Getty Images

Thesis

We updated our July article urging investors to consider waiting for a deeper retracement as we didn’t think Morgan Stanley (NYSE:MS) was undervalued.

Its Q3 earnings release corroborated our conviction that the bank sees increased risks to its Investment Banking deals cadence, even though Wealth Management remains robust. However, the days of cheap financing are well over, even with the Fed nearing its median terminal rate (4.6% as of the previous FOMC). Moreover, even Morgan Stanley CEO James Gorman wasn’t sure whether the Fed would stop at that, as he articulated:

[The Fed is] probably going to go mid-4s, but that remains to be determined. And with that, there will be consequences. So far, we haven’t seen clarity around inflation abating. My guess is that we will see that clarity and it will be more evident certainly by the middle of next year. (Morgan Stanley FQ3’22 earnings call)

Therefore, we believe investors need to be prepared for unforeseen risks from the Fed’s unflinching determination to defeat record inflation rapidly. As a result, it could lead to a severe recession or an environment less receptive to deals for an extended period. As such, MS could find significant challenges in recovering its earnings growth cadence compared to its peers less exposed to investment banking challenges.

Coupled with a valuation we believe is still too high going into a potentially extended downtime, we believe the consensus estimates seem overly optimistic.

Furthermore, MS’ price action is unconstructive and remains way above its long-term trend support zones. Therefore, we deduce that the potential for further value compression cannot be ruled out, with the reward-to-risk profile unattractive at the current levels.

As such, we reiterate our Hold rating on MS.

Investment Banking’s Growth Could Remain Weak For Longer

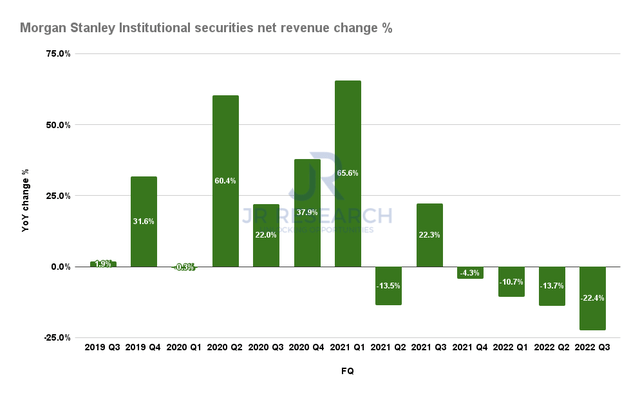

Morgan Stanley Institutional Securities net revenue change % (Company filings)

Morgan Stanley’s Institutional Securities segment continued to underperform against its corporate average, with net revenue down 22.4%, against Q1’s 13.7% decline. However, the strength in Equity and particularly in Fixed Income, mitigated the massive downturn in Investment Banking.

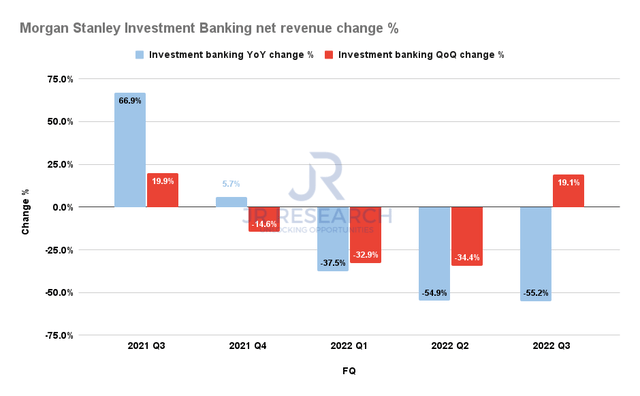

Morgan Stanley Investment Banking net revenue change % (Company filings)

As seen above, Investment Banking’s net revenue fell by 55.2% in Q3, following Q2’s decline of 54.9%. However, it’s up by 19.1% QoQ, but we aren’t going to be overly enthusiastic about the sustainability of its QoQ recovery.

Management’s commentary continues to point to a tepid investment banking climate, at least in the near term, given the significant value compressions and much higher costs of capital seen in the market.

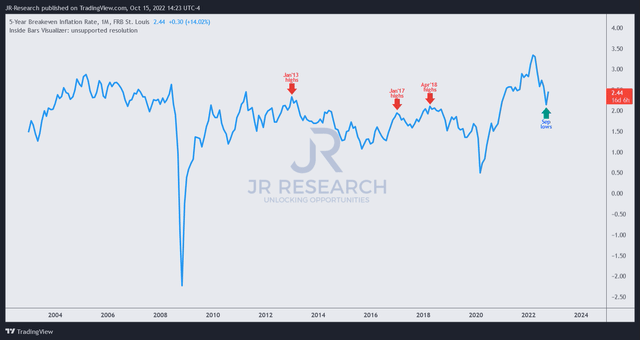

US 5Y Breakeven Inflation rate % (TradingView)

With the Fed determined to combat record inflation, it’s clear that the days of cheap, easy money is well over. Furthermore, inflation expectations remain well-anchored above their past five-year highs.

