increase our storage facilities and capabilities, adopt information of technologies, and for general working capital and corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is ‘not a party to any significant proceedings in Singapore. We are not aware of any legal proceedings of which we are a party outside of Singapore.’

The sole listed bookrunner of the IPO is Spartan Capital Securities.

Valuation Metrics For Multi Ways

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$75,000,000 |

|

Enterprise Value |

$90,478,000 |

|

Price / Sales |

1.84 |

|

EV / Revenue |

2.22 |

|

EV / EBITDA |

40.30 |

|

Earnings Per Share |

$0.05 |

|

Operating Margin |

5.50% |

|

Net Margin |

3.58% |

|

Float To Outstanding Shares Ratio |

21.33% |

|

Proposed IPO Midpoint Price per Share |

$2.50 |

|

Net Free Cash Flow |

-$587,000 |

|

Free Cash Flow Yield Per Share |

-0.78% |

|

Debt / EBITDA Multiple |

12.02 |

|

CapEx Ratio |

0.09 |

|

Revenue Growth Rate |

58.16% |

(Source – SEC)

Commentary About Multi Ways’ IPO

MWG is seeking U.S. public capital market investment to fund its various expansion plans.

The company’s financials have shown increasing topline revenue, growing gross profit and gross margin, and higher operating profit but lowered cash flow from operations.

Free cash flow for the twelve months ending June 30, 2022, was negative ($587,000).

Selling and Distribution expenses as a percentage of total revenue have trended slightly lower as revenue has increased; its Selling and Distribution efficiency multiple rose to 9.8x in the most recent reporting period.

The firm currently plans to pay no dividends and reinvest all future earnings back into the firm’s growth and operating requirements.

MWG’s CapEx Ratio indicates it has spent heavily on capital expenditures related to its operating cash flow.

The market opportunity for providing heavy construction equipment rental services is large and expected to grow at a moderate rate of growth through 2030, although the company faces significant competition in major global markets.

Like other firms with Asian country operations seeking to tap U.S. markets, the proposed listing entity operates as a Cayman Islands corporation that owns interests in its other country operations.

U.S. investors would only have an interest in an offshore firm with interests in or only agreements with operating subsidiaries (i.e., potentially no equity interests), some of which may be located in or have substantial operations in China or other Asian countries with restrictions or unpredictable regulatory environments regarding those interests.

Additionally, restrictions on the transfer of funds between subsidiaries within China or other Asian countries may exist.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable regulatory rulings that may affect such companies and their U.S. stock listings.

Additionally, post-IPO communications from the management of smaller Asian companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

Spartan Capital Securities is the lead underwriter and the only IPO led by the firm over the last 12-month period has generated a return of negative (78.9%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 2.2x at IPO.

In recent periods, many companies have gone public on U.S. markets at $5.00 per share pricing. Almost all of these IPOs have performed poorly post-IPO.

With MWG attempting an IPO at $2.50 per share, I’m even more skeptical of the stock’s post-IPO performance over the medium term.

While the low price may attract day traders seeking volatility, I’m on Hold for the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment