Heath Korvola

Introduction

The United States is closer than it has ever been to legal cannabis reform. The odds are impossible to quantify, but the prospect of reform passing in Congress soon is real. Investors need to prepare by being invested now, because as reform progresses through the legislative process movements in stock prices across the US industry will be sudden and substantial. This report begins with an extended discussion of the current reform environment, followed by an examination of the AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS) as a way to take advantage of the reform process.

Cannabis in America today

The United States has been steadily moving towards a more positive cannabis environment for many years. It’s important not to discount this trend in the face of present depressed conditions for US cannabis. Investors may feel besieged by stock prices and gloomy sentiment, but there is a steady accumulation of positive news. Very recent developments include:

These are a few of many signs of a national movement favoring cannabis that will benefit investors over time.

Riding this wave of positivity there are two developments that will have a strong and durable impact: federal legalization and SAFE banking. NOTE: In this article legalization and descheduling are viewed as part of one process and the terms are used interchangeably.

Federal cannabis legalization

Federal legalization/descheduling is the promised land, and would mean massive increases in company profits and stock prices. In its basic form, it means removing cannabis from the list of Schedule I drugs, which are illegal under all circumstances. Schedule I contains substances that the government says are very addictive and have no therapeutic value, such as marijuana, heroin, ecstasy, and LSD. Entities that make money from them can be prosecuted for money laundering under the Controlled Substances Act. The fact that cannabis companies did about $25 billion in US business last year underlines the obvious dysfunction of the system.

Legalization means “descheduling” cannabis, that is, moving it to a less restrictive one of the five schedules to enable legal trade. The sticking point is which schedule cannabis ends up on. Schedule II includes substances like Vicodin, cocaine, meth, and oxycodone, and wouldn’t be much of a help to the cannabis industry as it’s currently structured. It’s highly unlikely that dispensaries could ever meet the requirements for distributing under Schedule II. Schedule III is the category for drugs like codeine, steroids, and ketamine. Schedule IV includes Xanax, Valium, Ambien, and Tramadol, and Schedule V substances like low dose codeine, Lyrica, and Lomotil. Dispensaries will be expected to operate under the same restrictions as other drugs in the same schedule. Clearly, benefits for the cannabis industry is dependent on which schedule it ends up on, and that is completely unknown at this point.

The schedule question means investors need to temper their enthusiasm for legalization. Another daunting question is when a scheduling decision might be made. The recent order by President Biden to begin studying if cannabis should be rescheduled caused quite a reaction in cannabis stocks. As the table below shows, prices jumped overnight 40% and more. Much of the gain was quickly reversed, however, when investors had time to process the news. The fact is that the process will take years of study, discussion, reporting and revision by a host of government agencies, who all move quite deliberately and slowly. The bottom line is that legalization/descheduling will have a huge impact but is much farther out than many investors care to contemplate.

| Oct. 5 price | Oct. 6 price | % increase | Oct. 24 price | % increase remaining | |

| Green Thumb (OTCQX:GTBIF) | 9.45 | 14.01 | 48.2% | 11.05 | 16.9% |

| Trulieve (OTCQX:TCNNF) | 8.82 | 13.06 | 48.1% | 10.90 | 24.5% |

| Cresco (OTCQX:CRLBF) | 2.63 | 3.58 | 36.1% | 3.34 | 27.0% |

| Curaleaf (OTCPK:CURLF) | 4.50 | 6.48 | 44.0% | 5.58 | 24.0% |

| Verano (OTCQX:VRNOF) | 4.37 | 5.76 | 31.8% | 5.20 | 19.0% |

| MSOS (MSOS) | 8.82 | 12.40 | 40.6% | 10.50 | 19.0% |

SAFE Banking Act

In terms of potential passage, the SAFE Banking Act is a more exciting development. SAFE banking (hereafter referred to as “SAFE”), when passed in Congress, will allow financial entities of all types to do business legally with cannabis companies. This is a more substantial change than most people realize. The best discussion of its impact that I have encountered is an interview with StateHouse Holdings (OTCQX:STHZF) Chairman Matt Hawkins titled Scaling Towards Legalization on the Cannabis Investing Podcast. Hawkins also runs a private equity firm so to some degree is “talking his book,” but the points he makes are legitimate. To summarize Hawkins, SAFE banking will enable US companies of all sizes to

-

Reduce the cost of capital

-

Access the Small Business Loan program

-

Borrow from banks at commercial rates

-

Develop working capital lines

-

Engage in factoring (an important financing tool)

-

Obtain capital from many more and larger financial entities.

