JHVEPhoto

Investment Thesis

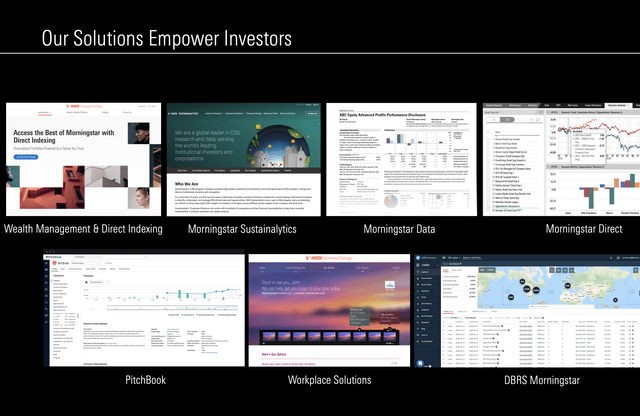

Morningstar (NASDAQ:MORN) is one of the leading financial research companies in the world. It offers market data and insights to asset managers, institutional investors, and financial advisors. Its product includes indexing, sustainability analytics, data tracking, and more. The company currently has approximately $253 billion in assets under advisement and management as of the quarter. Morningstar has been a very solid compounder in the past decade, up almost 250% in the period.

The company got caught in the broad market sell-off last year and has been dropping since. It is now down over 35% from its all-time high, currently trading at $217.2 per share. The company is seeing strong growth opportunities in ESG and its Pitchbook segment. Recent financial results have also been resilient despite facing a tough macro environment. However, despite the huge drop, the current valuation remains very high when compared to peers. While I do like the business and the fundamentals are intact, I believe the potential upside at the current price point is limited. Therefore I rate the company as a hold and will wait for a better entry point.

Strong Growth Opportunities

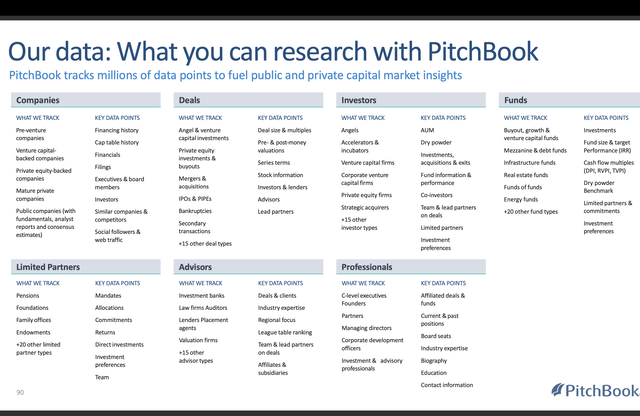

Pitchbook and ESG represent a huge growth opportunity for Morningstar. Pitchbook is a tool that tracks millions of data points across the finance industry to provide insights to firms and corporations. It has a wide range of use cases including market analysis, benchmarking, valuation, identifying trends, and more. Current customers include Northrop Grumman (NOC), 3M (MMM), Khosla Ventures, etc. According to the company, the TAM (total addressable market) for Pitchbook is estimated to be $4.9 billion. Its current penetration rate of the TAM is less than 7% which opens up a lot more room for growth. Pitchbook had a sales CAGR (compounded annual growth rate) of 56% in the past decade and I believe it will continue to perform very well in the future.

ESG (environmental, social, and governance) is another segment with strong secular tailwinds. The demand for ESG products continues to increase due to the government’s tighter regulations and sustainability requirements. There are currently 3 million plus securities and 95,000+ funds with ESG risk ratings and the number has been accelerating. According to Acumen Research and Consulting, the ESG software market is estimated to grow from $558 million in 2021 to $2.01 billion in 2030, representing a CAGR of 15.7%. The increasing awareness of sustainability will continue to boost the demand for ESG-related products and I believe Morningstar will benefit significantly from this tailwind.