The 5Y breakeven inflation rate also turned back up this month to 2.44% after falling to 2.14% in September. Therefore, it goes to show how sticky inflation expectations have become. As a result, we believe the climate for investment banking will continue to be highly challenging in the near term as long as the Fed continues to press on further.

And The Consensus Estimates Could Be Too Optimistic

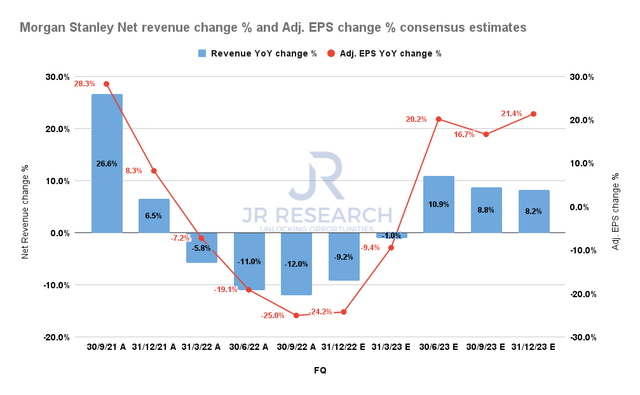

Morgan Stanley Net revenue change % and Adjusted EPS change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that Morgan Stanley’s net revenue growth could reach a nadir in FQ3 before recovering markedly through FY23, as it laps easier comps from FY22. As a result, it’s also expected to lift its adjusted EPS growth significantly, with Morgan Stanley expected to post EPS growth of 26% in FQ2’23.

Therefore, we believe it’s pretty clear that Street analysts aren’t concerned that the global recession could scupper the other segments in Morgan Stanley’s portfolio.

However, we urge investors to reconsider the Street’s assumptions. We expect Investment Banking to continue facing significant challenges as the Fed remains hawkish through H2’23. In the best-case scenario, even if the Fed does not raise its terminal rates further, they would likely stay high for some time. But, if the Fed deems it necessary to push its terminal rates up further, then we expect Investment Banking’s challenges to continue impinging on Morgan Stanley’s recovery cadence through FY23.

Furthermore, the revised consensus estimates for the financial industry suggest an EPS growth of 13.1% in FY23 (again, no recession). Morgan Stanley’s FY23 EPS growth is estimated to be 15% in FY23, well above the industry’s consensus. Therefore, it increases the execution risks for MS through the coming recession and could face further value compression if these estimates get revised markedly.

MS Stock’s Valuation Has Not Been De-risked Adequately

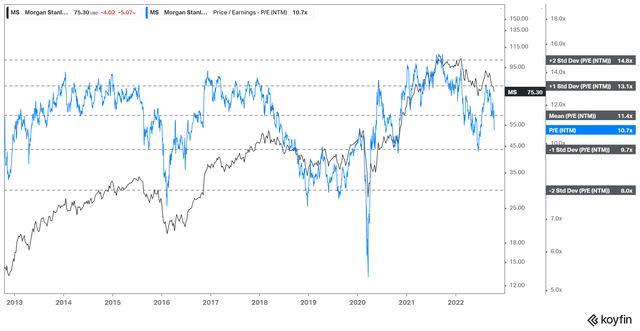

MS NTM normalized PE valuation trend (Koyfin)

MS has fallen below its overvaluation zone from 2021 but remains well above the valuation multiples seen at significant bear market bottoms (two standard deviation zone under its 10Y mean).

Therefore, we deduce that MS had not been de-rated adequately, even as its Investment Banking segment could remain weak through FY23. Hence, its valuation could face substantial digestion from the current levels.

Is MS Stock A Buy, Sell, Or Hold?

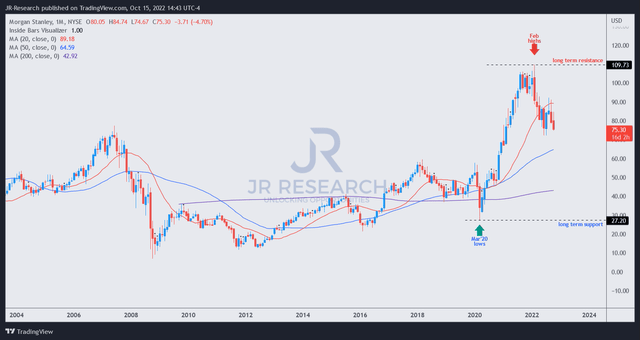

MS price chart (monthly) (TradingView)

MS continues to trade well above its 50-month moving average (blue line). Therefore, we aren’t convinced that its price action is constructive at the current levels, in line with our observation of its valuation.

We believe the market had used the summer rally to draw in more buyers before digesting them astutely.

As MS moves closer to its July lows, we encourage buyers considering adding exposure to watch how MS re-tests these lows before pulling the buy trigger.

Otherwise, investors should remain patient, as we believe the value compression in MS is unlikely to be over.

We reiterate our Hold rating in MS stock.

Be the first to comment