Companies in emerging growth industries need capital, and as Hawkins and others have reported it’s very hard to obtain capital in this environment. This is why we still see loans at 12-14% and REITs like Innovative Industrial Properties (IIPR) can make deals at cap rates far better than other industries. SAFE will open up cannabis to the massive US financial sector.

Dynamics of SAFE Banking Act passage

SAFE banking has powerful supporters in Congress, including Charles Schumer, Nancy Pelosi, and Cory Booker. They understand that if the upcoming election produces a House or Senate controlled by the GOP chances of cannabis reform drop to zero. Consequently they are highly motivated to pass it in some form before the next Congress is seated in January. The holdup thus far has been the insistence by Senator Booker and others that some social equity be included, in contrast to the clean, banking-only act passed repeatedly by the House. This haggling is a normal part of the legislative process. The Booker faction acknowledges that they won’t get everything they want and proponents like Schumer concede that some social equity is necessary for passage. Deadlines concentrate the mind, and as we approach a potentially Republican Congress on January 3 expect quick movement towards a successful bill.

Summary of the legislative landscape

The landscape looks like this:

- Pro-cannabis sentiment is still growing around the country.

- Legalization/descheduling would transform the industry in a positive way, but is a long way off.

- SAFE banking will have a major positive impact and has a reasonable chance of passing in 2022.

SAFE will be a tide that lifts all boats. Cannabis stock prices move almost in unison, up or down based on related news. This is clear by looking at the reaction of cannabis stocks to the recent announcement that Pres. Biden was pardoning cannabis possession and ordering a rescheduling study. It’s notable that much of the gains have been maintained, as shown in the last column in the table above.

Risks

SAFE banking is by no means certain, and if it doesn’t make it to the President’s desk the massive upside from this catalyst doesn’t occur. That leaves all US cannabis companies subject to industry conditions and sentiment, which currently are not favorable. Furthermore, as a high beta industry, price swings are more dramatic than the larger stock market. Consequently, if the market goes down from here as many anticipate, cannabis investors could be hit hard.

MSOS: A pure play on US cannabis

AdvisorShares Pure US Cannabis ETF is a pure play on US cannabis and a good choice for betting on the US industry. Many people find ETFs a useful investing vehicle, while others are opposed, and there’s no point in revisiting that debate here. For those who are interested, I outlined the case for cannabis ETFs way back in 2019 in Cannabis Investing: Maximize Your Chance for Success. The only additional point to add is regarding MSOS’s use of swaps instead of direct share purchases, which some people find concerning. Swaps are used because Federal bank restrictions prevent MSOS from investing in some U.S. cannabis companies directly. My position is that there is no cause for concern. Swaps are frequently used in many sectors without incident. There is a very useful explanation of swaps on the AdvisorShares MSOS page.

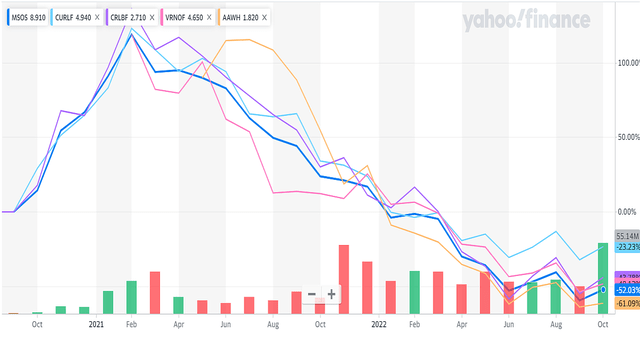

The chart below shows the MSOS stock price since inception in September 2020 along with a sample of cannabis companies: Curaleaf, Cresco Labs, Verano, and Ascend Holdings (OTCQX:AAWH). MSOS reflects prices in the industry as a whole, making it a good proxy for those who want broad coverage.