Financials

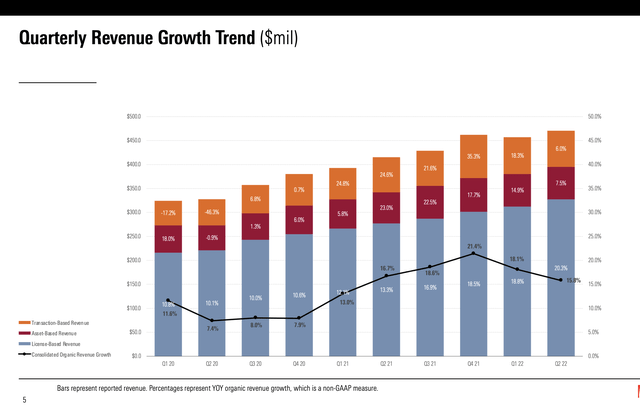

Morningstar reported its second quarter earnings in July. Top-line growth continues to be consistent while the bottom line dipped due to acquisition and other expenses. The company reported revenue of $470 million, up 13.2% YoY (year-over-year) from $415.4 million. On a segment basis, license-based revenue increased 18.1% from $277.2 million to $327.5 million. The growth is driven by strong traction in Pitchbook and Morningstar Sustainalytics (ESG), which were up 46.7% and 47.4% respectively. Pitchbook is benefiting from broader product offerings while ESG data continues to see strong demand. Asset-based revenue increased 4.3% from $64.8 million to $67.6 million. This is led by the growth in Morningstar Indexes, which was up 31.3% YoY. Transaction-based revenue was the weakest segment, up only 2.6% from $73.4 million to $75.3 million, as issuance for asset-backed securities and residential-backed securities continues to slow.

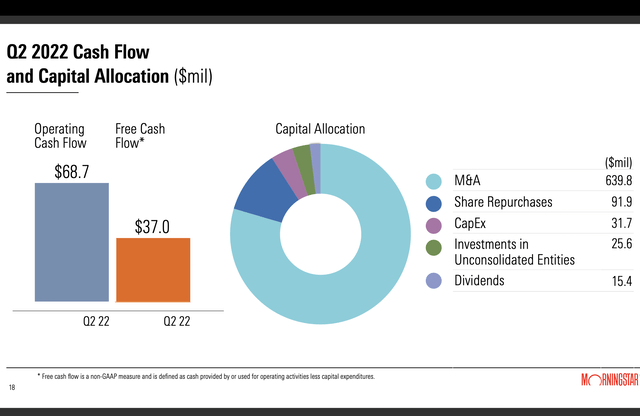

Operating income for the quarter was $53.9 million compared to $47.2 million, up 13.1% YoY. The operating margin was 11.5%, up 10 basis points from the prior year. On an adjusted basis, operating income was down 23.9%. This is largely due to an increase in stock-based compensation expenses to the PitchBook management for hitting the pre-set financial target. As adjusted operating income dipped, the diluted net income per share was also down 7.9% from $0.76 to $0.70. Free cash flow was $37.0 million compared to $108.5 million. The significant drop is due to the two acquisitions made during the quarter, and the final payment for a prior acquisition, which amounted to almost $700 million.

Kunal Kapoor, CEO on operating expenses

Our organic growth remains strong despite market headwinds. That success is the fruit of ongoing strategic investments that we are making in key business areas, including in compensation and benefits for our teams globally. While these investments have contributed to higher operating expenses in the near term, they position Morningstar for continued growth and the increased scale that we expect will drive long-term profitability.

The bottom line is all over the place this quarter due to pre-scheduled bonuses and acquisitions-related payouts but these expenses are all one-off and I believe they will normalize in the coming quarters. The company’s balance sheet remains strong with over $410 million in cash and equivalents. During the quarter, it bought back $91.9 million worth of shares and paid $15.4 million in dividends. The ongoing buyback will continue to reduce share counts and provide support for its EPS figure moving forward.