Interesting information arises when we look at the top 20 MSOS holdings.

| Stock Ticker | Shares/Par (Full) | Traded Market Value (Base) | Portfolio Weight % |

| GTBIF | 11,945,220.00 | 139,281,265.20 | 21.43% |

| CURLF | 20,688,295.00 | 117,716,398.55 | 18.11% |

| TCNNF | 9,425,381.00 | 106,129,790.06 | 16.33% |

| VRNOF | 13,480,784.00 | 71,852,578.72 | 11.05% |

| CRLBF | 15,422,643.00 | 53,053,891.92 | 8.16% |

| CCHWF | 18,917,173.00 | 31,213,335.45 | 4.80% |

| AYRWF | 5,800,911.00 | 25,349,981.07 | 3.90% |

| TRSSF | 14,107,731.00 | 22,981,493.80 | 3.54% |

| JUSHF | 12,026,698.00 | 17,679,246.06 | 2.72% |

| FFNTF | 23,066,571.00 | 9,641,826.68 | 1.48% |

| IIPR | 94,054.00 | 8,894,686.78 | 1.37% |

| GRWG | 2,646,794.00 | 8,628,548.44 | 1.33% |

| PLNHF | 6,669,285.00 | 8,136,527.70 | 1.25% |

| GLASF | 1,550,000.00 | 5,828,000.00 | 0.90% |

| HYFM | 1,229,893.00 | 2,828,753.90 | 0.44% |

| UGRO | 583,181.00 | 2,659,305.36 | 0.41% |

| PW | 277,561.00 | 2,542,458.76 | 0.39% |

| GRAMF | 5,492,948.00 | 2,416,897.12 | 0.37% |

| AFCG | 138,657.00 | 2,201,873.16 | 0.34% |

| GDNSF | 4,390,229.00 | 1,734,140.46 | 0.27% |

The top five holdings, which are identical to the five largest cannabis companies, comprise a whopping 75.08% of portfolio value The top ten holdings add what are mostly the next five largest companies, comprise 91.52% of value. This is very concentrated for an ETF, even considering the small universe of companies to choose from. It appears that MSOS has decided on a strategy of putting most of its money in the largest companies, which is similar to a strategy I advocated in Trulieve: Why You Must Own This Future Dominant Cannabis Company and A Reassessment of the Cannabis ETFs.

This Makes the decision easy

If you are inclined to add money in anticipation of SAFE, the choice of an ETF like MSOS is simplified by the data. MSOS is a legitimate proxy for the largest companies in the US and, as discussed in the Trulieve article referenced above, going large is a compelling long term strategy. If, on the other hand, you are leery of ETFs because of fees, swaps, management, etc., you can replicate MSOS by investing in the largest five or ten companies. Finally, individual stock picking is always a popular activity.

Investment recommendations

I recommend MSOS as a BUY as a proxy for an industry with a potential game changing catalyst on the horizon. If some form of SAFE banking passes before January all cannabis stocks will go up at least as much as the transient 41% pop of October 6, but the gains are likely to be long-lasting because SAFE banking is a substantive improvement in industry conditions. If you want to take the money and run, a 41% short term gain is quite acceptable. The downside if SAFE doesn’t pass is minimal. As a non-occurrence of an event that many don’t expect to pass, it won’t change sentiment or fundamentals. In the longer term MSOS will grow along with the rest of the industry.

Summing up

Passage of SAFE banking in any form will be a huge catalyst for all US cannabis stock prices that no cannabis investor can afford to miss. The time to position for it is now. As we saw on October 6, price changes can be immediate and large. There’s no predicting the timeline, but any incremental steps toward passage will cause stock price jumps that may prove durable. Such steps could occur any day, starting today, before the next Congress convenes on January 3, 2023. The downside if SAFE banking is not passed is minimal. In that case cannabis stocks will simply continue to reflect existing sentiment.

MSOS is a reasonable vehicle for benefiting from the SAFE banking catalyst. For anyone inclined to take advantage of the benefits of an ETF, MSOS has performed well as a proxy for the overall US industry. Other investors can largely replicate MSOS by buying the largest five or ten companies if they desire broad coverage, and still others will prefer to test their skills with individual stock picking.

Be the first to comment