Expensive Valuation

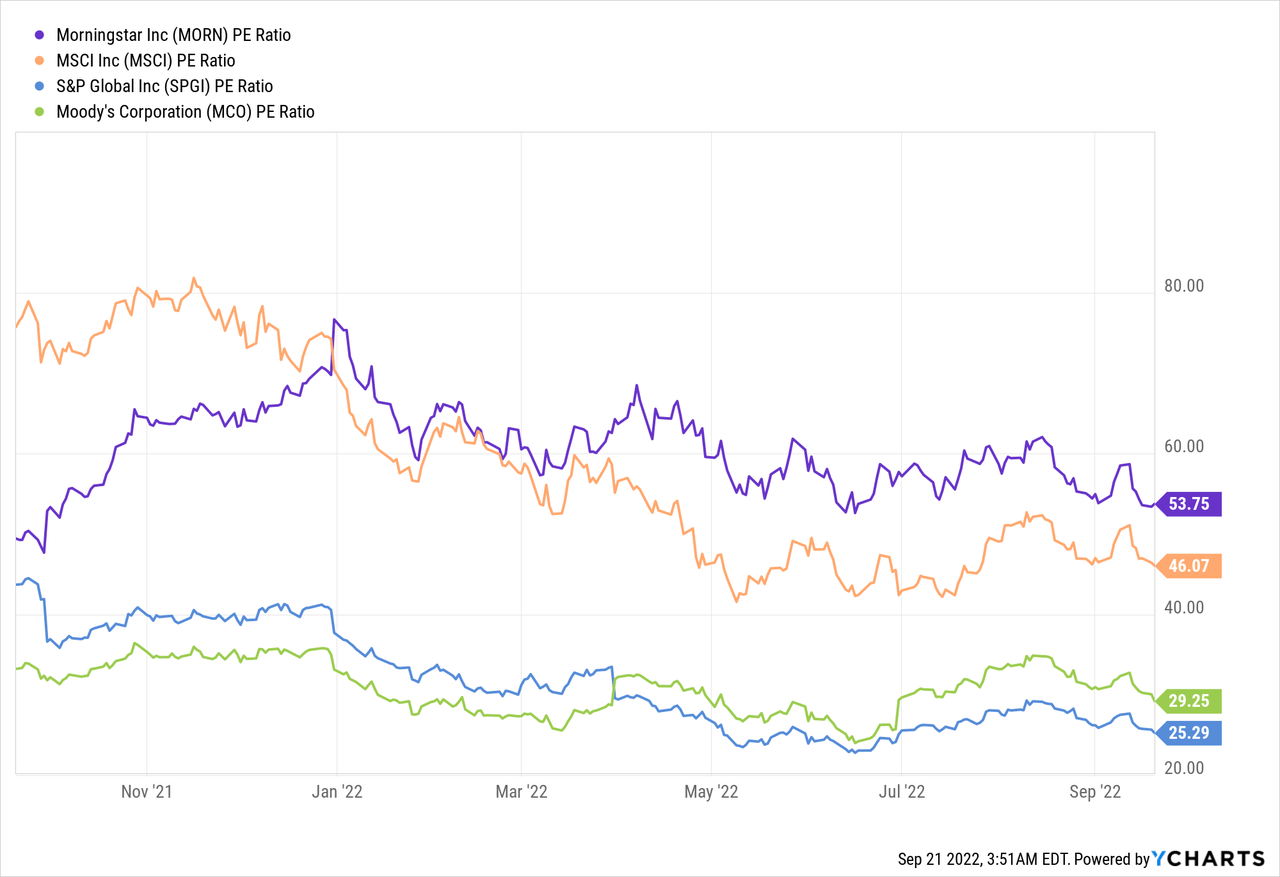

While I like Morningstar’s business and prospects, valuation continues to be the main concern here. Despite falling by over 35%, the company’s valuation remains very expensive. As shown in the first chart below, you can see that its current multiple is much higher than its peers such as MSCI (MSCI), S&P Global (SPGI), and Moody’s (MCO). The company is trading at a P/E ratio of around 53.8, or a 39.4% premium compared to the industry’s average P/E ratio of 38.6. This makes it hard to initiate a position on Morningstar as peers seem to offer better value. MSCI for example is growing at a similar rate and has better margins, yet it is now trading at a 17% discount.

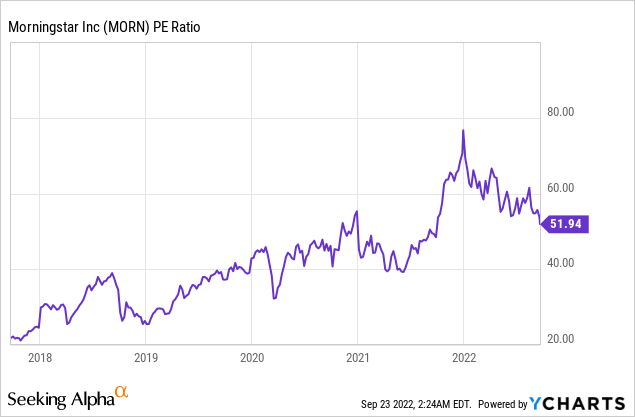

On a historical basis, the valuation is also really stretched. As shown in the second chart below, you can see that the company is trading at the high end of its multiple. The current multiple represents roughly a 27.2% premium compared to its 5-year average P/E ratio. Considering the challenging macro backdrop, it is hard to justify the current valuation as it offers limited potential upside for new investors.

Risks

Besides valuation, I believe currency headwinds may also pose unprecedented risks to the company. Due to its significant overseas presence, Morningstar is quite exposed to the strong dollar, which has been popping in recent months. During the latest quarter, the company already took a $12.3 million (or 2.6%) hit on revenue due to unfavorable FX headwinds. If the dollar continues to spike, financials may see further impacts moving forward. While the dollar looks quite stretched here, I think this is something investors should definitely keep a close eye on.

Conclusion

I believe investors should wait for a pullback before initiating a position. Morningstar has very solid fundamentals and its ESG and Pitchbook segment will continue to drive future growth as the TAM expands. The recent financial results also indicate strong resilience as revenue continues to grow at a double-digit rate. However, its valuation is simply too expensive. The current multiple is way above the industry’s average and its historical average, which limits the company’s potential upside. It is also facing currency headwinds that may continue to impact its financials. Therefore I rate the company as a hold.

Be the first to comment